A novel approach to funding your RESP

When life moves, your money moves. When you have a child, life starts moving. This article provides an overview of the Registered Education Savings Plan (RESP), an excellent tool to save for a child’s education. It explains the three phases of RESP planning and shares a novel approach to funding your RESP that could potentially accelerate its benefits.

The strategies discussed here may or may not be directly applicable to your wealth plan. But if saving for a child’s post-secondary education is in your plan, there’s no denying that an RESP can play a vital role.

A review of RESP basics

RESPs are designed to help parents save for their children’s post-secondary education at a university, college, trade school, or technical school in Canada or abroad. Contributions to the account grow on a tax-sheltered basis until withdrawals are made to support post-secondary education expenses. A unique feature of RESPs is that our federal government matches a portion of the funds contributed.

RESP Account Types

There are Family Plans and Individual Plans. A Family Plan consists of multiple qualified beneficiaries, who are children related by blood or adoption. An Individual Plan is for a single beneficiary. Family Plans offer more flexibility since the contributions, government grants, and growth of the investments can be shared between beneficiaries.

Who can open a RESP?

Anyone can open an RESP, including parents, grandparents, relatives, friends, or guardians. These are known as “subscribers.” It is generally best to open RESPs in the joint names of the beneficiaries’ parents and have others contribute to those RESPs. This can help avoid accidental over-contributions and also provide the most flexibility if a child does not pursue post-secondary education.

Contributions and grants

There is no annual RESP contribution limit, but there is a lifetime maximum contribution limit of $50,000 per beneficiary. RESP contributions are not tax deductible, but they attract a government grant known as the Canadian Education Savings Grant (CESG) equal to 20% of annual contributions, up to $2,500 per year and $7,200 per beneficiary over their lifetime.

The CESG is a federal program. British Columbia and Quebec also offer provincial programs that could be worth up to $1,200 and $3,600 respectively.

Phase one: Accumulation

The first phase of an RESP is all about making contributions, earning grants, and accumulating money. Due to the long-time horizon associated with RESPs, investment strategies focused on growth are generally the most suitable. But as in all investing, it is important to remain within your comfort level and risk tolerance.

The power of tax-sheltered compound growth

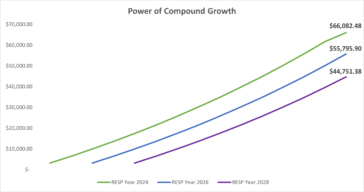

A key advantage of RESPs is being able to compound your investment and earn returns within a tax-sheltered environment. And, like all compounding, the sooner you start the better. The graph below compares what would happen if you started investing in 2024, 2026 or 2028 based on annual contributions of $2,500, an annual CESG of $500, and annualized investment growth of 5%.

If you start in 2024, the account will be worth just over $66,000 when the beneficiary turns 15 in 2038. This is $10,000 more than if you delayed two years and $20,000 more than delaying contributions for four years.

A novel approach: pre-funding your RESP

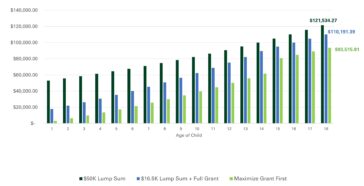

Since there is no annual contribution limit for RESPs, you can pre-fund your account and have more tax-sheltered money growing for longer. The extreme case would be contributing the full $ 50,000-lifetime limit all at once. In this scenario, you would maximize the amount of money that is able to grow in the plan and receive one $500 CESG payment for the initial contribution but sacrifice the remaining $6,700 in grants.

However, if you wanted to boost your tax-sheltered growth and also receive the maximum CESG, you could contribute $16,500 in year one and then contribute $2,500 annually until the $ 50,000-lifetime limit is reached. This mix of contributions will allow you to claim the maximum CESG of $7,200.

The graph below illustrates three scenarios: $50,000 all at once versus $16,500 in year one followed by $2,500 annually versus $2,500 annually and a final top-up in year 15. All three scenarios assume 5% annualized investment growth.

In this illustration, the $50,000 upfront contribution results in the highest end value. More money compounding for a longer period more than compensates for the government grants that were sacrificed. However, there is a caveat: this illustration assumes a level 5% annualized rate of return, and returns are more variable in the real world. This strategy could underperform if there is a period of lower investment performance, or outperform by an even greater margin if returns are higher.

Pre-funding strategies should be assessed in terms of your overall financial priorities, wealth, and life objectives. While post-secondary education is important, other financial commitments or strategies may need to be prioritized if excess funds or cash flow are available.

For the more risk-tolerant, making larger initial deposits may be appropriate. For the more risk-averse, making an initial $16,500 contribution followed by regular contributions to maximize the government grant may be more suitable.

Phase two: Transition

The transition phase is the 3 years leading up to the start of post-secondary education. During this period, you will want to assess the likelihood of your child attending a post-secondary education program, identify other sources of funding if your RESP alone is insufficient, and de-risk your investments as the withdrawal date gets closer

What if you child is not pursuing post-secondary education?

