Q3 2021 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Third Quarter of 2021. You can download the full reports via the links shown below.

KEY OBSERVATIONS

Another quarter, another big stock market gain. The S&P 500 rose 3.4% in Canadian dollar terms, with positive earnings growth once again the main performance driver. While earnings were expected to be strong, the 91% year-over-year increase far exceeded estimates. In fact, 87% of S&P 500 companies reported positive earnings surprises, which is the highest percentage since 2008.

In a divergent trend, some key economic indicators, including the Purchase Managers’ Index, jobs data and the latest inflation figures cooled somewhat. This fact, combined with some seasonal choppiness in stock prices, has led to the market trepidation many are currently feeling. The question is whether this will become a material headwind to earnings and share price performance.

For clues, we periodically calculate the implied future earnings of the market based on bond yields and equity risk premiums, and compare that to the consensus earnings estimates. We currently find that the implied earnings are about 5.7% below the estimates, suggesting that the market has actually become a little cheaper over the past nine months and has continued upside potential.

Declining US inflation between June and August lends credence to the view right now that higher inflation is transitory. As investment analysts, the disconnect is that we hear about inflation concerns from companies almost daily. The good news is we think most of the companies we own are successfully passing rising costs through to their customers. In fact, this appears to be the case for the majority of companies in the S&P500 index.

The recent stream of softer economic data and lack of any significant pullback in the market has set some investors on edge. While a correction can never be ruled out, particularly since they are pretty common in secular bull markets, in the current environment of strong earnings growth and practically zero interest rates, we continue to believe the outlook for equities is positive.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our exposures remained virtually the same at 47% US equity, 49% Canadian equity and 4% cash. It is important to note that many of our clients’ portfolios are invested in our North American plus International Equity strategy, meaning that the actual weights of US and Canada will be proportionately lower by about 20% given the approximate 20% allocation to international equities.

We have continued to position the portfolio toward value-oriented stocks to benefit from the economic recovery, while maintaining exposure to growth stocks for about a third of the portfolio.

During the third quarter, we added to our energy and mining exposure by increasing our weighting in Topaz Energy (Topaz) and purchasing a position in ERO Copper Corporation (ERO Copper) on the off-chance that inflation does take a bigger bite out of the economy than we currently think.

Topaz acquires royalty and non-operated energy infrastructure assets, and has 83% of its assets tied to the price of natural gas, which is trading at 5-year highs. Almost all of Topaz’ royalty production and processing revenue converts to free cash flow, supporting a sustainable dividend yield of 4.6%, which we believe can increase. Topaz expects a 17% compound annual growth rate of production over the next three years.

Having reached a threshold of almost $2bn in market cap and expanded its float recently, we expect Topaz to be eligible for index inclusion as early as December 2021, which would create more demand for the stock from institutional investors.

ERO Copper is a mid-sized copper and gold producer in Brazil whose management and board are laser focused on Return on Invested Capital, which is a discipline most global mining companies lack. Management and the board own approximately 16% of the company, which makes them highly aligned with shareholders like us.

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

On a year-to-date basis to September 30th, the S&P 500 Total Return Index is up 16.8%, while the MSCI World Total Return Index is up 13.6% (in Canadian dollar terms). This advance has been driven by a global economic recovery and further progress with COVID-19 vaccinations.

Recent volatility can be attributed to concerns about peak economic and earnings growth, inflation, the US debt ceiling, Fed tapering, the Delta COVID variant, vaccine efficacy, China’s economic slowdown, Evergrande, and supply chain disruptions. While these worries may be warranted, volatile periods are normal and have historically been a good time to buy stocks given that most of the concerns prove to be temporary.

The underlying rationale for our overall positive stance on global equities is related to our expectation of an ongoing global economic recovery. On the supply side, we believe significant economic slack will be taken up as the economy returns to normal and production shortfalls are relieved. On the demand side, we believe consumers will return to restaurants, sporting events, concerts, hotels, and airports in droves.

In terms of the key risks, we put inflation near the top of the list. If inflation remains stubbornly above market expectations, it could have negative implications for the stock market. However, from our vantage point, inflation appears largely driven by transitory disruptions that occurred across global supply chains. Further, we see technologies such as automation, robotics and e-commerce acting as long-term counter-inflationary factors.

The companies that we own are profitable across the business cycle and generate strong free cash flow even during economic downturns. Given their leading market positions, our companies have strong pricing power which will help them if inflation remains persistent.

In summary, we expect an ongoing recovery for the global economy and believe that our global and international mandates are well positioned to benefit from this recovery.

Diane Pang, CPA, CA, CFA

Portfolio Manager, Fixed Income

For the first two-and-a-half months of the third quarter, markets moved quietly and slowly in a positive direction. Towards the end of the quarter, things became more interesting as COVID-19 cases started to spike, the US ran up against its debt ceiling, and one of China’s largest real estate developers, Evergrande Group, faced hefty interest payments on its debt obligations.

In the US, Treasury Secretary Janet Yellen had estimated that the US would run out of money by October 18th unless action was taken to suspend or increase the federal debt limit. After some initial failed attempts, the Democrats successfully passed a nine-week stopgap funding bill that will kick the can a little further down the road to December 3rd.

Investors are watching and wondering whether China’s second-largest real estate developer, Evergrande, will be able to meet its pile of debt obligations. According to Bloomberg, eight of the world’s 10 most indebted property developers are based in China, and real estate/construction accounts for about 29% of China’s economic output.

Reports say that Evergrande had 778 projects under construction in 223 cities and carried about USD$89 billion in debt borrowed from banks and bond investors The company appears to have bought some time by selling its stake in Shengjing Bank, but will need to complete some of its current projects in order to avert another crisis. Stay tuned.

During the quarter, the US Federal Reserve kept interest rates unchanged at 0%.The Canadian Bond Universe Index now yields 1.80%, but we target a yield above that for our strategies. With the prospect of central bank tapering in both Canada and the US, we believe there will be some volatility in the near future that will create opportunities to lock-in higher yields. We continue to operate and invest in a very patient manner.

Crypto:

A safe way to preserve your wealth?

In 2013, Levon Barker was part of a small operation that mined a dozen Bitcoins. By the following year, he had sold his coins for a small profit, and his partner’s coins had been stolen in a $450 million raid on Mt. Gox, one of the world’s leading Bitcoin exchanges of the time.

Today, Levon is a US and Canadian Equity Portfolio Manager and Research Analyst at Cumberland and remains a close observer of the evolution of crypto assets. He recently shared his considerable insight on the topic in a presentation to clients and friends of Cumberland. He addressed issues such as:

- Do crypto assets contain value, like stocks or commodities?

- How do they work and why?

- Can they be trusted despite the risks of theft, loss and fraud?

- Should crypto assets be used to preserve your wealth?

Levon covers these topics and more in a manner that is clear and accessible, even for those who are new to this fast-changing space.

