Liquidity Always Trumps the Economy

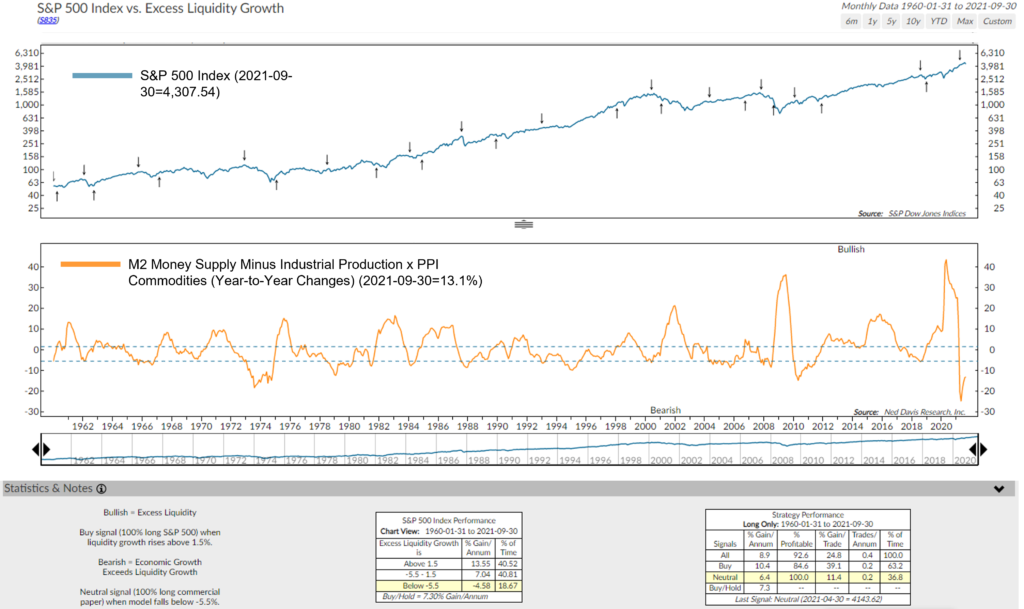

We’re always asked what we think of the market. But, history shows that making predictions about the averages is a mug’s game in the short term. For sure earnings expectations, interest rates, Federal Reserve policy and the state of the economy influence the daily fluctuations. So, I’ll touch on some of these. But one of the principals that I have learned over the years is that liquidity always trumps economic statistics. You only have to go back to March 2020 for a good example. The economy was falling apart as the government shut it down as a defense against the spreading Coronavirus. If this had been your only stock market indicator, you’d have bailed out. However, coincidentally, the Federal Reserve instituted a massively stimulative monetary policy. That set the bottom for the market. That liquidity had to go someplace and as it does historically, it went into financial instruments and stocks and bonds rallied.

By most accounts, it’s still game on as the Fed is holding the short-term interest rate at close to zero and purchasing or driving $120 billion of liquidity into the bond market every month. So, by my liquidity measure, you still want to favor equities. When will this change, you might ask? Well, now you are into reading the economists’ tea leaves. Is inflation more than transient? Is the economy about to slow? Is the stock market overvalued? I’ll give you my take on these issues, but remember Warren Buffett’s warning when he said, “Market forecasters were invented to make fortune tellers look good.”

Economy

There are two schools of thought. One believes that economic growth is slowing dramatically. The government’s fiscal stimulus is behind us and the consumers that were inclined to spend the government handouts have already spent it. Goldman Sachs estimates that fiscal support boosted disposable income 9% above the pre-pandemic trend in the first half of this year. Enhanced unemployment benefits and stimulus checks are now behind us and the Atlanta Fed’s “now” forecast for the third quarter has collapsed.