If you have a Family Plan with more than one child named as a beneficiary, you can use the RESP to support your other children’s post-secondary education plans. In a Family Plan CESG, contributions and growth can be shared between family members within certain limits.

If none of your children attend post-secondary education, you can withdraw your contributions and return the grants to the government, however, the growth of the RESP could be taxed at your marginal rate plus a 20% penalty. The way to avoid this tax is to transfer the RESP growth to your RRSP, provided that you have enough RRSP contribution room.

This scenario highlights the importance of naming both parents as joint subscribers to the RESP. If correctly timed, a couple can greatly reduce the amount of RESP growth that could be taxed and penalized. And, if some RESP growth needs to be included as income for tax purposes, you have two incomes to spread the tax over.

When the RESP isn’t enough: Other income sources

RESPs are rarely enough to cover all of a child’s post-secondary education expenses. When the start of the program nears, it is important to evaluate the potential expenses in comparison to your RESP value. If extra funds are required, you can start to plan their potential sources. This could be from your cash flow or savings (TFSAs or non-registered accounts are best).

De-risking your investment strategy

A sharp drop in your RESP’s value just when you need to start making withdrawals is a risk you want to minimize. Options to consider are shifting a year or two worth of expected expenses to cash, or changing your investment strategy to be more conservative overall. With a Family Plan, it’s wise not to get too conservative too quickly, as there are multiple beneficiaries to consider and a need to balance current and future needs.

Phase three: Withdrawal

The withdrawal phase is when you actively withdraw funds from the RESP to support post-secondary education expenses. This phase is all about taxation.

There are two types of RESP withdrawals, non-taxable withdrawals consisting of your contributions, and taxable withdrawals consisting of CESG and accumulated growth. The taxable withdrawals can be attributed to the beneficiary or to the subscriber.

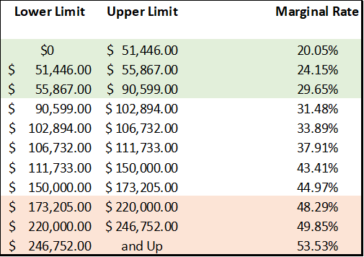

To maximize the benefit of the RESP, you want to prioritize having taxable withdrawals attributed to beneficiaries, since these amounts will be included in their income and taxed at much lower marginal rates. This can be seen in the table below showing the combined Federal and Ontario Tax brackets for 2024.

There is also the Basic Personal Amount to consider, which is the amount of income that can be earned before any tax has to be paid. For 2024, this amount is $15,705, which means that if the child has no other income, they can take $15,705 from their RESP tax-free to cover education expenses.

It is also important to prioritize taxable withdrawals early to ensure all the CESG that has been received is paid out. If it has yet to be fully paid out by the time beneficiaries have finished post-secondary education, it will be returned to the government.

Another helpful tax tool is the Tuition Tax Credit. This is a non-refundable tax credit available for post-secondary students. The credit is equal to 15% of “eligible tuition and fees”. These amounts are usually provided by the post-secondary institution. Unused credit can be carried forward to future years or transferred to a parent.

Key RESP points to remember

- When you contribute to an RESP, you receive a 20% grant from the federal government. The more you contribute and the sooner, the greater the benefits of tax-sheltered compound investment growth.

- When post-secondary education nears, plan to de-risk your investment strategy and consider additional ways to pay for education expenses. If your child is unlikely to pursue post-secondary education, it’s time to implement a backup strategy.

- When it’s time to start withdrawing from the RESP, aim to have them taxed in your child’s name while he or she has little or no other income to maximize the after-tax benefits of the RESP.

If you have questions about the best RESP strategies and approach for your specific situation, a Cumberland Portfolio Manager is available to assist you. We seek ways to optimally integrate education savings goals with a family’s overall wealth management plan.

Plan your life, manage your wealth

Wealth management is the process of utilizing financial assets and human capital to realize, protect and enhance the life you are living and the life you are building towards. Wealth management is, therefore, a deeply personal process. It is also multifaceted, requiring the consistent assessment of emerging opportunities and risks.

The rise in interest rates over the past two years has presented a material change in the landscape. Higher interest rates have boosted returns for short-term investment vehicles. This creates opportunity. But if short-term returns interfere with long-term strategy, that is a real risk.

Take advantage of short-term opportunity

The rise in interest rates has boosted cash investment returns from 0.55% at the start of 2022 to over 5% at the end of 2023. That is an increase of almost 1,000%. As a practical matter, it now pays to scrutinize where your cash is held. For example, are you carrying too much money in a bank account that pays little to no interest? Is your current “high interest rate” competitively priced? Could you benefit from locking in a short-term rate? Answering these questions will ensure your cash is working optimally towards your short-term objectives.

The current high returns on cash are a boon for short-term objectives. Enjoy it. But it is critical, in our opinion, to keep this opportunity in the proper perspective. Cash is not a long-term investment solution, and trying to time the market rarely pays.

