Climbing the Wall of Worry _ May 2023

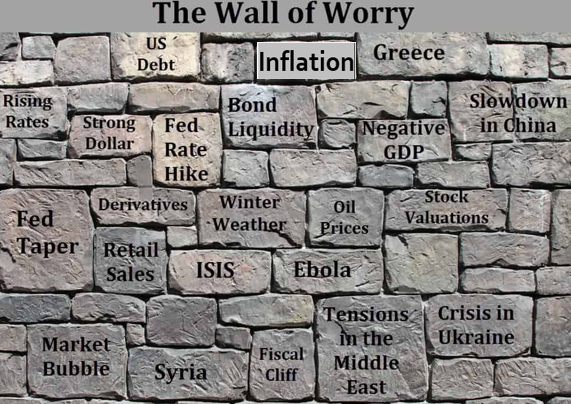

Global equity markets have been very strong thus far in 2023 with broad based strength across geographic regions. Year-to-date returns up to the closing price on May 26th are up approximately +9.5% for the S&P 500, up +8.5% for the Stoxx Europe 600 Index, and up +18.5% in Japan as measured by the Nikkei 225 Index. This might be surprising to some investors given all of the concerns including sticky inflation, the ongoing war in Ukraine, recent bank failures, the debt ceiling fiasco in the United States, and the potential for an economic recession. Despite these headwinds, global stock markets have continued to rise in 2023. This concept is often referred to as Climbing the Wall of Worry. The Wall of Worry refers to a tendency in financial markets for stocks to rise in the face of seemingly insurmountable problems. However, it usually turns out that the problems are temporary and that they are eventually resolved. As seen in the illustration below, there has been and always will be a rotating cast of things to worry about in the stock market.

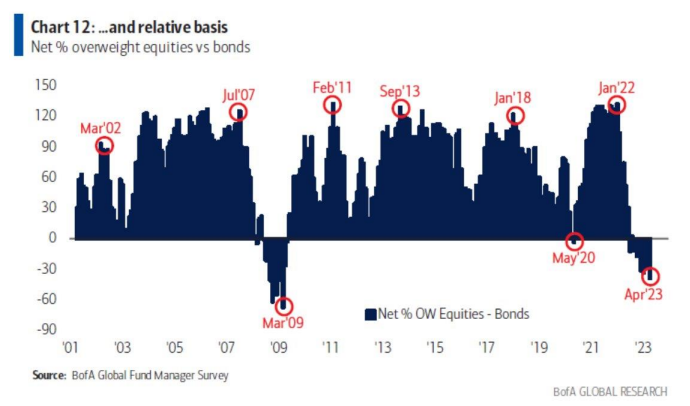

Of all the concerns that exist today, we believe the possibility of an economic recession is the one that is causing the most anxiety for investors. And we believe this is justified because the potential for a recession is a realistic concern. Bond market yield curves are currently inverted and that has historically been a sign that a recession is on the horizon. In addition, the dislocation that has occurred in the banking sector also increases the probability of a recession. One of the consequences from the recent bank failures is that lending standards in the banking industry have tightened. This is very likely to create a drag on economic growth. If the economic drag is too big, the economy will fall into a recession. However, if a recession does materialize, we believe it will be a milder, garden variety type recession. Our rationale for saying this is that global banks have robust levels of capital, while corporates and consumers are significantly less exposed to credit risk and leverage risk than they have been historically. In terms of the stock market, it appears that investors are already bracing for a recession based on market positioning. As seen in the chart below, the recent Bank of America Global Fund Manager Survey showed that global fund managers are the most underweight in equities relative to bonds since March of 2009.

The current positioning by Global Fund Managers does not mean that the stock market won’t go down if the economy falls into a recession. And it doesn’t mean that markets won’t go down if we avoid a recession. Stock market corrections are part of the cycle and they occur frequently. According to Cornerstone Macro, there have been more than 230 corrections of 5% or more for the S&P 500 since 1928. The average duration of these corrections was approximately 1.8 months and the average decline of these corrections was about 12%. The complicating factor about market corrections and economic recessions is that nobody can predict when they will happen, nor can anybody predict how long they will last. We think that with the many factors considered, the best course of action for investors at this time is to accept that they will occur from time to time and that eventually the stock market will recover. Despite the uncertainty that exists at this time, we are comforted by the types of companies we own across our portfolios. Companies with robust free cash flow generation and strong balance sheets are the types of companies that are best positioned to weather the storm should we be headed for a recession.

Link for Fund Manager survey chart

https://financialpost.com/investing/bearish-investors-most-underweight-stocks-versus-bonds-2009

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Any comments, statements or opinions made herein are those of the author and do not necessarily reflect those of Cumberland Private Wealth Management Inc. (Cumberland) and are not endorsed by Cumberland. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.