5 Hidden Truths About US-Canada Trade and Tariffs

When it comes to US tariffs on Canada, the headlines may paint a simple picture, but the reality is far more complex. Canada is a critical trading partner that directly supports US industries, jobs, and consumers in ways that aren’t always obvious. Here are five key facts about the Canada-US trade relationship that might surprise you.

1. The US Has a Merchandise Trade Surplus with Canada (When Energy Is Excluded)

While the overall US-Canada merchandise trade balance shows a deficit, this picture is skewed by energy imports. When energy is excluded, the US actually had a merchandise trade surplus of $28.6 billion with Canada in 2023, a trend which has held since 2007¹, driven by high-value sectors like manufacturing, machinery, and automotive parts.

Why it matters: This surplus supports thousands of American jobs and highlights how interdependent the two countries are. As Cumberland Chief Investment Officer Peter Jackson has commented, energy imports heavily influence the deficit figures, but in key sectors like manufacturing, the US gains more than it loses.

2. Canadian Crude Imports Create a Win-Win Through Refining Arbitrage

Canada exports about four million barrels of crude oil to the US every day, accounting for 21% of US daily consumption². Canadian heavy crude oil flows into US refineries at a discount that can generally be estimated at $10–$20 per barrel as compared to lighter WTI crude³. US refineries process this Canadian heavy crude into gasoline and diesel, which are sold in the domestic market at competitive prices. Meanwhile, the US exports some of its own lighter crude globally at a premium.

The takeaway: As we have noted, this refining arbitrage benefits US refiners, oil producers, and consumers by keeping fuel prices low while allowing the US to profit from exports.

3. Canada Buys More US Goods Than Any Other Country

In 2023, the US exported $449 billion worth of goods and services to Canada, making it the US’s #1 export destination4. From machinery to precision instruments and aircraft, Canadian businesses are major consumers of American innovation. And it’s not just confined to border states—it’s a national relationship. In fact, 36 US states, from Michigan to Texas, rely on Canada as their #1 export destination5.

The impact: Industries across the US depend on Canadian demand, and disruptions in trade could ripple through local economies nationwide.

4. Canadian Imports Drive US Manufacturing Efficiency

Nearly 70% of US imports from Canada are used as inputs for the production of American goods6. From automotive parts to metals and chemicals, Canadian imports fuel US factories, enabling them to remain competitive globally.

Why it’s important: Tariffs on Canada could increase input costs for US manufacturers, reducing their ability to compete internationally.

5. Tariffs on Canada May Hurt US Consumers More Than Canada

Because Canadian energy and raw materials play such a large role in US supply chains, imposing high tariffs would likely lead to higher costs for American manufacturers and consumers. Tariffs on key imports, like energy and automotive parts among others, could raise production costs, making American goods less competitive globally.

It’s also critical to note that, while Canada’s overall trade imbalance with the US has increased since Trump’s first term, largely driven by higher energy prices, it is still dwarfed by the imbalances with China (close to US$300 Billion) and the Euro Area and Mexico (each around US$200 billion +/-)7.

The twist: Canada’s close trade ties create efficiencies that directly benefit the US economy. And, while Canada has been portrayed as a major contributor to the US trade deficit—in reality, it is not. Targeting it with tariffs is more about political narratives than economic necessity.

In our view, a closer look at the trade data reveals that Canada is not just another trading partner—it’s an essential economic ally to the U.S. As tariff debates unfold, acknowledging this deep interdependence could pave the way for more strategic solutions that ultimately benefit both nations.

At Cumberland, we’re closely tracking these developments to assess their impact on markets and position our portfolios accordingly. Our focus remains on helping clients navigate uncertainty while balancing attractive investment opportunities and prudent risk management.

Are the Magnificent Seven (and the other 493 stocks) fairly valued?

Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla comprise the so-called Magnificent Seven – companies revered for their high tech, high growth, high margins, and high investment returns over the past decade.

