Beyond Bull and Bear: A Clear View of The Market

In 2010, as investors were still reeling from the Great Financial Crisis, we offered a simple piece of advice: Don’t be a bull or a bear. Just be right. It was a reminder that successful investing isn’t about ideology—it’s about weighing the evidence and making decisions grounded in reality, not emotion.

Today, that philosophy matters just as much. After two years of double-digit gains, US equities were down close to -20% earlier this year, and are still underwater on a year-to-date basis.

| Equity Market Index | Q1 2025 12/31/24-3/31/25 |

Year to Date April 30, 2025 |

One Year to April 30, 2025 |

| TSX | +1.5% | +1.4% | +17.9% |

| S&P500 (USD) | -4.3% | -4.9% | +12.1% |

| S&P500 (CAD) | -4.4% | -8.8% | +12.5% |

| Morningstar Developed Mkts(ex. North America) TME | +6.9% | +7.3% | +13.0% |

Source: Bloomberg

Now, many are wondering: Does the volatility of 2025 represent a temporary correction as we navigate the U.S. trade standoff before resuming more-or-less normal economic activity, or are we on the verge of a more extended downturn?

Before we go further, let’s stop to consider what a bear market could actually look like. Research from Goldman Sachs suggests that there are three types of bear markets going back to the 1800s, defined by their causes as well as their average declines, lengths, and times to recover.

- Structural bear markets are the most severe. They are triggered by structural imbalances and asset bubbles. They average declines of -60% over three years or more and can take up to a decade to fully recover. Good examples are the 2000 Tech wreck and, more recently, the 2008 Global Financial Crisis.

- Cyclical bear markets are the most typical. They are a function of the economic cycle, triggered usually by inflation, rising interest rates, and falling profits. They average declines of about -31%, last about two years, and take around four years to fully rebound. A version of this occurred in 2022, although with corporate debt in check and US consumers largely locked-in at low mortgage rates, we avoided a recession.

- Event-driven bear markets are triggered by one-off events. They do not lead to a domestic recession. They are associated with average declines of about -27%, last only about eight months, and recover within a year. Examples could include a war, an oil produce shock, and the Covid pandemic. Leading up to Covid, the economy was in good shape, with low inflation and stable growth—very similar to today.

We’ll return to these bear market scenarios in our final analysis. For now, let’s review some of the strongest arguments for the bull and bear cases going forward.

The Bear Case

Let’s start with what could go wrong.

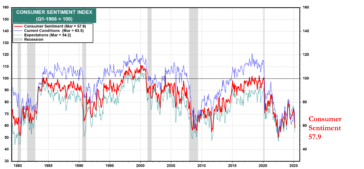

Consumer sentiment has plunged. In March, the University of Michigan Consumer Sentiment Index fell to its lowest level since November 2022, and well below consensus expectations. This marks the third straight month of decline, with many consumers citing high uncertainty about government policy, personal finances, inflation, and market conditions. Sentiment today sits at or below levels historically associated with recessions.

Source: Yardeni Research

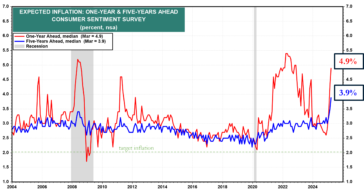

Inflation expectations are also on the rise. In March, year-ahead consumer inflation expectations spiked to 4.9%, up sharply from 4.3% in February. Five-year inflation expectations rose to 3.9%, the largest one-month increase since 1993. Both measures sit well above the Federal Reserve’s target of 2%, suggesting that consumers are now more pessimistic than policymakers.

Source: Yardeni Research

If consumers pull back on spending in response to these fears, recession could prove to be a self-fulfilling prophecy.

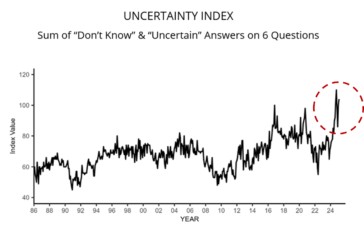

Small businesses are sending similar signals. The National Federation of Independent Business (NFIB) Small Business Optimism Index marked its second consecutive monthly decline in February. Meanwhile, the NFIB Uncertainty Index rose to the second highest reading ever recorded.

Source: National Federation of Independent Business (NFIB), February 2025 Small Business Economic Trends

According to the NFIB Chief Economist, “Uncertainty is high and rising on Main Street,” with inflation and labour quality ranking as the two biggest problems. Uncertainty has already begun to weigh on hiring and capital expenditure decisions, and unless it resolves, could further drag down growth.

Aggressive U.S. trade policies are clearly driving much of this uncertainty. As we have seen in past cycles, lack of clarity can paralyze corporate decision-making, disrupt supply chains, and slow capital expenditures. Should trade negotiations drag on or deteriorate further, the probability of a self-reinforcing downturn would increase materially.

In short, the bear case rests on deteriorating consumer and business confidence, rising inflation expectations, and political uncertainty. While much of this is based on “soft” data, such as surveys rather than hard economic statistics, it can still drive real-world behavior if uncertainty persists long enough.

The Bull Case

Now, on to what we think can go right from here.

After back-to-back US S&P500 equity market gains of over 20% in 2023 and 2024, what should we expect in year three of a bull market? History suggests returns tend to moderate but remain positive. As this chart shows, despite the wilder ride, net performance so far in 2025 is tracking closely to historical averages.

Source: Daily-Shot, Raymond James

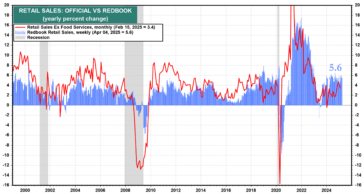

Beyond the pattern of returns, hard economic data offers further support. Retail sales continue to show resilience. The Redbook Research weekly retail sales series shows that, as of mid-March, retail sales were up +5.5% year-over-year, reinforcing the view that consumers, despite political and policy-related uncertainty, are still spending.

Source: Yardeni Research

This spending strength may be in part due to the strong labour market. Weekly jobless claims remain low at 241,000. This suggests strong job growth and limited layoffs. The unemployment rate, at 4.2%, is still well below the 50-year average of 5.8%, and only modestly above the 50-year low of 3.4% reached in 1969.

On the inflation front, market-based expectations remain relatively contained. The spread between nominal Treasury yields and Treasury Inflation-Protected Securities (TIPS) suggests an inflation outlook over the next five to ten years that is very close to the Fed’s long-term 2% target. This is far less alarming than the consumer survey data would suggest and gives the Fed room to maneuver if needed.

Source: Yardeni Research

Finally, the credit markets are not flashing recession signals. High-yield credit spreads remain well within their historical norms and have not widened meaningfully despite the recent equity market volatility. Canadian spreads have been even more stable, further supporting the notion that financial stress remains contained.

Taken together, muted but positive historical patterns, resilient consumer behavior, a strong labour market, well-anchored inflation expectations, and stable credit markets form the foundation for the bull case. While uncertainties remain, the underlying economic data remains on solid ground.

Which Bear Could it Be?

So far, we have a correction. At Cumberland, we’ve managed through numerous volatile periods over three decades. Today, we’re awaiting the resolution and potential impacts of the Trump 2.0 tariffs. The bullish view may well prevail.

If downside volatility continues, we believe it’s unlikely to morph into a structural or cyclical bear market. Economic fundamentals remain strong, and interest rates are more likely to fall than rise.

Therefore, we believe that any bear market will be of the event-driven variety, with the Liberation Day tariff shock as the instigating event. Given the historic size and scope of event-driven bear markets, most of the damage is likely already done. And, as a man-made event, it could all be reversed tomorrow.

Navigating From Here

Overall, US trade policy will dictate outcomes. But given the cross currents between sentiment and data, we are tilting portfolios toward a more cautious stance. We have modestly reduced our overall equity exposure, trimming positions in areas such as technology and industrials and adding to more defensive sectors, cash, and gold earlier.

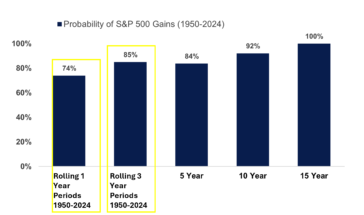

However, it is important to note: we remain invested. History teaches that staying on the sidelines can be costly. Since 1950, the S&P 500 has been higher 74% of the time on a rolling one-year basis and 85% of the time over rolling three-year periods. Missing just a few of the market’s best days can severely diminish long-term returns.

Percentage of Time S&P 500 Rose Over Rolling Perions

1,3,5,10 and 15 Years from 1950-2024

Source:LPL Research 03/11/25

Markets will continue to challenge our patience and our emotions. But in a world full of noise, our approach remains simple: eschew dogma, stay alert, lean on our long experience through many economic and market cycles, and follow the evidence through fundamental research and relevant data wherever it might lead.

Q1 2025 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the First Quarter of 2025. You can download the full reports via the links shown below.

KEY OBSERVATIONS

The S&P500 and TSX hit new highs in January and February, only to lose steam in recent weeks. In the U.S., concerns about inflation due to tariffs and policy uncertainty that could lead to slower economic growth are not helping what was a pretty decent Q4 earnings season. The S&P500 total return for Q1 was -4.27% in U.S. dollars and -4.37% in Canadian dollars. The TSX total return was +1.51%.

At its March meeting, the Federal Reserve held the federal funds rate steady at 4.25-4.50%, while still favouring two rate cuts later this year. The Fed’s Summary of Economic Projections showed weaker GDP growth but higher inflation forecasts “cancelling each other out,” in Chair Powell’s words. More tellingly, participants’ assessments of uncertainty and risks around their projections have increased significantly.

We entered a correction on March 13th, with the S&P500 down -10.1% from the February 19th high. While this could signal a deeper pullback, most of the supporting data for the “bear case” is based on soft indicators, such as surveys and sentiment. In contrast, hard data such as retail sales and jobless claims remain strong, and corporate earnings continue to rise.

Outside North America, European equities delivered one of their strongest quarterly performances in decades, supported by Germany’s landmark fiscal stimulus package focused on defence and infrastructure. Earnings revisions were positive, relative valuations remain attractive, and multiple rate cuts are expected in the region this year.

In China, manufacturing activity expanded at the fastest pace in a year, suggesting that recent stimulus measures may be gaining traction. Meanwhile, Japan continued to grow at a modest pace, although government officials expressed concern about the potential impact of U.S. tariffs on their export-driven economy.

Markets have been driven by emotion in recent weeks. Amid the volatility, we’ve taken a more cautious stance, but the underlying data remains supportive. The economy is still strong, interest rates have come down and are projected to fall further, earnings continue to rise, and valuations are more attractive than they were three months ago. For now, we are staying the course.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

Our overall equity exposure decreased 3% to 93% and cash increased from 4% to 7%. Our US equity exposure fell from 57% to 53%, while our Canadian equity exposure rose from 39% to 40%.

We reduced allocations to both technology and industrials in favour of more defensive sectors like healthcare, cash, and gold. While uncertainty remains high, the earnings outlooks, particularly for the companies we own, are still solid. Valuations are cheaper, and there are no signs of stress in credit markets. We’ve assumed a more cautious stance, but are prepared to adjust as conditions evolve.

In our North American strategy, we established the following new positions:

AstraZeneca PLC is a U.K.-based pharmaceutical company operating globally with a strong track record in oncology, cardiovascular, and rare diseases. The company has one of the best growth profiles among large-cap pharma and trades at an attractive valuation of 16.5x FY25 P/E. With a robust pipeline and strong emerging market exposure, we believe AstraZeneca is well positioned for mid-single-digit revenue growth and double-digit earnings growth over the mid-term.

Brookfield Corporation is a high-quality earnings business that has delivered an 18% compound annual return over the past 30 years. It currently trades at a significant valuation discount relative to peers, despite higher expected earnings growth. Recent acquisitions in insurance and private credit position Brookfield to benefit from structural growth in alternatives, annuities, and the retirement market.

iShares S&P/TSX Global Gold Index ETF (XGD) provides diversified exposure to gold mining companies. While we typically avoid gold equities due to their volatility, current conditions—including trade tensions, inflation risk, and geopolitical instability—support gold’s traditional role as a store of value. Using a basket ETF helps reduce company-specific risk while maintaining exposure to this potential safe haven.

A detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

In a reversal of fortunes, the S&P500 was a laggard among large developed markets during Q1. The “Magnificent Seven” stocks averaged declines of more than 15%. One of the key drivers of this weakness was renewed fears of recession in the U.S., largely due to uncertainty around the Trump administration’s tariff policy.

Outside the U.S., returns were mixed, with strong gains in Europe and Canada and modest losses in Japan. European equities outperformed the S&P500 by over 15% in U.S. dollar terms, the widest margin in more than 30 years.

Germany’s March 18th announcement of hundreds of billions of euros in defence and infrastructure spending marked one of the largest fiscal shifts in postwar Germany. These measures could significantly boost German and broader Eurozone growth.

We see several tailwinds supporting European equities, including fiscal and monetary policy support, favourable valuations, and improving earnings revisions. Meanwhile, China’s manufacturing activity showed signs of life in March, and Japan continues to grow modestly, although concerns remain about Trump’s trade policy given Japan’s export dependence.

In response to rising uncertainty, we raised cash in our portfolios. While near-term risks have increased, we remain constructive over the longer term, driven by anticipated rate cuts, fiscal stimulus, and structural tailwinds across several international markets.

This quarter saw elevated trading activity in both our Global and International strategies, reflecting what we believe could be a turning point in global market leadership. With U.S. equities retreating after years of outperformance, we took the opportunity to reposition the portfolios toward companies and regions we believe are poised for the next phase of the cycle.

In our Global strategy, we established the following new positions:

3i Group is a private equity company whose net asset value is primarily driven by Action, Europe’s fastest-growing non-food discount retailer. Action’s treasure-hunt retail model and private-label strategy support double-digit sales growth and margin expansion. Management sees the potential to expand from 2,900 stores to over 7,000, suggesting a long runway of future growth.

Autodesk is the global leader in design, engineering, and entertainment software. Its platform supports industries from architecture and construction to manufacturing and media. With strong organic growth, a broad set of end-to-end design tools, and a cloud migration strategy that’s improving customer retention, Autodesk is well positioned for sustained earnings growth.

Cadence Design Systems provides essential Electronic Design Automation (EDA) software for semiconductor development. With a near-duopoly market position, strong pricing power, and increasing demand tied to AI and custom chip design, Cadence offers attractive growth prospects and consistently strong returns on capital.

Progressive Corporation is a top U.S. auto and property insurer with the lowest expense ratio in the industry. Its leadership in telematics and underwriting performance positions the company to gain market share while maintaining profitability. We believe Progressive has the potential to double its revenues within the next 5–7 years.

Stantec is a global leader in sustainable engineering, architecture, and environmental consulting, with a growing focus on water infrastructure. The company is benefiting from tailwinds tied to U.S. legislation including the Inflation Reduction Act and the CHIPS Act. Strong organic growth, supported by acquisitions, positions Stantec for continued momentum.

In our International strategy, we established the following new positions:

Adyen is a financial technology platform offering a full-service payments infrastructure through a single integration. Its unified architecture provides clients with high authorization rates, simplified global expansion, and end-to-end transaction visibility. Adyen’s global footprint and enterprise focus make it a compelling long-term holding in the evolving digital commerce space.

Aon is the world’s second-largest insurance brokerage and a leader in risk, retirement, and health solutions. With a globally integrated network and exposure to major trends like climate change and cybersecurity, Aon benefits from built-in inflation protection and consistent industry tailwinds.

Hannover Re is a leading global reinsurer with a conservative underwriting strategy and low-cost structure. Unlike many peers, Hannover focuses solely on reinsurance and prioritizes long-term capital stability. This approach has delivered low variability in returns and steady growth in book value and dividends.

Publicis has transformed from a traditional advertising agency into a global provider of data-driven marketing and digital solutions. With operations in over 100 countries and a strong consulting arm, Publicis is gaining market share thanks to its integration of Epsilon and enhanced personalization capabilities.

Reply is a decentralized IT services company specializing in next-gen technologies like AI, IoT, cloud, and big data. With 210 niche-focused companies under its umbrella, Reply helps clients adopt and scale innovative technologies across sectors including automotive, financials, and telecom.

Sony Group is a diversified entertainment and technology company with market leadership across gaming, music, semiconductors, and imaging. The company is benefiting from secular trends in mobile devices and digital media, and is actively integrating its intellectual property across platforms to drive margin growth.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

Canada’s GDP increased by 2.6% in Q4 2024, and inflation remained in line with the Bank of Canada’s 2% target. With 175 bps of rate cuts in 2024 taking root, economic activity picked up. January GDP rose 0.4%, the best monthly result in nearly a year.

However, U.S. policy uncertainty, especially around tariffs, has become a new risk. The chaotic nature of the trade war has weighed on the outlook for Canadian growth, leading to two more rate cuts in Q1, bringing the overnight rate to 2.75%.

The Canadian yield curve shifted lower at the short end, with the 3-month to 2-year tenors down 35–50 bps. The curve is now fully upward sloping, returning to a “normal” structure. Falling yields supported bond prices and drove positive returns for fixed income in Q1.

Credit spreads, which had tightened through 2024, widened modestly in Q1. High yield spreads rose from 301 to 328 bps, and investment grade spreads from 114 to 126. Despite the widening, spreads remain below historical averages and do not suggest elevated recession risk.

We nonetheless remain cautious on corporate credit. With consumer confidence weakening and businesses showing signs of hesitancy, we believe fundamentals could come under pressure. As such, we are not increasing our exposure to credit-sensitive issues at this time and are maintaining a modest allocation to non-investment-grade positions.

Looking ahead, we believe the trajectory of the global trade war will be the key driver for markets. Broad tariffs without exemptions could pressure credit-sensitive assets, while delays or exemptions may trigger a relief rally.

In terms of portfolio strategy, we plan to maintain or possibly extend duration based on our view that rates will continue to trend lower. We are not increasing credit exposure at this time, and we continue to hold non-investment-grade positions selectively where risk-return profiles are attractive. Overall, we remain defensively positioned pending greater policy clarity.

A detailed review of each company can be found in the full report per the link above.

