Big Tech Meets Big Government

As companies mature, they increasingly look to M&A to find new markets for growth. The big cap technology stocks¹ (“Big Tech”) have used M&A to (1) develop new markets and, (2), to ward off new entrants competing for market share. Regulators have been increasingly hawkish towards approving these mergers which may slow growth in the future. The relative outperformance of small and mid cap technology companies² (“SMID Tech”) in 2022, despite being more expensive at the beginning of the year, could be a signal that the market is pricing-in a more difficult growth environment for Big Tech in the future.

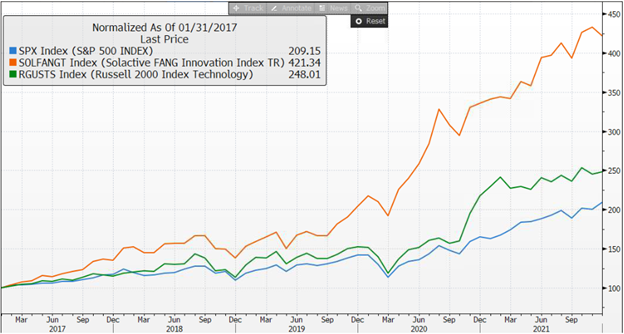

For the five years prior to 2022, the largest technology stocks (“Big Tech”) was the best place to be for US investors, with +34% compound annual return over the period. Small and medium sized technology companies (“SMID Tech”) performed well relative to the S&P 500 (+20% vs. +16%) but Big Tech outperformed them both.

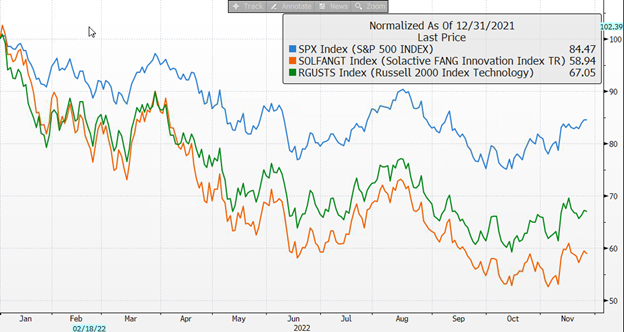

That strategy broke down in 2022 as the S&P 500 outperformed the technology sector and SMID Tech outperformed Big Tech.

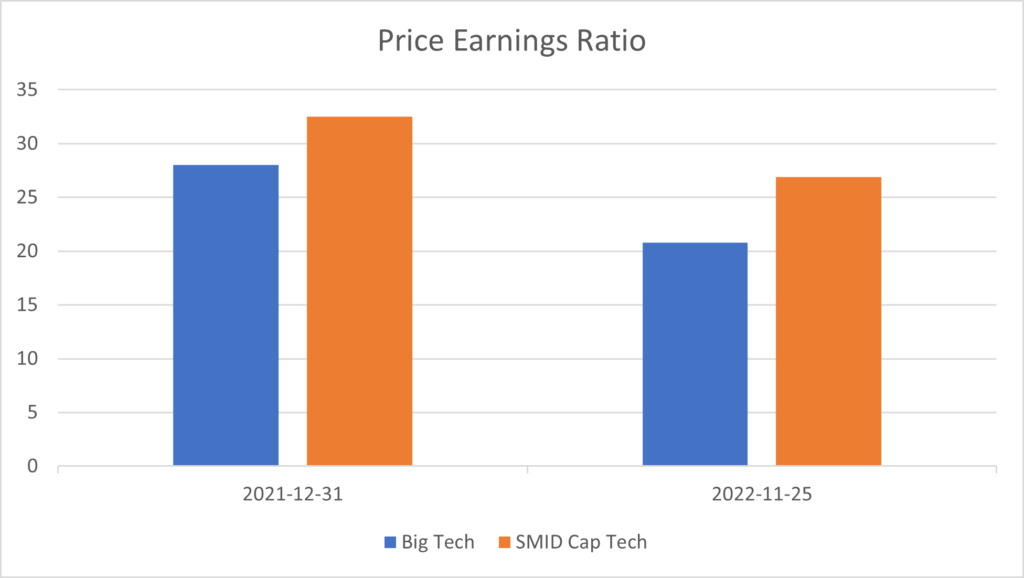

The shift from growth to value (or expensive stocks to less expensive stocks) helps to explain the lagging performance in technology, but it doesn’t explain why smaller technology companies outperformed Big Tech in 2022. On a price-to-earnings basis, SMID tech was more expensive at the beginning of the year and remains so today. Being more expensive, SMID Tech was more vulnerable to the markets shift to value over the course of the year. Yet, on a year-to-date basis, Big Tech stocks are down 41% while SMID Tech stocks are only down 33%.

Big Tech’s price-earnings multiple has contracted 26% while small cap technology’s multiple has only contracted 17%. Generally, Investors are willing to pay a higher price-to-earnings multiple if earnings are growing. The obvious inference is that investors are becoming concerned about Big Tech’s ability to grow earnings in the future.

One source of concern could be the increasing attention big technology is garnering from competition regulators. Over the last decade, Big Tech used acquisitions to establish new areas of growth and to entrench their competitive position in new markets. The usual competitive advantage for these large technology companies is a network effect – where a digital platform becomes more powerful as it gains more users, content, and developers.

In past years, regulators were less likely to interfere with network reinforcing acquisitions. One prevalent example was in 2012, when the Federal Trade Commission (the “FTC”) cleared Meta’s[3] acquisition of Instagram without objection. Meta had the dominant social media platform on the web, but Instagram was gaining momentum with mobile users. The acquisition crystalized Meta’s virtual monopoly on the web and with mobile devices. The FTC didn’t think much of the acquisition at the time. Instagram was just a small company with 13 employees.