Following steep declines in 2022, the Magnificent Seven have grown so far and fast, that they currently make up close to 30% of the S&P 500 Index’s market value. As such, they can be seen as overshadowing the other 493 stocks in the index.

So with the strong stock market gains of 2023 and the first quarter of 2024, it now seems fair to ask:

“Are the current valuations of the Magnificent Seven justified?

And what about the rest of the market?”

Let’s start with earnings

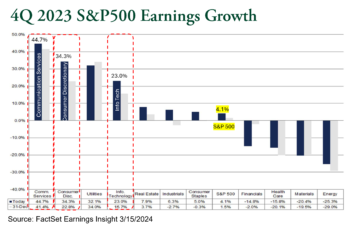

The following chart shows that 73% of S&P 500 companies reported a positive earning-per-share surprise at the end of 2023, and 64% reported a positive revenue surprise. And, as highlighted in yellow, overall S&P 500 earnings grew 4.1% year-over-year.

This earnings growth was much stronger than the 1.5% market consensus, and marked the second quarter of earnings growth after three negative quarters. In short, corporate earnings took a powerful turn to the upside in the final quarter of 2023.

There’s something else to notice about these upside earnings surprises: they were driven disproportionately by the Magnificent Seven’s industry sectors, Communication Services +44.7% (Meta, Alphabet), Consumer Discretionary +34.3% (Amazon, Tesla) and Information Technology +23.0% (Microsoft, Apple, Nvidia).

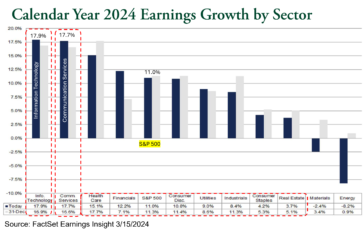

Looking ahead to 2024, the next chart shows that market participants anticipate more of the same going forward, with Information Technology earnings expected to grow at +17.9% and Communication Services at +17.7%, making them materially positive standouts. Looking beyond these, the chart also demonstrates a much wider breadth of earnings growth ahead, with positive, mostly high single-digit or low double-digit growth expected in all but two market sectors. Take a closer look below.

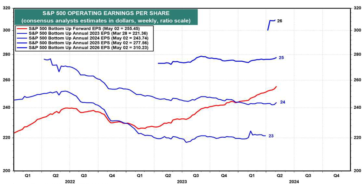

In addition, as the next chart shows, S&P 500 calendar operating earnings growth for 2024 and 2025 have recently turned positive, after having pulled back in previous months.

So what does this mean for valuations?

Earnings are strong, but you might wonder if valuations are getting ahead of earnings. In other words, broadly speaking are S&P500 stocks relatively expensive? The next chart shows the forward 12-month Price to Earnings (P/E) valuation multiple for the S&P 500 (green line). At first glance, the current multiple of about 21.0x looks a bit rich relative to its historical near 10 year average of 18.2x. However, there is in fact some distortion in this picture when you look closer.

The P/E for the Magnificent Seven stocks (red line) is currently at 29.5x, which heavily skews the S&P 500 index, since it is a market capitalization-weighted index. That means the biggest companies have the biggest influence, and the Magnificent Seven are huge, representing about 29% of the index.

If we de-emphasize the Magnificent Seven by equal weighting the stocks in the index (purple line), the S&P 500 trades at a much more reasonable P/E multiple of 17.3x, which is barely above its long-term average of 17.1x and below near 10-year average of 18.2x.

With that, perhaps the most relevant question is whether the current multiple or valuation for the Magnificent Seven is justified. When we compare their outsized Q4 2023 earnings growth and the growth expected for 2024, the answer is yes right now.

The chart below shows the historical forward P/E ratio premium of the Magnificent Seven relative to the S&P 500, another interesting set of statistics. At its current level of 40%, the premium is large, however, it currently sits at the low end of its 9-year trading range of about 30% to 80%. The Magnificent Seven have often traded at a significantly higher premium, and as recently as last summer.

