First Quarter 2024 Fixed Income Strategy Review

Recall that in last quarter of calendar 2023 the yield curve decreased markedly (and as you readers and investors know, when yields drop, bond prices rise). The resulting bond price rally that occurred was the strongest quarterly return performance by Canadian bonds in over 20 years. At the time, some believed there was a reasonably good chance interest rate cuts by the Canadian and US central banks might start as early as March 2024.

It would be difficult to repeat such a strong performance, as a result, the first quarter of 2024 always had a tough act to follow and the bond market return performance was in fact a mixed bag. Interest rates drifted slightly higher (see Canadian Yield Curve chart below), which is a negative factor for bond return performance. Inflation continued to trend downwards at a slower than anticipated pace, but the Canadian economy remained stronger than expected with a very modest beat in GDP growth in January (the latest data released), thus creating the environment for mixed bag return profile.

First Quarter 2024 Global Equity and International Review

After delivering robust returns in 2023, global equity markets started off 2024 with a bang. Some of the key factors driving the returns included strong corporate earnings, an expectation of interest rate cuts in 2024, and a turn in investor sentiment with investors abandoning their recession calls. Given this backdrop, stock market returns were not only strong, but also widespread across geographic regions.

First Quarter 2024 North American Equity Strategy

In our view, the current market advance is a result of the combination of a strengthening economy, growing earnings and the expectation of rate cuts later in 2024. The market’s focus has pivoted away from concerns about rising interest rates, which facilitated the rally during the fourth quarter of 2023, focusing on the forecasted earnings growth in both 2024 and 2025 (after flat earnings in 2023) which took the markets to new heights in 2024 year to date. Price/earnings (P/E) multiple expansion (i.e.: an increase in what investors are willing to pay for every dollar of earnings) is not unusual at this point in the cycle as earnings estimates catch up. This leads to stock valuations that are higher than historical averages, however with that said, we still don’t believe they are unreasonable for this point in the cycle.

Finally, last week’s update by the Federal Open Market Committee of the U.S. Federal Reserve (Fed), seems to support our expectation of a lower Fed Funds Rate (and therefore lower interest rates) in the second half of 2024.

Q4 2023 and Year End Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Fourth Quarter of 2023. You can download the full reports via the links shown below.

KEY OBSERVATIONS

After declining -10.3% from its July 31, 2023 high, the S&P 500 increased or rallied +15.9% between its October low and the end of the year. We believe this reversal reflects at least three market headwinds that appear to be shifting into rather potent tailwinds.

The first tailwind is what many are calling the “Fed Pivot.” In December, the US Federal Reserve did not raise interest rates for a third consecutive meeting, and more importantly, the median projection for the Fed Funds target rate was lowered for 2024 and 2025. We are now almost certainly at the peak of the interest rate cycle. The bottom line is that it looks like the Fed is now clearly on the side of those who own stocks.

The second tailwind is an improving inflationary and economic picture. Also in December, the Fed’s preferred measure of inflation showed a month-over-month decline for the first time in over three years. Hovering at 2.6% year over year, inflation is not quite at the Fed’s long-run target of 2%, but moving in the right direction. When combined with easing GDP growth, inflation appears to be shifting from a headwind to a moderating tailwind – and without a recession.

The third tailwind is stronger corporate earnings. Profit growth among S&P 500 companies decelerated throughout 2022 (meaning it grew, but at a slower pace). It contracted from Q4 2022 to Q2 2023 (meaning earnings fell). But in Q3 2023, earnings grew +5.8%. We are awaiting results for Q4 2023, but the consensus is that we are now likely entering a phase of sustained earnings growth.

It appears that three of the market’s most significant recent obstacles are now supportive factors. Further, the current bull market is still young from a historical perspective, and judging by previous bull markets, there may be considerably more length and strength to this bull run.

In any event, an environment of falling interest rates on the back of better inflation prospects and higher earnings growth is a combination of tailwinds that cannot be ignored.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the fourth quarter, the S&P500 total return was +11.7% in US dollars or +8.9% in Canadian dollars. The TSX total return was +8.1% in Q4.

Our overall equity exposure increased marginally from 94% to 95% with cash declining from 6% to 5%. We shifted our allocation in favour of US equities (+5%) over Canadian equities (-4%) with cash making up the difference.

