Debating the Bear Market Narrative

Over the past year, the bear market narrative has transitioned from fears about a recession to renewed concerns about interest rates. The reason why interest rates concerns have re-emerged is due to several inflationary data points that were worse than expected. These hotter than expected inflation reports have shifted investor expectations regarding interest rate cuts from the U.S. Federal Reserve. As a result of this, the bond market is now only pricing in 1 interest rate cut by year-end, which compares with expectations for 7 interest rate cuts at the at the beginning of 2024. Given this shift in sentiment, the U.S. 10-year Treasury yield has jumped from 3.9% at the end of 2023 to 4.5% currently.

Just over a year ago, most investment banks on Wall Street were forecasting a U.S. recession due to the impact of stubborn inflation and high interest rates. In March of 2023, 65% of economists polled by Bloomberg believed that the U.S. economy was headed for a serious downturn within the next 12 months. However, Wall Street has largely abandoned its recession call given the resilience of the U.S. economy over the last 12 months. This shift in sentiment regarding a recession was evident in the Deutsche Bank Global Markets Survey that was conducted in March of 2024. The results from that survey showed that only 17% of respondents expected a recession or a hard landing for the U.S. economy. Although many of the bears have abandoned their call for a U.S. recession, many of them have moved on to a different narrative. The new narrative is that high interest rates are bad for stocks. The argument basically says that the even though the economy will avoid a recession, stocks will perform poorly due to high interest rates. The interesting thing about this new narrative is that history tells us that investors should not fear higher rates. In fact, some of the strongest periods of performance for the S&P 500 over the last few decades have coincided with rising interest rates or higher levels of interest rates.

Since 1990, periods of rising interest rates have been associated with stronger stock market returns than periods with falling interest rates. As seen in the chart below, the S&P 500 has posted an average annual price return of 13.9% during periods of rising interest rates, which compares with just a 6.5% average annual gain during periods of falling interest rates.

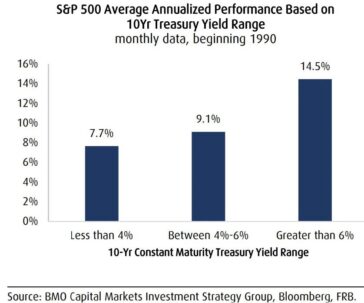

Not only have stocks done better during periods of rising interest rates, but stocks have also generated higher returns during periods when interest rates were at higher levels as seen in the chart below.

Since 1990, the S&P 500 has performed better when interest rates were higher, as measured by the U.S. 10-Year Treasury Yield. When the 10-Year Yield was less than 4%, the average annual return was 7.7%. This compares with an annual return of 9.1% when the 10-Year Yield was between 4-6%, and an annual return of 14.5% when the 10-Year Yield was above 6%.

The data outlined in this note suggests that the current bear market narrative is somewhat flawed. The argument that higher interest rates is bad for stocks is not consistent with the historical data since 1990. This does not mean that there aren’t any risks because there are always going to be risks for the stock market. When we take everything into consideration, we continue to have a cautiously optimistic view for global equity markets. First, the global economy continues to demonstrate resilience which has significantly reduced concerns about an economic recession. Second, while inflation remains above the targeted threshold for many central banks, it is moving in the right direction. This is setting the stage for interest rate cuts in Europe in the months ahead and rate cuts in the U.S. later in 2024 and into 2025 Finally, corporate earnings have been steady and have surprised to the upside across several markets around the world.

Sources:

Nearly half of all investors expect a ‘no landing’ scenario for the economy where inflation remains but there’s no recession, Deutsche Bank survey shows

https://finance.yahoo.com/news/nearly-half-investors-expect-no-185051052.html

Will Higher Rates Spell Doom For the Stock Market?

https://awealthofcommonsense.com/2024/04/will-higher-rates-spell-doom-for-the-stock-market/

Rate Worries Resurface Yet Again: Rising Interest Rates Causing Investor Consternation, but Should They? BMO Capital Markets

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.