Q2 2023 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Second Quarter of 2023. You can download the full reports via the links shown below.

KEY OBSERVATIONS

“The US government won’t default on its debts. There are plenty of jobs. Unit-labor-cost inflation is moderating. The banking crisis is abating. The recession is still a no-show. Earnings were better than expected during Q1 and are probably bottoming during the [second] quarter. The FOMC likely will pause its rate hiking for at least one meeting (they did). Summer is coming. No wonder the S&P 500 sailed to a new 2023 high yesterday.”

That is a summary of “what’s going on” according to respected market-watcher Ed Yardeni, and it’s generally music to our ears, even if it’s not coming from Marvin Gaye… In other words, his views closely match our own. On June 8th, less than a week after Yardeni wrote this, the S&P500 officially entered a new bull market, up more than 20% from its 52-week low in October 2022.

During the second quarter, the S&P500 total return was +8.7% in US dollars or +6.4% in Canadian dollars, as the Canadian dollar appreciated about +1.5 cents. The TSX total return was +1.1%. While given technology stocks continued to dominate the performance of the S&P500, we saw considerable widening in the breadth of performance late in the quarter as the market began to price in the possibility of a soft landing rather than a recession.

In terms of valuations, the TSX and the FactSet European index are trading at 10% and 5% discounts to their 20-year averages, respectively. The S&P 500 is trading above its historical average, but this is arguably skewed by a handful of large companies.

Indeed, the 10 largest S&P 500 companies by index weight have outperformed by almost 4x over the past 12 months, and we own five of them (Apple, Microsoft, Alphabet, Facebook and United Health Group). We are balancing these higher-growth holdings against attractive value-oriented names like GM, Elevance Health, Royal Bank, and Rogers Communications, among others.

Overall, we remain constructive on the equity market, notwithstanding the recent rise in prices. While corrections commonly occur during bull markets, we believe that the positive economic fundamentals that we observe should limit the downside. The earnings outlook is improving and, with economic growth slowing but likely not turning strongly negative, interest rates are closer to a peak than a trough, suggesting that equity market valuations are also less of a headwind going forward than they were in early 2022.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our overall equity exposure was unchanged at 94%. Within the North American investments, our US equity exposure increased from 40% to 42% while our Canadian exposure decreased from 54% to 52%. Cash was unchanged at 6%.

Currently, our portfolio is positioned toward value-oriented stocks (including financials, consumer discretionary, industrials, energy and materials), which make up 58% of the portfolio, although this has declined from 63% on December 31st. Exposure to growth stocks (including healthcare, information technology and communication services) increased to 34%, up from 29% on December 31st.

We added the following new stock positions during the 2nd quarter:

Quebecor Inc. is a Canadian diversified media and telecommunications company based in Montreal. The acquisition of Freedom Mobile has opened a large avenue of growth for a company that has been traditionally restricted to the province of Quebec. We see a long runway ahead for Freedom that is not reflected in the present share price.

Novo Nordisk is the world’s leading diabetes and obesity pharmaceutical company with a market capitalization of approximately US$360bn. Its Ozempic drug is now the most prescribed GLP-1 product. The company has demonstrated high margins and free cash flow, and a ~45% dividend payout while continuing to invest in its drug pipeline.

Applied Materials is a leading supplier of advanced equipment, tools, inventory, and maintenance services to logic, memory and analog semiconductor companies. We see the company benefiting from the growth in digitization, automation, and AI, plus onshoring of semiconductor supply chains and a rebound in capital spending.

A detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

After generating strong gains during the first quarter, global equity markets also continued their upward climb during the second quarter. On a total return basis, the STOXX Europe 600 index returned +2.7%, the Nikkei 225 index was +18.5%, and the Nasdaq gained another +13.1%, taking its year-to-date gain to more than 32% – its best first half of a year since 1983.

Despite these returns, a great deal of pessimism remains in the market. Several commentators continue to warn about a forthcoming recession. Most are concerned about the potential for a recession in the US given elevated inflation, aggressive monetary tightening, and the fallout from the collapse of several regional banks. Despite these concerns, the U.S. economy has demonstrated remarkable resilience and consumers continue to spend.