The final verdict

While we don’t own ALL of the Magnificent Seven stocks, as of this writing, we are comfortable with core positions in Apple, Alphabet and Microsoft, as well as Amazon (recently added) and Meta (sold in early 2022 and repurchased in 2023). While they command premium valuations, they are remarkably profitable businesses with the potential for continued, strong earnings growth ahead.

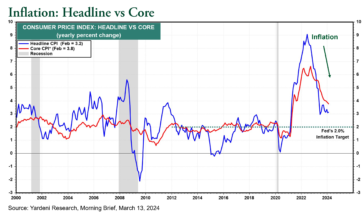

As for the other 493 stocks in the S&P 500, valuations are not unreasonable, particularly given the US economic outlook and expected continued earnings growth. The US Federal Reserve is still looking to ease interest rates against a backdrop of solid economic growth, low unemployment, and inflation that continues to move toward target levels as shown in the final chart below.

So to close, historically stock markets have performed well in times like these. We remain selective by sector and company, while being generally positive on the outlook for the market.

Q1 2024 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the First Quarter of 2024. You can download the full reports via the links shown below.

KEY OBSERVATIONS

During the first quarter of 2024, the S&P 500 was up +10.6% in U.S. dollars, or +13.3% in Canadian dollars. We believe that this large advance was primarily the result of a strengthening economy, growing earnings, and the expectation of rate cuts later this year.

Price/earnings multiple expansion – or an increase in what investors are willing to pay for every dollar of earnings – is not unusual at this point in the cycle. This leads to stock valuations that are higher than historical averages, however, we don’t believe they are unreasonable today.

Last week’s update by the Federal Open Market Committee of the U.S. Federal Reserve seems to support our expectation of lower interest rates in the second half of 2024. However, with recent bumps in the inflation rate, the market’s expectation of as many as six rate cuts this year has been pared back to about three. This sent mixed signals to the fixed-income markets, which saw rates drift modestly higher. However, credit spreads remained strong and returns were bifurcated, with corporate bonds outperforming their government counterparts.

S&P 500 earnings grew +4.1% year-over-year last quarter, much stronger than the 1.5% market consensus growth rate at the end of 2023. This may have been skewed by positive earnings surprises in the Magnificent 7 Technology stocks, however, it was the second quarter of overall positive earnings growth after three negative quarters, which gives us some confidence in the consensus calendar forecasts, which call for earnings to reaccelerate to double-digit levels in 2024 and 2025. Growing earnings could provide a catalyst for further market appreciation.

This is a US election year, and while we can’t rule out a pullback moving toward the November 5th election day, particularly as pullbacks of 5-10% typically happen most years at some point or another, stocks historically tend to rise regardless of which party is in the White House or controls the House and Senate.

Overall, we remain positive on the markets given that the upcoming monetary easing cycle and the decline in interest rates is likely to take place against a backdrop of solid economic growth, low unemployment, declining inflation and improving earnings.

NORTH AMERICAN EQUITY UPDATE

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

Our overall equity and cash exposure were unchanged this quarter at 95% and 5% respectively. Our U.S. equity exposure increased from 47% to 52,% while our Canadian exposure decreased from 48% to 43%. It is important to note that many of our clients’ portfolios are invested in our North American plus International Equity strategy, meaning that the actual weights of US and Canada within their equity holdings will be proportionately less than this given the allocation to international companies.

During the quarter, we continued to shift our allocation in favour of US equities (+5%) over Canadian equities (-5%). While there are pockets of strength in Canada, overall forward 12-month earnings growth remains negative in Canada as compared to positive earnings and improving breadth of earnings in the U.S. Our Canadian holdings are focused on these pockets of strength and most of the Canadian companies we own have globally diversified revenue sources despite a Canadian headquarters.