Market timing is a high-risk proposition

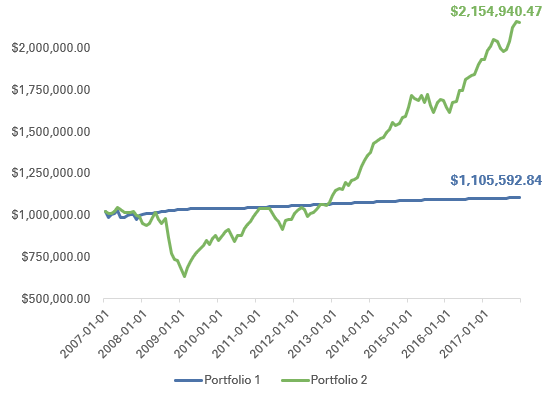

Allow us to share the story of an investor who sold all their long-term investments in 2007 and moved to cash. It appeared to be an amazing investment decision at the time, because they avoided market declines of over 40% when the Great Financial Crisis hit in 2008.

However, this stroke of genius went very wrong as they continued to hold cash. By 2013, the markets had recouped all their losses, yet this investor had not re-entered the market. By 2017, when this investor finally came to see us, the market had gained another 50%, and they had missed out entirely.

This story highlights the reality of timing the market: You can be right about getting out of the market and still end up worse off, because you must also be right about getting back in.

Let’s suppose you are right 50% of the time in exiting the market and 50% correct in getting back in. You will only be right, on average, 25% of the time. Not great odds, especially when your retirement is at stake. The reality is there is never an all-clear signal telling you when to start investing again.

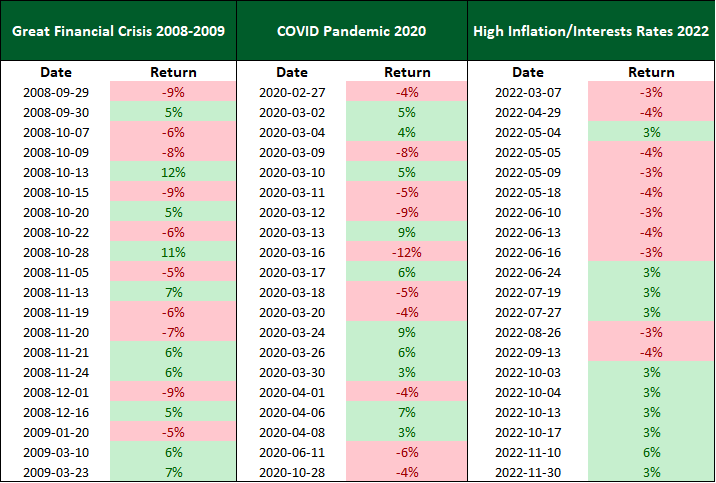

The decision to reenter the market is further complicated by the sequencing of returns. Often the best and worst days in the market are clustered together. Chart 1 shows the 10 best and worst days for the S&P 500 TR index, a broad US equity index, for three time periods. The best days are green and the worst days are red.

Notice that, during the Great Financial Crisis, 17 of the best and worst days occurred within a 78-day period. During COVID, 18 of the best and worst days occurred during a mere 41-day period. In 2022, the market was down over 14% between April and June in 2022, then up almost 14% between October and November.

The windows of opportunity to time the markets are incredibly small – usually just a matter of days. Even if you thought you knew when they were going to happen, would you have the emotional fortitude to execute your investment strategy? And would your lifestyle and schedule even allow you to make such decisions? In practical terms, the task is all but impossible.

How cash actually erodes wealth

Let’s put market timing aside now and consider another risk with moving into cash: in the long run, it provides the lowest expected investment returns.

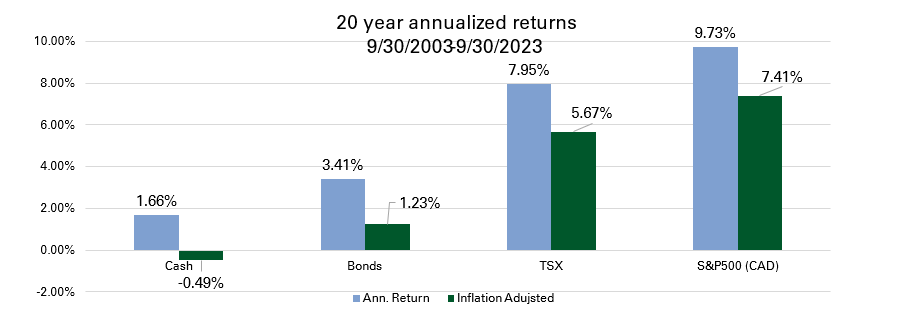

The blue bars in Chart 2 show the returns for cash, bonds, Canadian equities (represented by the TSX), and US equities (represented by the S&P 500) for the past 20 years. Cash significantly lags the alternatives, and we can expect this to continue because of one foundational principle of investing: taking the least risk means accepting the lowest returns. Bonds and equities offer higher expected returns because investors bear the risk of greater short-term volatility.

But perhaps the more important takeaway is what’s depicted in the green bars, which is the return of each asset class after inflation is accounted for. In the long term, cash has offered negative after-inflation returns. In other words, your future dollars are worth less than they are worth today. Therefore, you need to save more, delay retirement, spend less to compensate, or potentially settle for having less economic power in the future.