US housing was one of the hardest hit sectors in 2022, but recent data suggests that we could be on the cusp of a rebound. New home sales jumped 12.2% to the highest level since February 2022. A potential rebound in U.S. housing is significant given that the housing sector is one of the largest and most important sectors of the U.S. economy, contributing an estimated 15-18% to GDP.

Inflation continues to move in the right direction as measured by the consumer price index. According to recently published data from the U.S. Labor Department, the inflation rate for the month of May cooled to its lowest annual rate in more than two years.

The global economy is growing at a modest pace, inflation has been moderating in both the U.S. and Europe, and consumer confidence has recently improved in the US. Corporate earnings have proved to be more resilient than the market was expecting. Taking all of this together, we remain cautiously optimistic as the second half of the year gets underway.

During the quarter, we initiated several new positions. In portfolios invested in our Global strategy, we added Applied Materials, Deckers Outdoor, Novo Nordisk, RELX, and YUM! Brands. In the International strategy, we invested in ASML, Hoya, Sony, and YUM China.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

In reverse to what happened in Q1 of 2023, interest rates across the Canadian yield curve shifted higher in Q2, with the more pronounced moves occurring in the short to medium term terms. The slope of the curve also steepened negatively. Typically, longer-dated bonds offer more yield given the additional risks inherent in lending money over a longer timeframe. However, at present, and as has been the case for the past year or so, the curve is “inverted,” with higher rates at the short end of the curve than the long end.

The primary factor influencing fixed income markets was inflation and central bank policies to address it. While inflation continued to decline on a year over year basis, some underlying trends clouded market sentiment and dulled risk appetite. For example, the April CPI reading of +4.4% marked the first time in 10 months that this figure rose. Even though it dropped back to +3.4% in May, it still looks a long way from the Bank of Canada’s stated annual inflation target of 2%.

Meanwhile as described above, economic growth as measured by GDP slightly exceeded expectations during the quarter, as did employment and wage growth statistics. On the surface, this may seem like positive news, however it is negative news from an inflationary perspective, as a stronger economy increases pricing pressures. These factors caused the bond market to reassess the probabilities that interest rates would be “higher for longer.”

Our expectation is that inflation will continue to decrease, albeit in a slower and less linear manner, and that we are very close to the end of the rate hike cycle, perhaps after one more increase in mid-July here in Canada.

Given the shape of the yield curve, and that it is inverted, the most attractive rates are in the shorter end. We see opportunities in existing issues that are trading below par, and therefore offer higher tax-advantaged returns for taxable investors. At the same time, we have identified some attractive new issues, such as short-dated bonds from some of the major Canadian banks offered with a 5.5% coupon.

All in all, it has been a solid first half of the year, and we remain constructive on fixed income as a place to allocate investment funds.

Second Quarter 2023 Global Equity and International Review

After generating strong gains during the first quarter, global equity markets continued their upward climb during the second quarter. On a total return basis, the S&P 500 was +8.7%, the STOXX Europe 600 index returned +2.7 %, and the Nikkei 225 index was +18.5%. The Nasdaq was particularly strong with the index generating a total return of +13.1% during the second quarter. For the first six months of the year, the Technology-heavy Nasdaq index soared by more than 32%, which marks the best first half for the Nasdaq since 1983 when it rose by 37%. The strong gains in the Nasdaq have largely been driven by the excitement surrounding artificial intelligence (AI) and the potential productivity gains that AI could generate for the global economy.

