A Soft Landing for the U.S. Economy is in the Realm of Possibility

One of the biggest debates in the market today is whether the U.S. economy is headed for a recession or a soft landing. Given that the United States is the world’s largest economy, the outcome of this debate matters a lot given the implications it would have for the rest of the world. One of the key factors that will impact the outcome of the debate is the rate of inflation. The bears argue that inflation remains far too high and that the U.S. Federal Reserve will need to keep hiking interest rates which will eventually tip the U.S. economy into a recession. Recent inflation data over the last few weeks is not the type of fodder that the bears were hoping for given that both the Consumer Price Index (CPI) and the Producer Price index (PPI) declined more than consensus expectations.

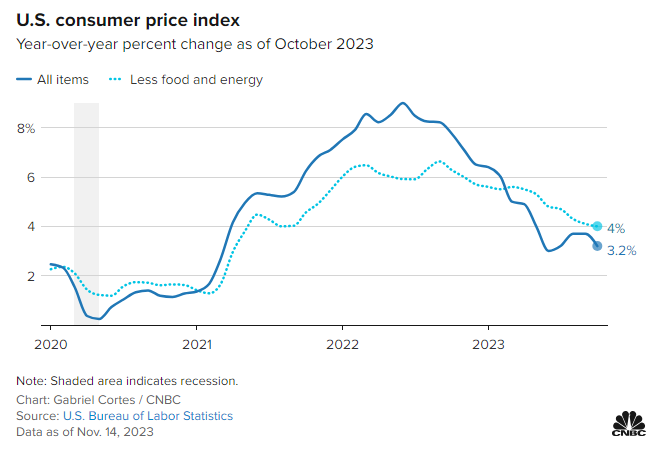

As seen in the chart below, the consumer price index for the month of October increased by 3.2% compared to one year ago. This was better than consensus, which called for an increase of 3.3%. The consumer price index is a measure of the average change over time in the prices paid by urban consumers for a broad basket of consumer goods and services.

On a month over month basis, the CPI for October was flat versus September. This is fueling hope that stubbornly high prices are easing their grip on the U.S. economy and that the U.S. Federal Reserve is in a better position to stop raising interest rates. And eventually cut interest rates.

The Producer Price Index (PPI) also delivered results that were better than consensus expectations. During the month of October, the PPI declined by 0.5%. This marked the biggest monthly decline since April of 2020. Consensus was expecting an increase of 0.1% so this result was much better than consensus.

The Producer Price Index measures the average change over time in selling prices received by domestic producers of goods and services. The PPI index measures the price change from the perspective of the seller, which is different than the Consumer Price Index that measures price change from the purchaser’s perspective. It’s good to see that both the CPI and PPI data was better than consensus as it provides more evidence that inflation is falling faster than expected.

In addition to the favourable inflation readings, there was also a positive economic data point with the recent release of the Chicago PMI Index. The Chicago PMI captures manufacturing and non-manufacturing business conditions across Illinois, Indiana, and Michigan. A reading below 50 signals contraction in the economy while a reading above 50 signals expansion in the economy. The Chicago PMI has been in contraction mode for 14 consecutive months. However, November’s reading put an end to the streak as the Chicago PMI surged past consensus expectations. The November reading of 55.8 was well ahead of October’s reading of 44, and ahead of consensus at 46. While 1 month of data is a small sample size, it is encouraging especially given the magnitude of the difference between the actual reading versus consensus.

There is one data point that will encourage the bears and that is the recent release of the Beige Book from the Federal Reserve. According to the Beige Book the economy has slowed in recent weeks as consumers are keeping a closer eye on their spending.

From our perspective, falling inflation and a sudden turn in the Chicago PMI increases the probability of a soft landing in the U.S. economy despite the slowdown that was highlighted in the Beige Book. While nothing is for certain and there are no guarantees in our industry, we are encouraged by the recent data points and believe the likelihood of a soft landing has increased.

Have a good weekend.