We added two new investments during the quarter:

Mastercard operates a digital payment network with integrated solutions that links consumers, banks, merchants, and merchant acquirers. Mastercard’s business is protected by a network effect as merchants are more likely to subscribe since so many consumers carry its cards, and consumers are more likely to carry a card that is accept in so many places. We think Mastercard has a long runway for growth as they benefit from the ongoing secular shift from cash to electronic payment, especially outside of North America, and the continued adoption of their value-added services, which include fraud detection, data analytics, and loyalty programs.

O’Reilly Automotive owns and operates automotive part distribution warehouses and retail stores predominantly in the United States, but also in Mexico and Canada. O’Reilly serves both the do-it-for-me (pro) market as well as the do-it-yourself (consumer) market through its 5,600 stores. O’Reilly has 30 distribution centres located in 30 major cities, and it has used its distribution advantage to build out its pro business, which now makes up 45% of its revenues. As a result, O’Reilly has better inventory turns, working capital management, and higher return on invested capital compared to most of its peers.

A detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

Global equity markets started off 2024 with a bang. Some of the drivers were strong corporate earnings, anticipated interest rate cuts, and a turnaround in investor sentiment. Given this backdrop, stock market returns were strong across many geographic regions.

About a year ago, economists and investors were forecasting a U.S. recession due to the impact of stubborn inflation and higher interest rates. In March of 2023, approximately 65% of economists polled by Bloomberg were convinced the U.S. economy was headed for a serious downturn within 12 months. This widely held viewpoint has completely reversed.

Given the resilience of the U.S. economy and a significant decline in inflation, economists and investors have now largely abandoned their “hard” or “soft” landing recession predictions. Indeed, 45% of now believe the U.S. economy is headed for a “no landing” scenario, where inflation falls towards the Fed’s 2% target and economic growth remains firm.

Outside of the United States, the global economy is growing, although it remains sluggish across many parts of the world. Markets are now expecting the European Central Bank to cut rates in June, which should help the recovery across the Eurozone. In China, the economy remains weak but there is some recent evidence of positive momentum.

Good news has continued to come out of Japan, as its central bank raised interest rates for the first time since 2007. This is viewed as a sign that Japan may have finally won its fight against deflation, with prices now rising consistently for the first time in decades.

Overall, we are seeing encouraging signs across the largest economic regions outside of the United States and continue to have a favourable outlook for global equity markets.

We added several new investments across a variety of industries during the quarter, including Alimentation Couche-Tard, Mastercard, O’Reilly Automotive, and Vertex Pharmaceuticals in the Global portfolio, and Icon, Inditex, Itochu, Mastercard, and Shin-Etsu in the International portfolio.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

In Q4 2023, the yield curve decreased markedly, which resulted in the strongest quarterly performance by Canadian bonds in over 20 years. In Q1 2024, it would be difficult to repeat such a performance. Indeed, performance was mixed as rates drifted moderately higher and inflation continued to trend downwards, but not at the pace many would like it to.

Economic growth was stronger than expected during the quarter, with the US GDP figures meeting or exceeding the consensus estimates in each of December, January and February. Here in Canada, there was a very modest upside surprise in GDP growth in January. The impact from these results was the realization that, while progress in the inflation fight continued, it did not proceed as much as expected. This, in turn, meant that the long-awaited cut in interest rates by central banks would be delayed – known as the “higher for longer” narrative.

Nonetheless, we continue to believe that the fixed income market will be good for investors in 2024 with returns exceeding the rate of inflation and the opportunity to benefit from potential interest rate cuts by the central banks.

Credit spreads, or the difference in yield offered by a corporate bond versus a federal government bond, tightened over the first quarter, reflecting confidence that economic activity had exceeded expectations, and that the economic outlook had improved somewhat.

In terms of portfolio investment positioning, as we anticipate rate cuts in the relative near-term, it makes sense to extend the fund’s duration, which will positively impact valuations if the cuts do materialize. We also anticipate modest increases in weights in federal, provincial and/or investment grade corporate bonds. We will continue to have exposure to non-investment grade credits we identify that possess attractive risk-return prospects.

