Plan your life, manage your wealth

Wealth management is the process of utilizing financial assets and human capital to realize, protect and enhance the life you are living and the life you are building towards. Wealth management is, therefore, a deeply personal process. It is also multifaceted, requiring the consistent assessment of emerging opportunities and risks.

The rise in interest rates over the past two years has presented a material change in the landscape. Higher interest rates have boosted returns for short-term investment vehicles. This creates opportunity. But if short-term returns interfere with long-term strategy, that is a real risk.

Take advantage of short-term opportunity

The rise in interest rates has boosted cash investment returns from 0.55% at the start of 2022 to over 5% at the end of 2023. That is an increase of almost 1,000%. As a practical matter, it now pays to scrutinize where your cash is held. For example, are you carrying too much money in a bank account that pays little to no interest? Is your current “high interest rate” competitively priced? Could you benefit from locking in a short-term rate? Answering these questions will ensure your cash is working optimally towards your short-term objectives.

The current high returns on cash are a boon for short-term objectives. Enjoy it. But it is critical, in our opinion, to keep this opportunity in the proper perspective. Cash is not a long-term investment solution, and trying to time the market rarely pays.

Market timing is a high-risk proposition

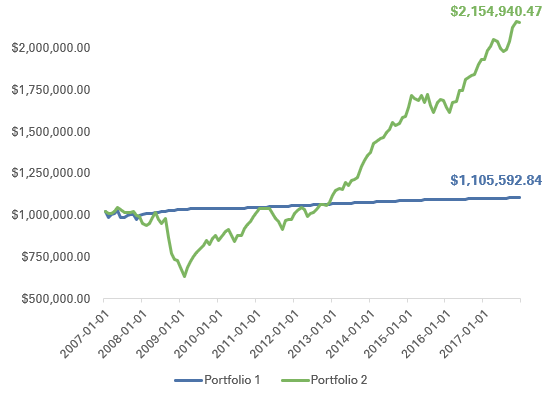

Allow us to share the story of an investor who sold all their long-term investments in 2007 and moved to cash. It appeared to be an amazing investment decision at the time, because they avoided market declines of over 40% when the Great Financial Crisis hit in 2008.

However, this stroke of genius went very wrong as they continued to hold cash. By 2013, the markets had recouped all their losses, yet this investor had not re-entered the market. By 2017, when this investor finally came to see us, the market had gained another 50%, and they had missed out entirely.

This story highlights the reality of timing the market: You can be right about getting out of the market and still end up worse off, because you must also be right about getting back in.

Let’s suppose you are right 50% of the time in exiting the market and 50% correct in getting back in. You will only be right, on average, 25% of the time. Not great odds, especially when your retirement is at stake. The reality is there is never an all-clear signal telling you when to start investing again.

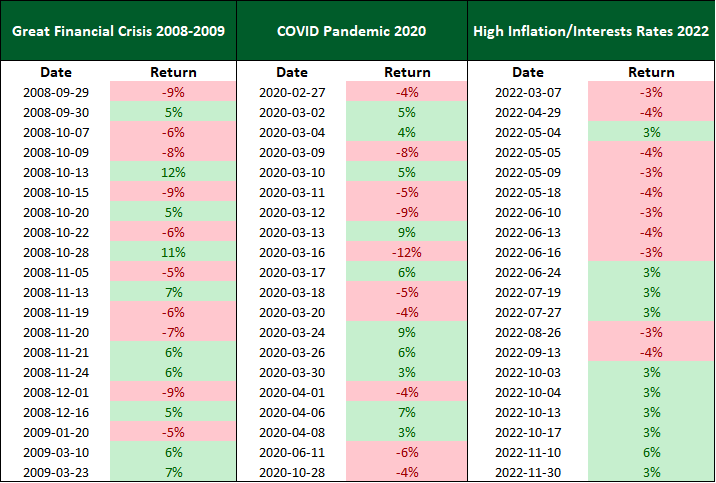

The decision to reenter the market is further complicated by the sequencing of returns. Often the best and worst days in the market are clustered together. Chart 1 shows the 10 best and worst days for the S&P 500 TR index, a broad US equity index, for three time periods. The best days are green and the worst days are red.

Notice that, during the Great Financial Crisis, 17 of the best and worst days occurred within a 78-day period. During COVID, 18 of the best and worst days occurred during a mere 41-day period. In 2022, the market was down over 14% between April and June in 2022, then up almost 14% between October and November.