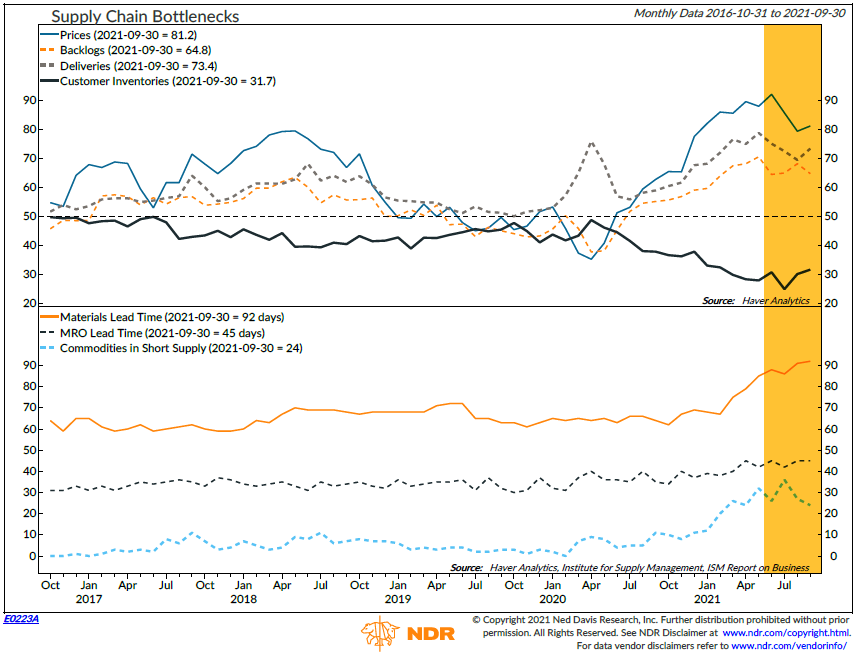

The other camp believes that there is pent up consumer demand. People would buy goods if they were available, but because of shortages, they’re not. They’d also like to go to a restaurant or get on an airplane, but the latest Delta variant makes them reluctant. I’m in this camp. My decision is based on inventory levels. They’re too low. You can go into a car dealership, but there are no cars on the showroom floor. Motor vehicle sales have dropped 6.2 million units from the recent high of 18.5 million in April to 12.3 million units during September. A friend of mine recently bought a car, but was given two choices, black or white and take it or leave it. No negotiating. Sort of sounds like dinner options around my house. And, I see this in many other industries that are impacted by supply shortages or transportation delays.

See the above chart which graphically tells this story. Prices, backlogs and delivery times are way up, while inventories are bouncing along the bottom.

We recently had Peter Aitken, TD’s investment strategist, in to give us his views. Peter has been around awhile, he’s practical and has good judgment based on years of experience.

The main theme of his outlook was based on the inventory cycle. He currently sees an economic slowdown due to this pent-up demand with nothing on the shelves and believes the situation may last until next spring before the bottlenecks get sorted out. When they do, he sees an acceleration in spending and a rush to rebuild depleted inventories. This will give the economy a significant boost. This will then be followed by slower spending but continued inventory building until a normalized level is reached. That will then be the inflection point for slower economic growth. If you accept that as your economic road map, the market should probably behave pretty well through the first quarter of next year.

In the meantime, economic forecasts for the next couple of quarters are being trimmed. But, I think the reasons behind it are probably more important to the market than the actual number.

Inflation

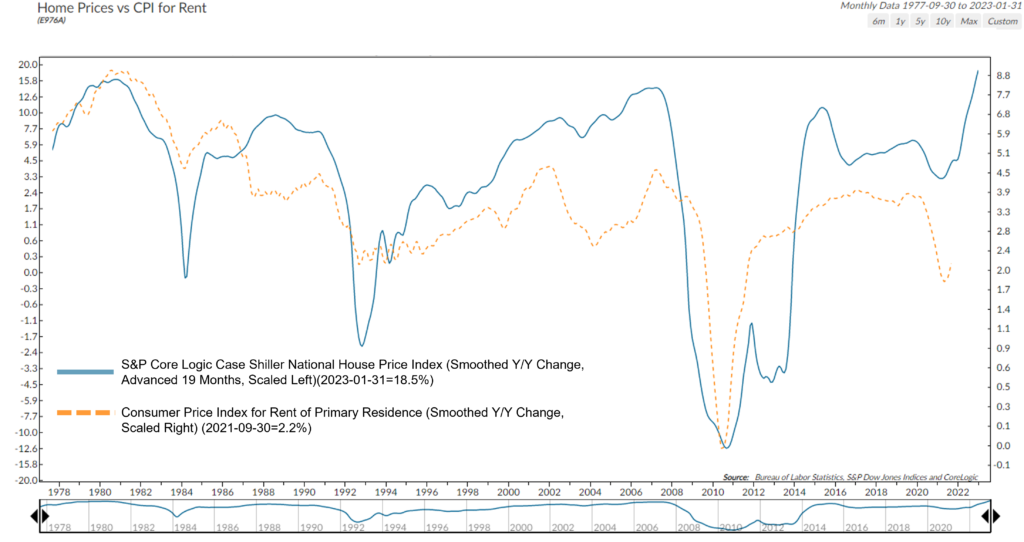

I said in my last quarterly that I bought into the transient theory on inflation, but only up to a point. I don’t think it will stay north of 5% as commodity prices will revert. That said, I do feel there will be a residue of pricing pressure from housing and employment costs. Housing prices are a contrived number based on what one would pay himself to rent his own home (Owner’s equivalent rent). Only a government paid economist can figure out this number, but it does tend to follow housing prices after a delay of about one year.