Looking ahead, we believe that any recession will be mild, or may not be experienced at all. This view is buttressed by continued low unemployment figures, providing a buffer against a consumer-driven shock to domestic demand. Further, rate cuts should also ease to a degree the mortgage-related stress on consumers and the economy.

In summary, absent a material and unforeseen shock, we firmly believe the remainder of 2024 will provide a constructive environment for fixed income investors.

First Quarter 2024 Fixed Income Strategy Review

Recall that in last quarter of calendar 2023 the yield curve decreased markedly (and as you readers and investors know, when yields drop, bond prices rise). The resulting bond price rally that occurred was the strongest quarterly return performance by Canadian bonds in over 20 years. At the time, some believed there was a reasonably good chance interest rate cuts by the Canadian and US central banks might start as early as March 2024.

It would be difficult to repeat such a strong performance, as a result, the first quarter of 2024 always had a tough act to follow and the bond market return performance was in fact a mixed bag. Interest rates drifted slightly higher (see Canadian Yield Curve chart below), which is a negative factor for bond return performance. Inflation continued to trend downwards at a slower than anticipated pace, but the Canadian economy remained stronger than expected with a very modest beat in GDP growth in January (the latest data released), thus creating the environment for mixed bag return profile.

First Quarter 2024 Global Equity and International Review

After delivering robust returns in 2023, global equity markets started off 2024 with a bang. Some of the key factors driving the returns included strong corporate earnings, an expectation of interest rate cuts in 2024, and a turn in investor sentiment with investors abandoning their recession calls. Given this backdrop, stock market returns were not only strong, but also widespread across geographic regions.

First Quarter 2024 North American Equity Strategy

In our view, the current market advance is a result of the combination of a strengthening economy, growing earnings and the expectation of rate cuts later in 2024. The market’s focus has pivoted away from concerns about rising interest rates, which facilitated the rally during the fourth quarter of 2023, focusing on the forecasted earnings growth in both 2024 and 2025 (after flat earnings in 2023) which took the markets to new heights in 2024 year to date. Price/earnings (P/E) multiple expansion (i.e.: an increase in what investors are willing to pay for every dollar of earnings) is not unusual at this point in the cycle as earnings estimates catch up. This leads to stock valuations that are higher than historical averages, however with that said, we still don’t believe they are unreasonable for this point in the cycle.

Finally, last week’s update by the Federal Open Market Committee of the U.S. Federal Reserve (Fed), seems to support our expectation of a lower Fed Funds Rate (and therefore lower interest rates) in the second half of 2024.

Q2 2023 Strategy & Market Reviews

Each quarter, our Investment Management teams publish their key observations and portfolio updates across Global Equity and Fixed Income markets. This is a summary of our views for the Second Quarter of 2023. You can download the full reports via the links shown below.

KEY OBSERVATIONS

“The US government won’t default on its debts. There are plenty of jobs. Unit-labor-cost inflation is moderating. The banking crisis is abating. The recession is still a no-show. Earnings were better than expected during Q1 and are probably bottoming during the [second] quarter. The FOMC likely will pause its rate hiking for at least one meeting (they did). Summer is coming. No wonder the S&P 500 sailed to a new 2023 high yesterday.”

That is a summary of “what’s going on” according to respected market-watcher Ed Yardeni, and it’s generally music to our ears, even if it’s not coming from Marvin Gaye… In other words, his views closely match our own. On June 8th, less than a week after Yardeni wrote this, the S&P500 officially entered a new bull market, up more than 20% from its 52-week low in October 2022.

During the second quarter, the S&P500 total return was +8.7% in US dollars or +6.4% in Canadian dollars, as the Canadian dollar appreciated about +1.5 cents. The TSX total return was +1.1%. While given technology stocks continued to dominate the performance of the S&P500, we saw considerable widening in the breadth of performance late in the quarter as the market began to price in the possibility of a soft landing rather than a recession.