Canadian real GDP growth declined -1.1% annualized during the third quarter of 2023 and the latest report for October pointed to little rebound so far for the fourth quarter. About 60% of all outstanding mortgages in Canada will come due over the next three years, which will create a further drag as consumers refinance at potentially much higher rates. It is worth noting that most of our Canadian holdings have international revenue, thus limiting our true exposure to the economic environment in Canada.

We added three new investments during the quarter:

Walmart and Amazon: These investments share three key metrics that we think define their respective competitive advantages today: 1) revenues growing faster than their peers and taking additional market share, 2) profitability is starting to turn higher, and 3) valuations at current levels are attractive.

In the case of Walmart, the company wins in almost any economic environment. Consumers turn to Walmart during inflationary times to stretch their purchasing power. As inflation subsides, it will likely lead in lowering prices, which should drive increased traffic and unit growth.

In Amazon’s case, before the pandemic, the company was only starting to become profitable. During the pandemic, it had to invest heavily to overhaul its distribution network, which weighed on its profitability. We believe the bulk of the investment is over and that it will now benefit from higher profitability.

Vertex Pharmaceuticals has a global monopoly in cystic fibrosis treatments, which has led to industry-leading sales and profitability, along with an exciting pipeline of other potential therapies, including a non-addictive pain treatment with the potential to compete with opioids.

A detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

After a tumultuous 2022, in which both stocks and bonds fell by double digits, stocks came roaring back in 2023. Some of the factors behind this strength were low expectations, the absence of a global recession, and a faster-than-expected decline in the rate of inflation.

The U.S. proved to be more resilient than expected in 2023, driven by a robust labour market, continuing COVID stimulus, and legislation such as the Inflation Reduction Act and the CHIPS Act. We believe that the probability of a soft landing in 2024 has increased in light of this economic strength, combined with falling global inflation and expected interest rate cuts.

A high dependence on imports and exports hurt the Eurozone economy in 2023. Germany contracted in the third quarter, which is worrisome given its status as the region’s largest economy. Its vast manufacturing sector has struggled due to weak demand from China, elevated energy costs, and significantly higher interest rates. The Eurozone economy should gradually pick up as consumption recovers and inventories are rebuilt.

Going into 2023, expectations for China were high as it reopened following the COVID lockdowns that crippled the economy for over two years. However, the optimism faded quickly as concerns about the country’s real estate problems resurfaced. Although we expect China to remain weak as 2024 begins, its government has announced a series of stimulus measures and we believe that the economy is in a bottoming process.

Japan was a bright spot for global equity investors in 2023. The country appears to have emerged from three decades of economic stagnation as the economy expanded at an above-trend pace in both nominal and real terms during 2023. Given that approximately 50% of public companies in Japan are trading at less than 1x book value, there is substantial room for share price appreciation as companies improve their capital efficiency and profitability. We are optimistic about the prospects for Japan going forward.

We added several new investments across a variety of industries during the quarter, including Amazon and TFI International in the Global Strategy portfolio, and Keyence, Partners Group, Sage Group, Universal Music Group, and Wolters Kluwer in the International portfolio.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

The last quarter of 2023 rewarded fixed income investors for their patience after a challenging first nine months of the year. The FTSE Universe Canada Bond Index gaining +8.27% for the quarter, bringing the YTD figure to +6.69%. November saw the bond market’s second-largest monthly gain in over 20 years, and the rally continued in December.

A confluence of factors drove these returns. The US released a string of weaker-than-expected economic data, which hinted that the economy was cooling, suggesting the need for rate cuts. Canadian economic data was more mixed, with November producing a weaker jobs report and slightly negative GDP, although this was offset by a big upward revision to Q2 GDP and a stronger December jobs report.

From a fixed income investor’s perspective, 2024 will be spent focusing on timing the first rate cut by the central banks. As of this writing, the market expects the first US rate cut to occur in March and the first Canadian cut to take place in the spring. Our suspicion is that central bankers will be more cautious than widely anticipated. In our view, the first cut by the Fed will likely occur in May or June, and that it will be a modest 25 bps to begin with. We believe that the Bank of Canada will ultimately cut before the Fed does, largely due to the softer state of our economy.

In terms of positioning our portfolio, extending the duration will benefit the fund if the anticipated rate cuts do materialize. Even in the absence of rate cuts, extending duration will not impact investors negatively should rates remain relatively static. In addition, given that the odds of a Canadian recession, albeit mild, have risen in our view, modest increases in weights in federal, provincial, and/or investment grade corporate bonds are prudent.

