Why Stay the Course?

One of the most basic investment principles can be surprisingly difficult to grasp. Intuitively, you might think that if you lose 10% one year and make 10% the next year, you will break even. But that is not true, and it becomes even less true as losses become larger.

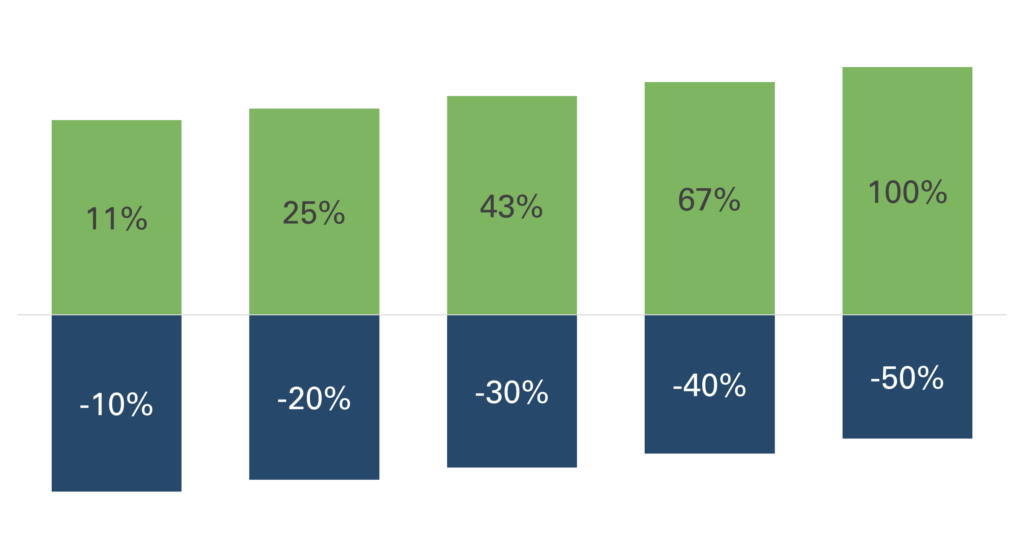

As the following chart shows, you need an 11% return to recover from a 10% loss. And the larger the loss, the harder it is to catch up. In the extreme, if your portfolio goes down 50%, you need to recover 100% just to get back to even.

It can be easy to forget about the jobs you intend your holdings to perform, then make emotional decisions that are counter to the portfolio’s long-term goals. For example, a holding intended to protect better in down markets will likely underperform in strong markets, and a position held for growth will likely hurt the portfolio when markets are weak. Forgetting about this or becoming impatient is one of the main reasons investors go off course and suffer negative consequences.

Markets vs. Human Nature

Markets have done well over time, but investors don’t always do as well. A perfect example comes from investment company Fidelity and its flagship Magellan Fund, which delivered a stellar 29% average annual return between 1977 and 1990. Despite this performance, the average investor actually lost money1. How is that possible? According to Fidelity, investors would run for the doors during periods of poor performance and come rushing in after periods of success.

It is human nature to chase performance and buy what did well last year but that goes counter to the entire concept of intelligent investing. If your portfolio is set up so that everything does well in a given year, that means everything can also do poorly in a given year. Being a successful investor over the long-term involves diversifying your portfolio with investments designed for different market conditions.

What about the bears?

Bear markets are never easy, but the market has been incredibly resilient. For example, since the bottom of the Great Recession in March 2009, the S&P 500 has delivered a return of 727% including dividends through March 31, 2023.

Go back further and you will see that, in the 50-year period ending December of 2022, the S&P 500 returned more than 13,000%. It may help to keep this history in mind when you contemplate market volatility. If you had invested $10,000 in the S&P 500 at the start of 1973 and just left it there, it would be worth more than $1.3 million today. (Source: Bloomberg SPX Index Total Return CAD, March 31, 2023.)

When a bear market hits, it may take a while to recover. As we saw a moment ago, a 30% drop necessitates a 43% recovery. But look at how the power of compounding can help. If your $100 investment declines to $70 and you make 10% the next year, you’re back up to $77. The next 10% gets you to nearly $85. Two more years of 10% gains, and you have $102.50.