First Quarter 2025 North American Equity Strategy

The S&P500 and TSX hit new highs in January and February only to lose steam in recent weeks. In the US, concerns about inflation due to tariffs and policy uncertainty that could lead to slower economic growth are not helping what was a pretty decent fourth quarter earnings season. In Canada, shifting concerns from tariffs related to fentanyl and the border to annexation are impacting emotions as we head into an election. Perhaps surprisingly though, the impact on the markets during the first quarter was relatively small, although the intra-quarter swings were larger. During the first quarter of 2025, the S&P500 total return was -4.27% in U.S. dollars. Adjusting for currency, the S&P500 returned -4.37% in Canadian dollars, as the Canadian dollar remained flat only changing by 0.02 cents, closing the quarter at $0.6950. The TSX total return was +1.51% in the first quarter.

Q4 2024 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Fourth Quarter of 2024. You can download the full reports via the links shown below.

KEY OBSERVATIONS

Markets moved higher heading into year-end with the help of a decent earnings print for the third quarter and a decisive victory for Donald Trump. During the fourth quarter, the S&P500 total return was +2.41% in US dollars. Adjusting for currency, the S&P500 returned +9.10% in Canadian dollars, as the Canadian dollar depreciated about 4.42 cents. The TSX total return was +3.76%.

While the Federal Reserve lowered interest rates for the third time in December, it surprised markets with a relatively hawkish outlook in its Summary of Economic Projections, removing two interest rate cuts in 2025 from its September projection of four cuts. However, just two days after the Fed meeting, the Fed’s preferred inflation measure came in lower than expected. While the data may be choppy, our bias is to accept that rates will likely continue lower in 2025, just not at the same pace seen in late 2024.

The US economy is performing well, even with higher rates. In Canada, October’s latest read on real GDP was better than expected, coming in at a 1.9% annualized rate. Meanwhile, third quarter US earnings growth was 5.9%, exceeding estimates of 4.2%, and fourth quarter earnings growth estimates of 11.9% are the highest they have been in three years, exceeding the 10-year average of 8.5%. These figures are all significant, as economic growth drives earnings growth, and investors’ expectations for both tend to drive share valuations.

There are a lot of “known unknowns” regarding fiscal policy under Trump 2.0 that could impact the market. Both tax cuts and tariffs could put upward pressure on inflation unless they are offset by a stronger US dollar. On the other hand, deregulation, reductions in government spending, and higher US energy production could be disinflationary. It’s useful to remember that, historically, the S&P 500 has continued to move higher over time, regardless of whether it is the Republicans or Democrats in the White house (or Mar-a-Lago).

In assessing our thoughts for 2025, we like to take a systematic, data-driven approach. This is what’s kept us in the market during the past two years despite broad-based investor concerns over Fed policy, economic growth, and “Mag 7”-dominated returns. While the year ahead will not be without its challenges, the outlook for inflation, interest rates, economic growth and earnings remains constructive, and general expectations are that Trump 2.0 should be supportive of economic growth. Within that context, we remain optimistic.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

Our overall equity exposure decreased 1% to 96% and cash increased from 3% to 4% since September 30th, 2024. Our US equity exposure increased to 57%, up from 55%, on September 30th, while our Canadian equity exposure declined to 39% from 42%.

Compared to a year ago, our exposure in Canada has declined 9%, while our US exposure has increased 10%. It is important to note that many of our clients’ portfolios are invested in our North American plus International Equity strategy, meaning that the actual weights of US and Canada within their equity holdings will be proportionately less than this given the allocation to international companies.

Over the past 12 months, we continued to shift our allocation in favour of US equities over Canadian equities and remained fully invested in equity to the extent that clients’ individual limits allow.

The US economy and earnings growth for the S&P500 continued to outpace the Canadian economy and earnings growth for the TSX so far in 2024, and this is estimated to continue in 2025 and 2026.

Having said that, interest rates are declining faster here in Canada than in the US, which may mitigate the risk of a slowdown in Canada, as the Bank of Canada is clearly focused on trying to accelerate growth in 2025. It is worth noting that our Canadian companies have growing earnings, and many are globally diversified in terms of revenue sources despite having a Canadian headquarters.

We did not initiate any new stock positions during the quarter.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

The end of 2024 marked another year of solid returns for global equity markets. The S&P 500 rose 25% on a total return basis, following a 26.3% increase in 2023. The last time this benchmark index generated two consecutive years of 20%+ returns was in 1998. Outside of the US, the Tokyo Stock Exchange generated a total return of just over 20%, while the Euro Stoxx 600 index delivered a total return of nearly 10%.

The leadership of US stocks was driven by a resilient economy and strong corporate earnings. The US consumer is in good shape, with the effective interest rate on mortgage debt at just 4% and the debt-to-disposable income ratio declining. The US economy is also being supported by trends such as reshoring, electrification, and artificial intelligence, as well as stimulative fiscal policies including the CHIPS Act, Inflation Reduction Act, and JOBS Act.

The European economy is not enjoying the same tailwinds as the US economy. High energy prices, ongoing struggles in the region’s largest economy (Germany), and the knock-down impact of the weakness in China are some of the key factors that weigh on Europe’s economy. We expect there will continue to be a wide divergence in the economic prospects between Europe and the United States for some time.

In terms of risks, we would highlight tariffs, immigrant deportation, and a resurgence in inflation. If enacted, Trump’s tariff proposals would push the effective tariff rate up roughly sevenfold to 21%, according to analysts at Fitch Ratings. Further, a crackdown on undocumented immigrants could create a significant shock to the U.S. labor market. Taken together, tariffs and immigrant deportation have the potential to reignite inflation.

At the end of the day, we believe cooler heads will prevail. Donald Trump has surrounded himself with a team of market-savvy individuals, and he prides himself on a strong economy and market. It seems unlikely that he would pursue an agenda that would jeopardize all of the good things that are currently happening in the economy and the stock market.

We have a cautiously optimistic view for the global economy overall. According to the OECD, there are more countries that are expected to experience accelerating economic growth than decelerating growth in 2025, and not a single major economy is expected to fall into recession.

In our Global strategy, we established the follow new positions during the quarter:

Booz Allen Hamilton Holding Corporation provides civil and military government services to the federal government. Booz Allen has historically outgrown its peers by 2% to 4% per year and has delivered mid-to- high single-digit organic revenue growth. The company also uses M&A to accelerate growth and to bring new capabilities to the firm. Booz Allen is a very cash generative business and the company has a strong track record of efficient capital allocation.