If you would like to view his presentation and the Q&A that followed, please send us a note requesting a link to the recording.

Why Dividends Matter

We often read in the press about the importance of dividends. However, the significance can be easy to under-appreciate. Dividends can be a relatively modest amount of money being reinvested or showing up in our accounts on a monthly or quarterly basis. So, why are dividends important?

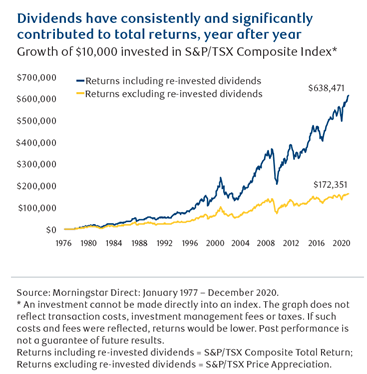

Dividends Can Make a Significant Difference in Returns Over Time

The reinvestment of dividends has historically made a significant difference to an investor’s ultimate wealth. As shown in Figure 1, an investor who invested $10,000 in the S&P/TSX Composite in 1977 had over $638,000 at the end of 2020. The same investor who did not reinvest the dividends had only about $172,000.

Figure 1: Dividends have consistently and Significantly Contributed to Total Returns, Year After Year

Source: RBC Global Asset Management

Dividend-Paying Stocks Have Historically Outperformed

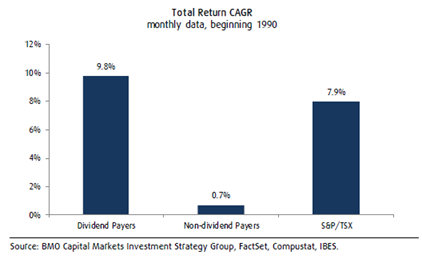

Second, dividend-paying stocks have outperformed their non-dividend-paying counterparts. As shown in Figure 2, since 1990 dividend-paying stocks have comfortably outperformed the S&P/TSX Composite Index. Meanwhile non-dividend-paying equities barely managed to post a positive return. By investing in dividend-paying equities over their non-dividend-paying counterparts, investors are tilting the probabilities of outperforming in their favour.

Figure 2: Total return comparisons

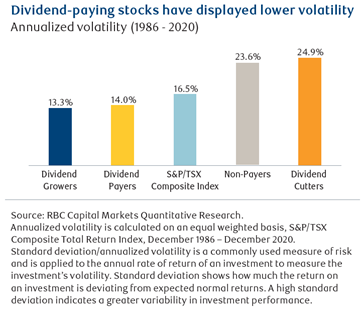

Dividend-Paying Stocks Have Historically Displayed Lower Volatility

We all know that one of the hardest things to deal with as investors is volatility. When a stock declines in value it can be difficult to resist the temptation to make an emotional decision. While dividend-paying stocks are not immune from volatility, these stocks have historically displayed lower volatility than their non-dividend-paying or dividend cutting** peers.

**Dividend cutters are companies that have reduced their dividend payouts to shareholders

While there are many quality companies that don’t pay dividends, historically dividend-paying companies have exhibited better returns and lower volatility (as measured by standard deviation) than their non-dividend-paying peers. Furthermore, by reinvesting these dividends, investors can harness the power of compound interest. This can make a big difference over time.

Having a component of one’s portfolio invested in a dividend and/or dividend growth equity strategy remains a core strategic component of our team’s investment discipline. There are times in a market cycle where dividend-paying stocks come in and out of favour. However, the long-term evidence indicates that dividend-paying equities have historically produced higher returns and lower volatility. Consequently, holding high quality dividend-paying equities within our client portfolios is a key part of our equity strategies and asset allocation decisions.

Can you be Defensive with a Growth Strategy?

During the first half of 2021, the World Indices returned 12% in Canadian dollars and since the beginning of 2020 earned a total return of 28.4%.

Almost an entire market cycle was crammed into the last year and a half. We began the 2020 pandemic with the flight to quality and defensive businesses. Anything with a hint of cyclicality was discarded and for the first time ever people were modeling near zero revenues for entire industries. The economic drop led governments to supersize policies as failure was not an option. This political support reversed markets out of the sharp decline and into the fastest recovery on record for indices. If you blinked, you would have missed it. All losses that occurred between February and April were recovered by July. Market behavior also changed with the clear backstopping by the government. Professionals and individuals post the bottom went out and purchased the cyclical, volatile, and damaged businesses, venturing out shelter that was used during the storm. Over the past year this had been the prevailing trend in the market up until the peaking of SPAC (Special Purpose Acquisition Company) and Meme stocks over the last couple of months.

This led to what worked best: the opposite of expectations with levered, volatile, and speculative companies being the best performers. Inflation expectations have set in a new high of 2.5% in May and been steadily declining since. Often times a leading indicator for people switching from cyclicals back into stable businesses. When economies stabilize off such hot GDP numbers from the bottom it is hard for cyclically orientated business to continue beating expectations.

What This Really Means Is That It’s Time to Upgrade Your Portfolios

This has setup quality, defensive, and profitable investment factors to be very underweighted by professionals and are near their cycle lows in terms of relative performance. This is exactly where we are currently invested. Despite swimming against the stream with low levels of cyclical investments, the Kipling Global Enhanced Growth Fund has managed to hold its own. While still showing strong protection in down markets where the resilience shined in losing less than benchmark indices.

Time to Go High

Rebound in top-quality U.S. stocks is just starting in Morgan Stanley’s view

We continue to own defensive growing businesses at reasonable valuations and shun the higher multiple unprofitable growth companies or the heavily cyclical. Speculation and junk in every cycle have their moment in the sun during the early economic recovery, but as things stabilize from such a low base it is hard to keep the momentum going.

Here are a few company highlights:

Amazon

Amazon has been one of the greatest beneficiaries over the past year. With both its online retailing taking significant share from physical stores and Amazon Web Services acquiring larger workloads. However, over the last year it has lagged the S&P500 by 19%. Given the significant under performance, its two year forward P/E ratio has declined to 30x today from the highs of 50x. While markets are expensive, hitting 90% plus percentiles ranges for valuation, Amazon is sitting in the lower third of its historic range. It is now the cheapest it has ever been over the last decade relative to the indices. The business is still on track to triple its profits by 2024 using consensus numbers.

NVR

NVR is one of the United States largest home builders, producing approximately 20,000 homes annually. New homes sales have had an incredible resurgence while existing home inventory fell from 4 million in 2007 to 1 million at the end of 20201. NVR carries net cash on its balance sheet and the order book has grown 26% year over year. Similar to Amazon, NVR is trading at the lowest relative P/E multiple (0.75x the Global Index) in the past decade while still having the ability to grow its earnings per share at a double-digit rate going forward.