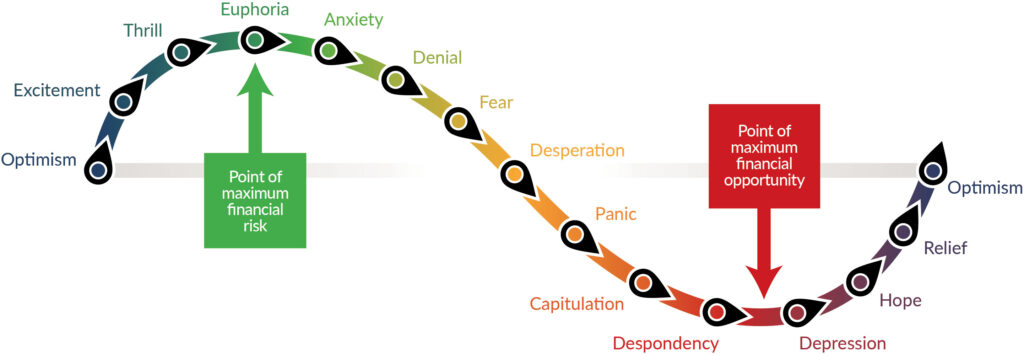

A roller coaster of emotion

The trick to effective diversification and compounding returns is to stay the course. Investing based on panic or gut feelings will almost always lead to underperformance. Most investors are incapable of ignoring these reactions, which is why they hire professional advisors or money managers to look after their portfolios.

Investment professionals are trained to look at the long term and the big picture. Unfortunately, even this is not foolproof, because some investors will second guess their long-term plans based on short-term performance. Some will even abandon their advisors during market downturns, just to repeat the process again in the next downturn.

The following illustration highlights the emotional cycle of investing. Failing to control for these emotions leads to many of the most common serious investor errors, such as chasing returns, buying high/selling low, panic selling, making decisions based on individual holdings rather than an overall portfolio, lack of diversification, and purchasing narrowly-focused investments rather than broad asset classes.

Map out your course

Perhaps the best way to stay the course is to have it clearly mapped out. Spend time finding a professional advisor and firm you trust, then work with them to document your goals and set a long-term financial plan. After that, the best thing you can do is let them run your portfolio based on your strategy, without emotion or overreactions to short-term events.

Think of it as you do your winter coat. You do not get rid of it in the summer – you continue to hold onto it for when it is needed. As an investor, you should understand why you own the investments that you do and be reluctant to change them unless there is a different “job” that needs to be done in your portfolio.

We would like to finish with one of my favourite quotes by the legendary investor, Benjamin Graham, which highlights the importance of staying on course by avoiding needless errors:

“The essence of portfolio management is the management of risks, not the management of returns.”

Q1 2023 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the First Quarter of 2023 You can download the full reports via the links shown below.

KEY OBSERVATIONS

It’s hard to believe that we saw positive returns from both the S&P 500 (+7.5%) and TSX (+4.6%) during the first quarter. After all, inflation is still high, the Federal Reserve continued to increase interest rates, consensus earnings declined, and we witnessed the second largest bank failure in US history.

The bank failures in the US and Europe may be a drag on growth going forward, but we do not anticipate a wider crisis. We currently have no exposure to US banks, little exposure to European banks and some exposure to Canadian Banks. Canadian Banks are consistently more profitable than US and European banks and carefully regulated, so when problems do occur, they can usually manage without the need for external capital.

Despite the banking turmoil, the Fed increased rates 25 basis points or +0.25%, bringing the upper end of the federal funds rate to 5.0%. They maintained their 2023 target rate of 5.1% and raised their 2024 target to 4.3% from 4.1%. In contrast, the fixed income market seems to have priced in about -0.85% of rate decreases this year. The question now is whether this reflects an expectation of lower inflation and slower growth, or a recession. Either way, it’s clear that the rate hiking cycle is virtually over.

We continue to believe that, if a recession does materialize, it will be relatively mild. Global banks are well-capitalized and businesses and consumers are significantly less exposed to credit and leverage risk than they have been historically. In addition, unlike a year ago, with interest rates now higher the Fed now has some room to maneuver its policy. In other words, if the economy slows too quickly, they can cut rates.

Consensus S&P 500 corporate earnings estimates for 2023 and 2024 have fallen nearly -12% and -11%, respectively, from their peaks in the spring of 2022. However, valuations (the price investors are willing to pay for a dollar of a company’s earnings) are now much more reasonable and almost two-thirds of S&P 500 companies are showing positive 3-month percent changes in forward earnings. Both of these factors are positive for stock prices.

We remain confident in the long-term outlook for our portfolio holdings given their robust free cash flow and strong balance sheets. We believe that these types of companies are best positioned to weather any storm that might arise.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

We have continued to position our portfolios toward value-oriented stocks. Value stocks now make up 61% of the portfolio. Our exposure to growth stocks increased slightly to 31% of the portfolio. Staples, which we don’t classify as either growth or value, make up the balance of our equity exposure.

We added a number of new stock positions during the quarter, including:

BCE Inc. represents a stable and defensive investment in uncertain times, where you are “paid to wait” with an excellent dividend that currently yields about 6%.

Canfor Corporation is a contrarian deep-value cyclical investment. Their lumber operations stand to benefit from eventual declining interest rates and higher housing demand as a result.

General Motors Company has made significant investments in R&D and supply chain. Based on this, among other positive factors, and given its current valuation, we expect GM stock to perform well.

