Putin vs. Powell

I’m not a fan of Vladimir Putin. I think he’s a thug. But, if you’re going to resolve a conflict you have to understand your opponent’s position. What I’m seeing happen in the Ukraine reminds me of the Cuban Missile Crisis in 1962. It was a period during October of that year when we thought there was a chance there would be a nuclear confrontation as the Soviets threatened to put missiles into Cuba. Khrushchev had misjudged President Kennedy as being a weak President. He had failed in the Bay of Pigs invasion in 1961 and failed to take action against the building of the Berlin Wall. The hypocrisy of the standoff was the US intolerance of missiles close to their borders in Cuba while they were installing ballistic missile bases in Turkey. History suggests that Kennedy won the contest with a blockade and the Russian withdrawal. The reality is that Kennedy agreed to end his threat by pulling his weapons back from the Soviet borders.

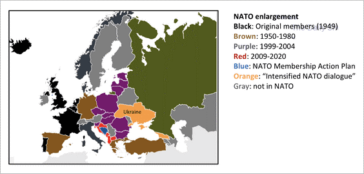

If you look at this map, you can see how the NATO Allies have continued to sign alliances that encroach on Russia’s borders. So, maybe there is reason for their paranoia, especially with a leader that envisions restoring his country to its former greatness. Although global economies have advanced dramatically since the Cold War era, we’re still dependent on the movement of commodities and this latest conflict with the Ukraine is highlighting this.

Historically, geopolitical crises have tended to be a buying opportunity in the stock market and most strategists are siding with history. Given that the current market was already in a slump due to Fed Chairman Powell’s shift towards a tighter monetary policy, Putin’s actions have driven investor sentiment to an extreme that is usually bullish, at least for a bounce but maybe not a bottom. With inflation running hot and interest rates already low, there is little leeway for the Fed to provide market support. However, in the battle for headlines, I think Powell will regain the advantage and push Putin off the front page. Nonetheless, it’s worth trying to assess how Mr Putin has altered the landscape since the end of the Olympics.

At year end, we felt that the economy had one more advance left in it, as bottle necks got resolved, inventories were rebuilt and consumption shifted from goods to services. Inflation was likely to hang around as labour shortages aggravated wage settlements, housing costs got passed through in higher home equivalent rents and oil prices remained high due to shortages brought about by environmental capital blockades and insufficient sources of alternative clean power to make up for declining hydrocarbon reserves.

The Russian economy isn’t one of the top ten in the world. So, it’s not likely to impact this outlook very much. However, at the margin, what is going on in the Ukraine can change the complexion. Especially if things escalate.

So, what’s changed since the year end? Let’s start with the sanctions against Russia for the invasion:

1. The natural gas pipeline, Nord Stream 2, from Russia to Germany has been put on hold.

2. Access to high tech items such as semiconductors has been limited.

3. Travel bans and asset freezes were implemented on targeted individuals and politicians.

4. Trade and finance restrictions were initiated against selective banks and bond financings.

Sanctions were determined so as to not hurt Allies and to avoid unintended consequences. On balance, the actions taken were considered pretty mild and probably ineffective. Putin himself was not restricted and the nuclear option of barring them from the international monetary settlement system, SWIFT, was not taken.

Yet, there will be ramifications. The unintended consequences are not yet known and one would assume this first round of sanctions is just part of the sequencing that will unfold as reprisals for any further Russian aggression. So, things could and will likely get worse.

Let’s start with oil. No one wants to aggravate the price of energy. It would be too painful for Europe and US voters are already upset by the cost of gasoline. But, oil is also moved by ship and insurance companies are already either raising the cost of insuring cargos or are refusing to insure due to war risk. Refiners are looking to source crude from other locations further aggravating shortages. In the unintended consequences categories, Biden may be more motivated to come to a nuclear treaty with Iran to bring their crude oil back to the market. Where would this leave the Israelis? They have proven to not only have the capability for military action but the willingness to use it. Do they end up feeling threatened and without creditable US support, given Biden’s actions in Afghanistan, and do something unilaterally that provokes a Middle East war? Furthermore, there is the Taiwan wildcard. Everyone knows China’s stated intentions to reunite with the Island nation and Western alliance’s opposition. Does successful aggression by Russia encourage them to move on this issue? Right now, China is in its own balancing act trying to maintain a united front with Russia while avoiding being associated with destabilizing acts against some of its biggest trading partners. They have suggested that they may not support a full-scale invasion and have called for a diplomatic solution while condemning sanctions. One would assume that they will watch to gauge the West’s reaction in their deliberations on Taiwan.

Furthermore, you cannot assume Russia won’t unilaterally reduce its exports to further their negotiating power. They’re the world’s largest exporter of natural gas, supplying Germany with 40% of their requirements. They are also one of the world’s largest exporters of wheat and provide 10% of the world’s copper and aluminum. After the Crimean annexation, sanctions put Russia into recession as oil prices were declining. This time oil prices are improving. Additionally, they’re in a much better financial position with a current account surplus equal to 5% of GDP. Their sovereign debt is only 20% of GDP, amongst the lowest in the world with gold and foreign exchange reserves amounting to about $600bn.

One could go on, but I think you get the message. There are a lot of moving parts and we don’t yet know if there are further moves in store.

Conclusion

The economic recovery and inflation outlook we envisioned earlier remains intact. Although, the Russian invasion has probably aggravated the inflation outlook, especially for energy, and detracts from economic growth as higher oil prices are a de facto tax on consumption and will foster more concerns over stagflation.

As for the stock market, we got the type of reaction that one would expect. Initially interest rates declined due to a flight to safety that also pushed the US dollar higher. But once the shooting started, shares rallied from a very oversold condition and the most depressed growth issues that benefit from lower rates led the advance. But, interest rates didn’t stay depressed very long and recovered quite quickly which retuned the market to its earlier mode of favouring value and commodity producers over mega cap growth stocks.

Without further escalations in the Ukraine the headlines will probably once again focus on the Federal Reserve and their policy meeting on March 16th. Tighter monetary policy and whether the European conflict will moderate the expected rate increases and hurt global growth, will likely dominate market forecasts.

The big risk is that the Ukraine conflict escalates and spills over into Baltic States which may have NATO treaty obligations.

Subsequent Events:

Over the weekend sanctions were escalated. Certain Russian banks have been restricted from using the SWIFT payment system. However, this is more of an inconvenience than it is punishing. What was punishing was the prohibition against banks providing US dollar transactions. This eliminates a lot of trade.

Sanctions have also limited Russian access to their Reserves and prevents them from defending the Ruble which has collapsed by 40%. The lower currency will aggravate inflation, which is already running at 9%, and some believe this will take it to 18%.

To defend their currency, Russia’s Central Bank has doubled interest rates to 20%.

Obviously the sanctions are intended to cause domestic economic pain while sparing energy users any additional burden.

Gerald Connor

Chairman