Liberty Broadband

Liberty Broadband is the holding company for Charter Communications, USA’s second largest cable company. The pandemic has shown the absolute necessity that broadband internet is for households and corporations. They are a buyback force having shrunk their share count by one third since 2016 and still growing broadband users at a mid to high single digit rate. Meaning, that the business is still growing at a double-digit rate per share. Liberty is also not expensive. Sitting exactly in the middle of its historic cash flow valuation range versus the global index.

Inflation: What it means and what could happen next

Twenty years ago, the price of a movie ticket was about $10. Today, you can expect to pay closer to $13. From an economist’s point of view, it’s not so much that movie tickets became more valuable, but that the dollar lost some of its purchasing power.

Inflation is a measure of how much purchasing power has been lost. We are currently experiencing a potent economic rebound and purchasing power is declining faster than usual at gas pumps, grocery stores, lumber yards and more. While the Bank of Canada and US Federal Reserve aim to keep annual inflation capped at around 2%, it has risen much more sharply this year.

Here’s what Cumberland Private Wealth Management Inc. (“Cumberland”) ’s Chief Investment Officer, Peter Jackson, communicated in his Strategy Review for the 2nd quarter of this year:

“Personal Consumption Expenditures (PCE) inflation is now expected to rise 3.4% in 2021 before trending back to just above 2% in 2023, the Federal Reserve’s long term targeted level. While the Fed Chairman, Jerome Powell, downplayed the inflation as transitory, as many components of recent Consumer Price Index (CPI) data, such as used vehicles, auto rentals, airfares and lodging probably were transitory, it is possible that a reacceleration in employment and future wage gains may not be so transitory.”

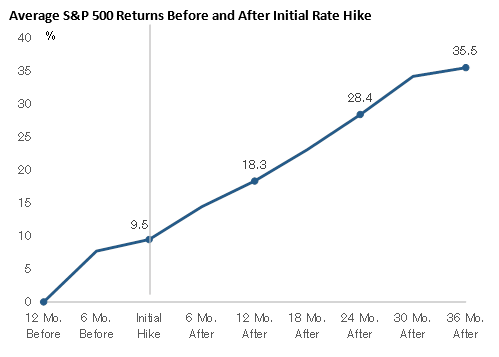

When central banks wish to curb inflation, one method they deploy is to increase interest rates. This tends to discourage borrowing and spending and prevent runaway prices. Jackson thinks hikes in the current record-low rates are likely to happen sooner than originally planned, while pointing out that stock markets have historically been able to persevere through similar periods:

“This higher inflation outlook is likely to pull forward the timing of a policy shift towards two rate increases in 2023. Also, several Fed members indicated a willingness to begin the discussion about the tapering of asset purchases. What this might mean for the markets is shown in the chart below, which reviews the historical performance of the S&P500 over four previous interest rate cycles. As indicated in the chart, the average returns both 12 months prior to the initial rate hike and 36 months after that have remained quite positive. It is not until the yield curve flattens or inverts that market returns typically turn negative.”

In his most recent commentary, Cumberland Chairman Gerry Connor agrees that inflation may be more than transitory as highlighted in the following excerpt:

“Obviously, everyone favors a strong economy, but they don’t want the inflation baggage that usually accompanies it. Here again, we have the transient argument. Most of it is supported by the short-term economic strength factors that most see waning. But the Fed adds other items to watch to this list, such as the base effect. This is the difference in prices today compared to the depressed prices during the Covid lockdown, which is accentuated by supply shortages and one-time stimulus cheques being spent. The Fed’s belief is that the secular forces that have held inflation down such as globalization and technology-driven productivity will reassert themselves, and that’s probably true, but there are some big hurdles to overcome before this.”

Among these hurdles are political pressures, the overhang of corporate and sovereign debt, and potential backlash from financial markets:

“The economy, inflation and earnings growth are as good as they are going to get and will diminish… but I don’t think we’re going to regress back to pre-Covid levels, and the residual economic strength will result in an inflation level above the Fed’s expectations.

Will the Central Bankers react to this or will they be compromised by political influence? I don’t know, writes Connor. Furthermore, given the enormous amount of corporate and sovereign debt outstanding, can the Fed even use traditional interest rate increases as an antidote for inflation? If not, it will fuel a secular shift in investments to an inflation hedge type of strategy.

For sure, any attempt to stem inflation with monetary policy will be met with a negative reaction by the financial markets, which has normally caused the policy makers to back off…”

Connor sees a departure from traditional economics, where politicians and policymakers were once more willing to do what was necessary to curb excesses. Nonetheless, he believes that, in an inflationary world, equities will remain the most desirable asset class:

“Structural forces are seen to replace traditional paradigms and this has allowed monetary policy to go beyond stabilizing the business cycle to underwriting political and social agendas under the guise of a pandemic.

Although I do expect the market to work its way higher, I think investors are going to have to be a little more astute as to what they invest in. I don’t think the general market averages will provide a rising tide to make index investing attractive. But, I do believe equities, even with a market correction, which is overdue, will be the best asset class to protect your wealth.”

This leaves the question of how exactly to position an equity portfolio for an inflationary environment – whether transitory or longer-lasting – as well as the higher interest rates that might accompany it. In his latest Strategy Review, Portfolio Manager Phil D’Iorio at CIC* explained the importance of choosing quality names:

“We believe that investing in high quality companies is the best way to protect our portfolios given the potential for higher inflation and increased volatility. High quality companies are characterized by strong pricing power and very stable cash flow generation. These types of companies can among other things,…pass along rising input costs and will also be insulated from the impact of higher interest payments associated with rising interest rates.”

At Cumberland Private Wealth**, a focus on quality is intrinsic to our investment process. While we will continue to monitor signs of inflation and signals from central banks, our experience and research tells us that owning high quality companies at appropriate valuations is an approach that should work regardless of the market cycle. Inflation or not, we believe that our clients’ portfolios are well-positioned for the current and potentially changing economic and market environments.

*CIC is Cumberland Investment Counsel Inc.

** Refers to Cumberland Private Wealth Management Inc. (Cumberland) and Cumberland Investment Counsel Inc. (CIC).

We All Agree, Up To A Point

Why so much attention on the Federal Reserve and obsession over inflation? Because Central Banks usually end Bull markets and economic expansions when inflation heats up. But, this time it is a little more nuanced than in past cycles. Statements such as, ‘until substantial further progress has been made toward the Committee’s maximum employment and price stability goals’ and ‘Transient’ are open to interpretation.

What we can all agree on is that the economy is recovering thanks to an unprecedented amount of fiscal and monetary stimulation and that the recent spike in inflation and economic growth will recede. So, you can forget about the newspaper headlines and current economic conditions, they’re already baked into equity prices. However, beyond transient there is a wide spectrum of outcomes and possibly a Bear Market lurking.

So, I want to look at where we are today and how the future will contrast to these current conditions and what that might mean for the markets.