We consider corporate bond spreads (the additional yield corporate bonds earn over Government of Canada bonds) to be a good indicator of financial stress. These spreads tightened throughout 2023, which is a sign of bullish sentiment toward corporate debt and does not indicate the expectation of a significant recession.

In summary, absent a major unforeseen shock, we believe 2024 will provide a constructive environment for fixed income investors.

Year End 2023 North American Equity Strategy

It seems like everyone in the investment world likes to use sports analogies to describe the current economic cycle and Federal Reserve Chairman Jerome Powell’s actions, which recently happened to be a pivot, generally known in the markets as the “Fed Pivot”. Team Powell has two coequal goals for monetary policy: those are maximum employment and low inflation. Exhibit 1 shows the evolution of the Federal Funds target rate (dot plots) by Federal Reserve Board members and Bank presidents. What was indicated at the Fed’s December meeting, and is confirmed in the charts below, was the “Fed Pivot”. That is, they did not raise rates for a third consecutive meeting but more importantly, the median projection for the Fed Funds target rate was lowered for 2024 and 2025.

A Soft Landing for the U.S. Economy is in the Realm of Possibility

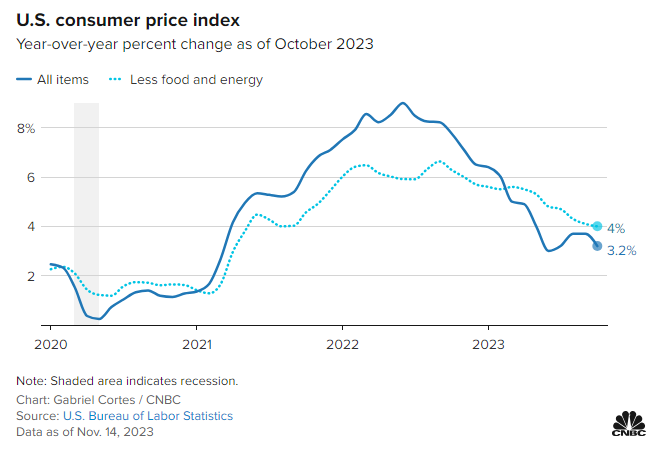

One of the biggest debates in the market today is whether the U.S. economy is headed for a recession or a soft landing. Given that the United States is the world’s largest economy, the outcome of this debate matters a lot given the implications it would have for the rest of the world. One of the key factors that will impact the outcome of the debate is the rate of inflation. The bears argue that inflation remains far too high and that the U.S. Federal Reserve will need to keep hiking interest rates which will eventually tip the U.S. economy into a recession. Recent inflation data over the last few weeks is not the type of fodder that the bears were hoping for given that both the Consumer Price Index (CPI) and the Producer Price index (PPI) declined more than consensus expectations.

As seen in the chart below, the consumer price index for the month of October increased by 3.2% compared to one year ago. This was better than consensus, which called for an increase of 3.3%. The consumer price index is a measure of the average change over time in the prices paid by urban consumers for a broad basket of consumer goods and services.

On a month over month basis, the CPI for October was flat versus September. This is fueling hope that stubbornly high prices are easing their grip on the U.S. economy and that the U.S. Federal Reserve is in a better position to stop raising interest rates. And eventually cut interest rates.

The Producer Price Index (PPI) also delivered results that were better than consensus expectations. During the month of October, the PPI declined by 0.5%. This marked the biggest monthly decline since April of 2020. Consensus was expecting an increase of 0.1% so this result was much better than consensus.

The Producer Price Index measures the average change over time in selling prices received by domestic producers of goods and services. The PPI index measures the price change from the perspective of the seller, which is different than the Consumer Price Index that measures price change from the purchaser’s perspective. It’s good to see that both the CPI and PPI data was better than consensus as it provides more evidence that inflation is falling faster than expected.

In addition to the favourable inflation readings, there was also a positive economic data point with the recent release of the Chicago PMI Index. The Chicago PMI captures manufacturing and non-manufacturing business conditions across Illinois, Indiana, and Michigan. A reading below 50 signals contraction in the economy while a reading above 50 signals expansion in the economy. The Chicago PMI has been in contraction mode for 14 consecutive months. However, November’s reading put an end to the streak as the Chicago PMI surged past consensus expectations. The November reading of 55.8 was well ahead of October’s reading of 44, and ahead of consensus at 46. While 1 month of data is a small sample size, it is encouraging especially given the magnitude of the difference between the actual reading versus consensus.