Avery Dennison Corporation is a global materials science and manufacturing company that we believe will grow earnings faster than the market, which provides good share price appreciation potential for investors.

Meta Platforms has over 3 billion monthly users across Facebook, Instagram, and WhatsApp and we expect strong earnings from cost cuts and rebounding ad sales. In addition, Meta has invested heavily in the Metaverse over recent years, and these capital expenditures are virtually complete, allowing the company to profit.

A more detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

After a challenging year in 2022, global equity markets more broadly also generated positive returns during the first quarter of 2023 with all the major geographic regions in the green. In addition to gains in the US and Canada, the STOXX Europe 600 index climbed by +7.8%, the Nikkei 225 increased by +7.5%, and the Emerging Markets collectively generated a positive return of +4%.

Some of the factors driving these returns include falling inflation, better than expected economic data in the US and Europe, as well as enthusiasm related to the reopening of China’s economy.

In terms of inflation, the headline figures continue to fall in both Europe and the US. Preliminary readings showed that Eurozone headline inflation fell to 6.9% during the month of March, down from 8.5% in February. In the US, the consumer price index increased by +6% from a year earlier, a decline from 6.4% in January and down from the 40-year high of 9.1% in June of 2022.

We remain cautiously optimistic in our outlook for 2023. Given last year’s significant market declines, stocks are trading at more reasonable valuations. In addition, inflation measures have been falling and the red hot job market is finally showing signs of cooling. When combining these developments with what’s happened in the banking sector, we believe that central banks are nearing the end of their interest rate hiking cycle.

During the first quarter, as described above we re-initiated a position in Meta Platforms. We had previously invested in the company, but sold our entire position back in February of 2022 when Mark Zuckerberg gave specific guidance on how much money it was going to spend on the Metaverse. Since we sold it, the stock fell by 70%.

Fast forward one year later, the company announced a strategic pivot in terms of its capital allocation. In addition to the tailwinds from its cost reduction efforts, Meta also has a potential opportunity should TikTok get banned in the United States. We also believe that Meta will benefit from the boom in artificial intelligence that will play out in the years ahead.

A more detailed review can be found in the full report per the above link.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

The drivers of fixed income returns in Q1 2023 were, in no particular order, the banking crisis, Canadian and US interest rate hikes (or pauses), and interest rate spreads, particularly the incremental return over lowest risk government bonds. In all, 2023 got off to a positive start for fixed income investors.

The Canadian yield curve shifted lower in most tenors, and remained inverted during Q1 2023. As you know, when interest rates decrease, bond prices increase, so this was a positive outcome for fixed income investors.

However, as a result of the interest rate volatility and the general “risk-off” tone of the market, corporate spreads widened modestly during the quarter. The level of corporate bond spreads are viewed as barometers for recession risk. While they currently suggest the risk of recession has increased, they do not, at present, indicate that a recession is imminent.

The Bank of Canada hiked rates by 25 bps or + 0.25% to 4.5% in late January, as expected. However, the Bank announced that it would pause, absent any material deviation from its economic forecasts, and it did just that at its meeting on March 8th, holding the rate at 4.5%. We do not currently anticipate further hikes here in Canada, but think there may still be one more increase in the US.

In Q1 2023, the trends for the US economy that were evident in late 2022 remained in place – high but declining inflation, very tight labour markets, and surprisingly resilient economic growth. The shock of the banking crisis caused rates to tumble, and the market believes the Federal Reserve Bank is tantalizingly close to the completion of its rate hike cycle.

We have not wavered in our belief that should a recession occur, it will be relatively mild. However, we believe the risk of recession has increased in the past three months as a result of tightened financial conditions, and the ongoing effect of the past year’s interest rate hikes.

We continue to favour government bonds and equivalents in our portfolio to buttress our defense against a potential recession. Having said that, bond yields remain compelling and we are modestly adding to the duration and average term to maturity of our portfolio. We will continue to seek strategic opportunities to add value through attractively-priced investments while carefully managing risk.

A more detailed review can be found in the full report per the above link.

First Quarter 2023 North American Equity Strategy

It’s hard to believe that the S&P500 and TSX delivered positive returns during the first quarter. After all, inflation is still high, the Federal Reserve (the Fed) continued to increase interest rates in March, consensus 2023 earnings are down almost -12% from their peak and on March 10th, Silicon Valley Bank (SVB) failed -the second largest bank failure in US history. During the first quarter the S&P500 total return was +7.5% in US dollars. Adjusting for currency, the S&P500 returned +7.4% in Canadian dollars, as the Canadian dollar appreciated about 2/10ths of a cent, closing the quarter at US$0.7398. The TSX total return was 4.6%.

