Partying like it’s 1999: When will the game stop?

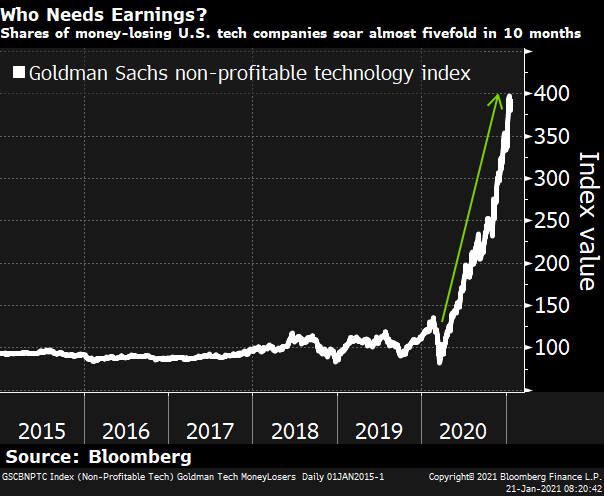

The past week has been one of the strangest weeks that we have encountered in a long time. In our previous commentary we discussed ‘potential’ bubbles in Tesla, Bitcoin, and non-profitable Technology companies. There have been extreme moves in all of these areas and 2020 was especially noteworthy for non-profitable Tech companies as seen in the chart below.

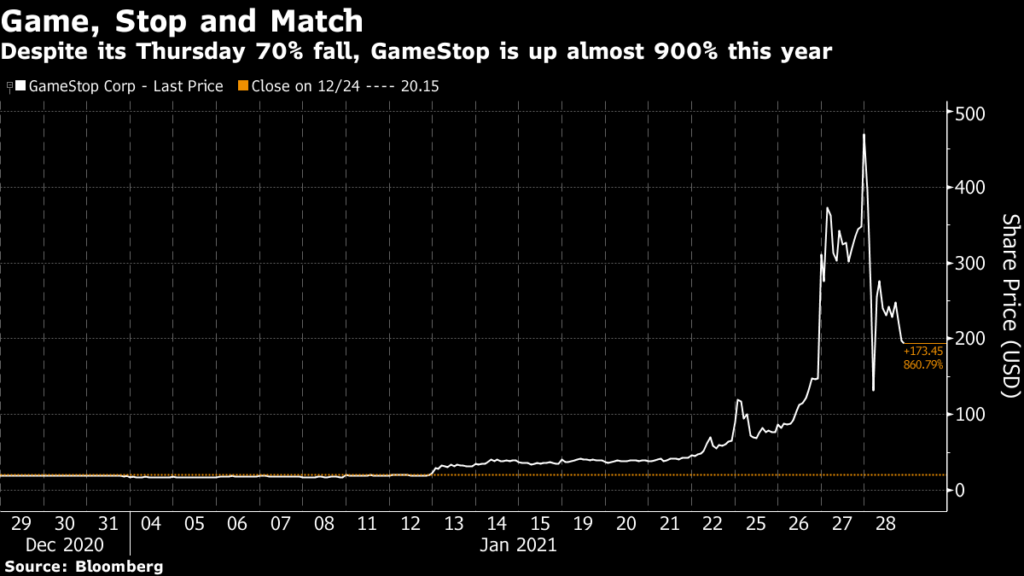

It probably makes sense to add Game Stop to the list of ‘potential’ bubbles because we now have retail investors short squeezing hedge funds via Reddit. But who’s David and who is Goliath?

Despite an intra-day drop of 70% yesterday, GameStop is still up nearly 900% this year. In a span of a few weeks, GameStop went from a small cap stock to a mid cap then a large cap stock. At one point it was large enough to be around number 260 in the S&P 500. It seems like speculation to us, but please don’t take our word for it because we’re not experts in the gaming sector.

So while we do see some froth in certain parts of the market, that’s not where we are investing our clients’ money so it’s somebody else’s issue to deal with. What this week does show is the magnitude of the firepower that the US retail investor has. Consumer wallets have swelled due to the stimulus and there is more on the way according to what we have heard from President Joe Biden.