Second Quarter 2023 Fixed Income Strategy Review

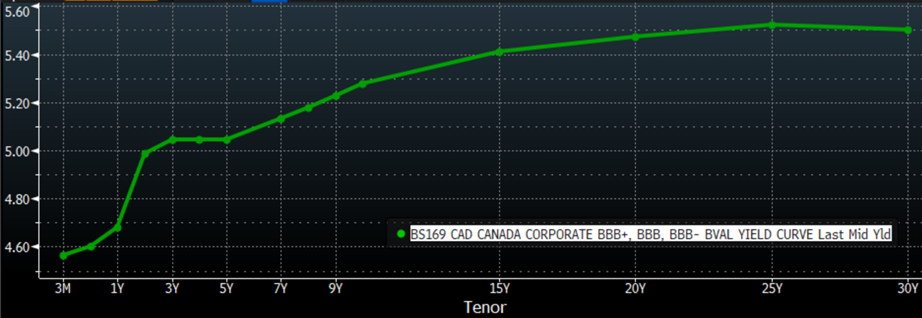

In a reverse from Q1, the Canadian yield curve level (the general, reflecting overall value of interest rates across the curve) shifted higher in Q2, with the more pronounced moves occurring in the short to medium term tenors (encompassing the 3 month to 7 year bonds). This is shown in the Canada Yield Curve chart below. Rates moved higher by an average of almost 60 bps across the curve. As bond investors, you know that when interest rates (yields) rise, bond prices fall, albeit modestly in this case.

Second Quarter 2023 North American Equity Strategy

So “What’s Going On” according to Ed Yardeni June 2nd, 2023.

This quote was music to our ears even if it was not from Marvin Gaye. It is in line with our current thinking at Cumberland and pretty much summed up what happened in the second quarter. In fact, the S&P500 officially entered a new bull market on June 8th, up more than 20% from its 52-week low of 3577.03 on October 12th, 2022.

Q1 2023 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the First Quarter of 2023 You can download the full reports via the links shown below.

KEY OBSERVATIONS

It’s hard to believe that we saw positive returns from both the S&P 500 (+7.5%) and TSX (+4.6%) during the first quarter. After all, inflation is still high, the Federal Reserve continued to increase interest rates, consensus earnings declined, and we witnessed the second largest bank failure in US history.

The bank failures in the US and Europe may be a drag on growth going forward, but we do not anticipate a wider crisis. We currently have no exposure to US banks, little exposure to European banks and some exposure to Canadian Banks. Canadian Banks are consistently more profitable than US and European banks and carefully regulated, so when problems do occur, they can usually manage without the need for external capital.

Despite the banking turmoil, the Fed increased rates 25 basis points or +0.25%, bringing the upper end of the federal funds rate to 5.0%. They maintained their 2023 target rate of 5.1% and raised their 2024 target to 4.3% from 4.1%. In contrast, the fixed income market seems to have priced in about -0.85% of rate decreases this year. The question now is whether this reflects an expectation of lower inflation and slower growth, or a recession. Either way, it’s clear that the rate hiking cycle is virtually over.

We continue to believe that, if a recession does materialize, it will be relatively mild. Global banks are well-capitalized and businesses and consumers are significantly less exposed to credit and leverage risk than they have been historically. In addition, unlike a year ago, with interest rates now higher the Fed now has some room to maneuver its policy. In other words, if the economy slows too quickly, they can cut rates.

Consensus S&P 500 corporate earnings estimates for 2023 and 2024 have fallen nearly -12% and -11%, respectively, from their peaks in the spring of 2022. However, valuations (the price investors are willing to pay for a dollar of a company’s earnings) are now much more reasonable and almost two-thirds of S&P 500 companies are showing positive 3-month percent changes in forward earnings. Both of these factors are positive for stock prices.

We remain confident in the long-term outlook for our portfolio holdings given their robust free cash flow and strong balance sheets. We believe that these types of companies are best positioned to weather any storm that might arise.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

We have continued to position our portfolios toward value-oriented stocks. Value stocks now make up 61% of the portfolio. Our exposure to growth stocks increased slightly to 31% of the portfolio. Staples, which we don’t classify as either growth or value, make up the balance of our equity exposure.

We added a number of new stock positions during the quarter, including:

BCE Inc. represents a stable and defensive investment in uncertain times, where you are “paid to wait” with an excellent dividend that currently yields about 6%.

Canfor Corporation is a contrarian deep-value cyclical investment. Their lumber operations stand to benefit from eventual declining interest rates and higher housing demand as a result.

General Motors Company has made significant investments in R&D and supply chain. Based on this, among other positive factors, and given its current valuation, we expect GM stock to perform well.

Avery Dennison Corporation is a global materials science and manufacturing company that we believe will grow earnings faster than the market, which provides good share price appreciation potential for investors.

Meta Platforms has over 3 billion monthly users across Facebook, Instagram, and WhatsApp and we expect strong earnings from cost cuts and rebounding ad sales. In addition, Meta has invested heavily in the Metaverse over recent years, and these capital expenditures are virtually complete, allowing the company to profit.

A more detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

After a challenging year in 2022, global equity markets more broadly also generated positive returns during the first quarter of 2023 with all the major geographic regions in the green. In addition to gains in the US and Canada, the STOXX Europe 600 index climbed by +7.8%, the Nikkei 225 increased by +7.5%, and the Emerging Markets collectively generated a positive return of +4%.

Some of the factors driving these returns include falling inflation, better than expected economic data in the US and Europe, as well as enthusiasm related to the reopening of China’s economy.

In terms of inflation, the headline figures continue to fall in both Europe and the US. Preliminary readings showed that Eurozone headline inflation fell to 6.9% during the month of March, down from 8.5% in February. In the US, the consumer price index increased by +6% from a year earlier, a decline from 6.4% in January and down from the 40-year high of 9.1% in June of 2022.

We remain cautiously optimistic in our outlook for 2023. Given last year’s significant market declines, stocks are trading at more reasonable valuations. In addition, inflation measures have been falling and the red hot job market is finally showing signs of cooling. When combining these developments with what’s happened in the banking sector, we believe that central banks are nearing the end of their interest rate hiking cycle.

During the first quarter, as described above we re-initiated a position in Meta Platforms. We had previously invested in the company, but sold our entire position back in February of 2022 when Mark Zuckerberg gave specific guidance on how much money it was going to spend on the Metaverse. Since we sold it, the stock fell by 70%.

Fast forward one year later, the company announced a strategic pivot in terms of its capital allocation. In addition to the tailwinds from its cost reduction efforts, Meta also has a potential opportunity should TikTok get banned in the United States. We also believe that Meta will benefit from the boom in artificial intelligence that will play out in the years ahead.

A more detailed review can be found in the full report per the above link.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

The drivers of fixed income returns in Q1 2023 were, in no particular order, the banking crisis, Canadian and US interest rate hikes (or pauses), and interest rate spreads, particularly the incremental return over lowest risk government bonds. In all, 2023 got off to a positive start for fixed income investors.

The Canadian yield curve shifted lower in most tenors, and remained inverted during Q1 2023. As you know, when interest rates decrease, bond prices increase, so this was a positive outcome for fixed income investors.

However, as a result of the interest rate volatility and the general “risk-off” tone of the market, corporate spreads widened modestly during the quarter. The level of corporate bond spreads are viewed as barometers for recession risk. While they currently suggest the risk of recession has increased, they do not, at present, indicate that a recession is imminent.

The Bank of Canada hiked rates by 25 bps or + 0.25% to 4.5% in late January, as expected. However, the Bank announced that it would pause, absent any material deviation from its economic forecasts, and it did just that at its meeting on March 8th, holding the rate at 4.5%. We do not currently anticipate further hikes here in Canada, but think there may still be one more increase in the US.

In Q1 2023, the trends for the US economy that were evident in late 2022 remained in place – high but declining inflation, very tight labour markets, and surprisingly resilient economic growth. The shock of the banking crisis caused rates to tumble, and the market believes the Federal Reserve Bank is tantalizingly close to the completion of its rate hike cycle.

We have not wavered in our belief that should a recession occur, it will be relatively mild. However, we believe the risk of recession has increased in the past three months as a result of tightened financial conditions, and the ongoing effect of the past year’s interest rate hikes.

We continue to favour government bonds and equivalents in our portfolio to buttress our defense against a potential recession. Having said that, bond yields remain compelling and we are modestly adding to the duration and average term to maturity of our portfolio. We will continue to seek strategic opportunities to add value through attractively-priced investments while carefully managing risk.

A more detailed review can be found in the full report per the above link.

First Quarter 2023 Fixed Income Strategy Review

The drivers of positive fixed income returns for Q1 2023, in no particular order, were the effective management of the isolated bank liquidity crisis, the central banks’ (Canada and the US) higher interest rate policies and the increase in corporate interest rate spreads (incremental return over government bond yields). After this positive start for fixed income investors, based on the fundamentals we continue to see, we retain our positive bias for income investments for the remainder of the year.