Equities provide the highest after-inflation rate of return, and that’s what makes them so well-suited for long-term investment objectives.

Why stocks outperform over time

One key fact has historically enabled equities to stay ahead: well-managed companies have opportunities to grow their profits faster than the rate of inflation. Here’s why:

- They participate in the overall growth of the economy – when the economy grows, sales increase.

- When prices increase due to inflation, strong companies can generally benefit by raising their prices too.

- Many of the expenses incurred by companies do not grow as sales increase. For example, a company may be able to increase their sales volume without having to hire more staff.

- Companies can use profits to reinvest in the business and further increase sales or reduce costs.

- Many companies share some of their profits annually by way of dividend distributions paid to their shareholders.

Over time, this virtuous economic circle leads to increasing shareholder value, which then translates into higher share prices. History shows that you don’t really need to pick the right time to invest, so much as you need to invest in quality businesses and remain invested.

Connecting market dynamics to your life plan

Financial planning involves many dynamics, but none are as fundamental as your individual goals. As the saying goes, “If you don’t know where you’re going, any road will get you there.”

By determining your goals, you can create a roadmap to achieve them and avoid potential wrong turns, including short-term distractions, attempted market timing, and choosing the wrong long-term asset classes for the desired objective.

Stating goals in qualitative terms, such as “purchase a home” or “retire early” is a good starting point. However, being as specific as possible will unlock the most opportunity.

For example, the path to “purchase a home next year” is a lot different than the path to “purchasing a home in ten years.” The amount of investment risk that can be taken in one year is substantially less than the amount that can be taken over 10 years. In fact, the high short-term interest rates of today might be a boon to someone with a one-year timeframe, but a bust for someone with a 10-year runway.

Planning for the long term is not easy. Markets can be volatile. Life, too, can be volatile. Balancing the demands of our careers, family, social lives, and passions is not always easy. But by defining what we want from life, prioritizing what is most important to us and aligning our finances to these objectives, we can greatly improve our chances of success.

A guiding question we can always ask is: Are our investments working towards our desired goals? If the answer is no, we need to act as soon as possible and create a plan to align them.

Optimize your estate with probate planning

On Tuesday, November 21st, we hosted a wealth management event of particular interest to families who wish to optimize the transfer of wealth from one generation to the next. The focus was on understanding the issue of probate fees, and how to mitigate their impact.

The first speaker was Laura Ross, CEA, MBA, an estate consultant who specializes in working with estate executors on a full range of duties, from selling properties and navigating government agencies to working with lawyers and wealth managers such as Cumberland Private Wealth.

She was joined by Marni Pernica, TEP, an estates and trusts lawyer who focuses on estate, income tax, and succession planning, including cross-border planning, the preparation of wills, powers of attorney and trusts, assisting with estate administration, and the main topic of our session, estate administration tax, also known as probate.

Both experts shared information, insights, and anecdotes that helped illuminate what probate means, how it can reduce a family’s net estate assets, and some of the strategies that can potentially reduce its impact.

Understanding probate

Probate is the process of the courts formally accepting a will, or, if the deceased did not have a will, the process of appointing someone to act on their behalf. The court seeks to verify that the person has indeed passed away, that they are in the fact the author of the will, and that the will is valid.

In exchange for this service, the province of Ontario, charges 1.5% on the total gross value of your estate above $50,000. It is important to note that this tax is not applied only to the capital gains within your estate, but to its entire market value. That’s $15,000 per million, which, when applied to all of your real estate, securities, and other assets, may be not be an insignificant sum.

In addition, when someone passes away, any assets that are subject to probate are frozen and cannot be sold until probate is completed, which can take 6-12 months. Laura shared the example of an executor who was out-of-pocket more than $100,000 because no estate planning provisions were made for funeral expenses and the cost of maintaining the deceased’s home during probate.

Another consideration when it comes to probate is that, once a will is filed with the courts, it becomes part of the public record. Many families wish to minimize the assets that are subject to probate to protect their privacy.

Strategies to optimize your estate

Our speakers shared many pieces of valuable advice – here are just a few of the key points around effective probate planning:

Create a financial asset summary. When someone passes away, their executor will be responsible for locating and valuing all of their assets for the purposes of probate. It is a good practice to create a financial asset summary that lists all of your insurance policies, bank accounts, investment accounts, properties and other assets. This will greatly assist a future executor. During this process, you may also discover opportunities to consolidate and simplify your affairs.

Consider joint ownership. When someone passes away with assets such as a home, investment account or bank account held in joint name with their spouse, those assets can pass to the spouse on a tax-free basis. It is advisable for couples to review which assets may be owned jointly, thus deferring any probate or other taxes until the passing of the second spouse.

Review your beneficiaries. The proceeds from certain types of financial assets, such as life insurance policies and registered investment accounts (RRSPs, RRIFs, and TFSAs), can pass tax-free to named beneficiaries. It is wise to review these accounts to make sure that the correct people have been named.

Consider a Bare Trust. A Bare Trust involves having a “primary will” for certain assets that must be subject to probate, and a “secondary will” that addresses certain other assets that you have transferred to a corporation or to joint ownership with an adult child in order to avoid probate.

Explore an Alter Ago Trust or Joint Partner Trust. These strategies are only available to taxpayers 65 years or older, but might allow you to roll a principle residence, securities, or other assets into a trust without triggering tax, and later transfer those assets to the next generation without probate.

Both speakers explained that there are no one-size-fits-all solutions for probate planning. There are many nuances to consider, including the specific dynamics of your family, set-up costs, ongoing tax filing requirements, and the precise legal language required to execute some of these strategies successfully.

However, with the right professional guidance, probate planning can preserve assets, save time, enhance privacy, and potentially provide protection from creditors. The range of solutions is wide, and, judging by the robust Q&A that followed this presentation, many listeners discovered solutions that may be applicable to their personal situations.

For a more detailed discussion of the event or for access to a video replay, please contact your Cumberland Portfolio Manager.

To trust or not to trust? That is the question!

It is common to use a family trust or other trust structures to allow assets to pass to the next generation in a measured way. But is this always the best strategy to pursue? We believe it’s critical to consider all the relationships, and the operational (among other) implications that come with establishing a trust.

Trusts are typically used to accomplish certain goals when leaving an estate to your spouse, children, or any other named beneficiary. To be effective, it’s important to consider not only the quantitative goals (financial protection, preservation of capital for the long term, and tax optimizations), but also the qualitative outcomes (relationship dynamics, lifestyle, and ultimately the overall impact) of using a trust. Ideally, it is better to avoid the transfer of wealth being viewed as just business and/or a tax transaction.

Author and retired attorney, Jay Hughes describes this well: “This trust is a gift of love. It exists to enhance the lives of the beneficiaries.” And here, he is not referring to materialism or handouts that allow for an expensive lifestyle. He is referring to some levels of preparation, education, core values, maturity and self-sufficiency. The trust should have meaning and emotions attached to it, so the next generation is prepared to receive it with grace and not abuse it.

What is a trust?

A trust is a legal agreement between the named trustees and beneficiaries. The agreement will outline the management, administration, and distribution expectations of the trust. The trustee has the discretion and obligation to follow the terms of the agreement. The beneficiary carries the accountability for the use of the distributions.

Here are three questions that can indicate whether a trust will make sense for your situation and family, and what its ultimate structure might look like:

- What is the main purpose or reason for using a trust?

- What is the most important outcome that you would like to see as a result of a trust being in place?

- Who will you select to take on the role of the trustee?

A trust establishes a mid to long term relationship between the trustee(s) and the beneficiaries. A beneficiary is dependent upon the capabilities, expertise, and knowledge of the trustee to manage the affairs of the trust over many years. This makes the selection of the right trustee a crucial one.

Selecting your beneficiaries is usually the easy part because they are typically your spouse and/or your children. Selecting a trustee is more difficult because you have choices about who it will be, and whoever you choose will have a solemn responsibility to carry out your intentions and make decisions that will impact the lives of your beneficiaries.

Your trustee may be a family member (sibling, aunt, uncle, child but caution is warranted here), a professional (a lawyer, accountant, manager), or a private trust company. It is imperative to have an inclusive selection process so all parties named within the trust have a clear understanding of the trust’s intentions, its management, and distribution expectations, and as such, they can start to work on the relationships that will continue beyond your lifetime.

In conclusion, before you decide to use a trust for estate and tax planning, consider the qualitative outcomes and relationship dynamics that will result. Ensure that family members and other parties involved in the trust comprehend the implications and expectations ahead of time so that when the trust is created, there is a seamless transition.

For a personal discussion about the use of trusts and whether they can assist you in meeting your goals, please contact us so you can speak with a Cumberland Portfolio Manager.

How grandparents can use RESPs to open doors of opportunity

A great deal of financial success comes down to executing the basics well. In this series called Investing Basics, we review some of the fundamental tools that can help you and your family build and protect wealth over time. In this installment: the power of RESPs, especially for grandparents.

Many grandparents are unaware that the total cost of a four-year degree at a Canadian university in 2023 is about $100,000. This includes tuition, books, supplies, housing, meals, travel and $125 for the traditional sweater to represent their university, faculty or program.

The cost of university has risen sharply, and so has the importance of graduating with a marketable set of skills and knowledge. Without a post-secondary education, employment and life opportunities are more limited now than ever before. Contributing to a grandchild’s education can open doors of opportunity and help you stay connected in a meaningful way.

Registered Education Savings Plans (RESPs) began in their current form in 1998 when government grants worth up to $7,200 per child were introduced. If you are a grandparent today, this program may not have been in place when your children were still looking forward to post-secondary education.

How you can use an RESP now

If you want to conscientiously pass wealth between generations and help minimize your children’s and grandchildren’s debt in the future, opening and contributing to an RESP on behalf of your grandchildren is an excellent option.

