Third Quarter Fixed Income Strategy Review

The drivers of fixed income valuation and thus its performance in Q3 2022 remained similar to those we spoke about for the first half of the year, resulting in a modest quarterly gain in total return. Inflation remained public enemy number 1,peaking at 9% in the US and 8% in Canada during the quarter, before receding through quarter end due primarily to declining energy prices.

Both the Federal Reserve and the Bank of Canada hiked their benchmark interest rates very aggressively during the quarter in response to extended inflation concerns.

Discussion of a global recession continued with increasing prices, consumer debt burden, employment levels and supply chain issues consuming the majority of the bandwidth for slowing growth theories in several key markets.

Kipling Strategic Income Fund

The Kipling Strategic Income Fund had a solid August 2022 relative to its benchmark. The M series of the fund generated a return of +0.1%, while the benchmark returned -2.2%. We have positioned the fund to have a shorter duration than the benchmark. This positioning benefitted our unitholders in August.

The bond market seems to be searching for direction and trying to decide if inflation or recession is the bigger risk. On July 27th, the Federal Open Market Committee (“FOMC”) in the United States raised the Fed funds rate by 0.75%. However, comments made in the press release and at the press conference by FOMC Chair Jerome Powell were deemed “dovish” by the market and the bond market rallied (interest rates went down/bond prices went up). The following Friday, strong employment data in the U.S. caused the market to fear that more interest rate increases were likely, and the bond market sold off. The following week, U.S. inflation data was slightly lower than forecast and the bond market rallied yet again. As August wore on, the bond market generally drifted lower.

We believe central banks in Canada and the United States are very focused on reducing inflation. Consequently, central banks will continue to increase short-term interest rates through at least late 2022 and will be reluctant to reduce interest rates. In early August, markets were pricing in four interest rate increases from the FOMC, followed by three interest rate cuts before the end of 2023. In our opinion, this bordered on irrational exuberance.

In a speech on August 31, Loretta J. Mester (President of the Federal Reserve Bank of Cleveland and a FOMC voting member) said of interest rates that “I think we’re going to have to move them up … above 4% and probably need to hold them there next year,”. Similarly in an August 30 speech, John C. Williams (President of the Federal Reserve Bank of New York and FOMC Vice Chair) said that the possibility of interest rates cuts in 2023 was “very unlikely”.

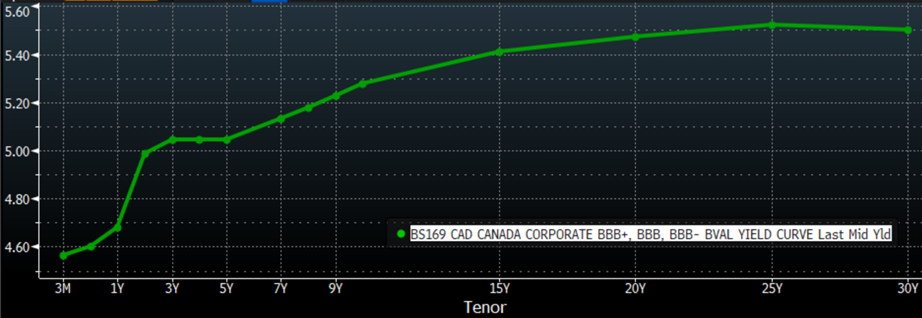

The yield curve is relatively steep in the extreme short end, but flattens in the 2-5 year range. Based on this yield curve, moving from 2 year (4.99%) to 5 year (5.05%) only adds 6 basis points in yield, but should increase interest rate sensitivity (which could be a proxy for volatility) by 150% all else equal. That is not a worthwhile trade-off in our opinion. Consequently, the duration of the fund is approximately 1.91.

Figure 1: Bloomberg Canada BBB+, BBB, BBB- Yield Curve

We have positioned the Kipling Strategic Income Fund to have a shorter duration than the benchmark (1.91 vs. 5.34) and to have a higher yield-to-maturity than the benchmark (7.1% vs. 4.4%). In an environment where all interest rates move higher, the fund should outperform the benchmark due to its’ shorter duration and higher yield-to-maturity. In an environment where interest rates are unchanged, the fund should outperform due to its’ higher yield-to-maturity. In an environment where all interest rates move lower, the fund should underperform. However, the underperformance should be mitigated by the higher yield-to-maturity and should still be positive as all bonds would increase in value (all else equal). We think this is the best way to position the fund in the current environment.

