The Return to Normality

It has been just over one year since COVID-19 was declared a pandemic and since global stock markets formed a bottom last March. It has been a challenging year but there are more and more signs that the global economy is healing and that everyday life is getting closer to normal. A quick look at the economies where vaccinations are furthest along is a good way to gauge the progress on the world’s return to normality.

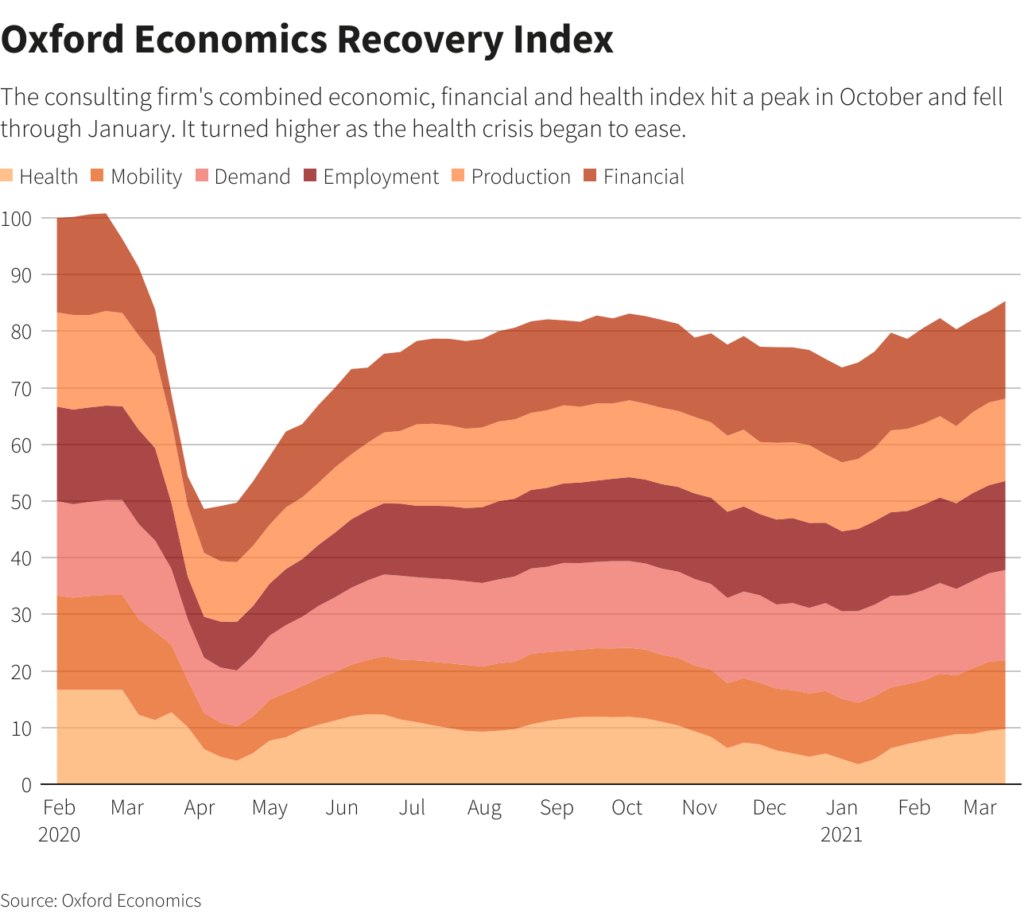

Oxford Economics has an all-encompassing Recovery Index that incorporates several factors including employment, demand, mobility, and health related factors. As seen in the chart below, the Recovery Index has been improving for several months and it is at the highest level since the pandemic began. The Recovery Index highlighted below is for the United States so it is not a perfect readthrough for the world. Having said that, the United States was one of the hardest hit countries by COVID-19 and it is also one of the furthest along in terms of vaccinations, so the progress being made is encouraging.