Economy

Let’s start with the economy. It’s ripping due to pent up demand and the enormous amount of stimulus that was injected by the government and Federal Reserve. Consensus believes that growth in GDP and earnings will peak in the second quarter. The Atlanta Fed expects growth to be 7.9% but that’s a drop from 13.7% in early May and analysts see earnings expanding by over 60%. But, growth is then expected to decline steadily to 2.4% by the fourth quarter of 2022 as some see a ‘fiscal cliff’ as government stimulus fades. Spending will shift from goods to services and there will be tax increases. The Delta variant could push us back towards shut down and auto and home sales are already declining as some fear that the consumer is tapped out. According to Rosenberg Research, whose advice we listen to, consumers bought more in the way of durable goods in the past fifteen months, 30% growth from pre-pandemic level, than they bought cumulatively in the prior six years. Furthermore, the Citicorp Economic Surprise Index has gone negative, meaning that current economic conditions are not meeting expectations, which is quite a contrast to a couple of months ago. Add to these concerns the recent flare up in the Covid Delta variant and slowing GDP in China. If this retraction is truly due to faltering demand, then the economic expansion scenario is in jeopardy, which is the Bear Market case.

Although I buy the slowdown argument, I’m not convinced that the consumer is tapped out. The regional Federal Reserve boards conduct regular surveys and the most recent one showed unfilled orders at a record high and inventories at a record low. So, the slowdown in sales maybe a reflection of supply shortages, not lack of demand. We also have the propensity to spend showing up in a shift from goods to services. Consumers want to travel, attend entertainment venues and go to restaurants. Furthermore, Europe’s economy is now coming around, so we face the prospect of a global synchronized recovery in the second half.

Supporting this is a record amount of savings, which represents latent spending that I’ll quantify later.

Evidence of this mixed message recently became apparent in the fixed income markets as 10 year Treasury yields dropped from 1.74% to 1.25% seemingly supporting the case for a weaker economy. However, this was not confirmed by the spreads between corporate and government yields, which invariably increase during economic slowdowns.

Inflation

Obviously, everyone favors a strong economy, but they don’t want the inflation baggage that usually accompanies it. Here again we have the transient argument. Most of it is supported by the short-term economic strength factors that most see waning. But the Fed adds other things to this list, such as base effect. This is the difference in prices today compared to the depressed prices during the Covid lockdown. It is accentuated by supply shortages and one time stimulus cheques being spent. Their belief is that the secular forces that have held inflation down such as globalization and technology driven productivity will reassert themselves, and that’s probably true, but there are some big hurdles to overcome.

Let’s start with housing. It is one third of the consumer price index (CPI). It is calculated by imputing what it would cost a home owner to rent his own home, or Home Owners’ Equivalent Rent (HOER). It was up only 2% over the last year but home prices have increased by over 18% in that period and there is usually about a one year lag between home prices and HOER. In 1995, the last time core CPI was above 3%, HOER was 3.5%. Furthermore some of the house price inflation is due to low interest rates, so it draws into question why the Fed is still buying $40bn of mortgage- backed securities each month.

Wages are another factor in the inflation puzzle. The transition crowd says productivity will be enough to offset wage increases and the government says there are still 7.6 million fewer employed than before the pandemic, so we have a surplus. Yet a recent government jobs report known as the JOLTS survey showed 9.21 mn job openings, a record high. Almost equal to the number of people unemployed. So why hasn’t employment improved more? Well, there are a number of reasons. First, many think that people are staying home because the unemployment benefits are higher than what they can earn. Already, 22 states have eliminated a $300 per week entitlement to encourage people back into the workforce. Otherwise, we’ll have to wait until September when the government benefits end for about 3.6 million people to test this theory. If people do return to the workforce, it suggests that the transient economic growth may transition to something hotter than expected. There are others that are staying home, especially women, because they can’t find day care for their children or because schools aren’t open. This too should get resolved in September. One would assume that this could ease wage pressure. However, the fastest wage growth has been in leisure and hospitality, the lowest paying industries and difficult to automate. As an example, Domino’s Pizza is offering some delivery drivers $1000 signing bonuses and $25/hr. There are also significant mismatches by skills, industry and location suggesting continued labor shortages.

The average hourly earnings (AHE) of lower-wage production and nonsupervisory workers (81% of payroll employment) rose 9.3% over the past 24 months through May. That’s twice as fast as the 4.8% increase in AHE for high-wage workers. Prior to the pandemic, AHE was rising 3%. Although forecasts for wages are thought not to be an issue, the Biden government and the Fed are focused on equality and how labor’s share in corporate profits has declined. To accomplish this you need higher wages and some of this will either get passed-on in price increases or you will see a decline in profit margins. Bottom line, the working age population, excluding those over 65, is declining. Baby-boomers on the verge of retirement still account for 6.5% of the workforce. Furthermore, as they age, they create caregiver jobs that can’t be automated or shipped offshore. You also have people that had jobs in leisure, entertainment and hospitality that are committed to career changes to jobs that are more sustainable and less subject to layoffs. This aggravates the jobs/skills mismatch.

So, I don’t disagree that transitional inflation will recede but with wage and housing cost pressure likely to pick up and last longer, the base rate of inflation may be higher than expected. If it isn’t dealt with, it will work its way into expectations and tolerance for further price increases as seen in a Conference Board survey in June where inflation expectations for the next twelve months jumped to 6.7%. Obviously, this debate over the statistics won’t be known until they are published. That won’t do us much good as the market will have already reacted. So, to help anticipate whether inflation is going to be problematic or transient, one has to rely on some economic theory and a lot of it is getting discredited. It’s the basis for my conclusions. But if you’d rather forego revisiting some of your college economics, please feel free to skip ahead.

Economic Theory

The ‘Quantity Theory of Money’ was originally set forth by Irving Fisher nearly a century ago and reborn in the ‘60s by Milton Freedman. It is the basis for traditional economic thinking that equates stimulative monetary policy with inflation. Those educated in this thinking have been waiting for a bout of inflation since the first rounds of Quantitative Easing (QE) were introduced during the Financial Crisis in 2008. Because it didn’t happen, many think the theory is no longer valid along with the Phillips Curve that equates labor shortages with rising wages.

However, there is an explanation. Central Banks execute monetary policy through the commercial banks. They do this by buying bonds from the banks which creates free reserves. The banks can then make loans up to ten times the amount of free reserves. However, in the aftermath of the financial crisis, those free reserves simply replaced about $4tn of problem bank loans, and in fact, were not lent out as they soared from roughly $50 bn to $4.5 tn. Therefore, monetary policy was short circuited and there was no impact on Main Street. This time, in the aftermath of the Pandemic Crisis, the Central Banks again engaged in QE but instead funded government treasury issues that were given directly to citizens in wage and other subsidies, thus bypassing the traditional commercial banking methodology. As we have seen, it worked and spending on consumer goods has increased dramatically, not only stimulating the economy but also causing inflation. So, the theory seems to be working and the only debate is whether it can be sustained. However, this hasn’t been a perfect pass through. There has been a short circuit in the form of savings. Total deposits at commercial banks rose $3.5 tn since March, 2020 to $17.1 tn. Furthermore, debt to disposable income has dropped to 85.5% in Q1, the lowest since 1995. So the consumer has firepower almost equal to the size of the economy. Of course, not all of it will get spent as lower income earners will be more likely to consume than higher ones.

