Are the Magnificent Seven (and the other 493 stocks) fairly valued?

Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla comprise the so-called Magnificent Seven – companies revered for their high tech, high growth, high margins, and high investment returns over the past decade.

Following steep declines in 2022, the Magnificent Seven have grown so far and fast, that they currently make up close to 30% of the S&P 500 Index’s market value. As such, they can be seen as overshadowing the other 493 stocks in the index.

So with the strong stock market gains of 2023 and the first quarter of 2024, it now seems fair to ask:

“Are the current valuations of the Magnificent Seven justified?

And what about the rest of the market?”

Let’s start with earnings

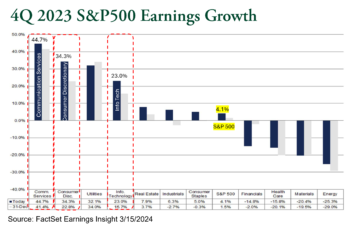

The following chart shows that 73% of S&P 500 companies reported a positive earning-per-share surprise at the end of 2023, and 64% reported a positive revenue surprise. And, as highlighted in yellow, overall S&P 500 earnings grew 4.1% year-over-year.

This earnings growth was much stronger than the 1.5% market consensus, and marked the second quarter of earnings growth after three negative quarters. In short, corporate earnings took a powerful turn to the upside in the final quarter of 2023.

There’s something else to notice about these upside earnings surprises: they were driven disproportionately by the Magnificent Seven’s industry sectors, Communication Services +44.7% (Meta, Alphabet), Consumer Discretionary +34.3% (Amazon, Tesla) and Information Technology +23.0% (Microsoft, Apple, Nvidia).

Looking ahead to 2024, the next chart shows that market participants anticipate more of the same going forward, with Information Technology earnings expected to grow at +17.9% and Communication Services at +17.7%, making them materially positive standouts. Looking beyond these, the chart also demonstrates a much wider breadth of earnings growth ahead, with positive, mostly high single-digit or low double-digit growth expected in all but two market sectors. Take a closer look below.

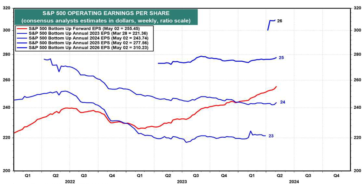

In addition, as the next chart shows, S&P 500 calendar operating earnings growth for 2024 and 2025 have recently turned positive, after having pulled back in previous months.

So what does this mean for valuations?

Earnings are strong, but you might wonder if valuations are getting ahead of earnings. In other words, broadly speaking are S&P500 stocks relatively expensive? The next chart shows the forward 12-month Price to Earnings (P/E) valuation multiple for the S&P 500 (green line). At first glance, the current multiple of about 21.0x looks a bit rich relative to its historical near 10 year average of 18.2x. However, there is in fact some distortion in this picture when you look closer.

The P/E for the Magnificent Seven stocks (red line) is currently at 29.5x, which heavily skews the S&P 500 index, since it is a market capitalization-weighted index. That means the biggest companies have the biggest influence, and the Magnificent Seven are huge, representing about 29% of the index.

If we de-emphasize the Magnificent Seven by equal weighting the stocks in the index (purple line), the S&P 500 trades at a much more reasonable P/E multiple of 17.3x, which is barely above its long-term average of 17.1x and below near 10-year average of 18.2x.

With that, perhaps the most relevant question is whether the current multiple or valuation for the Magnificent Seven is justified. When we compare their outsized Q4 2023 earnings growth and the growth expected for 2024, the answer is yes right now.

The chart below shows the historical forward P/E ratio premium of the Magnificent Seven relative to the S&P 500, another interesting set of statistics. At its current level of 40%, the premium is large, however, it currently sits at the low end of its 9-year trading range of about 30% to 80%. The Magnificent Seven have often traded at a significantly higher premium, and as recently as last summer.

The final verdict

While we don’t own ALL of the Magnificent Seven stocks, as of this writing, we are comfortable with core positions in Apple, Alphabet and Microsoft, as well as Amazon (recently added) and Meta (sold in early 2022 and repurchased in 2023). While they command premium valuations, they are remarkably profitable businesses with the potential for continued, strong earnings growth ahead.

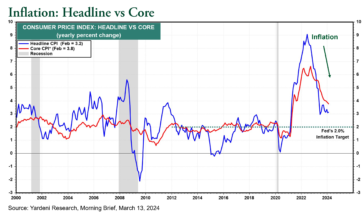

As for the other 493 stocks in the S&P 500, valuations are not unreasonable, particularly given the US economic outlook and expected continued earnings growth. The US Federal Reserve is still looking to ease interest rates against a backdrop of solid economic growth, low unemployment, and inflation that continues to move toward target levels as shown in the final chart below.

So to close, historically stock markets have performed well in times like these. We remain selective by sector and company, while being generally positive on the outlook for the market.

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). CIC acts as sub-advisor to certain CPWM investment mandates.

This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Reasonable efforts have been made to ensure that the information contained herein is accurate, complete and up to date, however, the information is subject to change without notice.

The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involved inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability.