Beyond Bull and Bear: A Clear View of The Market

In 2010, as investors were still reeling from the Great Financial Crisis, we offered a simple piece of advice: Don’t be a bull or a bear. Just be right. It was a reminder that successful investing isn’t about ideology—it’s about weighing the evidence and making decisions grounded in reality, not emotion.

Today, that philosophy matters just as much. After two years of double-digit gains, US equities were down close to -20% earlier this year, and are still underwater on a year-to-date basis.

| Equity Market Index | Q1 2025 12/31/24-3/31/25 |

Year to Date April 30, 2025 |

One Year to April 30, 2025 |

| TSX | +1.5% | +1.4% | +17.9% |

| S&P500 (USD) | -4.3% | -4.9% | +12.1% |

| S&P500 (CAD) | -4.4% | -8.8% | +12.5% |

| Morningstar Developed Mkts(ex. North America) TME | +6.9% | +7.3% | +13.0% |

Source: Bloomberg

Now, many are wondering: Does the volatility of 2025 represent a temporary correction as we navigate the U.S. trade standoff before resuming more-or-less normal economic activity, or are we on the verge of a more extended downturn?

Before we go further, let’s stop to consider what a bear market could actually look like. Research from Goldman Sachs suggests that there are three types of bear markets going back to the 1800s, defined by their causes as well as their average declines, lengths, and times to recover.

- Structural bear markets are the most severe. They are triggered by structural imbalances and asset bubbles. They average declines of -60% over three years or more and can take up to a decade to fully recover. Good examples are the 2000 Tech wreck and, more recently, the 2008 Global Financial Crisis.

- Cyclical bear markets are the most typical. They are a function of the economic cycle, triggered usually by inflation, rising interest rates, and falling profits. They average declines of about -31%, last about two years, and take around four years to fully rebound. A version of this occurred in 2022, although with corporate debt in check and US consumers largely locked-in at low mortgage rates, we avoided a recession.

- Event-driven bear markets are triggered by one-off events. They do not lead to a domestic recession. They are associated with average declines of about -27%, last only about eight months, and recover within a year. Examples could include a war, an oil produce shock, and the Covid pandemic. Leading up to Covid, the economy was in good shape, with low inflation and stable growth—very similar to today.

We’ll return to these bear market scenarios in our final analysis. For now, let’s review some of the strongest arguments for the bull and bear cases going forward.

The Bear Case

Let’s start with what could go wrong.

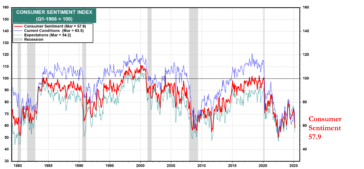

Consumer sentiment has plunged. In March, the University of Michigan Consumer Sentiment Index fell to its lowest level since November 2022, and well below consensus expectations. This marks the third straight month of decline, with many consumers citing high uncertainty about government policy, personal finances, inflation, and market conditions. Sentiment today sits at or below levels historically associated with recessions.

Source: Yardeni Research

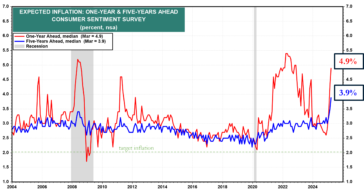

Inflation expectations are also on the rise. In March, year-ahead consumer inflation expectations spiked to 4.9%, up sharply from 4.3% in February. Five-year inflation expectations rose to 3.9%, the largest one-month increase since 1993. Both measures sit well above the Federal Reserve’s target of 2%, suggesting that consumers are now more pessimistic than policymakers.

Source: Yardeni Research

If consumers pull back on spending in response to these fears, recession could prove to be a self-fulfilling prophecy.

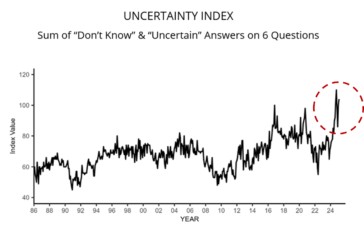

Small businesses are sending similar signals. The National Federation of Independent Business (NFIB) Small Business Optimism Index marked its second consecutive monthly decline in February. Meanwhile, the NFIB Uncertainty Index rose to the second highest reading ever recorded.

Source: National Federation of Independent Business (NFIB), February 2025 Small Business Economic Trends

According to the NFIB Chief Economist, “Uncertainty is high and rising on Main Street,” with inflation and labour quality ranking as the two biggest problems. Uncertainty has already begun to weigh on hiring and capital expenditure decisions, and unless it resolves, could further drag down growth.