Here’s what you need to know:

- You are the “subscriber” and the student is the “beneficiary” of an RESP

- The lifetime contribution limit is $50,000 for each beneficiary

- There is no limit to the number of RESPs that a beneficiary can have, but they cannot exceed their lifetime limit of $50,000 without penalties being incurred

- You can receive Canada Education Savings Grants (CESG) worth up to $500 per year (equal to 20% of the contribution) and a lifetime limit of $7,200

- Many subscribers deposit $2,500 per year to maximize this grant

- A catch-up for missed years of up to $1,000 is permitted

- You may also qualify for a Canada Learning Bond (CLB) for colleges, CEGEPs and apprentice programs of up to $500 in the first year and $100 per year thereafter

- Funds can be invested in an investment portfolio of your choice and grow tax-free, like an RRSP

- Money is paid out as an Educational Assistance Payment and taxed in the hands of the beneficiary. In practice, most students pay little or no income tax because of their education-based deductions and credits, and their relatively low total income.

Speak to your Cumberland Portfolio Manager

If you’d like to contribute to the post-secondary education expenses of a grandchild, speak with your Cumberland Portfolio Manager. We can help you open the account, devise the right funding strategy, set up an appropriate investment portfolio, and take care of applying for and collecting government grants on your behalf.

Back to School – The A,B,C’s of Withdrawing From Your RESP

A great deal of financial success comes down to executing the basics well. In this series called Investing Basics, we review some of the fundamental tools that can help you and your family build and protect wealth over time. In this installment: Withdrawing from your RESP

For parents of university students who have been disciplined in saving for a child’s post-secondary education through a Registered Education Savings Plan – congratulations! You can breathe a sigh of relief instead of despair as the tuition statements roll in. While many people are familiar with contributing to an RESP, we don’t necessarily know much about withdrawing from the account. For example, which expenses, other than tuition, are considered to be eligible expenses? Which documentation do we need to provide in order to access the RESP funds? How much can be withdrawn at a time? What are the tax consequences of such withdrawals?

Once your student is enrolled in a qualified post-secondary education or training program, the contributions, accumulated income, grants, and learning bonds can be paid out to the student. Withdrawals for the student can be categorized as: 1) a return of contributions (also called Post-Secondary Education Withdrawals or PSW), or 2) an Educational Assistance Payment (EAP), which includes accumulated income, grants provided by the Government, and learning bonds. The student must claim all EAPs as income on their tax return in the year in which they receive them – as such, a T4A will be issued in their name. Quite often, students have income below the basic personal amount, or they may be able to claim tuition tax credits, so this results in little or no tax liability. The return of contributions can go to you or be redirected to the plan beneficiary. These withdrawals are not taxable.

EAPs can be used to cover school expenses (ie. tuition, books, housing, and school travel) incurred while the student is enrolled. As of this year, full-time students can now access up to $8,000 in EAPs during the first 13 weeks of enrolment. Thereafter, there is no limit on the EAP amount. If your student is in their second year of school and you did not access any RESP funds for that first year, you would just need to prove enrollment for the previous year and the $8,000 limit will not apply. (Note that there are separate rules for part-time students, so please check the Government of Canada’s RESP guide.)

So, how do you go about accessing the funds from your RESP? To elect to withdraw an EAP, you must sign a withdrawal form from your RESP provider and the beneficiary must provide proof of enrolment in a qualified program. This can be a copy of a tuition fee invoice from the school, with evidence of credits indicating full-time enrollment. If you have a family plan, you can allocate the RESP funds amongst the beneficiaries as you see fit, although government grants are beneficiary specific.

The RESP is just one element of your financial plan. For more information, or if you are interested in an overall financial plan, please contact us at Cumberland Private Wealth. “Achieving your financial goals, is security. Understanding how, is power.” We are always happy to assist you.

Minimize risk when gifting assets to children

Imagine this:

You recently retired from running a successful business, and you’ve always been generous to your children. Your adult son lives with his wife and son in a condo that you purchased for him years prior. He receives an annual dividend from your family trust, and you also pay for your grandson’s private school tuition.

Then comes some bad news: your son is separating from his wife. Worse, her lawyer claims that his condo is now their matrimonial home, that his interest in the family trust is a shared asset, and that all of your past financial support should be imputed as income for the calculation of spousal and child support. There is also a demand for disclosure of your private trust and business documents.

Suddenly, you are faced with unanticipated litigation, an invasion of privacy, and the potential for a negative financial impact. Could this all have been avoided?

Yes, say family law partners Joseph J. Sheridan and Linda M. Ippolito of Sheridan, Ippolito & Associates. In a recent presentation to clients and friends of Cumberland Private Wealth, they shared this real-life story, as well as some best practices that could help protect you from experiencing something similar.

Avoiding unintended consequences

Joseph and Linda went on to outline a number of strategies that can help families pass assets from one generation to the next while minimizing the unintended consequences that can occur when a marriage breaks down.

Here are some of the concepts they discussed:

- Domestic contracts, also known as prenuptial agreements or “prenups,” are considered the gold standard for legally defining exactly how cash and other assets should be treated both during and after a marriage. The presentation discussed how and when to approach this potentially sensitive topic.

- Differentiating between gifts and loans with proper documentation and consistent behaviour is another way to create legal boundaries around assets in advance of a potential separation. The presentation explored this topic in depth, including pitfalls to avoid.

- Keeping assets in your own name or in a trust is an additional strategy that can be used to draw a protective line around property that you do not wish to be “equalized” and divided with a child’s former spouse.

This summary is short and certainly not exhaustive – during their presentation and the robust Q&A session that followed, Joseph and Linda shared many more stories, insights and strategies that could be relevant to you and your family.

For access to a video replay of the full presentation, or for direct assistance with your personal situation, please contact a Cumberland Portfolio Manager.

Drawing down your RRSP in Retirement in 2023 – Key Considerations

If you have been a good saver and diligently contributed to your RRSP, you should be rewarded with a sizeable six or seven figure RRSP that would make your retirement that much more enjoyable. The only issue now is – how do you get money out of the RRSP without paying more in taxes than you should? Typically, it is advised that investors leave their RRSPs alone for as long as possible to take advantage of the tax-deferred growth. While this can be true for many people, it is important to crunch the numbers before you retire to make sure this makes the most sense for your unique retirement situation. Many retirees, especially those with a high net worth, may find there could be a more efficient way to withdraw retirement income.

What You Need to Know

The intended use of an RRSP is to defer taxes from the time you are in a high tax bracket until you find yourself in a lower tax bracket, thereby saving on taxes by your contributions and allowing the money to grow tax-deferred for many years. At some point, however, you will have to take that money out and leave what’s left to your beneficiary. The government mandates that Canadians must convert their RRSP to a Registered Retirement Income Fund (“RRIF”), or an annuity, at age 71. The government also mandates that a minimum amount be taken every year after that. The issue with waiting until you are required to convert to a RRIF and take income is that you have little flexibility as to what you can withdraw. If your RRSP is large, the mandatory withdrawal amount may push you into higher tax brackets.

Could You Be in a Higher Tax Bracket?

Let us look at an example of how this could play out. In the situation described below, the retiree waited until age 71 to start drawing down their RRSP:

Joe has a RRIF worth $600,000 and his minimum withdrawal at age 71 will be $31,680 (5.28% x $600,000 = $31,680) for the year. He is receiving the maximum CPP benefit of $15,679 annually (for 2023) and an OAS benefit of $8,250. These three income sources alone will total $55,609. The lowest tax bracket for the 2023 year is $53,359. This means that Joe has been pushed into a higher tax bracket! This is before the income from his rental properties, defined benefit pension plan, and income from his non-registered investments are calculated.

As you can see from the example above, waiting until the last minute to start taking an income from your registered investments can have unintended consequences. Aside from simply paying higher taxes, there are also income tax implications that need to be considered as you move to higher tax brackets. At age 65, you gain two tax advantages: the Age Amount non-refundable credit ($8,396 for 2023) and the Pension Income credit (up to $2,000). The Age Amount is income-tested and it reduces by 15% of the amount your net income exceeds $42,335 for 2023. The Age Amount is completely eliminated if income exceeds $98,308. This clawback also applies to your OAS, which begins if your income exceeds $86,912. Both credits could be affected by RRIF minimums that become mandatory at age 71, therefore:

- Pushing you into a higher tax bracket

- Causing a partial or total loss of your Age Amount tax credit

- Causing a partial or total claw back of your OAS income

In addition, since the minimum withdrawal rate gets larger as you get older, this issue will only worsen as you age.

Ways to Look for Tax Efficiencies

Here are some strategies that could help you pay lower taxes on your RRSP withdrawals:

- Consider deferring your CPP and OAS. Both Canadian pensions allow you to defer until age 70 to start receiving them, and you get rewarded for the deferral by receiving higher amounts. (Your CPP payments can increase by 42% and your OAS payments by 36%.) You can use RRSP withdrawals to fill the income gap that the CPP and OAS would have provided, so you can draw down your RRSP at a lower tax bracket.

- When you stop working, you normally fall into a lower tax bracket, so top up your income to your existing tax bracket with RRSP withdrawals.

- Start a RRIF at age 65 to take advantage of a $2,000 pension income credit. No matter how much income you have, this pension credit will allow you to withdraw $2,000 tax free from your RRIF, if you do not have any other pension income. So, fund the RRIF with your RRSP money to take $2,000 out tax-free each year.

Where to Start

Always talk to a financial advisor before starting RRIF payments. There is no one-size-fits-all when it comes to planning for retirement income. Everyone must consider their own financial situation when deciding how and when to start taking an income from an RRSP.

Some things to talk to your advisor about:

a) the amount of your minimum RRIF withdrawals at 71,

b) how secondary income (rental income, side business etc.) will affect your tax bracket,

c) the best time for you to start OAS and CPP,

d) whether you are in a position to convert your RRSP into a RRIF earlier than by age 71.

It is important to ensure all your income sources are working as tax efficiently as possible so that you can get the most out of your hard-earned retirement savings.