In terms of valuations, the TSX and the FactSet European index are trading at 10% and 5% discounts to their 20-year averages, respectively. The S&P 500 is trading above its historical average, but this is arguably skewed by a handful of large companies.

Indeed, the 10 largest S&P 500 companies by index weight have outperformed by almost 4x over the past 12 months, and we own five of them (Apple, Microsoft, Alphabet, Facebook and United Health Group). We are balancing these higher-growth holdings against attractive value-oriented names like GM, Elevance Health, Royal Bank, and Rogers Communications, among others.

Overall, we remain constructive on the equity market, notwithstanding the recent rise in prices. While corrections commonly occur during bull markets, we believe that the positive economic fundamentals that we observe should limit the downside. The earnings outlook is improving and, with economic growth slowing but likely not turning strongly negative, interest rates are closer to a peak than a trough, suggesting that equity market valuations are also less of a headwind going forward than they were in early 2022.

Peter Jackson, HBSc, MBA, CFA

Chief Investment Officer

Portfolio Manager, North American Equities

During the quarter, our overall equity exposure was unchanged at 94%. Within the North American investments, our US equity exposure increased from 40% to 42% while our Canadian exposure decreased from 54% to 52%. Cash was unchanged at 6%.

Currently, our portfolio is positioned toward value-oriented stocks (including financials, consumer discretionary, industrials, energy and materials), which make up 58% of the portfolio, although this has declined from 63% on December 31st. Exposure to growth stocks (including healthcare, information technology and communication services) increased to 34%, up from 29% on December 31st.

We added the following new stock positions during the 2nd quarter:

Quebecor Inc. is a Canadian diversified media and telecommunications company based in Montreal. The acquisition of Freedom Mobile has opened a large avenue of growth for a company that has been traditionally restricted to the province of Quebec. We see a long runway ahead for Freedom that is not reflected in the present share price.

Novo Nordisk is the world’s leading diabetes and obesity pharmaceutical company with a market capitalization of approximately US$360bn. Its Ozempic drug is now the most prescribed GLP-1 product. The company has demonstrated high margins and free cash flow, and a ~45% dividend payout while continuing to invest in its drug pipeline.

Applied Materials is a leading supplier of advanced equipment, tools, inventory, and maintenance services to logic, memory and analog semiconductor companies. We see the company benefiting from the growth in digitization, automation, and AI, plus onshoring of semiconductor supply chains and a rebound in capital spending.

A detailed review of each company can be found in the full report per the link above.

GLOBAL EQUITY UPDATE

Phil D’Iorio, MBA, CFA

Portfolio Manager, Global Equities

After generating strong gains during the first quarter, global equity markets also continued their upward climb during the second quarter. On a total return basis, the STOXX Europe 600 index returned +2.7%, the Nikkei 225 index was +18.5%, and the Nasdaq gained another +13.1%, taking its year-to-date gain to more than 32% – its best first half of a year since 1983.

Despite these returns, a great deal of pessimism remains in the market. Several commentators continue to warn about a forthcoming recession. Most are concerned about the potential for a recession in the US given elevated inflation, aggressive monetary tightening, and the fallout from the collapse of several regional banks. Despite these concerns, the U.S. economy has demonstrated remarkable resilience and consumers continue to spend.

US housing was one of the hardest hit sectors in 2022, but recent data suggests that we could be on the cusp of a rebound. New home sales jumped 12.2% to the highest level since February 2022. A potential rebound in U.S. housing is significant given that the housing sector is one of the largest and most important sectors of the U.S. economy, contributing an estimated 15-18% to GDP.

Inflation continues to move in the right direction as measured by the consumer price index. According to recently published data from the U.S. Labor Department, the inflation rate for the month of May cooled to its lowest annual rate in more than two years.

