Big Tech Meets Big Government

As companies mature, they increasingly look to M&A to find new markets for growth. The big cap technology stocks¹ (“Big Tech”) have used M&A to (1) develop new markets and, (2), to ward off new entrants competing for market share. Regulators have been increasingly hawkish towards approving these mergers which may slow growth in the future. The relative outperformance of small and mid cap technology companies² (“SMID Tech”) in 2022, despite being more expensive at the beginning of the year, could be a signal that the market is pricing-in a more difficult growth environment for Big Tech in the future.

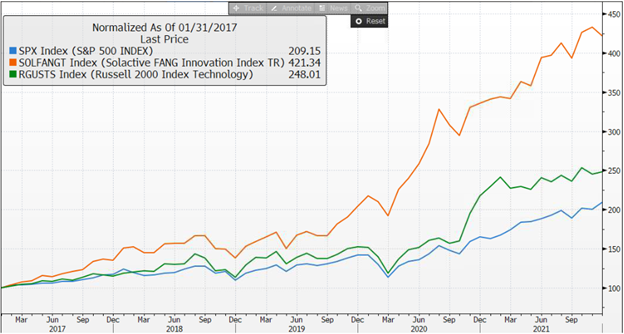

For the five years prior to 2022, the largest technology stocks (“Big Tech”) was the best place to be for US investors, with +34% compound annual return over the period. Small and medium sized technology companies (“SMID Tech”) performed well relative to the S&P 500 (+20% vs. +16%) but Big Tech outperformed them both.

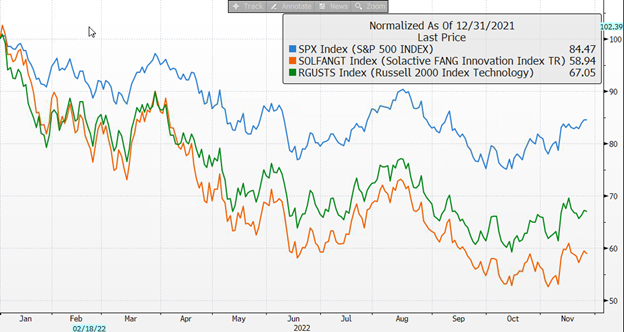

That strategy broke down in 2022 as the S&P 500 outperformed the technology sector and SMID Tech outperformed Big Tech.

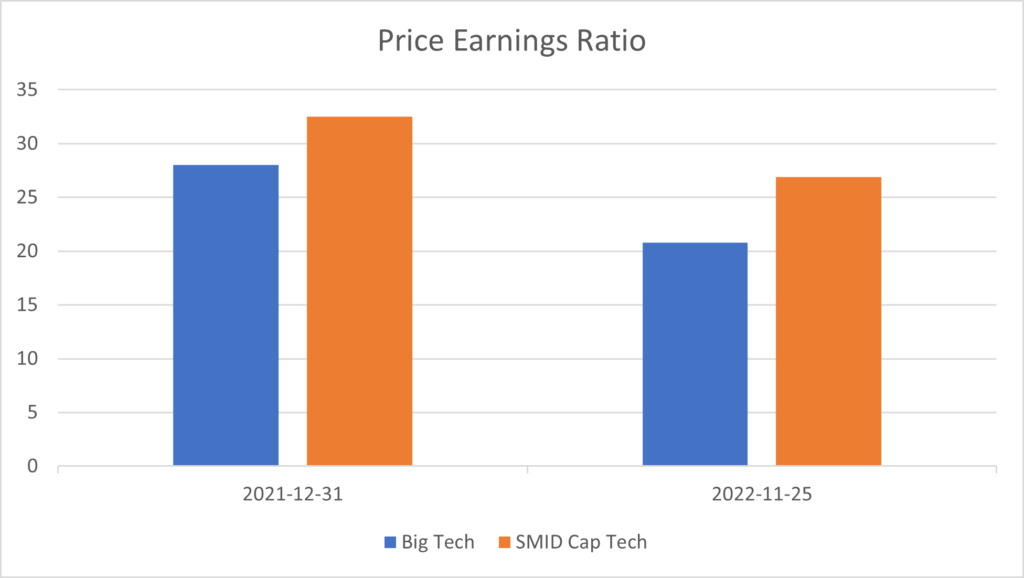

The shift from growth to value (or expensive stocks to less expensive stocks) helps to explain the lagging performance in technology, but it doesn’t explain why smaller technology companies outperformed Big Tech in 2022. On a price-to-earnings basis, SMID tech was more expensive at the beginning of the year and remains so today. Being more expensive, SMID Tech was more vulnerable to the markets shift to value over the course of the year. Yet, on a year-to-date basis, Big Tech stocks are down 41% while SMID Tech stocks are only down 33%.