Second Quarter Fixed Income Strategy Review

The second quarter of 2022 echoed many of the themes evident in the first quarter. Inflation in both US and Canada exceeded already lofty expectations and climbed to levels not seen since the early 1980s. The Federal Reserve and the Bank of Canada hiked rates sharply and aggressively in response. Oil, a primary driver of inflation, hit multi-year highs as well, as the conflict in

Ukraine entered a new, possibly more protracted stage, roiling energy markets. The impact to financial markets, although not as severe as the first quarter, was steeply negative across most asset classes.

Ready? (or Not) …Changes are Coming

Q1 started with Omicron, the COVID-19 variant being front and center: countries around the world re-imposed lockdowns and travel restrictions. Not sure anyone was “ready” for another wave and being under restrictions again, but as the French say … “c’est la vie”. While working from home continued for most of us, it was far from boring for bond portfolio managers: it was like watching the greatest bond movie in history unfold.

Transformers Land on Earth?

Yes, Omicron has landed, but in COVID-19 form. Just as we thought the Delta variant would be our focus, another variant emerged – Omicron. Markets not only reacted to the surge in COVID-19 cases this quarter, but also to the surge in inflation around the world and what central banks are going to do about it.

Boomerang- Lackluster Quarter

The first 2.5 months of the quarter were lackluster for the most part as markets moved quietly and slowly in a positive direction. Maybe most people just wanted to enjoy summer and not worry or even think about the markets. As summer started to wind down, unfortunately Covid-19 did not: cases started to spike again. Also, by mid September investors woke up and found reasons to focus their attention on lingering issues that would teeter the markets: the US debt ceiling expiration and the ability of one of China’s largest real estate developers, Evergrande Group, to pay some hefty interest payments on their debt obligations.

Accelerated Progress – But Let’s Not Totally Let Our Guard Down

Covid-19 fatigue is real. There has been so much conflicting news, that people have just started tuning out. For instance, to mask or not to mask: CDC is suggesting that no masks are required for fully vaccinated individuals, but yet WHO is still suggesting that a mask should still be worn for fully vaccinated individuals for better prevention again the Delta variant . Even in Canada, there has been some flip flopping regarding the use of the AstraZeneca vaccine about its safety and more recently, the push to mix and match vaccines in an attempt to push for herd immunity. Who can follow all of this and what is believable? Well, the one thing that is positive is Canada has made great progress in vaccinations over the last quarter! Whether or not it’s the right step forward on their methods, vaccinations have accelerated during the quarter with 67% of the Canadian population receiving 1 dose and 31% of our population now being fully vaccinated. Provinces are staggering re-opening over the coming weeks with targets of being fully operational by the fall. Vaccinations do seem to be working in terms of limiting the severity of Covid-19

(and variant) symptoms, reducing hospitalizations and increasing the confidence of society to be more active.

Patience is a Virtue

“Are we there yet?” It’s been more than one year since much of our society started working from home. Clearly, life is still not “normal” and it is very unclear what the “new normal” will look like or when we can say the pandemic is behind us. Everyone’s patience has been tested and is still being tested. Vaccination in Canada is rolling out at an embarrassing snail’s pace compared to other countries. As warmer weather approaches for Canada, provincial governments are concerned that it will lure people to venture outside more and gather socially. New variants are on the rise and we are seeing evidence in the positive test numbers that yet another wave is developing. I’m losing count which wave this is, as life has not changed much over the last 12 months for me, everything is pretty “boring” and routinely the same.

Income Strategy Third Quarter Review

The long awaited summer came and went in a flash as another quarter flew by. Q3 was a bit more trial and error as the reopening of the economy (restaurants/stores/offices) was phased-in with caution in Canada. Covid-19 cases remained low at the start of the quarter but started to spike again as the quarter came to an end.

The Canadian government continues to be supportive to ensure citizens will be able to endure these times of hardships. While there was optimism that people were returning to work and the unemployment rate looked to be declining from the heights of the pandemic, Canada is funding its way through the pandemic with debt. The province of Quebec announced a one-month lockdown for October towards the end of the quarter, setting alarms that this pandemic is definitely here to stay and drawing concerns that other provinces will follow.

Income Strategy Second Quarter Review

Heading into the start of the quarter, for the first time in anyone’s living memory, the world was forced to shut down and hibernate (or “social distance”) due to the threat of COVID-19. While countries and cities around the world slowly reopened throughout the quarter, most of the quarter seemed like a blur- people woke up confused about what day it was, where they were working and how or where to shop. Many had assumed back in February that we would be “done with this virus” post the normal flu season but, here we are entering Q3 still trying to understand it and get ahead of the battle to “flatten the curve”.