The global economy is growing at a modest pace, inflation has been moderating in both the U.S. and Europe, and consumer confidence has recently improved in the US. Corporate earnings have proved to be more resilient than the market was expecting. Taking all of this together, we remain cautiously optimistic as the second half of the year gets underway.

During the quarter, we initiated several new positions. In portfolios invested in our Global strategy, we added Applied Materials, Deckers Outdoor, Novo Nordisk, RELX, and YUM! Brands. In the International strategy, we invested in ASML, Hoya, Sony, and YUM China.

A detailed review of each company can be found in the full report per the link above.

Owen Morgan, MBA, CFA

Portfolio Manager, Fixed Income

In reverse to what happened in Q1 of 2023, interest rates across the Canadian yield curve shifted higher in Q2, with the more pronounced moves occurring in the short to medium term terms. The slope of the curve also steepened negatively. Typically, longer-dated bonds offer more yield given the additional risks inherent in lending money over a longer timeframe. However, at present, and as has been the case for the past year or so, the curve is “inverted,” with higher rates at the short end of the curve than the long end.

The primary factor influencing fixed income markets was inflation and central bank policies to address it. While inflation continued to decline on a year over year basis, some underlying trends clouded market sentiment and dulled risk appetite. For example, the April CPI reading of +4.4% marked the first time in 10 months that this figure rose. Even though it dropped back to +3.4% in May, it still looks a long way from the Bank of Canada’s stated annual inflation target of 2%.

Meanwhile as described above, economic growth as measured by GDP slightly exceeded expectations during the quarter, as did employment and wage growth statistics. On the surface, this may seem like positive news, however it is negative news from an inflationary perspective, as a stronger economy increases pricing pressures. These factors caused the bond market to reassess the probabilities that interest rates would be “higher for longer.”

Our expectation is that inflation will continue to decrease, albeit in a slower and less linear manner, and that we are very close to the end of the rate hike cycle, perhaps after one more increase in mid-July here in Canada.

Given the shape of the yield curve, and that it is inverted, the most attractive rates are in the shorter end. We see opportunities in existing issues that are trading below par, and therefore offer higher tax-advantaged returns for taxable investors. At the same time, we have identified some attractive new issues, such as short-dated bonds from some of the major Canadian banks offered with a 5.5% coupon.

All in all, it has been a solid first half of the year, and we remain constructive on fixed income as a place to allocate investment funds.

Second Quarter 2023 Global Equity and International Review

After generating strong gains during the first quarter, global equity markets continued their upward climb during the second quarter. On a total return basis, the S&P 500 was +8.7%, the STOXX Europe 600 index returned +2.7 %, and the Nikkei 225 index was +18.5%. The Nasdaq was particularly strong with the index generating a total return of +13.1% during the second quarter. For the first six months of the year, the Technology-heavy Nasdaq index soared by more than 32%, which marks the best first half for the Nasdaq since 1983 when it rose by 37%. The strong gains in the Nasdaq have largely been driven by the excitement surrounding artificial intelligence (AI) and the potential productivity gains that AI could generate for the global economy.

Second Quarter 2023 Fixed Income Strategy Review

In a reverse from Q1, the Canadian yield curve level (the general, reflecting overall value of interest rates across the curve) shifted higher in Q2, with the more pronounced moves occurring in the short to medium term tenors (encompassing the 3 month to 7 year bonds). This is shown in the Canada Yield Curve chart below. Rates moved higher by an average of almost 60 bps across the curve. As bond investors, you know that when interest rates (yields) rise, bond prices fall, albeit modestly in this case.

Second Quarter 2023 North American Equity Strategy

So “What’s Going On” according to Ed Yardeni June 2nd, 2023.

This quote was music to our ears even if it was not from Marvin Gaye. It is in line with our current thinking at Cumberland and pretty much summed up what happened in the second quarter. In fact, the S&P500 officially entered a new bull market on June 8th, up more than 20% from its 52-week low of 3577.03 on October 12th, 2022.