Phil

Third Quarter 2023 Fixed Income Strategy Review

Heading into the third quarter of 2023, the outlook for the economy gave investors a few reasons for a little optimism. Inflation had fallen very consistently for a year and measured 2.8% by the end June, not all that far off from the Bank of Canada’s 2% target. The economy, although slowing (GDP growth decreased to 1.8% for the prior 12 months by the end of Q1, and to 1.1% by the end of Q2) was still producing positive output. In addition, the unemployment figures remained surprisingly robust, with the unemployment rate at 5.5%, the net change in the labour force remaining positive (employers were adding to their payrolls), and average hourly earnings measured above 5% (meaning wages grew at a rate greater than 5%).

Third Quarter 2023 Global Equity and International Review

After a strong first half of the year, global stock markets took a breather during the third quarter. Equity market indexes were down across the board during Q3 with the S&P 500 returning -3.7%, the STOXX Europe 600 index returning -2.5%, and the Nikkei 225 returning -4.0%. Despite the weakness experienced in Q3, global stock markets have generated respectable gains throughout the first nine months of the year. On a year-to-date basis through September 30, the Nikkei 225 has returned +22.1%, the S&P 500 has returned +11.7% and the STOXX Europe 600 index has returned +6%.

Is the Artificial Intelligence hype creating a bubble in Technology stocks?

There has been a lot of excitement about Artificial Intelligence (AI) recently and this is being reflected in the Technology sector, which has led the stock market thus far in 2023. AI is a transformative technology for consumers and enterprises, and one that will create new opportunities that will enhance productivity. Although AI has been around for a long time, it has only been used to perform narrow tasks such as voice recognition. However, the more recent excitement around AI is related to the opportunities related to Generative AI. One of the key attractions of Generative AI is the Large Language Models that are being developed. One of the distinguishing factors of Large Language Models is their deep understanding of language, allowing them to perform a wide range of language-based tasks. By utilizing Large Language Models, businesses will have access to state-of-the-art models that can be customized to leverage their own data.

We believe that AI technology is for real and that it will create significant opportunities for organizations around the world. While it is still early days for Generative AI, it won’t take long for the benefits to impact the global economy. Technology research company Gartner predicts that by 2025, more than 30% of new drugs and materials will be systematically discovered using Generative AI techniques, up from 0% today. Gartner also predicts that by 2025, 30% of outbound marketing messages from large organizations will be synthetically generated, up from less than 2% during 2022. Generative AI is expected to have an impact on a wide range of industries including pharmaceuticals, manufacturing, media, interior design, engineering, automotive, aerospace, defense, medical, electronics and energy. One of the key benefits of Generative AI is that it will enable enterprises to create new products more quickly. As companies incorporate AI models into their core processes, they will be able to improve the productivity of their marketing, design, and corporate communications activities.

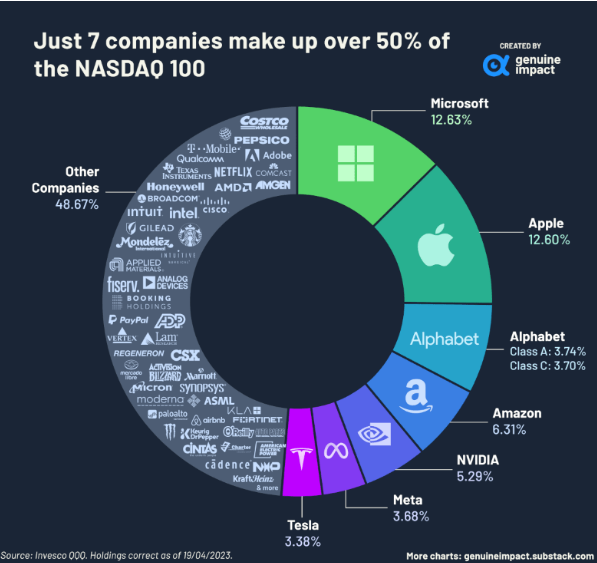

Given the huge run in AI related stocks, there are concerns that a Technology bubble is starting to form. And there is some data that one can point to if one wants to make an argument that a bubble is on the horizon. According to Goldman Sachs, hedge funds have increased their exposure to the seven biggest Technology stocks to the highest level ever seen. These 7 stocks include Tesla, Apple, Nvidia, Microsoft, Amazon, Meta and Alphabet. They have collectively been nicknamed the Magnificent Seven and they now make up more than 50% of the Nasdaq 100 as seen in the chart below.