A Strong Start to the New Year

After a challenging year in 2022, global stock markets were strong out of the gate. In the United States, the S&P 500 was up 6.2% while the Nasdaq added 10.7% during the month of January. Over in Europe, the Euro Stoxx 600 index gained 6.7% during the month of January while one of Japan’s leading indices, the Nikkei 225, was up 4.7%. The gains for all 3 markets continued into February although a portion of these gains were reversed as markets have pulled back towards the end of the month.

One of the key questions on the minds of investors is whether the strong start to the year will be sustained and whether global equity markets have begun a new bull market. Of course the answer to this question will only be known with the benefit of hindsight. The answer is not clear cut as there are many conflicting signals in the economy which are providing lots of fodder for both the bulls and the bears. The debate for the last few months has been whether the economy is headed for a soft or a hard landing. Given the recent wave of positive economic data, some market pundits are now saying that there will be no landing at all.

The bulls are pointing to an unemployment rate of 3.4%, stronger than expected retail sales in January, and a booming services sector. When the Bureau of Labor Statistics gave its update in January, it reported that the U.S. unemployment rate fell to 3.4%. Not only was this figure below consensus at 3.6%, but it also was the lowest unemployment rate in the United States in more than 50 years. For the month of January, the Commerce Department reported that U.S. retail sales rose by 3%, which was well above the consensus estimate of 1.9%. It’s safe to say that consumers are still spending. Another data point during the month of January came from The Institute for Supply Management, which reported that the ISM Services PMI increased to 55.2. The index had fallen to 49.2 in December, which is below the threshold level of 50 which signals contraction in the economy. The rebound in U.S. services during the month of January should be viewed very favourably given that services make up more than 75% of the U.S. economy.

The bears will argue that unemployment is a lagging indicator, that consumers are simply running down the last of their excess COVID savings, and that one good month of data for the ISM Services data is not enough to say that we are out of the woods. The bears would also point to January’s inflation data, which was hotter than expected. The consumer price index (CPI), which measures a broad basket of common goods and services, rose 0.5% in January and an annualized rate of 6.4%. Both of these figures were ahead of consensus estimates of 0.4% and 6.2% respectively. Excluding food and energy, the core CPI increased 0.4% monthly and 5.6% from a year ago, which were above consensus figures of 0.3% and 5.5%.

So bringing it all together, there are many good arguments from both the bulls and the bears as to why the economy may or may not go into a recession this year. Nobody knows for certain and we will only find out with the benefit of hindsight. We don’t have a strong opinion on the outcome of the recession debate. We believe there is a decent chance that a recession might be avoided but if a recession does materialize, we believe it will be a milder garden variety type recession. Global banks have robust levels of capital so a repeat of the 2008-09 Financial Crisis seems highly unlikely. Meanwhile, corporates and consumers are less exposed to credit risk and leverage risk than they have been historically. In the United States, debt servicing ratios are near multi-decade lows and 90% of U.S. mortgages are fixed, far below levels seen during previous tightening cycles. Similar to consumers, U.S. corporates have shifted to fixed rate debt. Today over 75% of S&P 500 debt is long-term fixed versus 40% back in 2007. For all these reasons, we believe that any recession that unfolds should be a shallow one as opposed to a deep, prolonged downturn. While the recession debate between the bulls and bears continues, we are comforted by the fact that the companies we own in our portfolios are well positioned for any environment that unfolds in the months ahead.

Have a good weekend.

Phil

The problem with comparing GICs to fixed income funds

For the first time in over a decade, Guaranteed Investment Certificates (GICs) are offering reasonably attractive interest rates or yields. As central banks across the globe have executed one of the fastest interest rate hikes on record last year, which will likely continue into this year, some GICs now offer 4-5% or more, but with a number of constraints.

With 2022 being a difficult year for investors and GIC rates relatively high, you might be wondering about the benefits of investing in a fixed income strategy through traditional fixed income markets. After all, the return on a GIC may now look similar to or higher than recent investment returns on your fixed income fund or strategy.

While this is a valid question, we believe there are very good reasons to invest in the fixed income or bond markets. Let’s start by comparing GICs to fixed income funds.

GICs and fixed income funds have some things in common

GICs are a type of fixed-income investment that typically offers a guaranteed rate of return over a specific period of time. When you invest in a GIC, you are agreeing to leave your money with the issuer (usually a bank or financial institution) for a set period of time without being able to redeem your money before the maturity date, and in exchange, you receive a guaranteed rate of return that is interest and taxed on account of income. The rate is typically fixed, meaning that it does not change over the course of the investment term and there is little risk of losing your capital. If interest rates fall, you will have locked in an attractive rate, but upon maturity, you may only have lower rates to look forward to. If rates rise, you will have locked-in a lower rate than what’s readily available, although you can switch into a higher rate at maturity. It is also noteworthy that GICs are often alternatives to short-term cash investments though mid and longer term GICs resemble fixed income investments.

Fixed income funds, on the other hand, allow investors to pool their money and invest in a diversified portfolio of bonds that offer a combination of higher yields to maturity and capital appreciation, potentially. Bonds are a type of debt instrument that allows governments and companies, among other organizations, to borrow money from investors for short-, mid- and long-term maturities across the interest rate spectrum. When you invest in a fixed income fund, you are essentially lending your money to a variety of counterparties. The portfolio can also contain an allocation to preferred shares, which pay tax-effective dividends, and other investments known as alternatives that provide extra yield and greater potential total returns.

An experienced fixed income manager will ensure that the portfolio is well diversified to mitigate downside risk and will actively manage the term and credit risk exposures to obtain best returns for the risks taken. As interest rates move up and down, opportunities to lock in capital gains or sell to protect against future losses are available. Fixed income funds typically provide regular distributions composed of coupon interest payments, tax-effective dividends and capital gains, though the fund’s value will fluctuate depending on the performance of its underlying securities.

Reading these two paragraphs, you might notice some similarities between GICs and fixed income funds, but there is still more to the story.

They also have a big difference

To sum these up, GICs offer guaranteed returns based solely on the interest earned on the GIC by its maturity, while fixed income funds provide broader opportunities for a range of investments offering both income / yields and total returns. This means that GICs can advertise forward-looking returns, which is the interest they promise to pay you in the future. In contrast, fixed income funds can only be viewed in terms of backwards-looking returns, which is the actual return they generated over a past period of time consisting of the interest and dividend income plus any realized capital gains or losses relative to the price at which the bonds were purchased.

Because interest rates have spent the majority of the last three+ decades moving downwards until recently, and this has caused the prices of bond prices to rise, fixed income funds have tended to do much better than GICs, which as we described, don’t provide any appreciation potential on the principal amount of your capital. Historically, over long periods of time, forward-looking GIC rates have generally not been better than backwards-looking fixed income fund returns.

So with rates higher now – how does the picture look?

The real question investors are pondering is whether a fixed income fund is still likely to have an edge given today’s higher rates? We believe the answer is yes. This is primarily because the same market dynamics that have led to higher GIC rates can enable us to buy bonds, among other fixed income securities, with higher interest rates or yields and increased return potential.

As described earlier, fixed income funds have a few other advantages to keep in mind. If interest rates rise further, the fund can benefit by buying bonds with ever-higher interest rates within its portfolio of securities. If interest rates fall, the fund’s fixed income securities will appreciate and capital gains may be taken along the way.

A fund can also benefit from bonds that are currently priced below their maturity value as they become more valuable as maturity approaches (and term shortens) and they revert to their par value, or the original price of the bond when it was issued.

Beyond these, an income fund can benefit from both higher yields provided by corporate bonds and preferred shares vs. government bonds, among others such as alternatives as we cited above, and tax-advantaged returns from capital appreciation.

Lastly, if you ever need access to your money, you are free to withdraw from the fund at any time. If you choose a GIC, you are locked into a fixed interest rate for a fixed period of time. If rates fall, you might feel good about your decision to lock-in, but you won’t necessarily do better than the fixed income fund. If rates rise, you won’t be able to take advantage of them. And again, if you need access to your money, you are stuck until the maturity date.

On balance, we believe that dynamic, diversified, and actively-managed income funds offer many advantages over GICs now and for the years to come, just as they have in the decades past.

If you have any questions about how we are managing our income portfolios and the opportunities for you as an investor, please reach out to your Client Portfolio Manager.

Q4 2022 and Year End Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Third Quarter of 2022. You can download the full reports via the links shown below.

KEY OBSERVATIONS

We have just concluded another year of tremendous volatility, although it finished on a positive note. The S&P500 total return for the fourth quarter was +7.6% in US dollars or +6.3% in Canadian dollars. The fourth quarter TSX total return was +6.0%. For the year, the S&P500 total return index was down -18.1% in US dollars or -12.5% in Canadian dollars. The TSX total return was -5.8% for 2022.

While it’s never fun to have a down year, the previous two years featured strong gains. Between 2020, 2021 and 2022, the average annualized total return for the S&P 500 was approximately 9.6%, which is close to the average of the past 50 years.

The losses of 2022 were almost entirely comprised of a forward price/earnings (P/E) multiple contraction of -22.07%, and were slightly offset by a positive contribution from dividends (+1.33%) and positive forward earnings per share of +3.37%. In other words, most of the decline was a result of people willing to pay less for every dollar of earnings in 2022 than they had been previously, mainly as a result of higher interest rates and perceived risk.

Two-year stretches of P/E multiple contractions are rare, and 2021-2022 ranks as the greatest two-year P/E multiple contraction of the past 38 years. Meanwhile, earnings themselves have not collapsed. Current forward earnings growth is still positive for 2023 and 2024 at +5.1% and +10.1% respectively, such that the forward P/E multiples are starting to look reasonably attractive at 16.7x and 15.2x compared to the historical 10-year average of 17.3x. Our experience is that the market begins to look forward to the next year (2024) usually by the second quarter of the current year.

While there are no shortages of negative economic forecasts for 2023, we think there is a reasonable chance for the Federal Reserve to tame inflation and for the economy to remain resilient. Even if we are wrong and we do experience a mild recession, our best guess is that long term interest rates will fall, which would lead to P/E expansion and support for market valuations – potentially reversing the historic P/E contraction of 2022.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our overall equity exposure decreased by 6% to 96%. Our US equity exposure increased from 37% to 38% while our Canadian exposure increased from 53% to 58%. Cash decreased from 10% to 4%. It is important to keep in mind that many of our clients’ portfolios are invested in equities globally, through our North American plus International Equity strategy, meaning that the actual weights of US and Canada within their equity holdings will be proportionately less than this given the 15-20% allocation to international companies.

We have continued to position the portfolio toward value-oriented stocks. Value stocks now make up 63% of the portfolio. Our exposure to growth stocks was trimmed by about 1% to 29% of the portfolio. Staples, which we don’t classify as either growth or value, make up the ~8% balance of our equity exposure.

During the quarter, we added a number of new stock positions, including:

Enghouse Systems Ltd. acquires and integrates technology companies. After a brief lull, it’s most recent quarter showed stronger revenue and EBITDA growth. This Canadian company also announced two acquisitions that should re-accelerate growth.

Arthur J Gallagher & Co is one of the leading insurance brokerage, risk management, and human capital consultants in the world. We like this business and consider it defensive, as most insurance purchases are non-discretionary.

Eaton Corp. PLC is a power management company that benefits from the shift to renewable power. New orders and backlogs have accelerated, and secular tailwinds should support prolonged revenue growth at mid-to-high single digits.

Elevance Health Inc. is one of the largest health benefits companies in the United States. We like the demographic-driven stability and growth characteristics of health care, and believe the company is well positioned to benefit from this trend.

A more detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

Inflation was percolating at the start of 2022, and the war in Ukraine served as a catalyst to drive it even higher. In response, central banks aggressively hiked interest rates as you have seen. Against this backdrop, both stock and bonds lost money. Since 1926, there have only been two calendar years when stocks and bonds were both down.

We believe that a changing of the guard may be unfolding in terms of stock market leadership. During the fourth quarter, the MSCI EAFE and MSCI Emerging Markets Indexes both outperformed the MSCI USA Index. This trend may continue after 15 years of outperformance by the United States, thanks in part to a fading US dollar.

We are cautiously optimistic about 2023. Inflation is showing signs of cooling, which means we may be getting closer to the end of rate hikes. We believe that the companies we own, with stable earnings, low leverage, and pricing power, are well positioned for 2023. And history suggests that forward returns are typically strong in the aftermath of a bear market.

We recently added several new stock positions, including Arthur J Gallagher & Co and Eaton Corp, which are highlighted on the previous page. We also added:

Avery Dennison is a materials science company specializing in labeling and functional materials with dominant market share, pricing power and economies of scale.

FinecoBank is one of the most established online banks in Italy and stands to benefit from the wealth transfer to younger generations and higher interest rates.

Keyera Corp is an integrated energy infrastructure business with extensive interconnected assets and a generous dividend yield.

Keysight Technologies is a global leader in testing and measurement equipment with exposure to several themes that we like, including electrification and reshoring.

A more detailed review of each company can be found in the full report per the above link.

During the last quarter of 2022, fixed income also markets continued to wrestle with three things: inflationary data, ongoing interest rate hikes and elevated recessionary risks.

In December, The Bank of Canada made two statements that highlight recent uncertainty. First, the Bank noted that “its Governing Council will be considering whether the policy interest rate needs to rise further,” potentially signaling that the rate hike cycle is close to an end, then noting that the “annual run rate inflation is still too high, and short-term inflation expectations remain elevated,” leaving the door open for further hikes.

Like Canada, the headline economic story in the US was inflation. The market currently expects another 50-75 bps of overnight interest rate hikes in 2023, and for the rate to peak at 5.0% in June. We anticipate that, like the Canadian situation, the Fed will pause and watch the state of the economy in the second half of 2023 before making further moves.

Subtle shifts in the Bank’s commentary and five consecutive months of declining inflation in both countries have us feeling more positive than we have in months.

Firstly, we believe we are near the end of the rate hike cycle, and therefore the impact of higher rates on fixed income securities should soon end, barring any unforeseen shocks. Secondly, there is a risk of a recession in our view, but we believe it will be mild. Consensus forecasts of Canadian and US GDP expects positive growth in 2023 and the labour markets in both countries remain tight.

With a rate hike or two still likely, we maintain a shorter duration than the benchmark. Some of the investment opportunities in the 2-3 year range offer yields that are almost as attractive as those maturing 7-10 years out, and we don’t believe the relatively minor additional yield of longer bonds compensates us adequately for the additional maturity risk or remaining interest rate risk.