This latent spending power is likely to sustain a higher consumption level beyond the actual disbursements by the government and argues for a stronger economy.

Another thought I’d like to introduce relates to the definition of inflation. For official purposes, we only include certain items, those that affect our cost of living but not those that support it like financial assets. This is the divide between Wall Street and Main Street. All the financial stimulation that we have seen since 2008 has had a major inflationary impact on financial assets and real estate, and has contributed to the financial social divide that we face today. Although the politicians would like to blame it on the capitalists, they are fully complicit in providing the wherewithal for the gap to be created through their own misunderstanding and lack of proper inflationary accounting.

Deutsche Bank published a very good piece on some of the softer aspects that will influence inflation that I would like to paraphrase.

The philosophical shift in government thinking from the fear of inflation and the rising levels of government debt, which shaped generations of policymakers, is now being replaced by the belief that economic policy should now concentrate on broad social goals.

Concerns over high and rising levels of sovereign debt are being relaxed as inflation has remained contained despite low interest rates. Concerns over debt sustainability and inflation have diminished as politicians believe structural forces will continue to suppress prices.

Policy has moved beyond just stabilizing output across the business cycle.

Fiscal stimulus is off the charts while Central Banks have shifted to having a tolerance for high inflation. Price growth could regain significant momentum as the economy overheats in 2022. The sum of the stimulus so far is in excess of $5tn or more than 25% of GDP not including the proposed legislation and deficits that are likely to come in at around $3tn.

Today’s stimulus dwarfs that seen in 2008 and the early 1930’s. Around WWII, deficits remained between 15%-30% for four years and inflation was 8.4%/14.6%/7.7% in ‘46/‘47/’48, respectively.

The Fed’s balance sheet has almost doubled during the Pandemic to nearly $8tn. Compared to the 2008 Crisis when it increased a little over $1tn and then another $2tn over the next six years.

The Fiscal Deficit and Fed balance sheet expansion combined equal approximately 30% of GDP in 2020 and will remain around 20% in 2021. This kind of explosive spike in monetary policy has, for the last 200 years, coincided with a similar spike in nominal GDP. This coordinated monetary and fiscal response has practically no parallel in US history.

Another difference between today and 2008 is that real disposable income has hit an all-time high in the US despite a recession. Consequently, excess savings has reached $2tn or more than 10% of GDP. Assuming 25% of these savings are spent over the next 18 months plus the stimulus from Biden’s Jobs and Families Plan will be enough to push GDP to more than 5% above potential by the later part of 2022. Overheated economies are typically quickly followed by a sharp run up in inflation.

Furthermore, there is political pressure on the Fed to err in the direction of delaying policy tightening, especially while the Fed leadership is up for renewal next year. Today, inflation is much less important than in the Reagan/Volcker era. Today, the focus is on not only employment but also on greater equality in income and wealth.

Monetary policy operates with long and variable lags. So, if inflation overshoots excessively and persistently, what will the Fed do? It will be forced to act, which will likely be highly disruptive to the markets and economy.

The perception that is being engrained is that high levels of debt and high inflation are a small price to pay for achieving progressive political, economic and social goals. This will make it difficult to accept higher unemployment in the interest of fighting inflation.

Federal Reserve

Now let’s talk about the Fed. We know that at some point, they are going to do two things. First, they will ‘taper’ which means, buy fewer bonds and mortgage-backed securities each month until they don’t buy any. Then they will start to raise interest rates to ‘normalize’ policy. This has a number of consequences for the stock market. Initially, Fed tightening can cause a correction but doesn’t historically end a Bull market. Second, it can change the complexion of which industries perform better, and influences the growth/value strategy. And finally, too much tightening can end the market’s and economy’s advance? So, every Fed meeting and economic release is dissected for some nuance on the Fed’s next move. Chairman Powell has repeatedly said that they will not raise rates ‘until substantial further progress has been made toward the committee’s maximum employment and price stability goals’. So what does that mean? They’ve said they’re willing to let inflation overshoot for a while to get to a socially-adjusted, fuller employment. If we use that as a benchmark and we take the average increase in employment, 468k new jobs per month which was the average in Q2, then it will take until mid-2022 to reach their goal of pre-pandemic employment.

And how long is Transient? Are we talking about fiscal stimulation? If so, and it’s been a one shot, demand-boosting policy, then shouldn’t the US budget deficit recede back to normal? According to Rosenberg Research, when examining prior spikes in inflation and the Fed’s reaction, this suggests that it could take 14 to 22 months before they react.

And what is tolerable ‘inflation overshoot’? Here the Fed talks about symmetry. Well, inflation averaged 1.6% since 2011 and only 1.2% in 2020. So, you need 2.4% average inflation through the end of the decade until 2030, with occasional peaks of 3% or more.

The Fed has also said that it will wait for actual evidence of inflation or other imbalances. This is also quite a departure from past protocol where the Fed has anticipated economic conditions using its many forecasts. After all, monetary policy is a leading indicator and now, it will be used in reaction to a coincident indicator. Consequently, there is a risk that if inflation is more than transient, the Fed will be well behind the curve, which will require a greater than otherwise required reaction to get inflation in check. Can this even be contemplated in an over-leveraged world? If not, what is the antidote for inflation?

Regardless, the mid-June Federal Reserve meeting was a bit of a reality check. Their message wasn’t much different, but they did open the discussion on when they would start to taper. The first sign of monetary tightening. Otherwise, the focus was on what is referred to as the ‘dot plot’. This is a record of when each Fed governor feels interest rates should be adjusted. Until June, the belief was that rates would hold until 2023. But this meeting saw 7 FOMC participants anticipate at least one rate hike next year up from 4 in the previous meeting and of those seeing an increase, two thought there would be two rate hikes. So, what happened to waiting for maximum employment, actual evidence and patience with inflation overshoot? Sounds like someone is looking at economic theory, which is why I elaborated on it earlier, as their inflation expectations rose from 2.4% to 3.4%. The reaction in the bond market was immediate as the curve flattened. Two year yields rose and ten year yields dropped. The reason: tapering means fewer Fed purchases of shorter-duration bonds, which is what they hold. That puts upward yield pressure on the two year Treasury note. However, willingness to raise rates sooner shows an inclination to fight inflation and puts downward pressure on the ten year yield.

The stock market took its lead from the bond market where the ten year yields had already dropped from 1.79% in March to 1.25% by July 9th. As longer rates dropped, signaling lower GDP growth, the growth stocks outperformed value. Some extrapolated this as a sign of weakening economic growth. However, the yield spreads between government and corporate yields would have widened if that had been the case and they did not. Yet, the Fed has not implemented any changes, which suggests that the decline in the ten year yields could be due to technical factors. In the past twelve months, the Fed has purchased $1,395bn of securities and has flooded the banking system with deposits while loans have been weak. This has resulted in the banks also being big buyers of treasuries, $867bn, to invest the surplus funds which drives rates lower. Combined, they have purchased $2.26tn in securities. Basically, government deficits are showing up in savings accounts and paid down loans.

The real question is why the Fed is still buying $120bn of securities each month when the economy is at a new record high and inflation is above their 2% target? On balance, the Fed’s mid-June statement suggested that there was a greater propensity to fight inflation than what there had been earlier.

Regardless, there seems to be an intractable course towards higher interest rates. If the economy continues to grow and inflation remains hot, the Fed may be pushed to react sooner than they have indicated. This would be especially true if the termination of unemployment benefits and the return to school in September drive the unemployed back into the workplace. But even if things cool off, the Fed has indicated a desire to normalize monetary policy. Only an unexpected slowing in economic growth could trigger a reappraisal and with so much consumption firepower sitting in bank savings accounts, that’s a hard case to make.

Stock Market

So, what does this mean for the stock market? Obviously, the focus is on the Federal Reserve and how and when they will start to tighten monetary policy. However, an increase in interest rates is only the beginning of the end and in the current conditions, maybe the beginning will be signaled when the Fed starts to taper its bond buying. This usually gives the market a shake but doesn’t terminate the advance. However, below the surface of the general market’s trend there is a lot happening that will determine performance.

Active management has had several themes to play over the last fifteen months starting with the Covid pandemic benefactors such as Amazon and Zoom. Then there were the ‘stay at home’ stocks like Netflix and Home Depot. This was followed by the recovery names such as the autos, industrials and home builders. The next phase was performance by the ‘coming out’ companies which included restaurants and airlines followed by a recent sell off in value and rotation to growth as the 2-10 year treasury yield spread narrowing surprised the market and concerns over the Delta Covid variant increased.

This growth/value backdrop has been a pervasive theme for the market through this whole period as falling rates in reaction to the pandemic supported growth. But, starting in November of last year the investment landscape changed as the anticipated Democratic victory brought forecasts of larger government deficits and a stronger economy which drove interest rates higher. Value, being more economically sensitive took the market leadership and has maintained that advantage until this June when treasury yields continued to drop from their March peak of 1.74% to a low of 1.25%. Since that peak in rates, the market has essentially flat-lined while growth has recently regained its leadership. During this period, growth is up 4.4% while value has slipped -0.8%. However, year to date through May, value still prevailed at +16.6% vs +7.8%.

In the second half, I would expect the themes to continue to rotate, but I would also expect the general market environment to be a little less friendly. In the second quarter, things were as good as they are going to get. Earnings and economic growth peaked along with government stimulation. The market will focus on what we refer to as the second derivative, which is the growth rate from one quarter to the next. So, earnings may be up 60% in Q2 but are projected to be up only 23% in Q3 and 17% in Q4. A declining rate of change, but still quite strong by historical standards. Nonetheless, the growth rate is slowing. Furthermore, a strong economy will require funding at potentially the same time as the Fed starts to contract liquidity. Financial instruments are generally the source of those funds which withdraws support for the market. Finally, the threat of tax rate increases next year could threaten significant fiscal drag as government spending proposals get watered down which would again be quite a contrast to the first half of this year. Historically, we’re following a fairly traditional pattern where monetary and fiscal policy are quite stimulative in the first year of a Presidency and then fall going into the second year, which is consistent with a market correction.

This combination of stretched valuations, peak economic growth, declining commodity prices and a Fed on the verge of becoming more restrictive provides an interesting but negative contrast to what we saw in the first half of this year.

Conclusion

As the title of my commentary states, I agree with the consensus view, but only up to a point. The economy, inflation and earnings growth are as good as they are going to get and will diminish or transcend in Fed speak. But, I don’t think we’re going to regress back to pre-Covid levels and that the residual economic strength will result in an inflation level above the Fed’s expectations. Will the Central Bankers react to this or will they be compromised by political influence? I don’t know. Furthermore, given the enormous amount of corporate and sovereign debt outstanding, can the Fed even use traditional interest rate increases as an antidote for inflation? If not, it will fuel a secular shift in investments to an inflation hedge type of strategy. For sure, any attempt to stem inflation with monetary policy will be met with a negative reaction by the financial markets, which has normally caused the policymakers to back off and certainly today’s collection of politicians and bankers stands in contrast to the Reagan/Volcker era which was prepared to do what was necessary to preserve some fiscal and monetary responsibility. The current Fed is not a guardian against inflation, but instead a proponent of it. ‘Group think’, low interest rates, debt monetization and massive borrowings not resulting in inflation has resulted in a re-appraisal of traditional economics. Structural forces are seen to replace traditional paradigms, and this has allowed monetary policy to go beyond stabilizing the business cycle to underwriting political social agendas under the excuse of a pandemic.

Although I do expect the market to work its way higher, I think investors are going to have to be a little more astute as to what they invest in. I don’t think the general market averages will provide a rising tide to make index investing attractive. But, I do believe equities, even with a market correction, which is overdue, will be the best asset class to protect your wealth.

Gerald R. Connor

Chairman

Credits

Grant’s Interest rate Observer

Deutsche Bank Research

Apline Macro

Rosenberg Research

Yardeni Research

Ned davis Research

John Aitkens

J.P Morgan

Barrons

Q2 2021 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Second Quarter of 2021. You can download the full reports HERE, or via the links shown below.

KEY OBSERVATIONS

Last quarter, we described the economy as “smoking hot,” the markets were strong and we wondered whether we were likely to see a temporary pullback that would allow corporate earnings to catch up with rising stock prices, or an upward revision of the already-rosy earnings outlook.

The verdict is now in. In the latest quarter, the S&P 500 advanced more than 8%, while the consensus earnings outlook rose by almost 11%. In other words, the economy remains smoking hot, yet the market is actually a little less expensive today than it was 90 days ago, at least relative to expected earnings.

The Federal Reserve (The Fed) increased its real GDP growth targets from 6.5% to 7% for 2021, unchanged for 2022, and up from 2.2% to 2.4% for 2023. We think this may provide a positive set-up for further earnings acceleration. Looking at the interplay between corporate earnings and stock prices over the past 50 years, this could prove quite positive for the market if history repeats itself.

