A Case for Optimism

After a brief period of volatility in September, global stock markets have resumed their upward trajectory during the month of October. In recent days several stock market indices have set new all-time highs including the MSCI World, the S&P 500, and the Nasdaq Composite Index. This should be viewed as a bullish sign, but it certainly feels like we are still climbing a Wall of Worry rather than celebrating new all-time highs. This is understandable given that there is a fairly long list of reasons to worry.

Today’s worries include but are not limited to, elevated stock market valuations, labor shortages, inflationary pressures, concerns around Federal Reserve tapering, the disfunction in Washington and the ongoing issues around the U.S. debt ceiling, China’s regulatory debacle and the evolving saga at Evergrande, the delta variant and whatever variant might emerge next, tightening global monetary policy, a developing energy crisis, and an array of inflation threats from a damaged global supply chain. All of these issues have added another brick in the wall for the bull market to climb over.

When we consider each of the forementioned risks, we view inflation as one of the more serious risks. Economic data has been pointing to stickier than expected levels of inflation tied to supply chain disruptions and labor shortages. If inflation remains persistent for an extended period, it will become a problem because it has been labelled as a transitory phenomenon by Central Banks around the world. If inflation is not transitory and it turns out to be significantly above market expectations, then the U.S. Federal Reserve Bank will ultimately find itself behind the curve. Under this scenario, it would be reasonable to expect a series of interest rate hikes that happen sooner and perhaps more frequently than the market expects. Based on history, this would spell trouble for the stock market.

From our perspective, we believe that inflation will remain elevated in the short term. However, we ultimately believe that most of the world’s supply chain issues will get resolved at some point in 2022. On a longer- term basis, we believe that there are several secular forces in the economy that will keep inflation in check. These forces include advances in technology and aging demographics. In addition to these secular trends, we believe that productivity will also be a key factor that drives down inflation. While the global economy has recovered significantly from the COVID-induced recession of 2020, there is still a significant amount of slack remaining in the economy. We believe that the global economy will grow at a healthy rate over the next few years on the back of pent-up demand from consumers and as global supply chains are repaired. We are especially optimistic about the recovery potential for the Consumer Services sector which includes restaurants, hotels, and travel related industries.

We believe that the United States will be a key driver of the global economic recovery. As we all know, the U.S. economy has important implications for the global economy because of its size and interconnectedness. The U.S. is the world’s single largest economy and it is also the largest recipient of foreign direct investment in the world. The U.S. Consumer is a crucial component of the economy given that consumer spending accounts for approximately 70% of the U.S. economy. We have an optimistic view for U.S. Consumers given our belief that they have both the willingness and the ability to spend in the years ahead.

The willingness exists because of the restrictions that were in place during the pandemic. As we move beyond COVID and the economy re-opens, consumers will return to baseball and hockey games, they will eat out at restaurants, go see their favorite band in concert, and travel to their cherished vacation destination.

It’s a great thing for U.S. consumers to have the willingness to spend but it’s just as important for them to have the ability to do so. When it comes to their ability, U.S. Consumers appears to be in great shape. There are many reasons for this including higher savings in the years following the Global Financial Crisis, today’s low interest rate environment, and the significant savings that were accumulated during the last 18 months as people were restricted to their homes for extended periods of time.

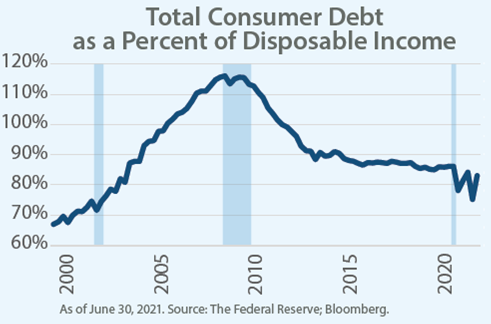

There are several different metrics that are used to measure the health of the U.S. Consumer. Total Consumer Debt as a percent of Disposable Income is a popular metric. Consumer debt is defined as all liabilities of households that require payments of interest or principal to creditors at fixed dates in the future. Disposable income is the amount of money that individuals or households can spend or save after income taxes have been deducted. As seen in the chart below, this ratio is near its lowest level in 20 years.

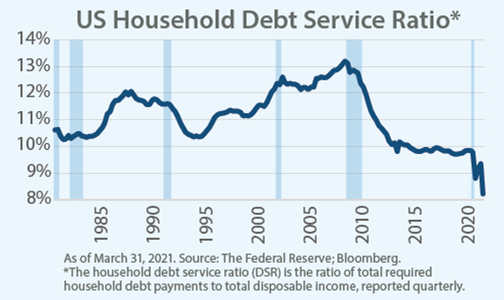

The U.S. Household Debt Service Ratio is another popular measure and it also paints a healthy picture of the U.S. Consumer. This ratio measures the percentage of disposable income that goes to interest on mortgages and other forms of debt. As seen in the chart below, this ratio is at its lowest level in 40 years.

In summary, we continue to have a cautiously optimistic view. We believe there is significant pent-up demand that will help drive growth for the global economy. We are confident that this pent-up demand will be unleashed given the health of the U.S. Consumer and the multiplier effect this will have on the rest of the world. Although inflation will likely remain elevated in the near term, we believe that inflationary pressures will eventually subside. This will occur as global supply chains are repaired, as productivity drives down inflation, and through ongoing help from secular trends such as Technology. Although today’s headlines are often filled with pessimism, we do see reasons for optimism.

Have a good weekend,

Phil

Sources:

Charts: The Federal Reserve and Bloomberg

The Global Role of the U.S. Economy: https://documents1.worldbank.org/curated/en/649771486479478785/pdf/WPS7962.pdf

FOREIGN DIRECT INVESTMENT IN THE UNITED STATES: https://www.selectusa.gov/fdi-in-the-us

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Reasonable efforts have been made to ensure that the information contained herein is accurate, complete and up to date, however, the information is subject to change without notice. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involved inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information.