There is one data point that will encourage the bears and that is the recent release of the Beige Book from the Federal Reserve. According to the Beige Book the economy has slowed in recent weeks as consumers are keeping a closer eye on their spending.

From our perspective, falling inflation and a sudden turn in the Chicago PMI increases the probability of a soft landing in the U.S. economy despite the slowdown that was highlighted in the Beige Book. While nothing is for certain and there are no guarantees in our industry, we are encouraged by the recent data points and believe the likelihood of a soft landing has increased.

Have a good weekend.

Phil

Q3 2023 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Third Quarter of 2023. You can download the full reports via the links shown below.

KEY OBSERVATIONS

Last quarter, we discussed the likelihood of a soft economic landing given that economic growth was slowing but likely not turning negative, and that the earnings outlook was improving. Since then, market consensus has shifted to agree with our view. The Federal Reserve is also now more positive, with forecasts of higher growth, lower unemployment, and improving inflation. The trade-off appears to one more rate hike expected in 2023 and only two rather than four rate cuts expected in 2024.

As a result of the Fed’s more hawkish tone, the 10-year US Treasury bond yield increased to as high as 4.61% as of this writing, which is a level not seen since 2007. The S&P 500 is also down -6.6% from its July 31st bull market high, and we think this is mostly due to the competition with higher bond yields.

The competition between equity valuations and bond yields can typically resolve itself in a few ways: Bond yields can decline (which should happen if the Fed’s projections for inflation are correct), the earnings outlook can catch up (which effectively lowers the valuation of the market), and/or the market can pull back (which has been happening for the past two months).

US manufacturing activity has continued to decline, but the pace of contraction seems to be slowing. There have been historic examples in the mid-1980s and mid-2010s when soft-landing slowdowns like this have subdued inflation without recessions. It remains possible that the current inflation gets resolved without a recession or any serious long-term implications.

The market often bottoms well ahead of the economy, and it would appear this time is no exception. Some of the best times to invest are when it’s most uncomfortable to do so. We remain cautiously optimistic about equities. While we can’t rule out a further market pullback, we believe the underlying economic fundamentals are improving, the earnings outlook has turned positive, interest rates have peaked or are close to it, and all of these factors should limit the downside as we look out to 2024.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the third quarter, the S&P500 total return was -3.27% in US dollars, or -1.22% adjusted for Canadian currency. The TSX total return was -2.20% over the same period.

During the quarter, our overall equity exposure was unchanged at 94%, with cash making up the balance. Our split between US/Canadian equity exposure also remained unchanged at 42% and 52% respectively. We continued to position our portfolio toward value-oriented stocks, which make up 58% of the North American portfolio. This declined from 63% on December 31st, while exposure to growth stocks increased to 34%.

We added two new stock positions during the quarter:

In Canada, TFI International, Inc. provides freight transportation and logistics services. It operates through four segments: Package & Courier, Less-than-Truckload (“LTL”), Truckload, and Logistics. The LTL market has just become less competitive with the recent dissolution of Yellow, a large competitor. With Yellow gone, TFII should gain volume and be able to increase prices. Further, we’ve bought TFII while the shipping industry is weak. Any recovery in general volumes will be accretive to earnings.

In the United States, Oracle Corporation is a technology company that provides database management, enterprise resource planning (ERP) and human capital management (HCM) applications. Oracle’s business has analogies to Microsoft as it is using its strength in software applications to drive its database and cloud infrastructure businesses. The company has accelerating organic growth due to 1) increasing cloud application revenue, and 2) increasing cloud infrastructure revenue. We think it has a reasonable valuation with earnings expected to grow in low double digits over the next couple of years, faster than the market overall, but it trades at market PE multiple.

A detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

After a strong first half of the year, global stocks markets took a breather. Equity market declines in North America were matched in Europe and Asia, with the STOXX Europe 600 index falling by 2.5%, and the Nikkei 225 down 4.0%. Nonetheless, global markets have generated respectable year-to-date gains, led by the NASDAQ’s stand-out +26.3% performance.

One of the biggest surprises of 2023 has been the absence of a recession, particularly in the United States. The consensus view at the end of 2022 was that the U.S. economy was headed for a recession in 2023. Instead of a recession, the economy has been resilient, despite the most aggressive interest rate tightening cycle since the 1980s.

In fact, real GDP growth in the U.S. is on pace to hit +2.2% in 2023, while inflation has moderated significantly. Many investors believe that we are at the tail end of the U.S. Federal Reserve’s interest rate tightening cycle. Why has the U.S. economy been so resilient? First and foremost, a strong labour market, with the U.S. unemployment rate near 50-year lows.

Both Europe and China remain in a period of stagnation with sub-par economic growth. The European economy suffers from high energy and borrowing costs combined with soft demand from export markets such as China. In China, policymakers are struggling with issues related to the property sector. On a positive note, China’s factory output expanded in September for the first time in six months, fuelling hope that the economy is in the process of bottoming out.

This year, we have added to our weight in technology. The tech sector generates superior growth to the overall market, above-average returns on invested capital, robust free cash flow, and strong balance sheets. In addition, many of our holdings significantly cut their cost base in anticipation of a recession that did not happen, and stand to gain attractive operating leverage as a result.

The global economy continues to grow at a modest pace and inflation has been cooling. The U.S. manufacturing industry has improved for three consecutive months and could soon move from contraction to expansion. Corporate earnings were resilient during the second quarter and were ahead of consensus expectations. Taking all of this together, we remain positive about the markets as we head towards the finish line in 2023.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

Heading into the third quarter of 2023, investors had reasons for optimism. Inflation had fallen very consistently for a year and measured 2.8% by the end June, not all that far off from the Bank of Canada’s 2% target. The economy, although slowing, was still producing positive output. In addition, the unemployment figures remained surprisingly robust.

However, in July and August, the downward trend in inflation reversed itself. While higher energy prices and shelter costs (mortgage interest cost) experienced notable upheaval, the underlying acceleration was also significant in its breadth, with inflation for goods, services, and wages all surging.

As a result, expectations that the Bank of Canada’s hiking cycle was at an end were diminished, although perhaps not quite extinguished. Our view remains that we are close to the end of the rate hike cycle, with likely one more increase by year-end here in Canada. The possibility that rates will remain elevated for longer is looking more likely, although this can change.

We believe the odds of a recession occurring in Canada have risen since our last update. Economic growth as measured by year-over-year GDP growth has decreased fairly consistently since mid-2022, although we note it remains positive as of the latest readings. We continue to believe that a recession, if it occurs, will likely be shallow. The unemployment rate has risen modestly from its low of 4.9%, and currently sits at 5.2%, but this is well below the long-term average of 6.9%.

We maintain our focus on higher-quality credit, including federal, provincial and agency bonds, and corporate bonds from investment-grade issuers. We also maintain a small weight in non-investment-grade credits with attractive yields and select opportunities.

We continue to find many of the more attractive opportunities in the shorter-dated tenors (0-3 years). We believe that the yield curve will slowly revert to its normal, upward sloping shape, however this may take longer than previously anticipated. In the meantime, yields are very attractive, and we remain confident about fixed income as a place to allocate investment dollars.

A detailed review of each company can be found in the full report per the link above.

Third Quarter 2023 Fixed Income Strategy Review

Heading into the third quarter of 2023, the outlook for the economy gave investors a few reasons for a little optimism. Inflation had fallen very consistently for a year and measured 2.8% by the end June, not all that far off from the Bank of Canada’s 2% target. The economy, although slowing (GDP growth decreased to 1.8% for the prior 12 months by the end of Q1, and to 1.1% by the end of Q2) was still producing positive output. In addition, the unemployment figures remained surprisingly robust, with the unemployment rate at 5.5%, the net change in the labour force remaining positive (employers were adding to their payrolls), and average hourly earnings measured above 5% (meaning wages grew at a rate greater than 5%).

Third Quarter 2023 Global Equity and International Review

After a strong first half of the year, global stock markets took a breather during the third quarter. Equity market indexes were down across the board during Q3 with the S&P 500 returning -3.7%, the STOXX Europe 600 index returning -2.5%, and the Nikkei 225 returning -4.0%. Despite the weakness experienced in Q3, global stock markets have generated respectable gains throughout the first nine months of the year. On a year-to-date basis through September 30, the Nikkei 225 has returned +22.1%, the S&P 500 has returned +11.7% and the STOXX Europe 600 index has returned +6%.

Third Quarter 2023 North American Equity Strategy

Last quarter we discussed the likelihood of a soft economic landing given that economic growth was slowing but likely not turning negative, and the earnings outlook was improving in the back half of 2023 and 2024. Since then, a few positive data points on the inflation front have come in over the summer months to support that hypothesis, and these have been enough to shift market consensus to the soft-landing from recession camp.