Eli Lilly is the largest pharmaceutical company in the United States, with leading positions addressing diabetes, obesity, and recently Alzheimer’s disease. We believe its innovative therapies have the potential to improve millions of lives while also driving significant value for investors in the years to come.

In the International strategy, we initiated three new positions:

BAE Systems is one of the world’s largest aerospace and defence companies, spanning all domains of the global security market, from air and space, to land, sea and cyber domains. The company’s backlog is at record levels, with many NATO countries now raising their spending commitments. The company has demonstrated a strong track record of growth, and it maintains a strong balance sheet supporting capital return to shareholders including acquisitions, dividends, and share buybacks.

Deutsche Boerse is a diversified exchange operator that offers a large suite of products and services. The company is responsible for well-known stock market index-based products (STOXX® and DAX®) as well as ESG and governance research for institutional investors and companies. Deutsche Boerse is a very cash generative business and has been a strong allocator of capital over the years.

Diploma is a decentralised distributor operating globally across three main end markets including Controls, Seals, and Life Sciences. Diploma distinguishes itself in the distributor sector by providing a higher degree of advice and customisation. This added value allows Diploma to command higher margins, as clients are typically willing to pay a premium for the specialized services and bespoke solutions.

Experian is one of the largest information services companies in the world, and well-positioned to benefit from major structural tailwinds associated with the collection and use of consumer and business data. The company’s operating model is highly cash generative, which has enabled it to simultaneously invest in its core business, make acquisitions, and return cash to shareholders via dividends and share buybacks.

Trane Technologies is involved in the design, manufacture, sale and service of heating, ventilation and air-conditioning (HVAC), and transport refrigeration technologies. Trane separated from its parent company, Ingersoll Rand, in 2020, and operates under the two major brands of Trane (HVAC) and Thermo King (Transport Refrigeration). We believe that the company will benefit from key industrial megatrends including AI-driven proliferation of data centers, US reshoring, and the need for greater energy efficiency.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

Decreasing economic growth, rising unemployment and receding inflation lead the Bank of Canada to cut interest rates twice during the fourth quarter of 2024, by a “jumbo” 50 bps each time, to bring the overnight rate to 3.25%, the lowest it has measured since October 2022. While the market largely believes further cuts will follow in 2025, it also believes we are closer to the end of the rate cut cycle than the beginning.

The Canadian yield curve decreased and flattened over the course of 2024, and we ended the year with rates in the 3-3.5% range across all tenors, and mostly upward sloping. A large downward move in the 2-year note was driven by five cuts to the Bank of Canada’s overnight lending rate, totaling 175 bps. This decrease was a powerful driver for price appreciation in bonds and fixed income securities in 2024. In the fourth quarter, the 2-year note remained relatively unchanged, while the 5-year and 10-year rates increased modestly.

Readers of previous updates will be familiar with another driver of fixed income returns, namely credit spreads. This is the additional yield provided by corporate bonds over government bonds. Spreads tightened throughout 2024, including in the fourth quarter. This tightening was driven by decreasing market-wide fears of financial stress, and therefore increasing comfort with corporate risk.

These two factors together – the move lower in rates, and the tightening of credit spreads – generated a positive year for investors, particularly for corporate bonds.

We believe the outlook for fixed income is generally positive, absent any unforeseen credit shocks. We believe we are in the later innings of an interest rate cut cycle by the Bank of Canada, however there is still some uncertainty related to the total number of cuts, the timing and the magnitude. We think that the yield curve will continue to normalize, and do not expect corporate spreads to widen materially.

In terms of the Cumberland Income Fund portfolio positioning, we anticipate maintaining, if not extending, the fund’s duration given our view on near-term interest rate movements. As rates decrease, our bond valuations should appreciate. In addition, as we believe corporate spreads are unlikely to widen to a significant degree, we will continue to maintain our exposures to corporate credit, as well as certain non-investment-grade credits that we identify as having attractive risk-return profiles.

Fourth Quarter 2024 Fixed Income Strategy Review

The fourth quarter of 2024 witnessed inflation levels that fell within the Bank of Canada’s target range, continuing interest rate cuts, political drama domestically, south of the border and abroad.

Decreasing economic growth, rising unemployment figures and the receding inflation trend, lead the Bank of Canada to cut interest rates twice during the quarter, by a ‘jumbo’ 50 bps each time, to bring the overnight rate to 3.25%, the lowest it has measured since October 2022. These cuts were expected by investors, and while the market largely believes further cuts will follow in 2025, it also believes we are closer to the end of the rate cut cycle than the beginning. But the year was a positive one for fixed income investments, and decidedly so for credit.

Fourth Quarter 2024 Global Equity and International Review

2024 marked another year of solid returns for global equity markets. The S&P 500 rose 25% on a total return basis, following a 26.3% increase in 2023. The last time this benchmark index generated 2 consecutive years of 20%+ returns was in 1998. The strong returns in the U.S. were driven by a handful of large companies known as the Magnificent Seven (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla). On a collective basis, these 7 companies accounted for over half of the return for the S&P 500. Excluding the Magnificent Seven, the remainder of the index returned approximately 10% in 2024. Outside of the U.S., the Tokyo Stock Exchange generated a total return of just over 20%, while the Euro Stoxx 600 index delivered a total return of nearly 10%. The key factors that drove global equity markets higher during 2024 included strong corporate earnings, interest rate cuts from central banks around the world, and significantly reduced fears about a global economic recession.

Fourth Quarter 2024 North American Equity Strategy

The S&P500 and TSX moved higher heading into year end with the help of another decent earnings print for the third quarter and a decisive victory for Donald Trump and the Republican Party, only to be somewhat spoiled by the Federal Reserve’s more cautious tone on further interest rate cuts in 2025. During the fourth quarter of 2024, the S&P500 total return was +2.41% in U.S. dollars. Adjusting for currency, the S&P500 returned +9.10% in Canadian dollars, as the Canadian dollar depreciated about 4.42 cents, closing the quarter at $0.6952. The TSX total return was +3.76% in the fourth quarter.

Q3 2024 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Third Quarter of 2024. You can download the full reports via the links shown below.

KEY OBSERVATIONS

Yet another good quarter for both the S&P500 and TSX has come to a close, with the S&P 500 up +5.89% in U.S. dollars or +4.59% in Canadian dollars, and the TSX total return up +10.54%.

The much-anticipated monetary policy easing cycle started earlier this month when the Federal Open Market Committee (FOMC) cut interest rates by 50 basis points as Chairman Powell signaled that he was shifting from an inflation hawk to an employment dove. That is, he now cares as much about maintaining employment as he does about reducing inflation.

According to comments from the Fed, we have inflation moving sustainably toward 2%, an unemployment level that, by historical standards, would still be considered low, and a stable real GDP growth outlook of about 2%.

The fact that the Fed has so far successfully engineered bringing inflation down without causing a credit crunch would seem to continue to support the soft-landing outcome that we’ve been a proponent of for some time. Indeed, our own checklist of economic indicators, including the latest GDPNow forecast for Q3, the payrolls data, the current level of credit spreads, and the performance of regional bank stocks, does not suggest any economic stress is present at this time.

In terms of corporate earnings, the S&P500’s third quarter earnings growth of 11.9% bested the estimated earnings growth of 8.9%, according to FactSet Earnings Insight. Forward earnings estimates have been a pretty good proxy for actual trailing estimates, and they are currently hitting all-time highs with an earnings growth outlook for 2025 and 2026 up 15.1% and 12.4% respectively.

Putting this all together, we think a robust earnings outlook, solid economic growth and lower interest rates is a positive backdrop for further share price appreciation. That said, we could see some near-term volatility leading into the U.S. election. However, beyond the election, if history repeats itself, market performance usually improves, and within the framework we just described, we remain constructive on the market outlook from here.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

Our overall equity exposure increased 1% to 97% and cash decreased from 4% to 3%. Our U.S. equity exposure is 55% while our Canadian equity exposure is currently 42%. For portfolios invested in our North American plus International Equity strategy, the US and Canada weights will be proportionately less than this given the current 20% allocation to international companies.

Over the past 12 months, we continued to shift our allocation in favour of US equities (+13%) over Canadian equities (-10%). US earnings growth continues to outpace Canadian earnings growth, and this is estimated to continue in 2025 and 2026. While we are not calling for a recession in Canada, we do believe the risk of one is higher, with economic growth slower and unemployment higher here than in the US. That said, so far, we have been seeing interest rates decline faster here in Canada than in the US, which may mitigate that risk.

We added three new positions during the quarter:

Nvidia Corporation needs no introduction, being the leader in the production of graphics processing units (GPUs) that power Artificial Intelligence (AI). We took advantage of the macro-pullback in the market this summer to initiate a position at a now-reasonable valuation as earnings continue to grow rapidly.

Eli Lilly is a healthcare company that has taken the place of Novo Nordisk in our portfolio, in which we had over a 50% gain. While both Novo and Lilly are strong players in the growing diabetes and obesity market, several factors helped make a compelling case for the switch.

Stantec is a global leader in engineering consultancy with a focus on water and infrastructure. With a strong 5-year compound annual EBITDA growth rate of over 20% and record current backlog, Stantec is positioned to continue to deliver strong operating results.

A detailed review of these companies can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

Global equity markets continued their upward climb this quarter. The S&P was up 20.8% over the first three quarters of the year, the strongest such showing since 1997. Key factors that drove markets higher included strong corporate earnings, interest rate cuts around the world, and reduced fears about a global economic recession.

Japan was an exception, with the Tokyo Stock Price Index falling -5.8%. This was partially driven by concern that recent strength in the Yen will weaken Japan’s exporters. However, we do not believe that this will derail the multi-year uptrend in Japan’s equity markets.

In the latest Bank of America Global Fund Manager Survey, 79% said that an economic soft landing is now the most likely outcome. We share this view for a number of reasons. Among them, strength in the U.S. and global economies, stock market gains that are broadening out beyond the big tech names, and an absence of recessionary signals from the bond market.

We believe conditions look steady across most of the major economic regions with China as the notable exception. During his most recent press conference, Fed Chairman Jerome Powell said that the U.S. economy is growing at a solid pace and that inflation is coming down. In Europe, the economy is growing modestly and is expected to improve significantly in 2025. Meanwhile, China’s economy continues to struggle in the face of sluggish GDP performance, sagging consumer confidence, and a collapse in property prices. The country recently announced a series of stimulus measures to lower borrowing costs, inject funds into the economy, and ease the mortgage repayment burden for households.

The lead-up to U.S. presidential elections has historically been associated with elevated volatility in the stock market. While we were spared from the market weakness that typically occurs in September, we’ll be on guard for potential volatility during October. Furthermore, we will be ready to act and take advantage of any opportunities that are presented to us.

In our Global strategy, we established the follow new positions during the quarter:

Amphenol makes connectors and sensors that are used across a wide range of applications. The company’s products are positioned to benefit from secular growth themes including increasing electrification in automobiles, Artificial Intelligence through data centre growth, and the Internet of Things.

Nvidia Corporation needs no introduction as described above, being the leader in the production of graphics processing units (GPUs) that power Artificial Intelligence (AI). We took advantage of the macro-pullback in the market this summer to initiate a position at a now-reasonable valuation as earnings continue to grow rapidly.

In the International strategy, we initiated three new positions:

3i Group is a private equity company with over 70% of its net asset value accounted for by a company called Action, which is Europe’s fastest-growing non-food discounter. Management is currently considering expanding its store base within and beyond Europe, and we believe there is a long runway of growth ahead for Action.

Disco Corp is the dominant semiconductor dicer and grinder equipment provider with market share of 85% and 65%, respectively. Disco is a beneficiary of more than $10 billion in additional semi-conductor backend processes announced by Taiwan Semiconductor and Intel in Malaysia and New Mexico.

Recruit Holdings is a dominant Human Resources Technology company. Recruit is pursuing a long-term strategy to transform its technology from a pay-per-click model to a pay-per-hire model that could expand its total addressable market tenfold to $327 billion and increase its take rate from less than 1% to a significantly higher level.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

On June 5th, the Bank of Canada cut the overnight interest rate by 25 basis points. This represented the first decline in the overnight rate since the beginning of the hiking cycle in March 2022, and the first cut in the overnight rate since March 2020. In the most recent quarter, the Bank of Canada continued to ease interest rates, cutting 25 basis points again at both its July and September meetings.

