Is Quality Making a Comeback?

Global equity markets have rebounded over the last several weeks. The leading indices in the U.S. are up more than 10% and several indices across Europe are up nearly 10% from the July lows. Earnings season is now in full swing and although the results have been somewhat mixed, it’s been pretty good with approximately 70% of companies having reported earnings that were above consensus expectations. As we think about the second half of this year, we expect volatility to continue given persistent inflation which has raised the probability of a recession.

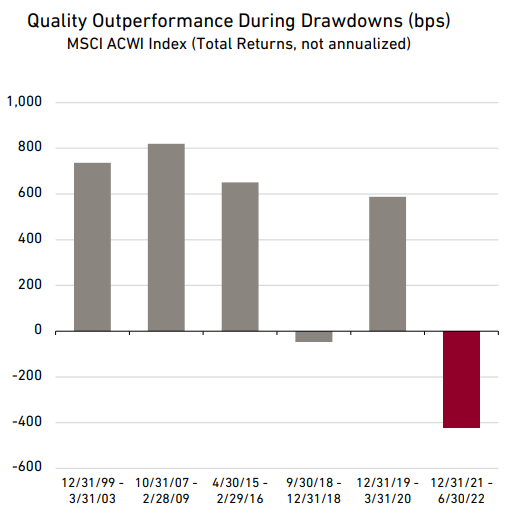

One of the surprising trends thus far this year has been the significant underperformance of the Quality factor. As seen in the chart below, Quality has significantly outperformed during stock market drawdowns over the last 2 decades. In 4 of the last 5 drawdowns, the Quality factor has outperformed the MSCI All Country World Index by approximately 600 basis points or more. However, this was not the case during the first half of 2022. In fact, the Quality factor underperformed the MSCI All Country World Index by more than 400 basis points during the first half of 2022.

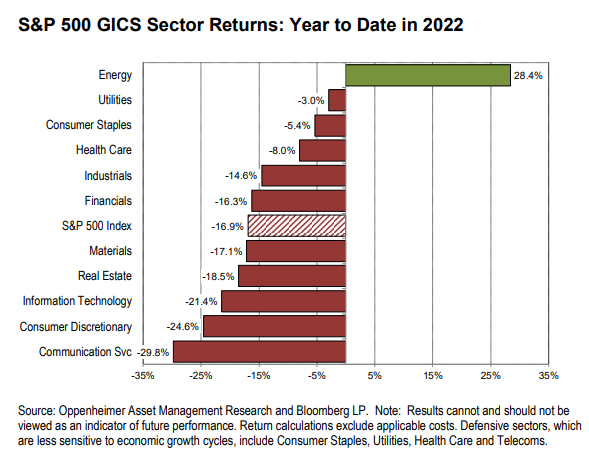

One of the reasons for the underperformance of the Quality factor is that there was a significant reset for valuations during the first half of 2022. Given their attractive characteristics (high ROE’s and stable cash flow generation), quality companies trade at higher valuations. When the 10-year U.S. Treasury Yield more than doubled from 1.5% at year-end of 2021 to nearly 3.5% during the first half of 2022, it caused a significant reset in stock market valuations. Given that high quality companies trade at higher market valuations, they were the hardest hit by this reset in valuations as investors started using higher discount rates to value companies. In addition to this valuation reset, another reason for the significant underperformance of the Quality factor has been the dominance of the Energy sector. This sector has been the best performing sector in the S&P 500 on a year-to-date basis. As seen in the chart below, Energy is not only the best performing sector, but it was the only sector that was up among the 11 sectors in the S&P 500 as of July 25th, 2022.

The Quality factor has started to improve significantly in recent weeks and that is good news for us given that our portfolios that follow our global and international strategies are largely constructed with high quality companies. We invest in quality businesses because we believe that they are more likely to create the most value for shareholders over the long term and they have typically been more resilient during periods of market adversity. Although we are disappointed that quality companies have not been as resilient in the first half of 2022, we are very encouraged to see that they have been performing much better in recent weeks. Importantly, we expect this trend to continue as we believe that investors will gravitate towards high quality businesses as they seek shelter in companies with stable free cash flow generation.

While we are very encouraged by the recent stock market rally, our portfolios continue to have a defensive tilt with significant exposure to stable sectors such as Consumer Staples and Healthcare. Given the ongoing tail risks associated with inflation and the war in Ukraine, we believe it is prudent to maintain a somewhat defensive posture. We also believe that our exposure to high quality companies will serve us well given the current market backdrop and that we own the types of companies that can weather the volatility that may lie ahead.

Have a great long weekend.

Phil

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Any comments, statements or opinions made herein are those of the author and do not necessarily reflect those of Cumberland Private Wealth Management Inc. (Cumberland) and are not endorsed by Cumberland. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.