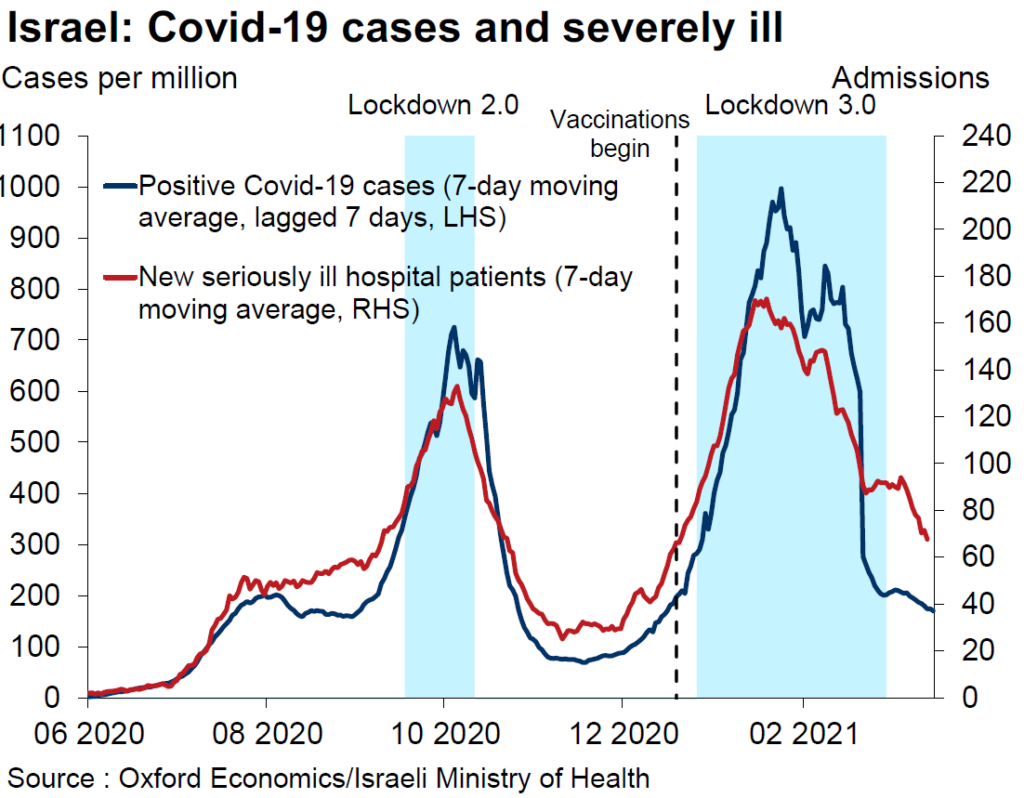

Data from Israel also paints an encouraging picture of the impact of extensive vaccinations on Covid cases and hospitalizations. Israel is another one of the countries that is furthest along the vaccination path with more than 60% of its citizens having been vaccinated. As seen in the chart below, cases of Covid and new severely ill hospital patients have plunged since the first week of February. Given that this occurred during a period when social distancing restrictions were eased, it is a promising sign for other countries as vaccinations begin to ramp up around the world.

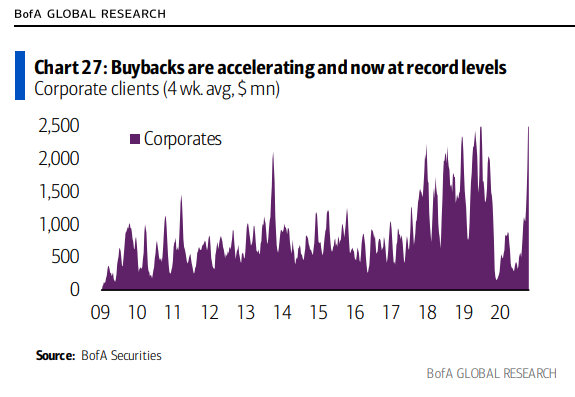

Another sign that we are on the road to recovery is that corporate share buybacks are now back to pre-COVID levels, suggesting that corporations are feeling good about the future.

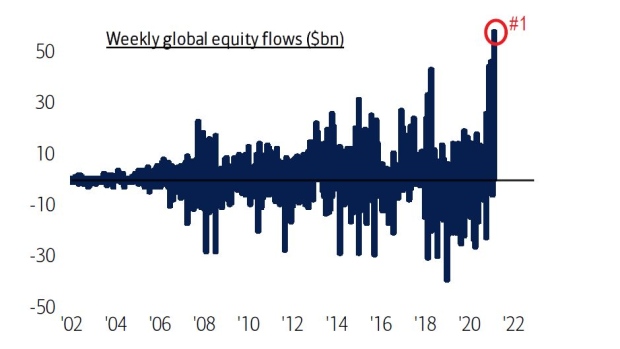

Individual investors are also feeling good about the prospects for the future as inflows into stock funds have reached their highest levels in the last 20 years.