Aggressive U.S. trade policies are clearly driving much of this uncertainty. As we have seen in past cycles, lack of clarity can paralyze corporate decision-making, disrupt supply chains, and slow capital expenditures. Should trade negotiations drag on or deteriorate further, the probability of a self-reinforcing downturn would increase materially.

In short, the bear case rests on deteriorating consumer and business confidence, rising inflation expectations, and political uncertainty. While much of this is based on “soft” data, such as surveys rather than hard economic statistics, it can still drive real-world behavior if uncertainty persists long enough.

The Bull Case

Now, on to what we think can go right from here.

After back-to-back US S&P500 equity market gains of over 20% in 2023 and 2024, what should we expect in year three of a bull market? History suggests returns tend to moderate but remain positive. As this chart shows, despite the wilder ride, net performance so far in 2025 is tracking closely to historical averages.

Source: Daily-Shot, Raymond James

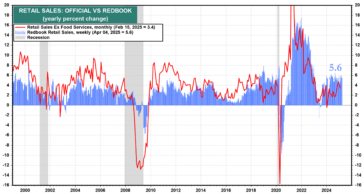

Beyond the pattern of returns, hard economic data offers further support. Retail sales continue to show resilience. The Redbook Research weekly retail sales series shows that, as of mid-March, retail sales were up +5.5% year-over-year, reinforcing the view that consumers, despite political and policy-related uncertainty, are still spending.

Source: Yardeni Research

This spending strength may be in part due to the strong labour market. Weekly jobless claims remain low at 241,000. This suggests strong job growth and limited layoffs. The unemployment rate, at 4.2%, is still well below the 50-year average of 5.8%, and only modestly above the 50-year low of 3.4% reached in 1969.

On the inflation front, market-based expectations remain relatively contained. The spread between nominal Treasury yields and Treasury Inflation-Protected Securities (TIPS) suggests an inflation outlook over the next five to ten years that is very close to the Fed’s long-term 2% target. This is far less alarming than the consumer survey data would suggest and gives the Fed room to maneuver if needed.

Source: Yardeni Research

Finally, the credit markets are not flashing recession signals. High-yield credit spreads remain well within their historical norms and have not widened meaningfully despite the recent equity market volatility. Canadian spreads have been even more stable, further supporting the notion that financial stress remains contained.

Taken together, muted but positive historical patterns, resilient consumer behavior, a strong labour market, well-anchored inflation expectations, and stable credit markets form the foundation for the bull case. While uncertainties remain, the underlying economic data remains on solid ground.

Which Bear Could it Be?

So far, we have a correction. At Cumberland, we’ve managed through numerous volatile periods over three decades. Today, we’re awaiting the resolution and potential impacts of the Trump 2.0 tariffs. The bullish view may well prevail.

If downside volatility continues, we believe it’s unlikely to morph into a structural or cyclical bear market. Economic fundamentals remain strong, and interest rates are more likely to fall than rise.

Therefore, we believe that any bear market will be of the event-driven variety, with the Liberation Day tariff shock as the instigating event. Given the historic size and scope of event-driven bear markets, most of the damage is likely already done. And, as a man-made event, it could all be reversed tomorrow.

Navigating From Here

Overall, US trade policy will dictate outcomes. But given the cross currents between sentiment and data, we are tilting portfolios toward a more cautious stance. We have modestly reduced our overall equity exposure, trimming positions in areas such as technology and industrials and adding to more defensive sectors, cash, and gold earlier.

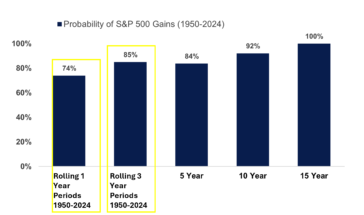

However, it is important to note: we remain invested. History teaches that staying on the sidelines can be costly. Since 1950, the S&P 500 has been higher 74% of the time on a rolling one-year basis and 85% of the time over rolling three-year periods. Missing just a few of the market’s best days can severely diminish long-term returns.

Percentage of Time S&P 500 Rose Over Rolling Perions

1,3,5,10 and 15 Years from 1950-2024

Source:LPL Research 03/11/25

Markets will continue to challenge our patience and our emotions. But in a world full of noise, our approach remains simple: eschew dogma, stay alert, lean on our long experience through many economic and market cycles, and follow the evidence through fundamental research and relevant data wherever it might lead.

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is owns and administers the Kipling Funds, CIC is the portfolio manager of these funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.