A Soft Landing for the U.S. Economy is in the Realm of Possibility

One of the biggest debates in the market today is whether the U.S. economy is headed for a recession or a soft landing. Given that the United States is the world’s largest economy, the outcome of this debate matters a lot given the implications it would have for the rest of the world. One of the key factors that will impact the outcome of the debate is the rate of inflation. The bears argue that inflation remains far too high and that the U.S. Federal Reserve will need to keep hiking interest rates which will eventually tip the U.S. economy into a recession. Recent inflation data over the last few weeks is not the type of fodder that the bears were hoping for given that both the Consumer Price Index (CPI) and the Producer Price index (PPI) declined more than consensus expectations.

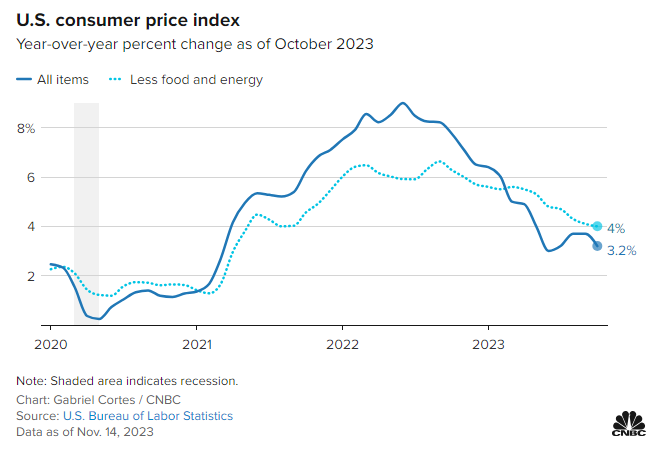

As seen in the chart below, the consumer price index for the month of October increased by 3.2% compared to one year ago. This was better than consensus, which called for an increase of 3.3%. The consumer price index is a measure of the average change over time in the prices paid by urban consumers for a broad basket of consumer goods and services.

On a month over month basis, the CPI for October was flat versus September. This is fueling hope that stubbornly high prices are easing their grip on the U.S. economy and that the U.S. Federal Reserve is in a better position to stop raising interest rates. And eventually cut interest rates.

The Producer Price Index (PPI) also delivered results that were better than consensus expectations. During the month of October, the PPI declined by 0.5%. This marked the biggest monthly decline since April of 2020. Consensus was expecting an increase of 0.1% so this result was much better than consensus.

The Producer Price Index measures the average change over time in selling prices received by domestic producers of goods and services. The PPI index measures the price change from the perspective of the seller, which is different than the Consumer Price Index that measures price change from the purchaser’s perspective. It’s good to see that both the CPI and PPI data was better than consensus as it provides more evidence that inflation is falling faster than expected.

In addition to the favourable inflation readings, there was also a positive economic data point with the recent release of the Chicago PMI Index. The Chicago PMI captures manufacturing and non-manufacturing business conditions across Illinois, Indiana, and Michigan. A reading below 50 signals contraction in the economy while a reading above 50 signals expansion in the economy. The Chicago PMI has been in contraction mode for 14 consecutive months. However, November’s reading put an end to the streak as the Chicago PMI surged past consensus expectations. The November reading of 55.8 was well ahead of October’s reading of 44, and ahead of consensus at 46. While 1 month of data is a small sample size, it is encouraging especially given the magnitude of the difference between the actual reading versus consensus.

There is one data point that will encourage the bears and that is the recent release of the Beige Book from the Federal Reserve. According to the Beige Book the economy has slowed in recent weeks as consumers are keeping a closer eye on their spending.

From our perspective, falling inflation and a sudden turn in the Chicago PMI increases the probability of a soft landing in the U.S. economy despite the slowdown that was highlighted in the Beige Book. While nothing is for certain and there are no guarantees in our industry, we are encouraged by the recent data points and believe the likelihood of a soft landing has increased.

Have a good weekend.

Phil

Sources:

Wholesale prices fell 0.5% in October for biggest monthly drop since April 2020

https://www.cnbc.com/amp/2023/11/15/wholesale-prices-fell-0point5percent-in-october-for-biggest-monthly-drop-since-april-2020.html

US Producer Prices Decline by Most Since April 2020 on Gasoline

https://financialpost.com/pmn/business-pmn/us-producer-prices-decline-by-most-since-april-2020-on-gasoline/wcm/43448125-1251-472c-b588-32599d80b2da/amp/

https://www.cnbc.com/2023/11/14/cpi-inflation-report-october-2023.html

Chicago business activity index moves into expansion territory for first time in more than a year

https://www.morningstar.com/news/marketwatch/20231130424/chicago-business-activity-index-moves-into-expansion-territory-for-first-time-in-more-than-a-year

Economic outlook deteriorates as growth, inflation slows: Fed’s Beige Book

https://www.investing.com/news/economy/economic-outlook-deteriorates-as-growth-inflation-slows-feds-beige-book-3246116

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.