Meta recently announced an acquisition of Within Inc., looking to entrench its early lead in virtual reality. Within Inc. is the application developer of Supernatural, the dominant dedicated fitness app for Meta’s virtual reality platform, Quest. Meta doesn’t currently compete in the dedicated fitness category. However, the FTC is challenging the acquisition on the basis that Meta has the size, resources, and capability to potentially compete in the dedicated fitness virtual reality app market.[4] If the potential competition challenge is successful, it could prevent many big technology companies – all of which have size, resources, and capability to potentially compete in any market – from entering newer markets through acquisition.

Regulators are also cracking down on “strategic” acquisitions intended to protect market share. Last year, Visa walked away from acquiring Plaid, who is building a competing payment network, to avoid a protracted legal battle with the Department of Justice.[5] Similarly, Adobe just announced the acquisition of Figma for 50x its annual recurring revenue – a price only a cornered incumbent would pay.[6] The DOJ is preparing to launch an investigation and it would not be surprising if the Adobe-Figma deal meets the same fate of the Visa-Plaid deal.

Many of the other Big Tech companies have an outstanding file with regulators to challenge an outstanding merger or for a potential breach of antitrust laws. For example, Microsoft is being challenged by the FTC and the UK’s CMA over its acquisition of Activision.[7] Alphabet is being sued by the Department of Justice for “unlawfully maintaining monopolies through anticompetitive and exclusionary practices in the search and search advertising markets.”[8] While not all these challenges will be successful, they slow down the M&A process and often result in concessions to the regulators.[9]

It’s no wonder that investors have preferred SMID Tech over the last year to avoid the uncertainty of regulator and political interference. SMID Tech companies often have robust organic growth that can drive stock price appreciation, without the need for M&A. At Cumberland Private Wealth Management, we still believe some of the larger technology companies are good investments, but we are careful to choose only those that have less growth priced in and those that continue to have organic growth opportunities available to them.

Never Look Santa’s Gift (Horse) In the Mouth

Every gathering, regardless of whether it is with friends or strangers, the question always arises “Is now a good time to invest in the market?”. Market timing is always difficult and has nuance depending on the time horizon being considered. If you have decades until retirement, the answer should always be yes, near fully invested. However, what people are really asking is, “If I buy today, will I be disappointed within the next couple of months?”. There is never a perfect answer, but we can highlight certain times when, on average, the probabilities are more in your favor for purchasing a long-term investment.

Here are four points to consider – Momentum, Seasonality, Sentiment, and Inflation.

- Since 1980, there have been 19 times where the price of over 45% of stocks made a new 30-day high together. Of the 19 times that this happened, 73.7% of the time you have a positive return exceeding 3% over the next two months (the median return was 7%). This indicator just occurred on the 10th of November 2022 (per Ned Davis Research).

- Seasonality has a real effect on when returns on average occur during a calendar year. The typical strongest point in time begins in October and extends all the way into the end of the year, sometimes into earlier next year. This is the well-known Santa Claus rally.

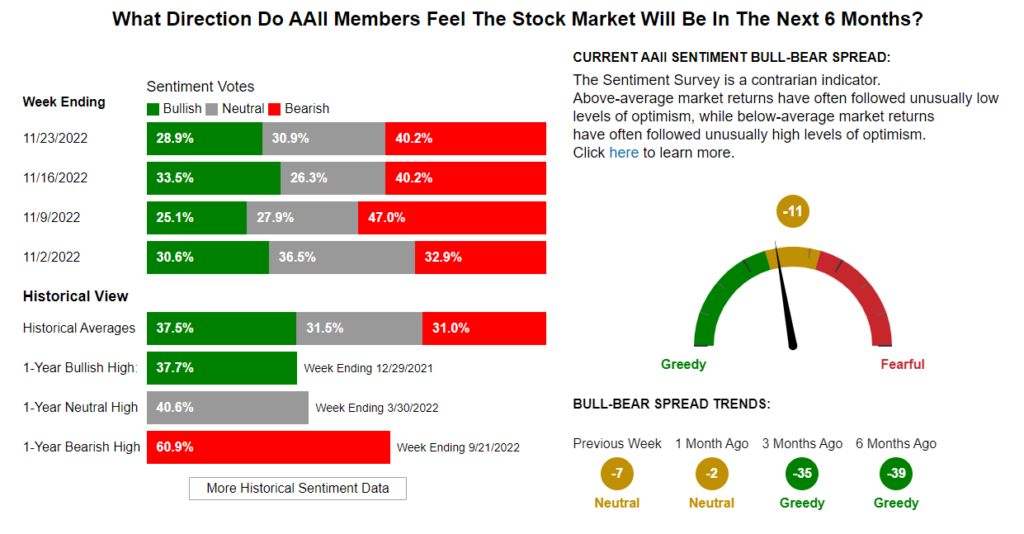

- Sentiment is currently more negative than normal. The AAII Bull vs Bear Sentiment Survey has a larger than normal tilt towards fearfulness. In addition, the futures market commitment of trader’s report has its lowest reading since 2016 (The report analyzes how negatively tilted money managers are positioned in futures markets). Remember the old adage, buy when there is fear.

- When inflation’s rate of change expands upwards, the price [or valuation multiple] investors pay for a business falls. Fear increases around the potential damage inflation will wreak on business profits. Conversely, when inflation’s rate of change peaks or begins to marginally decline, investors collectively heave a sigh of relief and become more willing to pay higher prices for businesses that have been previously beaten up.

To summarize: When there is bearish sentiment in the market, when inflation’s rate of change has potentially peaked, when we are in the seasonally strongest part of the year, and with many stocks having made a new 30-day high together, we just might get to enjoy some positivity over the coming months.

So, the next time you hear someone ask, “When is best time to buy the market?”. Tell them it always is, but typically, it works a little bit better a few months before Christmas.

Second Quarter 2022 North American Equity Strategy

The S&P500 officially entered a bear market on June 13th after it fell -21.8% from its January 3rd high. Any decline over -20% is considered bear market territory. For the second quarter ending June 30th, the S&P500 total return was -16.1% in US dollars. Adjusting for currency, the S&P500 returned -13.5% in Canadian dollars, as the Canadian dollar depreciated about 2.3 cents, closing the quarter at US$0.7768. The TSX total return was -13.2% in the second quarter. The main cause of the decline was probably the May CPI inflation data pressuring the Federal Reserve (Fed) to increase the federal funds rate by 75 basis points in June shortly after the inflation report.

Bottom or a Bounce?

I find it hard to sort out what is really going on in the market from all the noise unless I systematically work through it. There’s the war in the Ukraine, gasoline prices over $5.00 per gallon, the Fed being behind on the yield curve and the economy is probably already in recession. When I step back, the news is pretty negative and forecasters seem to be competing to report the worst possible outcome. The S&P 500 is down 20.6% in the first half, the worst six months since 1970, while the NASDAQ, home to many of the technology companies, is off 29.5%, the worst first half on record. Furthermore, stock market sentiment is worse than what we saw at the COVID bottom in 2020 or the bottom of the Great Financial Crisis in 2009. You can usually take some comfort from this type of peak sentiment and what may be the most anticipated recession on record. For a bounce, you probably don’t need things to reverse. They just don’t have to be as bad as expected. But, for a bottom, there has to be a change for the better and when I look at some of the longer term trends, I don’t see it. But let me take you through both scenarios. And, the best way to do this is to focus on a couple of time-tested principles of liquidity and regressions to the mean.

Liquidity

We’ve always contended that liquidity will trump economic statistics when it comes to predicting the stock market. Recessions end after stock market bottoms once the Central Banks start to loosen monetary policy. Unfortunately, the inverse is also true. The Federal Reserve has embarked on a tightening cycle, which is being reflected in the market’s averages even though the economic statistics and earnings estimates are still hanging in there. If you want to understand the market, I’m reminded of an old President Clinton campaign slogan, ‘It’s the economy, stupid’. It was a reminder to his entire campaign staff that there was a singular issue to focus on. For the current market, I’d revise the message to ‘ It’s valuation stupid’. Companies, in many cases are reporting good earnings and analysts’

estimates are still rising, but the stocks are going down. Investors are frustrated with the declines and believe it’s an over reaction. But, I can tell you, having lived through the ‘70’s, you might be surprised at how far price earnings valuations can fall if liquidity doesn’t improve.

Obviously, the key to this issue is held by the Federal Reserve and other Central Banks. So, it’s worth understanding how they operate and then I’ll give you my best guess on how this all plays out. The Fed has two methods of implementing monetary policy. The first is through stated intentions or moral suasion. This is done through ‘forward guidance’ when it indicates future policy moves. It is intended to get a reaction from the financial markets and to have the markets do some of its work. It is pretty apparent in this cycle as 10 Year Treasury bond yields have moved up from last year’s lows of about one half of one percent to a recent high of almost 3.5%. It’s caused mortgage rates to escalate and is shutting down new home acquisitions. Yet, the Fed’s actual implementation of tighter monetary policy has only just begun. Rates were raised a mere 25bps in March, another 50bps in May and finally 75bps in June. That gets us to 1.5% – 1.75%, not a particularly high bar. But Chairman Powell’s rhetoric is pretty hawkish and his hero is now previous Fed Chair Volcker who took government interest rates to 18% to cap

the inflation cycle of the ‘70‘s. Forecasters now expect him to be more aggressive and anticipate two more bumps in the Fed funds rate of 75pbs in each of July and September, which will get the rate between 3.0%-3.25%. Whether this is actually being more hawkish or just shorting the cycle and getting to the same objective sooner remains to be seen.

In my opinion, Powell is no Volcker and has some other unstated objectives in mind. He has pivoted from stated policy several times in the past. Remember, his original goal was focused on employment and being willing to accept higher than normal inflation for a period of time to balance the extended period of low inflation. Now, his focus is on rising prices and bringing them under control at the expense of employment, and he acknowledges the possibility of a hard economic landing. Not what the market wants to hear. In my opinion, he has probably been intentionally aggressive to give himself some maneuvering room. Hike more now to cut expectations later. I think inflation is on the verge of moderating, but secular trends will leave it higher than acceptable. I’ll come to these shortly. Nonetheless, it will leave the Fed compromised. Do they push further to bring inflation down to target (Volcker)? They can only affect demand and employment, not supply. Or, do they declare a victory at higher than normal inflation levels to save jobs? My bet is that Powell pivots and backs away from aggressive tightening.

As I said earlier, things don’t have to get better to cause a market rally. They only need to be not as bad as expected. Inflation coming off the peak and Powell taking his foot off the monetary breaks would constitute the conditions for a bounce. Furthermore, this would not be inconsistent with other Fed tightening cycles where the central bankers backed off to preserve growth and employment. My challenging the government’s resolve already has a real case example. The European Central Bank (ECB), even before they have started to raise interest rates, has had to relent on Quantitative Tightening by providing a new, yet to be unveiled, bond buying program to prevent government bond spreads from widening and impairing the borrowing ability of certain countries such as Italy. The ECB feels that it needs to continue to intervene.

Furthermore, I think there are some things that the Fed isn’t telling us. First, it will require significantly higher interest rates to cause the kind of demand destruction that is required to bring demand and inflation down to their stated goal. Second, I think they are willing to suffer stagflation to save jobs and avoid a serious economic downturn and bear market in an over leveraged economy. Financial Repression could be the undeclared goal to deal with the bloated size of government debt to GDP. This has been practiced in the past, most recently after WWII, to reduce the debt burden by holding interest rates below inflation to create a high nominal economic growth rate, but one that is low after accounting for inflation. When revenues and wages go up they are taxed, but bonds, after inflation, get devalued. In the 70’s nominal GDP kept climbing from the economic peak of the cycle in November, 1973, to its trough in March, 1975. But in real terms from peak to trough GPD dropped by 3.1%.