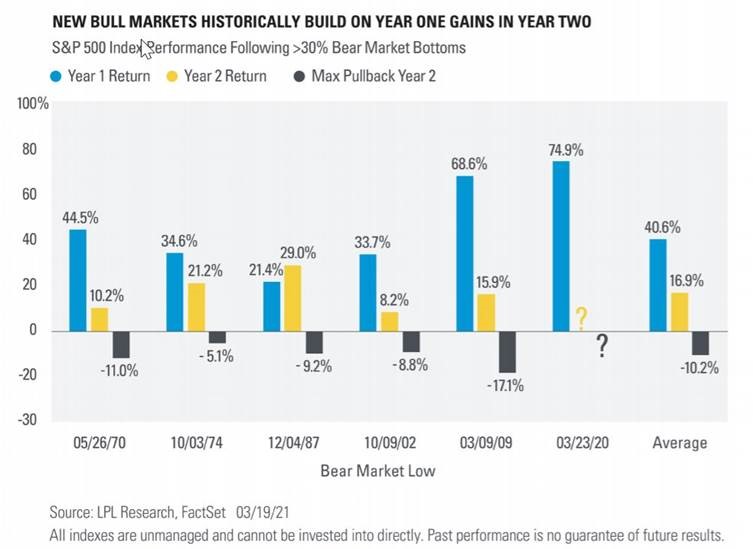

It appears that corporations and individual investors are using history as a guide. According to LPL Financial, the second year of a new bull market has historically been positive. As seen in the chart below, the average return for the S&P 500 in the second year of a bull market has been +16.9% over the last 70 years.

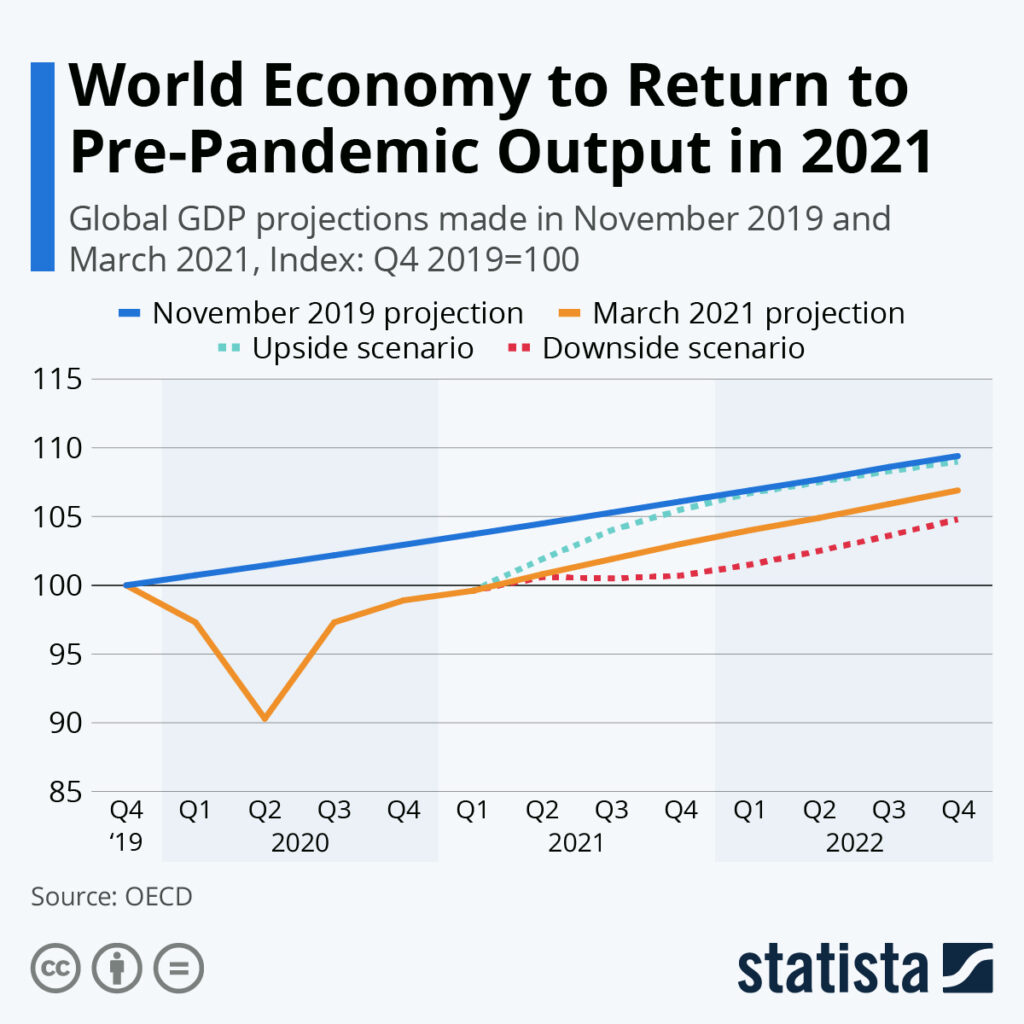

Perhaps the best sign that the world is returning to normal is that global GDP is expected to return to its pre-pandemic level during 2021. This will mark one of the quickest economic recoveries ever.

While it is too early to say that we are completely out of the woods, there are more and more signs that the world is making progress against COVID-19 and that we are getting closer towards a state of normality.

Have a good weekend,

Phil

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Reasonable efforts have been made to ensure that the information contained herein is accurate, complete and up to date, however, the information is subject to change without notice. Information obtained from third parties is believed to be reliable but no representation or warranty, express or implied, is made by the author, CPWM or CIC as to its accuracy or completeness. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involved inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd.