Thoughts on the Market

At the beginning of August, global equity markets experienced a sharp sell-off. In one day, the Nikkei 225 sold off by more than 12% and the S&P 500 fell by more than 3%. There were a number of different factors that led to the sell-off including concerns about slowing economic growth, crowded positioning in Technology stocks, and a rapid unwind of the Yen carry trade. It felt like a perfect storm as all of these factors came to a head at the same time.

Although the market began selling off in late July, it accelerated in early August (on a Friday) on the back of a report from the U.S. Labour Department. The report showed that U.S. Nonfarm payrolls grew by just 114,000 in July. This was significantly below the consensus estimate of 185,000. The same report showed that the unemployment rate edged higher to 4.3%, which marked its highest level since October 2021. This report triggered fears about a recession and led the bond market to price in more interest rate cuts for the U.S. than had been previously forecasted. This shift combined with a recent interest rate hike from Japan’s Central Bank led to the unwind of the Yen carry trade. For many years, global investors have been borrowing money in costless Yen and using the proceeds to buy higher-yielding U.S. bonds as well as U.S. equities including the Magnificent Seven Technology stocks. When the U.S. jobs report was released, it sparked an unwind of the Yen carry trade, which magnified losses in the S&P 500 index and the Nasdaq. It certainly didn’t help that over the weekend Warren Buffet’s company (Berkshire Hathaway) announced that it had cut its position in Apple by nearly half. All of this led to a big sell-off across global markets the Monday following the U.S. jobs report. In a span of less than 3 weeks, the S&P 500 experienced a decline of 8.5%. However, the market drawdown was very short lived. In fact, it took just over 2 weeks for the S&P 500 to rally back to within 1% of its all-time high.

While it’s not easy to precisely explain why the market rebounded so quickly, there are several reasons why we remain cautiously optimistic on global equities. These reasons include recent economic data points that refute the notion of a recession, a broadening out of the stock market, and a clear change in the tone of the U.S. Federal Reserve Chairman.

In terms of economic data, retail sales for July were much stronger than expected and the latest report for U.S. jobless claims showed a decline. In addition, some of the more discretionary areas of the economy remain steady including restaurant bookings, air travel, and hotel occupancy rates. In addition, U.S. gross domestic product increased at a 3.0% annualized rate last quarter according to the Commerce Department’s Bureau of Economic Analysis. This was an upward revision from the 2.8% rate reported last month. Taken together, these data points do not suggest that the U.S. economy is on the verge on a recession.

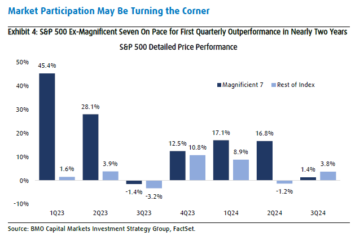

In addition to positive economic data, there has also been a broadening out in the stock market during the third quarter. After a long period of market dominance, shares of the Magnificent Seven have trailed the shares of the other 493 companies in the S&P 500. This means that the Magnificent Seven are on track to underperform stocks in the rest of the index for the first quarter in nearly two years as illustrated in the chart below.

We believe that the broadening out of the stock market is important and that it increases the likelihood of a sustained increase in the stock market going forward.

In addition to positive economic data points and a broadening out of the stock market, there has also been a significant change in the tone from the U.S. Federal Reserve Chairman with regards to interest rates. During the recently held annual retreat in Jackson Hole, Jerome Powell announced that “the time has come for policy to adjust”. He went on to say that “inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic”. This is a very significant change in the tone from Mr. Powell and it sets the stage for interest rate cuts with the bond market currently pricing in four rate cuts in the U.S. by the end of 2024.

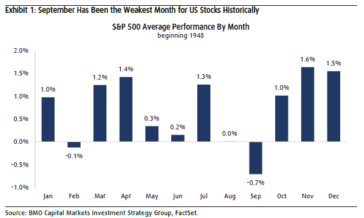

For all of these reasons we remain cautiously optimistic. But there is one caveat, given that we are entering a period of seasonal weakness as seen in the chart below.

Since 1948, September has been the weakest month of the year in terms of performance for the S&P 500 with an average loss of 0.7%. This is significantly lower than February, which has historically been the second worst month of the year with an average loss of 0.1%. In addition to seasonal weakness, the market will also have to deal with the uncertainty related to the U.S. Presidential Election. Given this backdrop, we may experience elevated volatility in the weeks ahead and we plan to use this volatility to take advantage of opportunities that are presented to us.

Phil D’Iorio