Regressions to the Mean

Most of the market’s decline can be attributed to the rise of interest rates, which causes an increase in risk premiums and higher discount rates. That’s analyst-talk for lower valuations. Price earnings ratios, a measure of valuation, have collapsed for the S&P 500 from about 22.5X at the beginning of the year to roughly 16X. That’s a 27% decline, and it is even worse for some of the big cap growth companies such as Amazon and Facebook.

This isn’t unusual for a market correction. What is generally required for a Bear Market is a recession and earnings deterioration. So far, you’re seeing softening economic data but not a collapse and no declines in earnings estimates. If a downturn isn’t coming, this market is a buy as a recession is now being factored in.

My problem is that I see a number of secular issues and trends that are regressing back to the mean, which I find troubling and will result in an extended headwind for the market. Let me take you through them.

1) Profit margins are still near all time highs. They reached current levels in the 1960’s and then were eroded from roughly 12% to 7% by the 1980’s as companies couldn’t pass through cost increases.

2) Risk. Low interest rates have required investors to take on more risk to achieve the same return objective. Investors have moved out of their safe GIC’s into longer dated bonds. Or they have moved from government bonds to corporates and even out of fixed income to equities. But to get a reasonable rate of return one has had to take on more risk. And some of this is benign. Even if you stayed with bonds, which did well in a declining interest rate environment you might not have appreciated that as the coupon rate approaches zero, the volatility risk gets transferred to the principal amount of the bond. The first quarter of this year saw the worst bond market on record even though interest rates went up only modestly. As investors come to grips with this new volatility and experience some negative results, they may be inclined to step back a little and look for safer returns and move away from equities.

3) Credit Spreads. One of the hallmarks of a Bear Market and distressed conditions in the financial markets is a widening in the interest rate spreads between government issues and those issued by corporations. These spreads have started to widen, but have not reached levels seen in past recessions. If the economy slides, this will be another negative factor for the market.

4) Earnings. As I said, earnings forecasts are still close to their highs and don’t reflect the worsening economic conditions. Consequently, valuations may be understating how much lower this market could go. Second quarter earnings releases could give us some insights as managements will get a chance to provide earning and business guidance for the balance of the year. But, I would be surprised if the current estimates hold up.

5) Liquidity. From 2009 until recently, we have seen an unprecedented amount of liquidity pumped into the system. Initially, it did not make its way to Main Street, but instead flooded into the financial markets resulting in an extended bull market in stocks and bonds. Recently, that excess funding has found its way into residential real estate. The Fed is now embarking on Quantitative Tightening that will remove $1.14 trillion dollars from the system over the next twelve months. We’ll see if they actually follow through, but if liquidity is key to a bull market, this is not a good sign and in my opinion will effect Wall Street more than Main Street not unlike what we saw in the 70’s.

Secular Inflation

There are other trends that I see reversing that are more specific to inflation. If I’m right on these, they support the case of stagflation.

1) Wages. Labour’s share of GDP has historically averaged about 66% and it has dropped to around 59% and they want it back. Demographics say we have run out of workers with almost two job openings for every unemployed person. With baby boomers retiring, we face a continued shortage of workers.

2) Housing. Over the last couple of years, the price of a median home has appreciated roughly 33%. With higher mortgage rates, home ownership is out of reach for many and they have turned to the rental market, which has seen the rent for a one bedroom apartment rise by 20%. This is getting fed back into homeowner’s equivalent rent which is about 42% of the Consumer’s Price Index (CPI).

3) Energy. The price of oil has been aggravated by the Russian- Ukraine War but is hardly the underlying cause. It is due to a colossal miscalculation of governments and environmentalists in transitioning from carbon-based fuels to renewables.

4) Globalization. China has provided the antidote of cheap labour and cheap goods that has offset loose monetary policy for years. Now trade wars and unreliable foreign sourcing and security issues are causing manufacturers to re-examine their supply chains. It’s resulting in manufacturing moving out of China and in some cases returning to North America while others are adjusting their inventory levels from just-in-time to just-in-case. Either way costs are going up.

5) Regulation. I haven’t mentioned this one before but regulation, besides monetary and fiscal policy, is one of the ways the government can control the economy and the role of regulation is reversing. Deregulation, tax cuts and free trade are good for corporate profits and bullish for the stock market.

Policies that promote income redistribution, higher taxes, industrial re-regulation, organized labour and

protectionism are bad for economic growth and stock prices. (Please accept these as over-generalizations as even I would argue that the capitalist system has some excesses that need to be addressed.

Pro-growth government policies dominated by supply side reforms, free market capitalism and globalization from 1980 to 2010 are beginning to reverse. The Trump Administration started the process with a trade war with China. Biden wants to tax and spend while pursuing an aggressive green agenda and continuing trade protectionism. As an example, it is estimated that California’s new restrictions on driver classification will take tens of thousands of truck drivers off the road according to the Wall Street Journal. Meanwhile, President Xi is aggressively regulating China’s platform companies, centralizing power, marginalizing private business and pursuing ‘common prosperity’ by forcing the rich to pay more.

Global geopolitical tensions are rising. Europe is already in a war. China – US tensions continue to rise and Western Europe is re-arming while Japan plans to spend more on defense.

Unfortunately, I don’t see any easy solutions for some of these issues and I don’t think they will favour the financial markets.

Stock Market

When I look at some of my individual portfolio holdings, I’m impressed by how cheap they are. On a one-off basis, there are a number of companies that I’d buy because they seem too undervalued, and eventually that’s what will put in a market bottom. But liquidity and valuation may be the headwinds for a general market advance.

The market has already discounted higher interest rates and is now discounting a recession, which my secular factors would suggest is likely. Nonetheless, a lot of damage has been done to the market. If the trends are cyclical, then we’re probably getting close to a bottom on a stock-by-stock basis. We’re oversold and due for a rally, which could be triggered by some relenting of inflation and the Fed backing off from its aggressive posture, my not as bad as expected scenario.