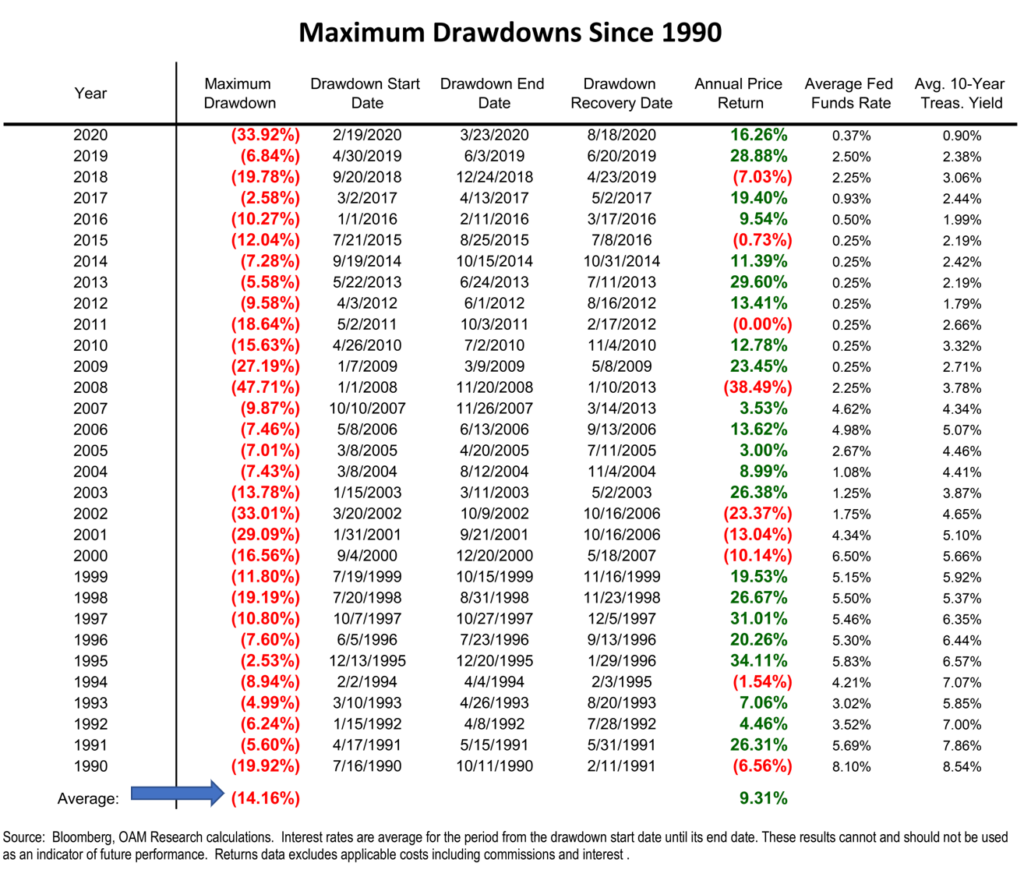

Over the last 10 months, there has been a very strong advance in global equity markets as measured by the MSCI World Index, which is up nearly 70% since bottoming in late March. Valuations are currently at the upper end of the range on certain metrics such as the price-to-earnings ratio. Furthermore, investor sentiment measures appear elevated and would imply that investors have become complacent. All of this suggests to us that the market is ripe for some consolidation and we did see a bit of that this week when the S&P 500 declined by 2.5% on Wednesday. Corrections are normal and they happen almost every year, even during bull markets. As seen in the chart below, the average annual drawdown over the last 30 years has been 14.2%.

Nobody knows when these drawdowns will occur nor do we know how severe they will be. The important takeaway from this chart is that even though there have been drawdowns of 7% or more in 24 of the last 31 years, the S&P 500 has only experienced a negative annual return in only 9 of those 31 years. And in 2 of those years (2011 and 2015), the market was down by less than 1% so essentially flat. The point is that market drawdowns have typically been good buying opportunities. Not always, but most of the time.

So, what about today’s situation? We believe that a drawdown in 2021 will likely represent a good buying opportunity because we continue to expect a global economic recovery. There are several tailwinds that will support the recovery including government stimulus measures, low interest rates, and a huge amount of pent-up demand from consumers. In addition, Q4 corporate earnings have been strong thus far and have led to earnings upgrades from analysts. And finally, financial conditions remain loose. According to the Federal Reserve Bank of St. Louis, (https://fred.stlouisfed.org/series/NFCI), the current reading of the Financial Conditions Index is near its lowest level of the last 20 years. This implies that there are few signs of stress within the financial markets. Putting it all together, we continue to have a cautiously optimistic outlook for 2021.

Have a good weekend,

Phil

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Reasonable efforts have been made to ensure that the information contained herein is accurate, complete and up to date, however, the information is subject to change without notice. Information obtained from third parties is believed to be reliable but no representation or warranty, express or implied, is made by the author, CPWM or CIC as to its accuracy or completeness. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involved inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd.