A Challenging Market Environment

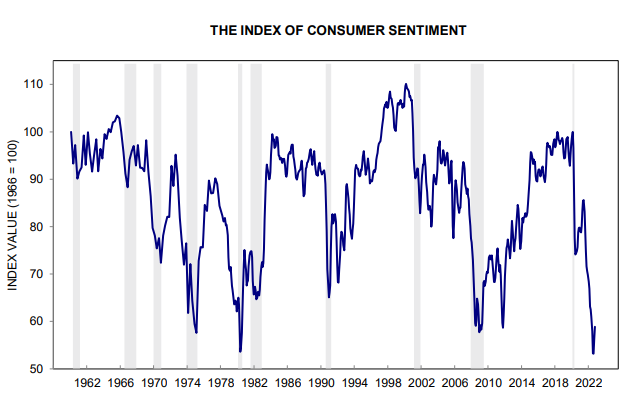

Well, it seems like bad news all around as the U.S. Federal Reserve continues its fight against inflation. The 10-Year U.S. Treasury yield has recently climbed above 4%, a level that is significantly higher than anything we have seen in recent years. The economy is slowing and consumer sentiment measures are at depressed levels. Consumer sentiment indexes are leading economic indicators that measure changes in the outlook for the economy. They are based on how shoppers feel about their interest and willingness to buy things in the future. As seen in the chart below, the University of Michigan Consumer Sentiment index is near 50-year lows.

In the first half of the year, corporate earnings had held up well, but in recent weeks the cracks have started to emerge. In the most recent earnings season, management teams have become increasingly cautious and guidance has fallen short of expectations. And this is happening to large blue-chip companies across various sectors including Technology, Industrials, Consumer, and Healthcare.

When it comes to company guidance, disappointment is a problem because the attention span for investors has become shorter and shorter in recent years. Investors tend to obsess over near-term prospects whether it’s the next economic data point or the next quarter for a company. A focus on the short term leads to active trading and volatility in stock and bond markets. And that’s exactly what we are seeing today.

Inflation remains uncomfortably high and the Fed won’t stand for it so U.S. Federal Reserve Chairman Jay Powell continues to increase interest rates. The result of this is that it will continue to slow the economy. One of the unintended consequences of the rapid rise in interest rates has been the big move in the value of the U.S. dollar as seen in the chart below which shows the jump in the DXY. The DXY is also known as the U.S. Dollar Index, which is an index of the value of the US dollar relative to a basket of foreign currencies.

Significant U.S. dollar strength has negative implications for domestic U.S. companies because their exports are more expensive and therefore less attractive to foreign buyers. It’s also challenging for US-based companies which have large footprints outside of the United States as profits earned abroad in other currencies translate back to fewer dollars and therefore lower reported earnings. This has been a key factor in the recent guidance downgrades.

A strong U.S. dollar also has negative implications for countries around the world who have high levels of debt that are denominated in U.S. dollars. Furthermore, commodities are priced in U.S. dollars so the cost of consuming commodities such as energy and agriculture for countries outside of the U.S. has gone up significantly. It’s no wonder that inflation has been stubbornly high.

So, the headwinds for stocks are real……but…the value of a stock is always calculated by taking the present value of the future cash flows generated by the company. A temporary slowdown in the economy and lower earnings for a few quarters does not impair the business value of a strong company. We own several world-class leading businesses that have seen their share price decline by 30% or more. I am fairly confident that the business value for these great companies has not been impaired by 30%. In fact, many of the great businesses we own are taking actions that will increase the future value of their business.

As this bear market plays out, our companies are investing in their businesses, they are generating substantial free cash flow, and they are taking market share from weakened competitors. Some will make acquisitions and buy assets on the cheap from distressed competitors that need the money now. We are highly confident that our companies will come out on the other side even stronger when the current bear market reaches its conclusion. When we get to that point we think it’s highly likely that our companies will be more valuable, not less valuable, as today’s share prices may lead some investors to believe.

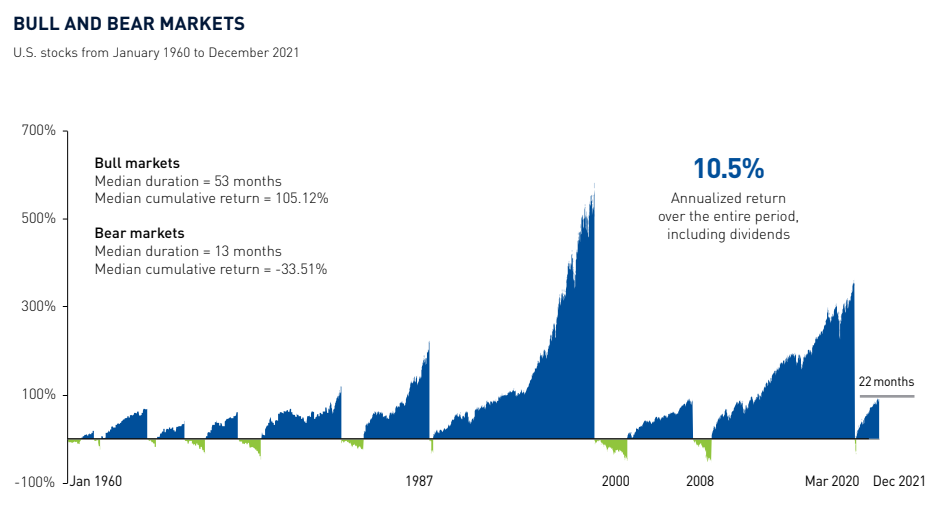

As we all know, market drawdowns are very painful while we are in the moment. But over the long history of the stock market, bear markets eventually run their course and new bull markets begin. And the gains that are generated during bull markets are significantly higher than the losses made during the bear markets as seen in the chart below.

During this period of market dislocation, we are actively searching for the babies that are being thrown out with the bath water, so to speak. Opportunities are being created and we are going to take advantage of them as they come our way.

Have a good weekend,

Phil

Sources:

Chart 1: http://www.sca.isr.umich.edu/files/chicsh.pdf

Chart 2: https://www.bloomberg.com/quote/DXY:CUR

Chart 3; https://www.neiinvestments.com/documents/Advantage/VolatilityTools/EN_NEI_BullsBears_Market.pdf

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Any comments, statements or opinions made herein are those of the author and do not necessarily reflect those of Cumberland Private Wealth Management Inc. (Cumberland) and are not endorsed by Cumberland. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involve inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.