However, if we do enter a recession there will probably be another leg down as earnings get revised. If it results in stagflation, the earnings drawdown may not be as great, but higher interest rates and limited liquidity will continue to erode valuations as we saw in the 70’s. Back then, we endured a decade long bear market where stocks made little progress, but earnings expectations were met most every quarter. From 1970 to 1989 corporate profits grew 4.7 fold, which equals an 8.4% annualized rate in a period of high inflation and rising inflation. From 2000 to 2019, corporate profits expanded 3 fold, equal to 6.1% annualized in a period of low inflation. Inflation in the 70’s depressed PE ratios as the average multiple for the S&P was only 12X. Multiples expanded by 85% since 2010 even though the US economic growth had been weaker than the previous decade.

Another differentiating factor is what we refer to as the Fed Put. This has been the Central Bank’s response to falling or troubled financial markets. In the last two decades, the Fed has been able to dramatically lower interest rates and provide liquidity at any sign of trouble because inflation was in a secular decline. In the 70’s, there was no such option and the Fed in fact raised rates even during economic slowdowns to fight inflation. Similarly today, it is highly unlikely that Powell could justify a reversal of his tight monetary policy because of a weak stock market. It will no doubt require a financial accident to cause a sudden reduction in rates.

So, there’s a realistic case for a bounce, but a bottom may be a bit more elusive and when it does come a new bull market will require a pivot to monetary easing.

In the meantime, remember this market is all about valuation and liquidity. With unemployment at 3.6% headed to 4.2% (Fed’s est.), we’re not likely to have much of a recession. Earnings, however, could suffer from margin compression as this monetary policy cycle hurts Wall Street more than Main Street.

Second Quarter Fixed Income Strategy Review

The second quarter of 2022 echoed many of the themes evident in the first quarter. Inflation in both US and Canada exceeded already lofty expectations and climbed to levels not seen since the early 1980s. The Federal Reserve and the Bank of Canada hiked rates sharply and aggressively in response. Oil, a primary driver of inflation, hit multi-year highs as well, as the conflict in

Ukraine entered a new, possibly more protracted stage, roiling energy markets. The impact to financial markets, although not as severe as the first quarter, was steeply negative across most asset classes.

Q2 2022 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Second Quarter of 2022. You can download the full reports via the links shown below.

KEY OBSERVATIONS

The S&P500 officially entered a bear market on June 13th after it fell -21.8% from its January 3rd high. Any decline over -20% is considered bear market territory. In the second quarter, the S&P500 total return was -16.1% in US dollars or -13.5% in Canadian dollars. The TSX total return was -13.2% in the second quarter.

A main cause of this decline was the May CPI inflation data, which pressured the Federal Reserve (Fed) to increase the federal funds rate by 75 basis points in June. Inflation is far more pervasive than the Fed originally believed, and in its June 15th press release, it became abundantly clear that its primary goal had become fighting inflation, potentially at the expense of the labour market and economy.

If there is any good news, it might be that the Fed’s forward guidance on interest rates appears to have caught up with the market implied rates, but there is still a long way to go to get to the Fed’s target level of 3.8% by the end of 2023 as we are currently only at 1.5-1.75%. The market’s focus will now likely shift to whether the Fed can engineer a soft landing or not.

According to BMO Capital Markets, the return of the average non-recessionary bear market going back to 1945 was -27.6%, and if we don’t enter a recession, we are pretty much there. However, the average recessionary bear market return is -34.8%, which implies more financial pain if we do enter a recession.

On the flip slide, average bull markets last almost five times longer than bear markets, and produce cumulative price gains of 156%. Although it’s tough to determine the exact bottom of a bear market and start of a new bull market, it’s critical to be invested at those times.

We are currently happy to hold some extra cash reserves, and concentrate on owning companies with lower volatility, consistent earnings and strong and growing dividends. Some positive signals we will watch for include signs of peaking inflation, higher unemployment, and a shift in Fed policy. A higher level of capitulation in stocks could create a valuation reset and potentially a compelling entry point.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our overall equity exposure decreased another 4% to 89%. Our US equity exposure decreased from 43% to 39% while our Canadian exposure was flat at 50%. Cash increased from 7% to 11%. Since many of our clients’ portfolios are invested in equities through our North American plus International Equity strategy, their actual weights in US and Canada will be proportionately less than this given the allocation to international companies.

Our portfolio is positioned toward value-oriented stocks that typically trade at or below market earnings multiples, while maintaining exposure to growth stocks at around 1/3 of the portfolio. During the quarter, we added several new stock positions:

- Bank of Montreal took the place of TD bank in our portfolio at the end of the first quarter of 2022. BMO looks stronger on several fronts, including loan growth, credit cards and earnings forecasts.

- Keyera Corp is a Canadian midstream energy company with an attractive pipeline of projects, significant earnings from fee-for-service, insulation from commodity prices, and a dividend yield of more than 6%.

- Primaris Real Estate Investment Trust is a Canadian shopping centre REIT with a focus on secondary markets in Canada. It trades at a deep discount to its net asset value and sports a 6.4% dividend yield.

- CT Real Estate Investment Trust is arguably the lowest-risk holding in the Canadian portfolio, with a 99.3% occupancy rate, 96.1% of tenants being investment grade, and a 5.4% dividend yield.

- Johnson & Johnson has leadership positions across a wide number of healthcare segments with 20-year compound annual growth of 8% earnings per share and 60 consecutive years of dividend growth.

A complete review of the business and fundamental outlook for each company can be found in my full report.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

To say that the first half of 2022 has been tumultuous is an understatement. To put things in perspective, the S&P 500 had its worst first half in more than 50 years. These challenges were global, with market indices also falling 15-20% across Europe, Asia, and Emerging Markets.

The reasons are well known, including persistent inflation, supply chain disruptions, the war in Ukraine, and a hawkish tone from the U.S Federal Reserve and other central banks.

During the quarter, we took a more defensive posture by reducing exposure to cyclical sectors like Technology, Banking, and Consumer Discretionary. We sold JPMorgan, Taiwan Semiconductor, Facebook, HDFC Bank, Adidas, and Silicon Valley Bank. Some of the proceeds went to the Consumer Staples and Healthcare sectors, as these companies tend to offer stable free cash flow and less risk of large earnings downgrades. Some of the stocks we bought include Johnson & Johnson, Nestle, GlaxoSmithKline, Diageo, and AstraZeneca.

Instead of worrying about a recession that is just around the corner, it’s worth considering the possibility that we are already there. Economic recessions are defined as two consecutive quarters of negative GDP growth. First quarter 2022 US GDP was -1.6% and, according to the Federal Reserve Bank of Atlanta’s forecasting model, US GDP growth for Q2 2022 is estimated to be -2.1%.

The real question is how to position a portfolio in light of these conditions. We believe it’s about striking the right balance. We have taken a more defensive tilt and have also raised some cash. We don’t believe that now is the time to abandon equities. Rather, we are preparing a list of stocks so we are ready to deploy our cash opportunistically when we feel the time is right. We remain confident in the long-term outlook for the businesses we own and are satisfied that these companies can weather the storms of inflation and possible recession.

FIXED INCOME UPDATE

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

The second quarter of 2022 echoed many of the themes evident in the first quarter. Inflation in both US and Canada climbed to levels not seen since the early 1980s. The Federal Reserve and the Bank of Canada hiked rates aggressively in response. The impact to financial markets, although not as severe as the first quarter, was steeply negative across most asset classes.

In the early days of the second quarter, Canadian inflation data continued to pick up steam, exceeding expectations in February and again in March. Following a period with much talk but little in terms of concrete action, the Bank of Canada hiked its overnight rate by 50 bps, to 1.00%, on April 14th. This was the largest increase in twenty years, and essentially an admission that conditions had been left too loose for far too long.

In mid-April, U.S. headline CPI (in)famously hit a 40-year high 8.5% year-over-year pace, and producer prices bested that with a blistering 11.2% year-over-year clip. On June 15th, the FOMC delivered a 75 bps hike, bringing the target range to 1.50-1.75%, the largest hike since 1994.

At the time of this writing, interest rate increase fears, while still substantial, are ceding ground to growth fears. Investors are weighing the probability that central banks can engineer price stability while maintaining positive, productive economic growth. That likelihood has weakened in the estimation of many investors over the past quarter.

In our view, inflation is close to, if not at, its peak for the near-term, and while it will likely remain elevated and above the central banks’ long-term target for the next few quarters, it will begin to recede soon. Early signs of this occurring are evident in real estate, metals, and wage growth (albeit the most recent readings of these remain high).

Given that rate hikes are highly likely to occur, we continue to favour the purchase of short duration bonds. We are also favouring higher-quality investment grade bonds in the possible event of recession. Yields are the most attractive they have been in quite some time, and opportunities are beginning to present themselves. We are well-positioned at present and will remain patient until we get a clearer picture of inflation and the path of future rate hikes.

Q1 2022 Strategy & Market Reviews

NORTH AMERICAN EQUITY UPDATE

GLOBAL EQUITY UPDATE

FIXED INCOME UPDATE

Seeking Income?

Private high yield alternatives could be the answer

If you’re relying on the traditional bond market to generate income, then you already know that today’s low interest rates make this a challenge. Even if the Bank of Canada enacts a handful of rate increases in the coming months, most investors will continue to find that rates are too low to yield sufficient income for their needs.

The question is how to earn a higher yield without assuming excess risk. To help answer this question, our clients were recently invited to a discussion on private high yield alternatives hosted by John Poulter, CFA, who is a Portfolio Manager at Cumberland Investment Counsel Inc. and a founding partner of our firm.

Private high yield alternatives, or “private alts,” have been around for decades. They are similar to bonds in that they represent debt and earn interest, but they have a number of unique attributes that enable them to generate higher levels of income.

- Specialized. Private alts tend to be highly specialized funds that originate lending where banks and other traditional lenders can’t or won’t.

- Managed. Private alt funds take advantage of the fund manager’s knowledge of the unique circumstances and risks associated with the industries where they lend.

- Diversified. Private alt funds are often very nimble and able to make many smaller loans that are diversified across many borrowers.

It’s this combination of specialized lending, active management and careful diversification that enables private alt funds to earn robust income with very attractive risk/reward profiles.

Investing in Private Alts

Last year was relatively rare in that Canadian investment grade bonds posted an overall loss of -2.8%. They were also highly volatile, with six up months and six down months throughout the year. For contrast, John and the Cumberland team shared the 2021 results of the seven private alt funds that are currently on Cumberland’s recommended list, which revealed that the average fund had less than two negative months in 2021, and positive annual returns ranging from +3.5% to +18.1%.

To be sure, investing in this space is not so simple. Just as you would carefully analyze a company before buying its shares, it is crucial to conduct due diligence on any private alts fund before committing capital to it. John and the Cumberland team have developed a recommended list based on decades of trusted relationships within the industry as well as extensive selection criteria, including compliance review, analysis of returns, individual holdings review and management team interviews.

Private lending example: Arena Investors, L.P.

As part of the discussion, the audience learned about a given loan made by one of the alternative funds – Arena Investors, L.P. (Arena)This is a US-based firm with $2.6 billion of assets under management and a lending portfolio that spans corporate credit, real estate, commercial and industrial assets, structured finance, consumer loans, and securities.

Arena’s typical loan has a two-year term and targets a 10-12% net return. To manage risk, their loans are the most senior in the capital stack, meaning that they are among the first to get paid if something goes wrong. They also typically include a 30%-40% loss cushion, which is provided by the borrower’s principals or a subordinated lender.

Arena’s employees have been involved in aviation-related investments since 2001, and one of their JV partners recently saw an opportunity to buy two commercial jets at an attractive discount to the value of the aircraft parts on a disassembled, liquidated basis.