Q4 2022 and Year End Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Third Quarter of 2022. You can download the full reports via the links shown below.

KEY OBSERVATIONS

We have just concluded another year of tremendous volatility, although it finished on a positive note. The S&P500 total return for the fourth quarter was +7.6% in US dollars or +6.3% in Canadian dollars. The fourth quarter TSX total return was +6.0%. For the year, the S&P500 total return index was down -18.1% in US dollars or -12.5% in Canadian dollars. The TSX total return was -5.8% for 2022.

While it’s never fun to have a down year, the previous two years featured strong gains. Between 2020, 2021 and 2022, the average annualized total return for the S&P 500 was approximately 9.6%, which is close to the average of the past 50 years.

The losses of 2022 were almost entirely comprised of a forward price/earnings (P/E) multiple contraction of -22.07%, and were slightly offset by a positive contribution from dividends (+1.33%) and positive forward earnings per share of +3.37%. In other words, most of the decline was a result of people willing to pay less for every dollar of earnings in 2022 than they had been previously, mainly as a result of higher interest rates and perceived risk.

Two-year stretches of P/E multiple contractions are rare, and 2021-2022 ranks as the greatest two-year P/E multiple contraction of the past 38 years. Meanwhile, earnings themselves have not collapsed. Current forward earnings growth is still positive for 2023 and 2024 at +5.1% and +10.1% respectively, such that the forward P/E multiples are starting to look reasonably attractive at 16.7x and 15.2x compared to the historical 10-year average of 17.3x. Our experience is that the market begins to look forward to the next year (2024) usually by the second quarter of the current year.

While there are no shortages of negative economic forecasts for 2023, we think there is a reasonable chance for the Federal Reserve to tame inflation and for the economy to remain resilient. Even if we are wrong and we do experience a mild recession, our best guess is that long term interest rates will fall, which would lead to P/E expansion and support for market valuations – potentially reversing the historic P/E contraction of 2022.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our overall equity exposure decreased by 6% to 96%. Our US equity exposure increased from 37% to 38% while our Canadian exposure increased from 53% to 58%. Cash decreased from 10% to 4%. It is important to keep in mind that many of our clients’ portfolios are invested in equities globally, through our North American plus International Equity strategy, meaning that the actual weights of US and Canada within their equity holdings will be proportionately less than this given the 15-20% allocation to international companies.

We have continued to position the portfolio toward value-oriented stocks. Value stocks now make up 63% of the portfolio. Our exposure to growth stocks was trimmed by about 1% to 29% of the portfolio. Staples, which we don’t classify as either growth or value, make up the ~8% balance of our equity exposure.

During the quarter, we added a number of new stock positions, including:

Enghouse Systems Ltd. acquires and integrates technology companies. After a brief lull, it’s most recent quarter showed stronger revenue and EBITDA growth. This Canadian company also announced two acquisitions that should re-accelerate growth.

Arthur J Gallagher & Co is one of the leading insurance brokerage, risk management, and human capital consultants in the world. We like this business and consider it defensive, as most insurance purchases are non-discretionary.

Eaton Corp. PLC is a power management company that benefits from the shift to renewable power. New orders and backlogs have accelerated, and secular tailwinds should support prolonged revenue growth at mid-to-high single digits.

Elevance Health Inc. is one of the largest health benefits companies in the United States. We like the demographic-driven stability and growth characteristics of health care, and believe the company is well positioned to benefit from this trend.

A more detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

Inflation was percolating at the start of 2022, and the war in Ukraine served as a catalyst to drive it even higher. In response, central banks aggressively hiked interest rates as you have seen. Against this backdrop, both stock and bonds lost money. Since 1926, there have only been two calendar years when stocks and bonds were both down.

We believe that a changing of the guard may be unfolding in terms of stock market leadership. During the fourth quarter, the MSCI EAFE and MSCI Emerging Markets Indexes both outperformed the MSCI USA Index. This trend may continue after 15 years of outperformance by the United States, thanks in part to a fading US dollar.

We are cautiously optimistic about 2023. Inflation is showing signs of cooling, which means we may be getting closer to the end of rate hikes. We believe that the companies we own, with stable earnings, low leverage, and pricing power, are well positioned for 2023. And history suggests that forward returns are typically strong in the aftermath of a bear market.

We recently added several new stock positions, including Arthur J Gallagher & Co and Eaton Corp, which are highlighted on the previous page. We also added:

Avery Dennison is a materials science company specializing in labeling and functional materials with dominant market share, pricing power and economies of scale.

FinecoBank is one of the most established online banks in Italy and stands to benefit from the wealth transfer to younger generations and higher interest rates.

Keyera Corp is an integrated energy infrastructure business with extensive interconnected assets and a generous dividend yield.

Keysight Technologies is a global leader in testing and measurement equipment with exposure to several themes that we like, including electrification and reshoring.

A more detailed review of each company can be found in the full report per the above link.

During the last quarter of 2022, fixed income also markets continued to wrestle with three things: inflationary data, ongoing interest rate hikes and elevated recessionary risks.

In December, The Bank of Canada made two statements that highlight recent uncertainty. First, the Bank noted that “its Governing Council will be considering whether the policy interest rate needs to rise further,” potentially signaling that the rate hike cycle is close to an end, then noting that the “annual run rate inflation is still too high, and short-term inflation expectations remain elevated,” leaving the door open for further hikes.

Like Canada, the headline economic story in the US was inflation. The market currently expects another 50-75 bps of overnight interest rate hikes in 2023, and for the rate to peak at 5.0% in June. We anticipate that, like the Canadian situation, the Fed will pause and watch the state of the economy in the second half of 2023 before making further moves.

Subtle shifts in the Bank’s commentary and five consecutive months of declining inflation in both countries have us feeling more positive than we have in months.

Firstly, we believe we are near the end of the rate hike cycle, and therefore the impact of higher rates on fixed income securities should soon end, barring any unforeseen shocks. Secondly, there is a risk of a recession in our view, but we believe it will be mild. Consensus forecasts of Canadian and US GDP expects positive growth in 2023 and the labour markets in both countries remain tight.

With a rate hike or two still likely, we maintain a shorter duration than the benchmark. Some of the investment opportunities in the 2-3 year range offer yields that are almost as attractive as those maturing 7-10 years out, and we don’t believe the relatively minor additional yield of longer bonds compensates us adequately for the additional maturity risk or remaining interest rate risk.

We believe the current yields are more compelling than they have been in many years. As a result, we are looking for opportunities to lock in investments for the benefit of our client portfolios. To get a deeper understanding, you can read the full report via the link above.

Q3 2022 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Third Quarter of 2022. You can download the full reports via the links shown below.

KEY OBSERVATIONS

Market volatility continued through the third quarter – initially to the upside, with the S&P 500 rising almost 14% through mid-August only to finish the quarter down -4.9% in US dollars, or modestly up +1.9% in Canadian dollar terms. The TSX total return was -1.4% for the quarter.

Famed investor Martin Zweig coined the phrase “Don’t fight the Fed” in the 1970s and it still rings true 50 years later. In September, Federal Reserve Chairman Jerome Powell reminded markets about what he previously said at Jackson Hole in August 2022:

“Restoring price stability will likely require maintaining a restrictive policy stance for some time… We will keep at it until we are confident the job is done.”

Indeed, the futures market now seems to be expecting another 100-125 basis point increase in interest rates between now and year end. This is on the heels of downgraded GDP projections through 2024, higher expected unemployment, and the expectation that it will take until 2025 for inflation to return to the Fed’s target 2% range.

The question now is how the stock market will react. In previous drawdowns, the market’s path has depended on whether or not a recession develops. Certainly, the odds of a recession is higher after the latest Fed rate move and new projections. However, if there is a silver lining, it is that the distance between where we are today and historic low points is about -5% to -10%, suggesting most of the damage may be done.

Our strategy is to concentrate on owning high-quality companies with lower volatility, consistent earnings and strong and growing dividends combined with some extra cash reserves on the sidelines. We feel we are well positioned to weather the turbulence and participate in the upside that may come given that we are likely now closer to a market bottom.

As we have pointed out in the past, the true beginning of a new bull market typically doesn’t feel like a very comfortable time to invest when it may just be the best time to do so.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our overall equity exposure increased 1% to 90% from 89% at June 30th. Our US equity exposure decreased from 39% to 37% while our Canadian exposure increased from 50% to 53%. Cash decreased from 11% to 10%. It is important to note that many of our clients’ portfolios are invested in our North American plus International Equity strategy, meaning that the actual weights of US and Canada within their equity holdings will be proportionately less than this given the allocation to international companies.

Currently our portfolio is positioned toward value-oriented stocks making up 56% of the portfolio versus 53% at June 30th while maintaining exposure to growth stocks at around 30% of the portfolio, which was down slightly from 32% at June 30th. Staples, which we don’t classify as either growth or value, make up the 4% balance of our equity exposure.

Our shift to value included one new purchase:

- Linamar Corporation is an advanced manufacturing company composed of two operating segments – the Industrial segment and the Mobility segment, both global leaders in manufacturing solutions and world-class developers of highly engineered products.

In the latest quarter, Industrial and Mobility sales grew 28.2% and 25%, respectively, on strong pricing and market share gains. The company is also having great success winning new business with their new business book now at $4.9 billion, which should add $600-800 million of revenue in each of the next two years on a current revenue run rate of about $7.5 billion. Linamar currently trades at just 7.2x next year’s earnings.

Given the recent pullback in energy through the third quarter, we also took the opportunity to increase our exposure slightly in existing portfolio names Keyera Corp. and Topaz Energy Corp. A complete review of new companies purchased and additions during the quarter can be found in my full report.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

The challenging market conditions during the third quarter were global in nature as equity markets throughout Europe and Asia experienced significant bouts of volatility just like the S&P 500. Market volatility during Q3 was driven by the same factors that led to the weakness in the first half of the year – inflation, tightening by central banks, and the war in Ukraine.

During the third quarter, portfolio activity remained busy as we continued to reduce our cyclical exposure and increase our weight in defensive areas such as Consumer Staples. Some of the notable activity during the quarter included a reduction of our weighting in Accenture (Technology) and Howden Joinery (Building Materials), and establishing two new holdings:

- Pernod Ricard is the world’s second-largest spirits manufacturer, with brands like Absolut, Chivas Regal, The Glenlivet, Jameson, Malibu, Martell, and Beefeater. The company has been able to generate above-average growth with strong pricing power and a presence in fast-growing emerging markets such as China and India.

- Heineken is the largest brewer in Europe and the second largest brewer in the world. The company has more than 300 brands and sells its products in more than 190 countries around the world, including high-growth markets across Asia, Africa and Latin America.

As we look ahead, we are cautiously optimistic. The valuations in our portfolios are now much more attractive, we are positioned defensively, and investor sentiment has reached levels seen at the bottom of the Great Financial Crisis in 2008-09 and the COVID pandemic in 2020.

Another reason is history: once the S&P 500 has a 20% drawdown, there is a strong likelihood of positive returns over the next 1, 3, and 5 years. At its September 30th low, the S&P 500 was down nearly 25% from its highs on a year-to-date basis. This is not too far off the average bear market decline of 33%. This leads us to believe that we are getting closer to a bottom.

FIXED INCOME UPDATE

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

The drivers of fixed income valuation and performance in Q3 2022 remained similar to those we spoke about for the first half of the year, resulting in a modest quarterly gain in total return. Inflation remained Public Enemy Number One, peaking at 9% in the US and 8% in Canada, before receding through quarter-end due primarily to declining energy prices.

Both the Federal Reserve (Fed) and the Bank of Canada (BoC) hiked their benchmark interest rates very aggressively in response to extended inflation concerns. The BoC raised its benchmark interest rate 1% on July 13th, and another 75 bps on September 7th. This brought the overnight interest rate to 3.25%, its highest level since 2008, and it is now forecast to top out at close to 4%. The Fed rate is now expected to peak at slightly less than 4.5% by the end of March 2023.

Discussion of a global recession has continued with increasing prices, consumer debt burden, employment levels and supply chain issues consuming the majority of the bandwidth for slowing growth theories in several key markets.

From here, it will be a balancing act between controlling inflation, managing any recessionary signals on the horizon and responding to other forces at play globally, such as the war in Ukraine, the energy markets, and macroeconomic shocks like the UK government delivered a couple of weeks ago with an unrealistic budget program.

Turning to the fixed income markets specifically, current bond yields have become more appealing. We see attractive opportunities for both conservative shorter- to mid-term duration government bonds and higher quality corporate bonds.

Interest rates will continue to fluctuate, and may drift moderately higher, causing some short-term decline in bond values, however, we believe the current yields are more compelling than they have been in many years. As a result, we are looking for opportunities to lock in investments for the benefit of our clients over time.

Kipling Strategic Income Fund

The Kipling Strategic Income Fund had a solid August 2022 relative to its benchmark. The M series of the fund generated a return of +0.1%, while the benchmark returned -2.2%. We have positioned the fund to have a shorter duration than the benchmark. This positioning benefitted our unitholders in August.

The bond market seems to be searching for direction and trying to decide if inflation or recession is the bigger risk. On July 27th, the Federal Open Market Committee (“FOMC”) in the United States raised the Fed funds rate by 0.75%. However, comments made in the press release and at the press conference by FOMC Chair Jerome Powell were deemed “dovish” by the market and the bond market rallied (interest rates went down/bond prices went up). The following Friday, strong employment data in the U.S. caused the market to fear that more interest rate increases were likely, and the bond market sold off. The following week, U.S. inflation data was slightly lower than forecast and the bond market rallied yet again. As August wore on, the bond market generally drifted lower.

We believe central banks in Canada and the United States are very focused on reducing inflation. Consequently, central banks will continue to increase short-term interest rates through at least late 2022 and will be reluctant to reduce interest rates. In early August, markets were pricing in four interest rate increases from the FOMC, followed by three interest rate cuts before the end of 2023. In our opinion, this bordered on irrational exuberance.

In a speech on August 31, Loretta J. Mester (President of the Federal Reserve Bank of Cleveland and a FOMC voting member) said of interest rates that “I think we’re going to have to move them up … above 4% and probably need to hold them there next year,”. Similarly in an August 30 speech, John C. Williams (President of the Federal Reserve Bank of New York and FOMC Vice Chair) said that the possibility of interest rates cuts in 2023 was “very unlikely”.

The yield curve is relatively steep in the extreme short end, but flattens in the 2-5 year range. Based on this yield curve, moving from 2 year (4.99%) to 5 year (5.05%) only adds 6 basis points in yield, but should increase interest rate sensitivity (which could be a proxy for volatility) by 150% all else equal. That is not a worthwhile trade-off in our opinion. Consequently, the duration of the fund is approximately 1.91.

Figure 1: Bloomberg Canada BBB+, BBB, BBB- Yield Curve

We have positioned the Kipling Strategic Income Fund to have a shorter duration than the benchmark (1.91 vs. 5.34) and to have a higher yield-to-maturity than the benchmark (7.1% vs. 4.4%). In an environment where all interest rates move higher, the fund should outperform the benchmark due to its’ shorter duration and higher yield-to-maturity. In an environment where interest rates are unchanged, the fund should outperform due to its’ higher yield-to-maturity. In an environment where all interest rates move lower, the fund should underperform. However, the underperformance should be mitigated by the higher yield-to-maturity and should still be positive as all bonds would increase in value (all else equal). We think this is the best way to position the fund in the current environment.

Second Quarter Fixed Income Strategy Review

The second quarter of 2022 echoed many of the themes evident in the first quarter. Inflation in both US and Canada exceeded already lofty expectations and climbed to levels not seen since the early 1980s. The Federal Reserve and the Bank of Canada hiked rates sharply and aggressively in response. Oil, a primary driver of inflation, hit multi-year highs as well, as the conflict in

Ukraine entered a new, possibly more protracted stage, roiling energy markets. The impact to financial markets, although not as severe as the first quarter, was steeply negative across most asset classes.