The Bank of Canada broadcast these moves ahead of time, and investors largely anticipated them. However, the market continues to believe that rates are heading even lower. The yield curve shifted downwards as a result of these moves over this period. A familiar theme in our recent commentaries is the reminder that when interest rates decline, the prices of fixed income instruments and securities increase. As a result, the third quarter was again a positive period for returns to fixed income investors.

Given the two rate cuts by the Bank of Canada and inflationary data suggesting price pressures are waning, the yield curve moved in a downward trajectory. In addition, the curve flattened quite a bit. However, as the overnight rate remains much higher than both inflation and the two-year interest rate, it seems likely that there may be a few rounds of interest cuts by the Bank of Canada still to come.

We continue to believe the outlook for fixed income is positive for the remainder of the year and likely into early 2025, absent unforeseen shocks. We believe we are in the middle of a rate cut cycle by the Bank of Canada, although the magnitude of the cuts in totality and the length of time the bank will take to complete this phase is still unclear.

In terms of the Cumberland Income Fund investment portfolio positioning, we anticipate further extension in the fund’s duration given our view on near-term interest rate movements. If our outlook is correct, as rates decrease, our securities’ valuation will react positively.

This translates into modest increases or fine-tuning of holdings in the fund’s weights for federal, provincial, and/or investment-grade corporate bonds over the coming quarters. We will maintain exposure to non-investment-grade credits that we identify as having attractive risk-return profiles. Indeed, with corporate spreads remaining relatively steady and below long-term averages, this does not suggest widespread anticipation of recession or of financial stress across the credit spectrum.

Thoughts on the Market

At the beginning of August, global equity markets experienced a sharp sell-off. In one day, the Nikkei 225 sold off by more than 12% and the S&P 500 fell by more than 3%. There were a number of different factors that led to the sell-off including concerns about slowing economic growth, crowded positioning in Technology stocks, and a rapid unwind of the Yen carry trade. It felt like a perfect storm as all of these factors came to a head at the same time.

Although the market began selling off in late July, it accelerated in early August (on a Friday) on the back of a report from the U.S. Labour Department. The report showed that U.S. Nonfarm payrolls grew by just 114,000 in July. This was significantly below the consensus estimate of 185,000. The same report showed that the unemployment rate edged higher to 4.3%, which marked its highest level since October 2021. This report triggered fears about a recession and led the bond market to price in more interest rate cuts for the U.S. than had been previously forecasted. This shift combined with a recent interest rate hike from Japan’s Central Bank led to the unwind of the Yen carry trade. For many years, global investors have been borrowing money in costless Yen and using the proceeds to buy higher-yielding U.S. bonds as well as U.S. equities including the Magnificent Seven Technology stocks. When the U.S. jobs report was released, it sparked an unwind of the Yen carry trade, which magnified losses in the S&P 500 index and the Nasdaq. It certainly didn’t help that over the weekend Warren Buffet’s company (Berkshire Hathaway) announced that it had cut its position in Apple by nearly half. All of this led to a big sell-off across global markets the Monday following the U.S. jobs report. In a span of less than 3 weeks, the S&P 500 experienced a decline of 8.5%. However, the market drawdown was very short lived. In fact, it took just over 2 weeks for the S&P 500 to rally back to within 1% of its all-time high.

While it’s not easy to precisely explain why the market rebounded so quickly, there are several reasons why we remain cautiously optimistic on global equities. These reasons include recent economic data points that refute the notion of a recession, a broadening out of the stock market, and a clear change in the tone of the U.S. Federal Reserve Chairman.

In terms of economic data, retail sales for July were much stronger than expected and the latest report for U.S. jobless claims showed a decline. In addition, some of the more discretionary areas of the economy remain steady including restaurant bookings, air travel, and hotel occupancy rates. In addition, U.S. gross domestic product increased at a 3.0% annualized rate last quarter according to the Commerce Department’s Bureau of Economic Analysis. This was an upward revision from the 2.8% rate reported last month. Taken together, these data points do not suggest that the U.S. economy is on the verge on a recession.

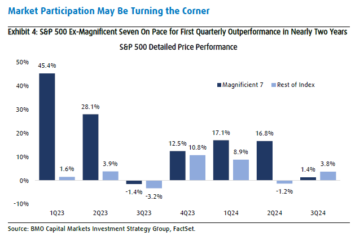

In addition to positive economic data, there has also been a broadening out in the stock market during the third quarter. After a long period of market dominance, shares of the Magnificent Seven have trailed the shares of the other 493 companies in the S&P 500. This means that the Magnificent Seven are on track to underperform stocks in the rest of the index for the first quarter in nearly two years as illustrated in the chart below.

We believe that the broadening out of the stock market is important and that it increases the likelihood of a sustained increase in the stock market going forward.

In addition to positive economic data points and a broadening out of the stock market, there has also been a significant change in the tone from the U.S. Federal Reserve Chairman with regards to interest rates. During the recently held annual retreat in Jackson Hole, Jerome Powell announced that “the time has come for policy to adjust”. He went on to say that “inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic”. This is a very significant change in the tone from Mr. Powell and it sets the stage for interest rate cuts with the bond market currently pricing in four rate cuts in the U.S. by the end of 2024.

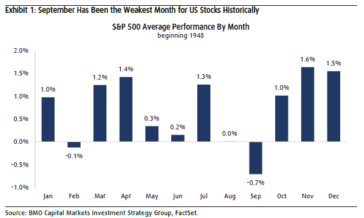

For all of these reasons we remain cautiously optimistic. But there is one caveat, given that we are entering a period of seasonal weakness as seen in the chart below.

Since 1948, September has been the weakest month of the year in terms of performance for the S&P 500 with an average loss of 0.7%. This is significantly lower than February, which has historically been the second worst month of the year with an average loss of 0.1%. In addition to seasonal weakness, the market will also have to deal with the uncertainty related to the U.S. Presidential Election. Given this backdrop, we may experience elevated volatility in the weeks ahead and we plan to use this volatility to take advantage of opportunities that are presented to us.

Phil D’Iorio

Q2 2024 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Second Quarter of 2024. You can download the full reports via the links shown below.

KEY OBSERVATIONS

Market performance for the second quarter of 2024 was mixed as the S&P 500 experienced a 5.35% gain in Canadian dollar terms, while the TSX slipped -0.53%.