Arena required the JV partner to contribute $3 million of his own capital, and to make his contribution subordinate to the $7 million loan that they agreed to provide. As the planes were liquidated, the equipment sales were subject to Arena’s approval, and Arena generally controlled all cash and bank accounts, including the JV’s, until the completion of the venture.

In short, Arena’s strong sourcing capabilities among its JV network unearthed the opportunity, its specialized knowledge permitted it to structure a unique deal, and its hands-on approach gave it robust controls over the life of the loan.

Reach a Cumberland Portfolio Manager to learn more

For a more detailed discussion of how our clients are seeking higher income through private high income alternative investments, a deeper look at our funds and strategies, and how they can add value to your portfolio, please reach out to us and speak with a Portfolio Manager.

12 Themes for 2022

Insights from our Calgary Office

Every year, we gain experience and wisdom and hope to pass on the fruits of such to our clients through our asset allocation decisions for your respective portfolios. Each of our themes is a key element within the market landscape that we believe will be relevant to your portfolio and its potential returns over the upcoming year. We hope you find them thought-provoking and an interesting read.

In no particular order:

- Favour Companies with Pricing Power

While many politicians and central bankers would like us to believe that inflation is transitory, there is every reason to believe that inflation will remain somewhat elevated well into 2022. Consequently, we think we as investors should focus on companies that can increase prices at a faster rate than their costs are rising. This allows these companies to have their margins increase, or at least be maintained. Furthermore, if some of these inflationary pressures subside at some point, these companies may also be able to maintain their prices even while their costs decline. This would lead to further margin expansion. We will maintain a bias towards value and cyclical stocks at this phase of the economic cycle.

- Don’t Forget About Copper and Oil

For much of the last decade, investing in many commodities has been a difficult experience for investors and many investors have exited these sectors entirely. However, after years of underinvestment, supply of commodities such as copper and oil are tight and the lead time on large projects (to increase supply) is often many years. If we continue to see COVID-related hospitalizations decline, we would also expect to see the economic expansion continue and demand for transportation and travel to increase. These conditions should result in higher demand for commodities such as oil and copper. Higher demand and tight supply are the textbook conditions for higher prices.

- Short Duration Bonds for the Win

To preserve capital and lock in yields, low coupon corporate bonds under 3 years will help reduce volatility in a rising rate environment (especially when Bank of Canada gets closer to and during liftoff).

- Capital is at Risk if you hold to Maturity

We will be actively realizing gains on our premium bonds because in a rising rate environment, capital losses will be permanent as yields increase and bond prices decline faster than in a stable rate environment. Given bonds mature at par, recovery of capital will be unlikely.

- Single Family Housing Strength Doesn’t Stop

From 1985 until today the United States has had 226,000 detached single-family homes started per quarter. Pre global financial crisis, this grew to nearly 400,000 per quarter, leading to an estimated 2 million homes being overbuilt. This naturally led to an over correction the other way, having only 160,000 homes started each quarter since 2010. Reversing the 2 million overbuilt homes to being nearly the same amount underbuilt. Late 2019 was the first year that new builds exceeded the long-term average. Housing cycles can last from five to fifteen years and given the current lack of supply, there is a possibility for housing to perform above its historical average, late into this decade.

- Liquidity continues to dry up

Since the beginning of the pandemic, central banks around the world have gone into full accommodation mode to try to support the financial markets. As of the end of November 2021, the US Federal Reserve has printed $4.5 trillion for the use of quantitative easing (buying government bonds) which has created an unprecedented amount of liquidity in markets. While participants quibble over whether this is inflationary, the reality is that this has been undeniably bullish for risk assets of all varieties. A rising tide lifts all boats and the boats that are most unfit for sea typically tend to rise the fastest in this type of environment. 2022 projects to see a diminishing liquidity environment with tapering of the quantitative easing process to zero by mid-year and the possibility of three interest rate hikes. We expect this diminishing liquidity environment to see capital appreciation to be more difficult to achieve with more fundamental work required with asset selection. In addition, we would expect a lot of those non-sea-worthy boats to really struggle.

- Tail-end risk protection

As of this writing, the US 10-year government bond is yielding 1.45%. Not only is this not keeping up with most inflation measures (leading to a negative real return) but if we see major volatility, you’re not going to see government bonds buffer your portfolio volatility as much as they have historically. The good news is the advent of ETFs has led retail investors to have more exposure to what had historically been reserved for sophisticated institutional investors with billions under management. The need for long volatility strategies has become more common, especially as we continue to exist in this negative real interest rate world. As these products become more available and more tested, we would expect these types of vehicles to become more prevalent in an investor’s portfolio.

- Non-Profitable Covid Beneficiaries Will Continue their Disappointment

2021 has not been a kind year to the next generation Covid beneficiaries. Post the February meme stock explosion, the Goldman Sachs Non-Profitable Tech Index has fallen from 446 to 275 (down 38% on an absolute basis) lagging the S&P 500 by 47%. As per Bloomberg calculations, the group still appears to be trading at 124x two-year forward earnings. Not to knock the performance too much, it is still up 150% from the start of 2020 versus 50% for the S&P 500. There still appears to be some air to come out of this balloon.

- T.I.N.A _ There Is No Alternative

In a world of historically low rates, pandemic induced supply issues, expanding role of monetary policy beyond price stability, and developed countries’ sole focus on “keeping the consumer spending,” investors that have long term time horizons will highly likely become frustrated with anemic returns (or even losses) generated from the fixed income asset class. While there is a considerable number of market observers pressing that equities have high valuations relative to history, investing is about making decisions today and expectations for the future. The fact is, the existing Equity Risk Premium (current cost of $1 of equity earnings vs $1 of bond income) suggests that, on a relative basis, equities remain attractive. Additionally, equities are unequivocally the single best place to be to provide a real return as inflation expectations rise. Consequently, all portfolios should be tilted to maximize exposure to this asset class subject to the over-arching asset mix strategy.