At Cumberland, we work closely with our clients so that they have a sound financial plan in place that optimizes their situation and ultimately allows them to meet their retirement and lifestyle goals.

Source: ARG Research

What we know about the Tax-Free First Home Savings Account

Canadians will soon get a boost when it comes to saving for their first home. Starting in April of 2023, the Tax-Free First Home Savings Account (FHSA) will be available to those over the age of 18 who have dreams of owning a home. This account is part of a campaign promise by the Liberal Party in the last election. There are many details associated with this interesting vehicle – here is a high-level summary.

Save up to $40,000 tax-free

The FHSA will allow Canadians to save up to $40,000 tax-free towards a first home. Eligible taxpayers can contribute up to $8,000 a year to the account and this amount can be carried forward into future years if not used. The FHSA will permit a range of investments, including stocks, bonds and other securities.

To open an account, you must be:

1) A Canadian resident,

2) Over the age of 18,

3) Not a homeowner in the current year or the previous four years.

The FHSA combines some of the best features of a Registered Retirement Savings Plan (RRSP) and a Tax-Free Savings Account (TFSA). The contributions are tax deductible, and the money grows inside the account tax-free. The money can then be withdrawn from the account without tax penalty, although it must be spent within 15 years of opening the account or before the age of 71, whichever is earliest.

The FHSA is unique because the proceeds must be used to purchase a home. However, any funds that are not used to purchase a home can be transferred to an RRSP or RRIF account on a rollover basis, and the RRSP rules will apply going forward. It is important to note that such transfers will not impact your RRSP contribution limits.

Speak to your portfolio manager

The FHSA looks like an interesting option for children or grandchildren who plan to purchase a home. Although the Federal Government aims to make FHSAs available after March 2023, the enabling legislation has not been enacted. In the meanwhile, now is a good time to sit down with your Cumberland Portfolio Manager to discuss how this new investment vehicle might fit into your family’s financial plans and to understand all of its many workings.

Tax-Advantaged Giving as a Force for Good

Charitable giving is becoming an increasingly important part of many peoples’ wealth management plans. If you are planning to do some charitable giving, one tax-smart strategy to consider is giving a gift of appreciated securities instead of cash.

To understand the potential benefits of this strategy, let’s look at what could happen in each scenario:

Giving $10,000 in cash

When you provide a gift to a registered charity, the federal government gives you a tax credit of 15% on the first $200 and 29% (to a maximum credit of 75% of your annual net income) for anything above that amount.

So, using round numbers, a $10,000 cash gift to charity will cost you a little more than $7,000 on an after-tax basis.

Giving $10,000 in shares

Now let’s say you have shares in a company that you bought long ago, which have since doubled in value. If you gave $10,000 worth of those shares to charity, you’d receive a tax credit of roughly $3,000 – exactly the same as if you had given cash.

But there is a second benefit in this scenario. Since those $10,000 worth of shares originally cost you $5,000, you have an unrealized taxable capital gain of $5,000. If you are in the top tax bracket, you’d owe around $2,500 in capital gains tax when you sold the shares. But since you gave the shares away, that tax liability vanishes.

Bottom line: the charity gets the same $10,000 whether you give cash or shares, but whereas the gift of cash would cost you roughly $7,000 on an after-tax basis, the gift of shares would cost you something closer to $4,500 when you factor in the tax savings.

The greater the unrealized capital gain, the greater the potential tax advantage. For example, if you have received shares at nominal cost after exercising stock options, almost the entire value of the shares could be considered a taxable gain. This strategy can offset that liability and serve to reduce the net cost of your gift even more.

You can look at giving securities as a way to reduce the net cost of your charitable giving or – if you prefer – you can see it as way to give more generously while maintaining the same net cost to you. It’s all a matter of your priorities and preferences.

This gifting strategy can also work in your favour if you want to continue owning shares of the company. Just keep the $10,000 you were going to give in cash, give the appreciated shares instead, then use the $10,000 to repurchase the shares or make another investment – and since you’re buying at current pricing, there is no embedded capital gains liability.

While we are examining the spectrum of in-kind giving alternatives, there is another consideration: you can either gift your shares directly to a charity, or you can gift them to a Donor Advised Fund (DAF) that you control, receive the full tax benefit in the current year, and then have the flexibility to make future gifts when and where you choose. For example, you could gift $50,000 worth of shares to your DAF now, and make five gifts of $10,000 to various charities in future years as long as you make the required annual minimum disbursement every year (the annual minimum is 3.5% this year and expected to increase to 5% in January 2023).

As with all tax planning strategies, there are some caveats. The charity needs to be set up to accept gifts of securities. There needs to be an unrealized taxable capital gain on the shares to make it worthwhile, which means they can’t be held in a TFSA or RRSP, as that would shelter the gains. And your mileage may vary depending on your tax bracket and other personal considerations. So in each of the above scenarios, you should consult your tax advisor before making your gift to make sure they are in fact suitable to your current situation.

If charitable giving is on your radar, an easy first step is to discuss the opportunities with your Cumberland Portfolio Manager. It just might be something that fits well within your overall wealth management plan.