We believe the current yields are more compelling than they have been in many years. As a result, we are looking for opportunities to lock in investments for the benefit of our client portfolios. To get a deeper understanding, you can read the full report via the link above.

Fourth Quarter Fixed Income Strategy Review

During the last quarter, fixed income markets continued to wrestle with

(i) inflationary data and expectations,

(ii) global central banks’ attempts to tame inflation through ongoing interest rate hikes and reducing money supply

(iii) the elevated recessionary risk concerns for the economy, both domestically and globally.

Fourth Quarter 2022 Global Equity and International Review

2022 was a challenging year for investors. Inflation had been percolating in the background when the year began and then the onset of the war in Ukraine served as a catalyst to drive inflation even higher. In response to inflation reaching levels not seen in 40 years, central banks in various parts of the world started hiking interest rates. Against this backdrop, both stocks and bonds lost money in 2022. It is very unusual for this to happen. Since 1926 there have only been two calendar years when stocks and bonds were both down. Those years were 1931 and 1969. According to Ned Davis, 2022 marked the first time on record that both stocks and bonds fell by more than 10%.

Fourth Quarter 2022 and Year End North American Equity Strategy

2022 was another year of tremendous volatility, although we ended the year with some positive recovery as the S&P500 total return for the fourth quarter was +7.6% in US dollars. Adjusting for currency, the S&P500 returned +6.3% in Canadian dollars, as the Canadian dollar appreciated about 1.5 cents, closing the quarter at US$0.7381. The TSX total return was +6.0% in the fourth quarter. For the year, the S&P500 total return index was down -18.1% in US dollars or -12.5% in Canadian dollars, as the Canadian dollar depreciated -5.3 cents. The TSX total return for the year was -5.8%. To put this negative performance for 2022 in context, recall that in 2021, the S&P500 total return index was up +28.7% in US dollars or +27.5% in Canadian dollars, while the TSX total return for the year was +25.2% and that followed positive returns in 2020 even with the large COVID-19 drawdown in March of that year. As well, the North American Capital Appreciation strategy has managed to do better than the markets over these past two years.

An Arbitrary Grading of Our 12 Themes for 2022

One of our more popular reading materials for the 2021 year was our “12 Themes of 2022” piece that we published just prior to the Holiday Season. As we have been working very diligently on publishing our 12 themes of 2023, we thought it would be an interesting exercise to go back and look at the potential themes we identified and see how they turned out. With the benefit of hindsight, we will be giving each theme a grade (completely arbitrarily) based on the relevance and the accuracy of the theme with respect to what transpired over the past 12 months. Keep your eyes open for our 2023 themes which should be published over the next few weeks.

1. Favour Companies with Pricing Power

Grade: A

Inflation continued to dominate headlines for the majority of 2022 and while markets were difficult throughout the year, companies and industries that could not raise prices for their goods/services were hit very hard relative to those that could. This theme was illustrated by the Healthcare Sector (with its pricing power) outperforming the Consumer Discretionary Sector(no pricing power) by nearly 20% year to date as of this writing. By focusing on investing in businesses with pricing power, we sheltered investors from a lot of potential downside.

2. Don’t forget about Copper and Oil

Grade: A-

This theme really looked good for the first half of the year and, due to that strength within commodities for those six months, which is why the grade is so high. As of November month end, commodities have been the best performing asset class in 2022 with the BCI ETF having outperformed the S&P500 throughout 2022 by 32%. A few marks are docked because all of this outperformance was felt in the first 6 months of the year. Commodities peaked as of June 8th and have underperformed the S&P500 by nearly 13% since.

3. Short Duration Bonds for the Win

Grade: A+

Absolute home run with this prediction as 2022 was a lesson for bond investors about the potential downside in long duration assets. For the first time in over 40 years, yields went up and went up A LOT and if your bond portfolio was exposed to long duration bonds you most likely experienced losses that you have never seen within fixed income before. The most widely used ETF for long duration bonds (TLT-US) and as of this writing, it is down nearly 30% on the year. While unprecedented, the TLT has serious interest rate risk as it is shown with a duration of over 17 years, as opposed to our Kipling Strategic Income Fund that has a 2 year duration and has seen a return of -1.8% through the first 11 months of the year.

4. Capital is at Risk if you Hold to Maturity

Grade: A+

Another dead accurate prediction when it came to bonds. This fall, we saw the US 10 year bond hit its highest yield since 2007 at 4.37%. This was preceded by a 3-year period from 2018-2021 where that same 10 year bond went from a high of 3.25% to a low of 0.52%. Essentially, nearly every bond that had been issued from 2018-2022 was trading at a premium to par and then that premium was erased to a point where many of those bonds began trading at a discount (below issue level or par).

5. Single Family Housing Strength Doesn’t Stop

Grade: D

Our worst prediction for 2022. So, where did we go wrong? Well, the thesis was driven around the fact that the fundamentals for housing were very strong. Structurally we had underbuilt new housing communities since the Financial Crisis until 2019. Mix in the underinvestment with the demographics of the Millennial generation beginning to reach average “first time home buyer age,” it suggested that the strength in housing would continue. However, we did not see interest rates going up nearly as much as they did, which tempered mortgage demand. US mortgage rates went from nearly 2% in 2021 to 7% at one point in the late summer, which caused mortgage applications to plummet. While wrong for 2022, the underlying fundamental argument is still holding true. November saw an increase in mortgage applications of nearly 13% from October as mortgage rates fell nearly 0.5%. Due to this bounce back in mortgage demand homebuilders have seen a recent bout of outperformance after seriously struggling through the first 6 months of the year.

6. Liquidity continues to dry up

Grade: B+

While accurate on the fact that we continued to see liquidity dry up, we were only talking about 3 rate hikes throughout 2022. In hindsight this is almost laughable as November saw the Federal Reserve raise rates for the 13th, 14th and 15th time all at once. December appears as if we will see another two rate hikes bringing the total of rate hikes to 17 for 2022. Liquidity within the financial system dried up faster and more rapidly than we could have imagined.

7. Tail Risk Protection

Grade: C+

While the argument for Tail-Risk protection was primarily revolving around the fact that, in our view, traditional fixed income instruments were not going to buffer investors’ portfolios in a potential down market (A+ on this), tail-risk protection didn’t help either. While painful at times, the bear market that we saw in 2022 was very orderly and the VIX (volatility or fear index) never spiked to levels that would see any kind of Tail-Risk Protection strategy buffer losses in portfolios.

8. Non-profitable Covid Beneficiaries Will Continue their Disappointment

Grade: A+

The pain and suffering continued. While Goldman Sachs Non-Profitable Tech index saw a return of -38% in 2021, the first 11 months of 2022 we saw that downward trend continue with that same index seeing a return of -58%. Worse than the index, major 2020 winners such as Zoom, Peleton and Roku followed their lackluster 2021’s with returns of -59%, -67% and -74% in 2022. What is perhaps more interesting is that the pain felt in the unprofitable sector expanded to include a lot of the profitable tech businesses and punishment for any new project that wasn’t profitable right away experienced downwards pressure in their stock prices (looking at you META). Investors mindset about profitability and growth has done a complete 180 over the last 24 months.

9. T.I.N.A -> There is No Alternative

Grade: C

While true at the beginning of the year, and why we were so weary on the majority of fixed income, this acronym was no longer relevant by about June. With the central banks on a historic rate hiking cycle TINA has transformed into TARA (There Are Reasonable Alternatives). Interest rates in GICs, Money Market Funds, Corporate Bonds and Government Bonds have gotten to a point that is generating a positive real rate of return for the first time in nearly 15 years. Equity investors are going to need to have a higher hurdle rate to justify the risk associated within equity markets going forward.

10. Diversification beyond the Traditional Balanced Allocation is the Key

Grade: A+

The traditional balanced 60/40 portfolio has had one of its worst calendar years on records as equity and fixed income became nearly perfectly correlated. A balanced portfolio made up of the MSCI World Index and the Canadian Aggregate Bond index would have seen a return of nearly –9% through the first 11 months of the year. Alternative assets and alternative strategies have buffered losses and done wonders for diversification within portfolios.

11. When it comes to Shorting, Fundamentals will Matter!

Grade: A

While possibly a very obvious theme, one must go back and think of the environment we were exiting at the end of 2021. Liquidity and support was the main theme and, as we had just experienced in 2020 and through the majority of 2021, stocks just went up. A rising tide lifts all boats and the least seaworthy rise the fastest. The reversal of liquidity that we saw in 2022 has reversed this phenomena and has led to a resurgence in fundamentals mattering.

12. Increased Participation in cryptocurrencies

Grade: B-

While the direction of the price doesn’t suggest it, major cryptocurrencies did continue to see an increase in participation. Globally the number of exchange traded crypto products has increased nearly 70% in 2022 going from 111 products at the beginning of the year to 186 products by the end of September. Interestingly enough, it is not North America that is leading the way of growth in product, but global banking capital Switzerland. All of this adoption in the face of a 70%+ drawdown.

Overall Grade: A-

As Yogi Berra famously said “It’s tough to make predictions, especially about the future” but we will happily take our arbitrary honour roll grade of A-. It has been a wild ride, but 2022 has proven to be a year where a lot of investors should be going back to the drawing board and adjusting the way they view the world. To our clients that have entrusted us with their hard-earned wealth – thank you for that trust. Keep your eyes peeled for our 12 themes of 2023 piece coming up in the next few weeks.