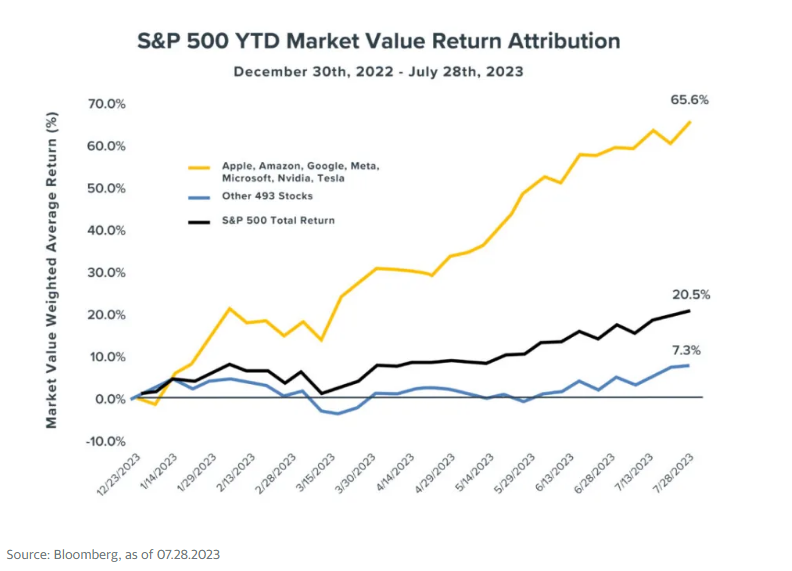

For those concerned about an AI bubble, one can also point to the outsized year-to-date returns generated by the Magnificent Seven compared to the rest of the S&P 500 as seen in the chart below.

In the first 7 months of the year, the Magnificent Seven soared by 65.6% as a group while the remaining 493 stocks in the S&P 500 gained 7.3% as a group. This implies that the Magnificent Seven have accounted for $4.5 trillion (or nearly 70%) of the S&P 500’s $6.5 trillion increase in market capitalization so far this year through to the end of July.

So are we in an AI bubble?

This is a good question, especially since many of us can remember the Dot.com boom in the late 1990’s, which ended with a 70% crash in the Nasdaq index. To address this question, we believe it makes sense to look at the individual stocks that make up the Magnificent Seven. Although some of the stocks in this group look expensive, some of them look very reasonably valued. On the expensive side, Tesla, and Amazon trade at a price-to-earnings (P/E) ratio of 54x and 43x, respectively, based on 2024 consensus estimates. While these multiples are lofty, they are lower than the 80x P/E ratio that was seen at the Dot.com peak in the late 1990’s. For the record, we don’t own Tesla and Amazon in our portfolios. On the more reasonable side, Alphabet (AKA Google) and Meta trade at a price-to-earnings (P/E) ratio of 20.0x and 17.5x, respectively, based on 2024 consensus estimates. These valuations appear attractive to us given the double-digit earnings profile of both companies. For the record we do own Alphabet and Meta in our portfolios. By looking at the individual stocks within the Magnificent Seven, we think it’s safe to say that some of the stocks within the Magnificent Seven are nowhere close to being in bubble territory.

So how are we playing the AI theme?

We own a number of stocks across our portfolios that will benefit from AI including language model developers, cloud service providers, and semiconductors. Meta has built a number of AI tools for developers including their open-sourced Large Language Models. Meta will also benefit directly from using their own models in their family of applications. Microsoft and Alphabet will also benefit from large language models and have much to gain from their cloud service offerings. Both Microsoft and Alphabet are building their platforms to enable their customers to train and deploy their models in the cloud. This will lead to an explosion of customized Large Language Models (LLM’s). Given their complexity and their size, these LLM’s will need to be stored and run in the cloud. We believe this puts Microsoft and Alphabet in a very favourable position. Within the semiconductor industry, we own several companies including ASML and Applied Materials. Given the large wave of data and computational power that will be required in the years ahead, we believe that the semiconductor industry is very well positioned to benefit from AI. In order to develop AI models, very large sets of data will be utilized in the training phase. The initial sets of data as well as the subsequent generation of new information will require semiconductor chips to perform computations and to store information. As demand for AI models grows exponentially, it will require significant gains in power efficiency. All of this will drive demand for the leading-edge chips, which is why we view the semiconductor industry as critical enabler for AI.