The windows of opportunity to time the markets are incredibly small – usually just a matter of days. Even if you thought you knew when they were going to happen, would you have the emotional fortitude to execute your investment strategy? And would your lifestyle and schedule even allow you to make such decisions? In practical terms, the task is all but impossible.

How cash actually erodes wealth

Let’s put market timing aside now and consider another risk with moving into cash: in the long run, it provides the lowest expected investment returns.

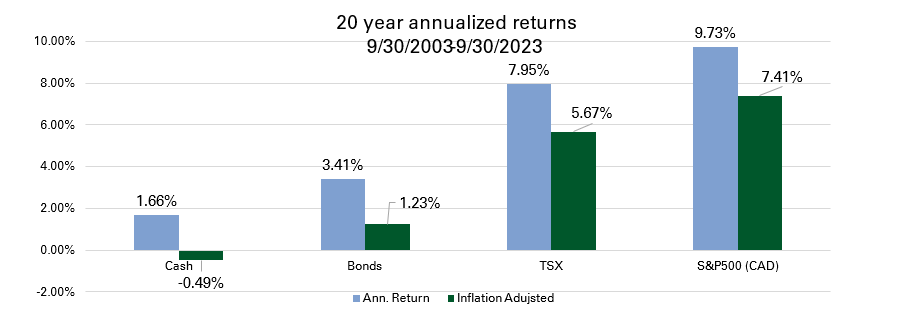

The blue bars in Chart 2 show the returns for cash, bonds, Canadian equities (represented by the TSX), and US equities (represented by the S&P 500) for the past 20 years. Cash significantly lags the alternatives, and we can expect this to continue because of one foundational principle of investing: taking the least risk means accepting the lowest returns. Bonds and equities offer higher expected returns because investors bear the risk of greater short-term volatility.

But perhaps the more important takeaway is what’s depicted in the green bars, which is the return of each asset class after inflation is accounted for. In the long term, cash has offered negative after-inflation returns. In other words, your future dollars are worth less than they are worth today. Therefore, you need to save more, delay retirement, spend less to compensate, or potentially settle for having less economic power in the future.

Equities provide the highest after-inflation rate of return, and that’s what makes them so well-suited for long-term investment objectives.

Why stocks outperform over time

One key fact has historically enabled equities to stay ahead: well-managed companies have opportunities to grow their profits faster than the rate of inflation. Here’s why:

- They participate in the overall growth of the economy – when the economy grows, sales increase.

- When prices increase due to inflation, strong companies can generally benefit by raising their prices too.

- Many of the expenses incurred by companies do not grow as sales increase. For example, a company may be able to increase their sales volume without having to hire more staff.

- Companies can use profits to reinvest in the business and further increase sales or reduce costs.

- Many companies share some of their profits annually by way of dividend distributions paid to their shareholders.

Over time, this virtuous economic circle leads to increasing shareholder value, which then translates into higher share prices. History shows that you don’t really need to pick the right time to invest, so much as you need to invest in quality businesses and remain invested.

Connecting market dynamics to your life plan

Financial planning involves many dynamics, but none are as fundamental as your individual goals. As the saying goes, “If you don’t know where you’re going, any road will get you there.”

By determining your goals, you can create a roadmap to achieve them and avoid potential wrong turns, including short-term distractions, attempted market timing, and choosing the wrong long-term asset classes for the desired objective.

Stating goals in qualitative terms, such as “purchase a home” or “retire early” is a good starting point. However, being as specific as possible will unlock the most opportunity.

For example, the path to “purchase a home next year” is a lot different than the path to “purchasing a home in ten years.” The amount of investment risk that can be taken in one year is substantially less than the amount that can be taken over 10 years. In fact, the high short-term interest rates of today might be a boon to someone with a one-year timeframe, but a bust for someone with a 10-year runway.

Planning for the long term is not easy. Markets can be volatile. Life, too, can be volatile. Balancing the demands of our careers, family, social lives, and passions is not always easy. But by defining what we want from life, prioritizing what is most important to us and aligning our finances to these objectives, we can greatly improve our chances of success.

A guiding question we can always ask is: Are our investments working towards our desired goals? If the answer is no, we need to act as soon as possible and create a plan to align them.