The Fed also said that it expects inflation to peak at 3.4% this year before trending back to just above 2% in 2023. While this higher inflation was portrayed as transitory – and many of the underlying components, such as used vehicles, auto rentals, airfares and lodging are probably transitory – it is also possible that a reacceleration in employment and wage gains may not be so transitory. Time will tell.

In our view, given the strength of the economy and the strong outlook for earnings, and provided that interest rates remain low, it makes sense to continue to own equities.

NORTH AMERICAN STRATEGY

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our overall equity exposure increased from 94% to 97%. Our US equity exposure remained flat at 48% while our Canadian exposure increased by 3% to 49%. Investors who follow our North American Plus International Strategy will have a higher allocation to international equities, which means their US and Canada weights will be proportionately lower.

We have continued to position the portfolio toward value-oriented stocks to benefit from the current economic recovery. These make up about 57% of the portfolio. Our allocation to growth stocks, which is typically less dependent on economic trends, is up slightly to about 35%. Staples, which we don’t classify as either growth or value, make up the balance.

Our allocation to Canada, which has predominantly value-oriented positions in sectors such as Financial Services, Consumer Discretionary, Industrials, Energy and Materials, has risen significantly since June 2020, from 40% to 49%. In parallel, there has been a decrease in US equity positions from 55% to 48%, comprising sectors such as Information Technology, Communications Services and Health Care.

We added one new position in the second quarter of 2021:

Topaz Energy is an oil and gas royalty company that takes a small (2-3%) royalty on each barrel of production on its acreage. Since it doesn’t have to commit any capital to exploration, free cash flow margins are very high at about 90% and can easily support a 5% dividend with a 65% payout ratio. Beyond the dividend, we believe upside will come from volume growth on their acreage and leverage to an improving natural gas price.

GLOBAL STRATEGY

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

Global stock markets continued to rise during the second quarter, with the S&P 500 increasing by 8.2% and the MSCI World Index rising by 7.3%. On a year-to-date basis, the S&P 500 is up 14.4% and the MSCI World Index is up 12.2%. The year-to-date return for the S&P 500 is the second-best start to a year since 1998.

The global economic recovery is most obvious in the United States where the vaccine rollout is at an advanced stage. The US economy is growing fast, jobs are being added at a strong pace, and US consumer confidence recently hit its highest point since the pandemic began.

The last 15 months have been very generous to global equity markets. While we anticipate an ongoing recovery for the global economy, we are mindful of the risks – including the potential for a period of market consolidation, inflationary pressures, and new COVID variants.

So how should investors position their portfolios given the current backdrop? We believe that as we have said earlier, investing in high quality companies is the best way to protect our portfolios. High quality companies are characterized by strong pricing power and stable cash flow generation. This allows them to pass rising input costs along to customers, while insulating them from the higher interest payments associated with rising interest rates.

While we expect stock market gains to moderate from the robust pace of the last 15 months, we do believe that we remain in a secular bull market and as such, our portfolios are very well-positioned for this environment.

FIXED INCOME STRATEGY

Diane Pang, CPA, CA, CFA

Portfolio Manager, Fixed Income

Canada made major progress in vaccinations during the second quarter of 2021 with roughly two-thirds of the population now having had one dose and more than 30% fully vaccinated. Double vaccinations in the US have plateaued at around 47% of the population as reopening is in full swing.

Amid this progress, as we indicated earlier, stock markets continued to set new highs. Bonds told a bit of a different story, however, at least in part because central banks are still intervening with quantitative easing and yield curve control, which is keeping yields low.

The Bank of Canada’s most recent Monetary Policy Report was highly optimistic, which may have hinted at a rate hike as soon as late 2022. This possibility hinges on a number of assumptions, including smooth sailing with COVID and federal fiscal stimulus, sustained higher oil prices, a strong CAD/US exchange rate, and no major supply issues in areas such as lumber and microchips. We believe that any of these assumptions could disappoint on the downside.

The Canadian Bond Universe Index now yields 1.72%, which is unchanged from last quarter. We target a considerably higher yield for our clients. While the bond market spent the quarter in somewhat of a limbo, we were proactive in looking for opportunities and locking in yield where it makes sense.

Many onlookers want more from bonds than the current yield, but we remain patient. Our strategy is not predicated on having high volatility from which to derive our fixed income total returns. Actually, our preference is to be well-positioned for higher volatility to maintain stability, while we take advantage of less volatile periods to clip or earn decent levels of income from interest and distributions.

Many onlookers want more from bonds with yield, but we remain patient. Our strategy is not predicated on having high volatility from which to derive our fixed income total returns. Actually, our preference is to be well-positioned for higher volatility to maintain stability, while we take advantage of less volatile periods to clip or earn decent levels of income from interest and distributions.

Sustainable Investing at Cumberland

Almost without exception, our clients’ primary objective is to produce positive, tangible outcomes, such as growing and preserving their wealth over generations, or stewarding the assets of a charitable foundation or non-profit organization. However, in recent years, a secondary objective has been prioritized: investing in a manner that is sustainable for our planet and its people for the decades that lie ahead.

At Cumberland, we are pleased to share that our proprietary investment process delivers on both of these sets of important objectives. Our range of investment strategies have produced attractive risk-adjusted returns through decades of positive and negative market cycles, while also scoring well in terms of environmental, social and governance (ESG) sustainability measures.

A record of sustainable performance

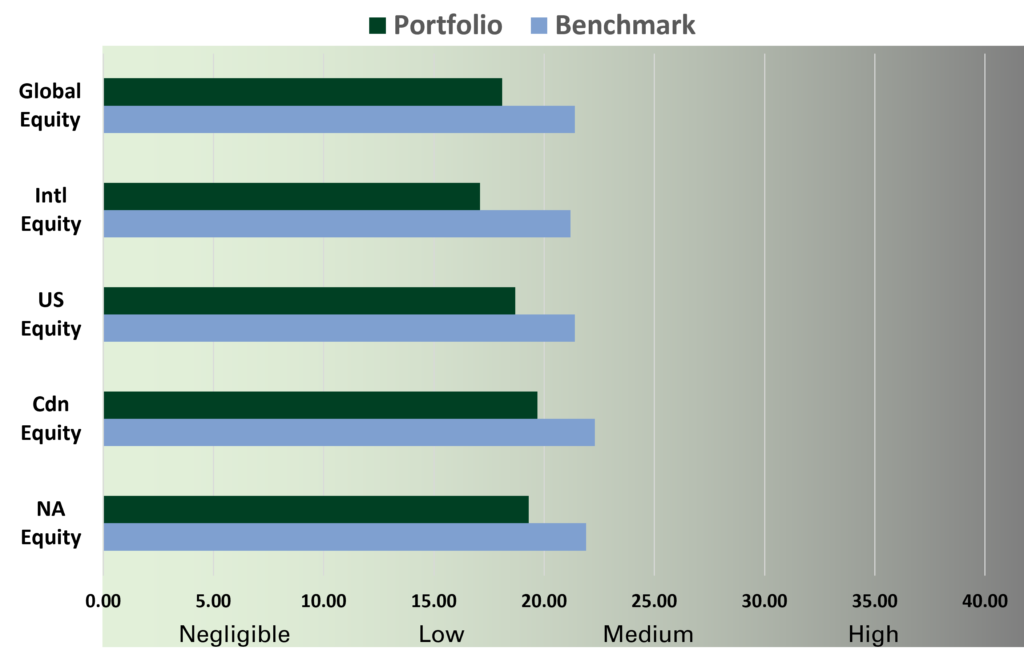

Based on data derived from Sustainalytics, a recognized leader in sustainability research, the six core investment strategies managed by Cumberland Private Wealth Management demonstrated better Corporate Sustainability Scores than their respective benchmark indexes. Note that a lower numerical score represents less ESG risk. Below is a comparison of the Q2 2022 data.

Portfolio Strategies vs. Benchmark ESG Risk Rating

At June 30, 2022

A Lower Numerical Score is less ESG Risk

Investing in sustainable companies

What makes our strategies more sustainable than the broader global investing indices? The short answer is the high quality of the companies in which we invest, resulting from our proprietary investment process and disciplined approach.

Today’s business leaders operate in an environment that is more competitive and transparent than at any time in history. These leaders are held accountable by the evolving expectations of shareholders globally, the scrutiny of regulators, employees and customers, as well as a growing class of stakeholders that can include everyone from activists and whistleblowers to citizen journalists and Twitter pundits.

In this environment, sustained success demands extraordinary vision, experience and discipline. At Cumberland, we screen thousands of public companies every year based on a process that has been honed over decades. We study numerous qualitative and quantitative factors to identify companies that have achieved a clear advantage over an extended period of time.

Qualitative and quantitative factors we study and prioritize

| Qualitative | Quantitative |

| Leadership track record | Return on invested capital |

| Business model | Return on equity |

| Competitive moat | Return on assets |

| Secular tailwinds | Free cash flow |

The result is a diversified portfolio of some of the best managed companies in the world. Their leadership teams understand more than just how to make money. They are attuned to their stakeholders, they take a forward-looking stance and they are strategic in their approach to business as a force for good. Many are industry leaders in terms of sustainability who tackle material issues head-on, so it should come as no surprise that they score highly on ESG criteria.

Positioned for a sustainable future

Our investment process has served our clients well over the 25 years since Cumberland was founded. From our top-down asset allocation strategies to our bottom-up security selection, our portfolios are built for the long term.

While specific ESG policies have not been integrated into our investment process at this time, we invest in portfolios of carefully-selected companies with strong, forward-looking leadership teams and track records of performance.

Reflecting on the historic data, we are proud to see that our investment strategies have grown steadily more sustainable. We expect this trend to persist as we, among other investors around the world, keep harnessing these forces. We believe our clients will remain well-positioned to participate and benefit from investing in a more sustainable future.

Rebirth of The Gen X Tech Stock

Microsoft was born in 1975 and went on to become one of the most powerful and profitable companies in history.

Five years ago, it looked like the company’s glory days might be over. Their personal computing business was down 5% and their cell phone division was going broke.

Yet, between 2016 and 2021, Microsoft doubled the growth of the broader stock market.

Watch Portfolio Manager Levon Barker explain the story of rebirth that most analysts missed, and why he believes Microsoft will continue to grow beyond expectations.

Year End and Q4 2020 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across North American, Global and Fixed Income markets. This is a high-level summary of our views for the Year Ended and Fourth Quarter of 2020. You can download more detailed reports below.

KEY OBSERVATIONS

A century ago, with no vaccine, the Spanish Flu killed an estimated 50 million people. Today, with 1.8 million dead from COVID-19, we have two vaccines approved and finally some light at the end of the tunnel. One can hope that history will repeat itself and usher in a new “Roaring Twenties.”

2020 was a rollercoaster. Global stocks, represented by the MSCI World Index, lost more than a third of their value early in the year, only to gain nearly 70% and reach a new peak in December.

Returns were dispersed by region and industry. Tech stocks drove the Nasdaq Composite Index up 43.6% for the year. The S&P 500 (+16.1%) and MSCI Emerging Markets Index (+15.8%) also saw big gains. Canada’s TSX Composite Index returned 5.6%, while the FTSE 100 Index in the United Kingdom (-14.3%) and CAC 40 in France (-7.1%) lost ground.

The economic declines and job losses of 2020 were the most severe since the 1930s. Yet, thanks largely to government stimulus, US disposable income actually increased, defaults in the banking system were minimal and economic activity recovered quickly.

We are now witnessing a classic inventory-restocking cycle as manufacturers respond to consumer demand, which is back to pre-COVID levels. Much of this demand is for durable goods like cars and housing-related items – spending decisions that are longer-term in nature, difficult to reverse and generally a sign of strong consumer confidence.

We predict a strong global economic recovery in 2021 with one important caveat: The vaccines must work as advertised. Effective vaccines combined with low interest rates, ongoing stimulus, and huge pent-up consumer demand should drive a rebound that becomes increasingly obvious as the year progresses.

NORTH AMERICA

We maintain a “barbell” strategy, blending companies that are more and less sensitive to economic growth. This allows us to play both offense and defense as events unfold.

We added four new positions in the final quarter of 2020:

Analog Devices, a circuit and semiconductor manufacturer, has exposure to the growth of industrial automation and autonomous and electric vehicles.

Intuit, a provider of business and financial software, stands to benefit as people and businesses increasingly turn to online tax filing and accounting.

Morneau Shepell, traditionally a pension consulting company, owns a hidden gem in the form of a fast-growing online employee wellness service.

Sherwin-Williams, the paint company founded in 1866, operates a growing network of 4,900 stores that generate very attractive returns.

GLOBAL

We recently added a position in Schneider Electric, a global leader in electrical management and automation. The company is well positioned to help address one of the world’s biggest challenges. Over the next 40 years, energy consumption is expected to grow by 50%, yet there is a goal to cut carbon emissions by half to address global climate change.

We also added positions in Analog Devices, Intuit and Sherwin-Williams, as did the North American portfolio.

We believe the Canadian dollar is likely to appreciate over the next 6-12 months, and implemented a 30% hedge against the US dollar during the quarter.

FIXED INCOME

With the overnight interest rate at 0.25%, many are wondering when the Bank of Canada will announce a rate increase.

In order for that to happen, the Bank will look for a significant improvement in unemployment along with inflation stabilizing at around their 2% target rate. Taking these factors into account, we believe rates will remain unchanged in the near-term and could even be cut to 0% if the pandemic is not brought under control.

In this environment, we continue to cautiously seek opportunities with a focus on preserving capital and managing risk.