While there has been a tremendous amount of hype around Artificial Intelligence, we don’t view it as a bubble. We believe that AI will create significant productivity gains for the global economy in the years ahead so we don’t believe this is a fad that will disappear over time. In terms of getting exposure to the AI theme, the companies we own have very strong core businesses that were growing and highly profitable before the recent hype around Generative AI came along. While we believe the above-mentioned companies are very well positioned to benefit from AI, they have multiple avenues for growth outside of Artificial Intelligence.

Phil

Second Quarter 2023 Global Equity and International Review

After generating strong gains during the first quarter, global equity markets continued their upward climb during the second quarter. On a total return basis, the S&P 500 was +8.7%, the STOXX Europe 600 index returned +2.7 %, and the Nikkei 225 index was +18.5%. The Nasdaq was particularly strong with the index generating a total return of +13.1% during the second quarter. For the first six months of the year, the Technology-heavy Nasdaq index soared by more than 32%, which marks the best first half for the Nasdaq since 1983 when it rose by 37%. The strong gains in the Nasdaq have largely been driven by the excitement surrounding artificial intelligence (AI) and the potential productivity gains that AI could generate for the global economy.

Climbing the Wall of Worry _ May 2023

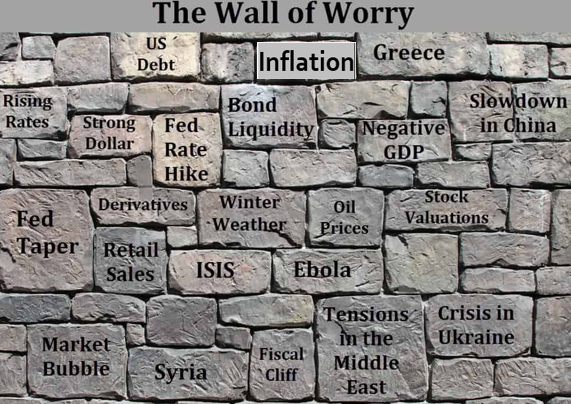

Global equity markets have been very strong thus far in 2023 with broad based strength across geographic regions. Year-to-date returns up to the closing price on May 26th are up approximately +9.5% for the S&P 500, up +8.5% for the Stoxx Europe 600 Index, and up +18.5% in Japan as measured by the Nikkei 225 Index. This might be surprising to some investors given all of the concerns including sticky inflation, the ongoing war in Ukraine, recent bank failures, the debt ceiling fiasco in the United States, and the potential for an economic recession. Despite these headwinds, global stock markets have continued to rise in 2023. This concept is often referred to as Climbing the Wall of Worry. The Wall of Worry refers to a tendency in financial markets for stocks to rise in the face of seemingly insurmountable problems. However, it usually turns out that the problems are temporary and that they are eventually resolved. As seen in the illustration below, there has been and always will be a rotating cast of things to worry about in the stock market.

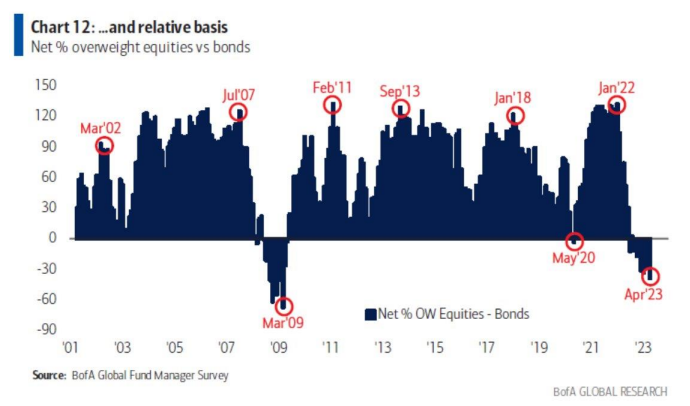

Of all the concerns that exist today, we believe the possibility of an economic recession is the one that is causing the most anxiety for investors. And we believe this is justified because the potential for a recession is a realistic concern. Bond market yield curves are currently inverted and that has historically been a sign that a recession is on the horizon. In addition, the dislocation that has occurred in the banking sector also increases the probability of a recession. One of the consequences from the recent bank failures is that lending standards in the banking industry have tightened. This is very likely to create a drag on economic growth. If the economic drag is too big, the economy will fall into a recession. However, if a recession does materialize, we believe it will be a milder, garden variety type recession. Our rationale for saying this is that global banks have robust levels of capital, while corporates and consumers are significantly less exposed to credit risk and leverage risk than they have been historically. In terms of the stock market, it appears that investors are already bracing for a recession based on market positioning. As seen in the chart below, the recent Bank of America Global Fund Manager Survey showed that global fund managers are the most underweight in equities relative to bonds since March of 2009.

The current positioning by Global Fund Managers does not mean that the stock market won’t go down if the economy falls into a recession. And it doesn’t mean that markets won’t go down if we avoid a recession. Stock market corrections are part of the cycle and they occur frequently. According to Cornerstone Macro, there have been more than 230 corrections of 5% or more for the S&P 500 since 1928. The average duration of these corrections was approximately 1.8 months and the average decline of these corrections was about 12%. The complicating factor about market corrections and economic recessions is that nobody can predict when they will happen, nor can anybody predict how long they will last. We think that with the many factors considered, the best course of action for investors at this time is to accept that they will occur from time to time and that eventually the stock market will recover. Despite the uncertainty that exists at this time, we are comforted by the types of companies we own across our portfolios. Companies with robust free cash flow generation and strong balance sheets are the types of companies that are best positioned to weather the storm should we be headed for a recession.

First Quarter 2023 Global Equity and International Review

After a challenging year in 2022, global equity markets generated positive returns during the first quarter of 2023 with all major geographic regions in the green. The S&P 500 was up 7%, the STOXX Europe 600 index climbed by 7.8%, the Nikkei 225 increased by 7.5%, and the Emerging Markets collectively generated a positive return of 4%. Some of the factors driving these returns include falling inflation, better than expected economic data in the U.S. and Europe, as well as enthusiasm related to the reopening of China’s economy.

A Strong Start to the New Year

After a challenging year in 2022, global stock markets were strong out of the gate. In the United States, the S&P 500 was up 6.2% while the Nasdaq added 10.7% during the month of January. Over in Europe, the Euro Stoxx 600 index gained 6.7% during the month of January while one of Japan’s leading indices, the Nikkei 225, was up 4.7%. The gains for all 3 markets continued into February although a portion of these gains were reversed as markets have pulled back towards the end of the month.

One of the key questions on the minds of investors is whether the strong start to the year will be sustained and whether global equity markets have begun a new bull market. Of course the answer to this question will only be known with the benefit of hindsight. The answer is not clear cut as there are many conflicting signals in the economy which are providing lots of fodder for both the bulls and the bears. The debate for the last few months has been whether the economy is headed for a soft or a hard landing. Given the recent wave of positive economic data, some market pundits are now saying that there will be no landing at all.

The bulls are pointing to an unemployment rate of 3.4%, stronger than expected retail sales in January, and a booming services sector. When the Bureau of Labor Statistics gave its update in January, it reported that the U.S. unemployment rate fell to 3.4%. Not only was this figure below consensus at 3.6%, but it also was the lowest unemployment rate in the United States in more than 50 years. For the month of January, the Commerce Department reported that U.S. retail sales rose by 3%, which was well above the consensus estimate of 1.9%. It’s safe to say that consumers are still spending. Another data point during the month of January came from The Institute for Supply Management, which reported that the ISM Services PMI increased to 55.2. The index had fallen to 49.2 in December, which is below the threshold level of 50 which signals contraction in the economy. The rebound in U.S. services during the month of January should be viewed very favourably given that services make up more than 75% of the U.S. economy.