Big Tech’s price-earnings multiple has contracted 26% while small cap technology’s multiple has only contracted 17%. Generally, Investors are willing to pay a higher price-to-earnings multiple if earnings are growing. The obvious inference is that investors are becoming concerned about Big Tech’s ability to grow earnings in the future.

One source of concern could be the increasing attention big technology is garnering from competition regulators. Over the last decade, Big Tech used acquisitions to establish new areas of growth and to entrench their competitive position in new markets. The usual competitive advantage for these large technology companies is a network effect – where a digital platform becomes more powerful as it gains more users, content, and developers.

In past years, regulators were less likely to interfere with network reinforcing acquisitions. One prevalent example was in 2012, when the Federal Trade Commission (the “FTC”) cleared Meta’s[3] acquisition of Instagram without objection. Meta had the dominant social media platform on the web, but Instagram was gaining momentum with mobile users. The acquisition crystalized Meta’s virtual monopoly on the web and with mobile devices. The FTC didn’t think much of the acquisition at the time. Instagram was just a small company with 13 employees.

Meta recently announced an acquisition of Within Inc., looking to entrench its early lead in virtual reality. Within Inc. is the application developer of Supernatural, the dominant dedicated fitness app for Meta’s virtual reality platform, Quest. Meta doesn’t currently compete in the dedicated fitness category. However, the FTC is challenging the acquisition on the basis that Meta has the size, resources, and capability to potentially compete in the dedicated fitness virtual reality app market.[4] If the potential competition challenge is successful, it could prevent many big technology companies – all of which have size, resources, and capability to potentially compete in any market – from entering newer markets through acquisition.

Regulators are also cracking down on “strategic” acquisitions intended to protect market share. Last year, Visa walked away from acquiring Plaid, who is building a competing payment network, to avoid a protracted legal battle with the Department of Justice.[5] Similarly, Adobe just announced the acquisition of Figma for 50x its annual recurring revenue – a price only a cornered incumbent would pay.[6] The DOJ is preparing to launch an investigation and it would not be surprising if the Adobe-Figma deal meets the same fate of the Visa-Plaid deal.

Many of the other Big Tech companies have an outstanding file with regulators to challenge an outstanding merger or for a potential breach of antitrust laws. For example, Microsoft is being challenged by the FTC and the UK’s CMA over its acquisition of Activision.[7] Alphabet is being sued by the Department of Justice for “unlawfully maintaining monopolies through anticompetitive and exclusionary practices in the search and search advertising markets.”[8] While not all these challenges will be successful, they slow down the M&A process and often result in concessions to the regulators.[9]

It’s no wonder that investors have preferred SMID Tech over the last year to avoid the uncertainty of regulator and political interference. SMID Tech companies often have robust organic growth that can drive stock price appreciation, without the need for M&A. At Cumberland Private Wealth Management, we still believe some of the larger technology companies are good investments, but we are careful to choose only those that have less growth priced in and those that continue to have organic growth opportunities available to them.

[1] This article uses the Solactive FANG Innovation Index, which comprises 15 large cap large cap technology and communication stocks including Alphabet., Amazon.com, Apple, Facebook, Microsoft, Nvidia, Netflix, and Tesla. https://solactive.com/downloads/Guideline-Solactive-FANG-Innovation-Index.pdf

[2] This article uses the Russell 2000 Index’s technology sector to refer to small and mid cap technology stocks.

[3] Formerly Facebook.

[4] Complaint for a Temporary Restraining Order and Preliminary Injunction, FTC v. Meta Platforms, Inc., Mark Zuckerberg, and Within Unlimited, Case No. Case 3:22-cv-04325 (N.D. Cal. July 27, 2022), available at https://www.ftc.gov/system/files/ftc_gov/pdf/221%200040%20Meta%20Within%20TRO%20Complaint.pdf

[5] https://usa.visa.com/about-visa/newsroom/press-releases.releaseId.17586.html

[6] https://news.adobe.com/news/news-details/2022/Adobe-to-Acquire-Figma/default.aspx

[7] https://www.gov.uk/cma-cases/microsoft-slash-activision-blizzard-merger-inquiry

[8] https://www.justice.gov/opa/pr/justice-department-sues-monopolist-google-violating-antitrust-laws

[9] Microsoft will likely have to agree to keep Activision games available to the Sony PlayStation platform

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Any comments, statements or opinions made herein are those of the author and do not necessarily reflect those of Cumberland Private Wealth Management Inc. (Cumberland) and are not endorsed by Cumberland. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.