Inflation data recently came in much lower than expected, inching closer to the Federal Open Market Committee (FOMC) target of 2%. However, despite mounting disinflationary data, the Fed’s projection for the Fed Funds interest rate for year end 2024 went from 4.6% to 5.1%, as compared to 5.25%-5.5% today, implying one rate cut this year versus three projected in March.

The bond market has interpreted the softer inflationary data favourably, as 10-Year Treasury yields have fallen from about 4.6% at the end of May to the current level around 4.4%. Lower Treasury yields support the idea that inflationary conditions are improving, even if more slowly than anticipated by the Fed earlier in the year.

While a rate cut might incite further stock market gains in the near term, it could also lead to excessive valuation. We prefer to see market gains supported by stronger earnings growth. The good news is that positive earnings surprises during Q1 2024 and higher forward guidance have led to upward revisions to 2024, 2025 and 2026 earnings expectations.

Despite a generally positive outlook, market pullbacks of 5%-10% in the third quarter of U.S. presidential election years have been the historical norm for the past 75 years. If history repeats itself, we can’t rule out some market turbulence in the July through September period.

Having said that, historical data show that secular bull markets last 16 years on average, and cyclical bull markets within those larger bull runs last about 30 months and produce a gain of 86%. The S&P 500 is now up about 53% from its October 2022 low roughly 20 months ago. We believe we are likely only part way through a cyclical bull market, suggesting that any pullback will be temporary.

Putting everything together, we see an economy that can sustain moderate economic growth with lower inflation, which should eventually allow for market-friendly monetary policy. Furthermore, stronger earnings growth should support stock valuations.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

Our overall equity exposure remains high, having increased by 1% to 96%, with cash decreasing to 4%. Our U.S. equity exposure increased from 52% to 56% while our Canadian exposure decreased from 43% to 40%. For portfolios invested in our North American plus International Equity strategy, the US and Canada weights will be proportionately less than this given the current 20% allocation to international companies.

During the quarter, we continued to shift our allocation in favour of US equities (+4%) over Canadian equities (-3%). US earnings growth continues to outpace Canadian earnings growth where recent F12M earnings for the TSX turned negative. This was largely driven by energy resource sector downgrades, which is a sector in which we maintain minimal exposure. Our Canadian companies have growing earnings, and many are globally diversified in terms of revenue sources despite their Canadian headquarters.

We added one new investment during the quarter:

Cadence Designs Systems is often referred to as one of the most important companies you have never heard of. It is a leader in Electronic Design Automation (EDA) software, a critical tool that turns complex chip designs into manufacturing blueprints. The EDA market has a near-duopoly structure dominated by Cadence and one other player ensuring stability and pricing power. This specialized software commands high returns on invested capital and less cyclicality than the semiconductor industry overall. Cadence is poised to benefit from the growing trend of companies designing their own chips.

A detailed review of this company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

After delivering robust returns during the first quarter, global equity markets continued their upward climb during the second quarter of 2024. Some of the key factors driving the returns included strong corporate earnings, reduced fears about a global economic recession, and enthusiasm over artificial intelligence that powered massive gains in Technology stocks.

In terms of the economy, Macroeconomic Surprise indexes turned negative during the month of June for major economies around the world. This phenomenon was particularly pronounced in the US. In our view, what’s really happening is that the economy is slowing, not shrinking. A slowdown in the economy strengthens the case for interest rate cuts and that’s a good thing as it would help stimulate the economy.

Technology stocks have continued to dominate. On a year-to-date basis, Nvidia alone has contributed 30% of the gain generated by the S&P 500. Microsoft, Amazon, Alphabet, Meta, and Apple have collectively generated another 30%. When you add it all up, six companies have generated more than 60% of the upside in the S&P 500 for the first six months of 2024.

We continue to focus on companies with strong fundamentals, competitive advantages, and exposure to secular growth themes. Some of these themes include artificial intelligence, electrification of global infrastructure, decarbonization of the global economy, and healthcare innovation. We would argue that many of the large Technology stocks deserve to trade at above-average valuations given their attractive growth profiles, their robust free cash flow generation, and their pristine balance sheets.

Our current outlook is cautiously optimistic. The global economy remains resilient and inflation has fallen enough to set the stage for interest rate cuts.

During the second quarter, we established several new positions in our Global and International portfolios. In our Global strategy, we established new positions in ASML, Broadcom, and Wolters Kluwer. In the International strategy, we initiated new positions in Arch Capital and Tokyo Electron.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

Following a challenging Q1 for interest rates, Q2 saw fixed income investments perform more positively. The tone of the interest rate cycle changed in June. First, the Bank of Canada cut rates by 25 bps on June 5th, to bring the overnight rate to 4.75%. This was the first cut by the Bank since the outset of the pandemic. The European Central Bank followed suit the next day, cutting rates by 25 bps as well, to bring its headline rate to 3.75% (its first rate cut since early 2016).

Very short-term interest rates (from 3 month to 2 years) are heavily influenced by the Bank of Canada overnight lending rate trend, and by the market’s expectations of the timing of any changes to that rate. These all gapped downwards on with the June 5th rate cut, but have not changed to a significant degree since.

We believe we are at the beginning of a rate cut cycle by the Bank of Canada, although how deep the cuts and the length of time the bank will take to complete the phase is unclear. Current data suggest that the market is expecting two or three more cuts.

Looking at the Canadian Yield Curve, it flattened a little in Q2, with the short end rates declining, and the longer-dated ones remaining relatively static. The curve slope remains inverted, with short term rates higher than long term rates, which is often cited as an indication the economy may be headed into a recession in the near term.

Another driver of fixed income returns are credit spreads, or the additional yield provided by corporate bonds over that of federal government bonds. Credit spreads narrowed very modestly over Q2, and remain well below year-end 2023 levels, which is positive for returns (as spreads narrow, it means yields decrease, and as yields decrease, bond prices increase).

In terms of the Cumberland Income Fund investment portfolio, as we anticipate interest rate cuts in the near term, it makes sense for us to continue to extend the fund’s duration, which will positively impact valuations as rates fall. We also anticipate modest increases in our exposure to federal, provincial, and/or investment-grade corporate bonds over the coming quarters.

We expect that the remainder of calendar 2024 will provide a positive outcome for fixed income investors.