The bears will argue that unemployment is a lagging indicator, that consumers are simply running down the last of their excess COVID savings, and that one good month of data for the ISM Services data is not enough to say that we are out of the woods. The bears would also point to January’s inflation data, which was hotter than expected. The consumer price index (CPI), which measures a broad basket of common goods and services, rose 0.5% in January and an annualized rate of 6.4%. Both of these figures were ahead of consensus estimates of 0.4% and 6.2% respectively. Excluding food and energy, the core CPI increased 0.4% monthly and 5.6% from a year ago, which were above consensus figures of 0.3% and 5.5%.

So bringing it all together, there are many good arguments from both the bulls and the bears as to why the economy may or may not go into a recession this year. Nobody knows for certain and we will only find out with the benefit of hindsight. We don’t have a strong opinion on the outcome of the recession debate. We believe there is a decent chance that a recession might be avoided but if a recession does materialize, we believe it will be a milder garden variety type recession. Global banks have robust levels of capital so a repeat of the 2008-09 Financial Crisis seems highly unlikely. Meanwhile, corporates and consumers are less exposed to credit risk and leverage risk than they have been historically. In the United States, debt servicing ratios are near multi-decade lows and 90% of U.S. mortgages are fixed, far below levels seen during previous tightening cycles. Similar to consumers, U.S. corporates have shifted to fixed rate debt. Today over 75% of S&P 500 debt is long-term fixed versus 40% back in 2007. For all these reasons, we believe that any recession that unfolds should be a shallow one as opposed to a deep, prolonged downturn. While the recession debate between the bulls and bears continues, we are comforted by the fact that the companies we own in our portfolios are well positioned for any environment that unfolds in the months ahead.

Have a good weekend.

Phil

Fourth Quarter 2022 Global Equity and International Review

2022 was a challenging year for investors. Inflation had been percolating in the background when the year began and then the onset of the war in Ukraine served as a catalyst to drive inflation even higher. In response to inflation reaching levels not seen in 40 years, central banks in various parts of the world started hiking interest rates. Against this backdrop, both stocks and bonds lost money in 2022. It is very unusual for this to happen. Since 1926 there have only been two calendar years when stocks and bonds were both down. Those years were 1931 and 1969. According to Ned Davis, 2022 marked the first time on record that both stocks and bonds fell by more than 10%.

Has Inflation Peaked?

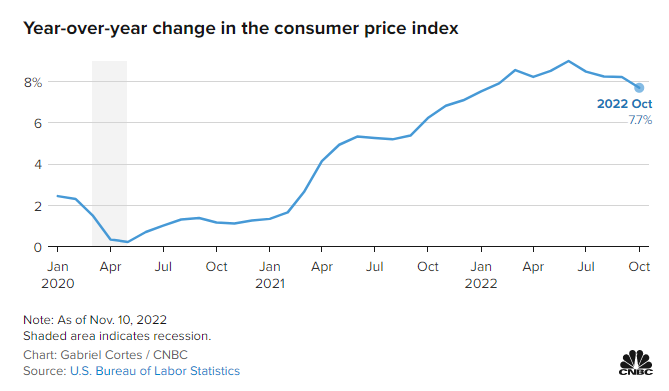

Inflation has been a problem for global economies throughout 2022 on the back of supply chain bottlenecks, inventory shortages, as well as rising prices for food, shelter, and wages. In response to the highest level of inflation in 40 years, central banks around the world have been raising interest rates to fight against sticky levels of inflation. For most of the year, it felt as though it would take a very long time for central banks to win their battle against inflation. More recently, we have received some signs which suggest that there might finally be some light at the end of the tunnel. The first positive signal was on November 10th when the U.S. Consumer Price Index (CPI) data was released by the Bureau of Labor Statistics. The Consumer Price Index is a broad-based index which measures the costs for a wide array of goods and services. For the month of October, the CPI index rose less than expected which provided a new sign that inflationary pressures might be starting to cool. As seen in the chart below, the index increased by 7.7% from a year ago, which was better than consensus estimate of 7.9%.