- Diversification beyond the Traditional Balanced Allocation is the Key

While there is no secret that the so called “neutral” allocation towards equities has steadily creeped upwards (50% in 1980, 60% in 2000, 70% in 2020), a truly well diversified portfolio will need exposure above and beyond just stocks and bonds to successfully navigate the coming years.

As interest rates move and bounce around from extremely low levels, we believe both equities and bonds will be subject to amplified (and sometimes extreme) valuation revisions. What this means is that price volatility is here to stay. Further, while there is debate on the pace of interest rate increases, it is widely expected that rates will rise, which will be a headwind for both stocks and bonds. This undermines the primary purpose of holding both stocks and bonds in the first place.

Portfolios may require allocations towards assets such as crypto, commodities, gold, and sustainable natural resources that provide scenario-specific inflation protection and non-correlated returns. Many portfolios are woefully underexposed to these assets.

Longer-term exposure to real assets and specific equity strategies (such as Real Estate, Global Equities, Dividend Growth, Frontier Markets and 130/30 Long Short Alternative Equity, Alternative Income among others) will not only be beneficial but necessary to minimize overall portfolio volatility.

- When it comes to Shorting, Fundamentals will Matter!

Stock fundamentals were long despised during the liquidity-infused favorable market post-March 2020. The strategy of shorting stocks will make a comeback as the market starts to move back towards fundamentals. Stocks that have no earnings, no cash flow, are highly leveraged, have questionable management and are based on living out a pipe dream (i.e., a story stock) will fall out of favor, again opening opportunities to add alpha and improve risk mitigation for portfolios. Similarly, sustainability trends will continue to create opportunities for skilled active managers. Hence our Kipling 130/30 equity portfolio structures offer an advantage.

- Increased participation in cryptocurrencies

Bitcoin has been investable for Canadians in their registered accounts for well over a year now. The newest products, ETFs, have now been around since early 2021. The SEC has now approved futures-contract based ETFs in the US (Canadian ETFs hold the physical), which has seen some inflows. There are expectations that a physical BTC ETF could be approved in 2022 and that is where we could see more institutional demand.

We welcome the opportunity to review our investment philosophy and process with you. Please reach out to us by calling 1-800-929-8296 or emailing [email protected], and one of our Portfolio Managers will be in touch soon.

What to Know Before you Invest in ETFs

Exchange Traded Funds, more commonly referred to as ETFs, are a popular alternative to traditional investment vehicles such as individual stock trading and mutual funds. An ETF is a passively-managed collection of stocks or bonds that may be purchased for one price. ETFs are relatively new in the investment world but have made a serious impact. There are almost 800 ETFs in Canada with over $160 Billion of Canadian assets invested*.

As a relatively new investment option, there are still many misconceptions about ETFs and how they work. Here are some of the most common myths about ETFs.

Myth #1: ETFs Are the Same as Stocks

While it’s true that ETFs and stocks are both traded on exchanges, they are very different investment vehicles. When you purchase a stock, you are purchasing shares of a single company and the success of your investment will depend on the rise/fall of that one stock. When you purchase an ETF, you are purchasing a basket of securities that work together to determine the value of your investment. ETFs offer much more diversification than a single stock. At Cumberland, we typically invest in a portfolio of carefully researched stocks, which provides investors with good diversification but also allows for stock selections (thereby avoiding regional, sector or stock exposures that may carry undesired risks). We may utilize ETFs in portfolios where they are the most efficient way to get specific exposures, as described in greater detail below.

Myth #2: ETFs Have Liquidity Issues

Perhaps one of the biggest concerns investors have when it comes to ETFs is their liquidity. ETFs have arguably developed an unfair reputation of having low liquidity. An ETF’s liquidity is made up of two components: the volume of ETF units traded on an exchange and the liquidity of the basket of securities that make up the ETF’s portfolio. Knowing how an ETF’s liquidity is determined will help you evaluate it appropriately and make a selection with sufficient trading volume of its units and its underlying holdings so you can comfortably buy and sell them without any significant issues or costs.

Myth #3: ETFs Only Offer Broad Exposure

Many ETFs offer broad market exposure, such as index funds that follow an entire index, like the S&P 500. These were some of the first types of ETFs available to investors and still make up a large part of the ETF market. However, ETF markets have evolved in the past number of years to offer more targeted investment options. Investors now have access to ETFs that focus on specific sectors (e.g. energy, infrastructure), asset classes (e.g. high yield bonds), and geographic locations (e.g. emerging markets). At Cumberland, we selectively use these more narrowly-focused ETFs in cases where it is the most efficient method of gaining a specific portfolio exposure.

Myth #4: ETFs are All Low Cost

ETFs came into the spotlight as a low-cost alternative to traditional mutual funds. It is true that some ETFs offer low-cost index tracking solutions, although many of them have hidden fees and costs embedded in them. While the cost of investing should be a consideration for investors, it should not be the most important driver. Performance, risk tolerance, appropriateness of the ETF, liquidity, and the given ETF’s role in overall portfolio construction should always be leading priorities.

Myth #5: ETFs Can Replace Active Portfolio Management

Passive ETFs are sometimes promoted as a substitute for active portfolio management. In reality, there are significant differences and trade-offs. To take just one example, Shopify recently became one of the most valuable stocks in the Canadian index, which means that many ETF investors ended up with it as their largest holding by default. In contrast, an active manager will judge the merits of a stock like Shopify and decide whether it deserves such a heavy portfolio weighting, or whether it’s better to take a more nuanced approach and limit the risk of a potentially large drawdown at given points in time.

At Cumberland, we believe that ETFs work best when integrated into a professionally-managed investment portfolio. This way, they can be used in the instances where they are most likely to align with your specific investment objectives, taking into account all the myths and realities surrounding diversification, liquidity, portfolio exposures, costs and active portfolio management.

We welcome the opportunity to review ETFs with you alongside our investment philosophy and process. Please reach out to us by calling 1-800-929-8296 or emailing [email protected], and one of our Portfolio Managers will be in touch soon.