On November 23rd, a few weeks after the encouraging inflation report, the minutes from the Federal Open Market Committee stated that Federal Reserve officials expect to switch to smaller interest rate increases soon. The minutes specifically stated that a substantial majority of participants believed that a slower pace of interest rate increases would likely soon be appropriate. According to the minutes, the justification for a slower pace of rate hikes is related to the lagged effect of monetary policy in terms of its effect on economic activity. This past Wednesday, Federal Reserve Chairman Jerome Powell confirmed what had been stated in the FOMC minutes when he said that the U.S. central bank could scale back the pace of its interest rate hikes as soon as December.

Overall, we received a healthy dose of good news on the inflation front during the month of November. But then on the morning of December 2nd, the U.S. jobs data was released. Nonfarm payrolls in the U.S. grew by 263,000, which was well above the consensus estimate of 200,000. More importantly, average hourly earnings jumped 0.6% for the month, which was double the consensus estimate of 0.3%. On a year-over-year basis, wages were up 5.1%, which was also well above the consensus estimate of 4.6%. At the time of writing, stock markets were trading down on the news given that strong wage data might strengthen the case for the U.S. Federal Reserve to keep raising interest rates.

Although wages remain sticky, there are other areas of the economy that are moderating including commodities and housing. Oil prices have fallen by more than 30% from the peak reached earlier this year. Meanwhile, home sales in the United States declined for the ninth month in a row in October as higher mortgage rates have cooled the market. Pending sales have also weakened according to the Pending Home Sales Index which is a leading indicator for the housing sector compiled by the National Association of Realtors. During the month of October, the Pending Home Sales Index fell 4.6% on a month-over-month basis and declined 37% on a year-over-year basis.

Taking everything together, we believe that inflation is moderating enough such that we are likely in the late stages of the interest rate hiking cycle. If this turns out to be the case, it will have far reaching implications. First and foremost, getting closer to the end of the rate hiking cycle would increase the chances of a soft landing whereby the U.S. economy may avoid an economic recession. Second, it has significant implications for the stock market. Expectations about the possible end of the rate hike cycle will have an impact on the 10- year U.S. Treasury yield. In the last 5 weeks, the 10-year U.S. Treasury yield has fallen from its peak of 4.3% to approximately 3.6%. The 10-year U.S. Treasury yield is a key input for stock market valuation tools and the significant drop in the 10-year can help explain why the stock market has been strengthening in recent weeks. Finally, the end of the U.S. interest rate hiking cycle would have significant implications for the US dollar. The greenback and US-based investments have attracted significant flows from investors in 2022 not only because of higher yields that are available relative to other regions around the world but also due to a flight to safety given the geopolitical situation that evolved between Russia and Ukraine. Since reaching a peak in late September, the DXY has fallen by nearly 10%. The DXY is a U.S. dollar index that measures the value of the U.S. dollar relative to a basket of foreign currencies. On the day of that favourable CPI print on November 10th, the U.S. dollar suffered its largest single day decline since 2009. In previous cycles, a peak in the U.S. dollar has often been followed by stronger returns in Europe and Emerging Markets. We are encouraged by this phenomenon given that we have significant exposure to European equities in our Global and International mandates and many of the European companies we own have substantial footprints in emerging markets.

Notwithstanding the recent data on wage growth, we believe that inflation is on the cusp of reaching its peak and we believe that we will continue to see a moderation in the inflation data in the months ahead. Monetary policy always works with a lag so it takes time for interest rate hikes to impact the economy and this phenomenon plays into our thinking. Despite our view of moderating inflation, some questions remain. At the top of the list of questions; How long will it take to get inflation back towards the 2% level that the US Federal Reserve is targeting? And can the Fed reach this level without inducing an economic recession? These questions are a key source of debate in the market and there are no clear-cut answers. At this juncture, it is too early to declare victory and say that we are completely out of the woods. Despite this uncertainty, we are comforted by the fact that we own high-quality companies with significant competitive advantages, strong balance sheets, and proven management teams. Even if we face a recession, these types of companies can withstand challenging economic environments and they typically emerge stronger on the other side as they are well positioned to gain market share during economic disruptions.

Have a good weekend,

Phil