See the above chart. As for employment costs, which are 65% of corporate costs, I see two secular factors that I think will continue to drive wages higher. The first is a reversal in the globalization of manufacturing. Companies are moving production away from Asia as shipping costs and lead times rise. This is boosting onshoring as manufacturing returns to the USA and Europe or nearshoring to East Europe. This helps control the supply chain. As an example, container costs from Asia are now $10k to $15k up from $1200 – $1500 and lead times drop from 7-8 months to 2-2 1/2 months or as little as 4-5 weeks in certain locations. So, although there are still some labor cost advantages, they aren’t as great and this secular force for lower wages is reversing.

The second is demographics. Population growth has slowed in all developed countries and the working age population is falling for the first time in history. Demand for additional workers has been subsidized by baby boomers working beyond traditional retirement age and by immigration, which has provided a buffer. With Covid, baby boomers, the oldest of which turned 75 this year, are electing to retire. It’s showing up in a record high quits rate. And, immigration has diminished under Trump’s border restrictions. The leisure and hospitality industry is highly dependent on temporary immigrant workers. Nearly a quarter of the leisure and hospitality workers were immigrants leading up to the pandemic according to Yardeni Research. Altogether, employment has plunged from a record high of 31.8 million to 22 million in April, 2020. It has since rebounded to 30.2 million but is still down 1.3 million from the record.

The 3.5% unemployment rate prior to the pandemic was a 50 year low and should have been the first recognition of a labor shortage. Policy makers believe that the pandemic and unemployment benefits are causing the problem. But, when this delayed return to the work force happens we’ll be back to an unsustainable shortage. The problem is availability, not demand.

Compounding these trends is labor unrest and inflation. There have been 176 strikes launched so far this year, mostly to demand higher wages. Furthermore, support for organized labor is growing. Union membership dropped to below 11% of employed Americans in 2020 from 20% in 1983. However, 68% of Americans now approve of unions, the highest since 1965 according to Reuters. And, this ratio climbs to 78% for those aged 18 – 29. To support this trend, the Biden administration, considered the most pro-union president of modern times, has initiated a task force led by VP Harris to promote unions and labor organizing.

Inflation is also a factor. A lot of the labor shortage is due to mothers staying home. School openings is an issue but child care costs are the problem. Will someone return to a $25/hr job and pay $15 /hr or more for day care costs that have been driven higher by labor shortages. It’s a vicious cycle that will sustain wage cost pressures.

Overall, we have about 11 million job openings for about 9 million unemployed workers. The optimists see productivity relieving the problem and we don’t disagree to some extent. However, social policies are advocating a better balance between wages and capital returns and pressure on environment spending will cannibalize some productivity enhancing capital. A good example of this is what is happening in the oil and gas industry. Domestic energy companies are now diverting surplus earnings into debt repayment and environmentally friendly projects in reaction to ESG-driven shareholder demands. Oil production out of the western basin is now about 2,000,000 barrels per day lower than pre-Covid. Meanwhile, renewable sources such as solar and wind are proving to be less reliable without more battery storage capacity. The result is oil over $80 / bbl, which wasn’t on any economist’s radar screen, and greater dependence on Saudi Arabia and Russia.

The reality is that we have underinvested in resources, energy and metals for the last several years and it takes years to bring on new supply especially in a highly regulated and environmentally hostile market.

Meanwhile, government stimulus remains at full throttle amid shortages and a record-breaking economic recovery in the second quarter. If economics 101 still applies, too much demand and too little supply gets you higher prices. It’s just an argument over how long. However, with the Fed not giving much credibility to the sustained inflation argument, it may mean a sudden change for monetary policy provided the Federal Reserve doesn’t become too politicized. Easy monetary policy is crucial to the Biden administration and Chairman Powell’s job comes up for renewal in February. I’m sure he aims to please or someone from further left on the ledger will be there to replace him. As one final thought on this issue, history has shown that the easiest way to raise tax revenue to pay for the out sized deficits is through higher inflation. It’s called financial repression.

Federal Reserve

Inflation and full employment are the Federal Reserve’s two mandates with their emphasis on the latter. Inflation is already exceeding their objectives, but employment still lags which is their rational for maintaining such an accommodative monetary policy. However, there are signs of change as the Fed is now openly discussing a reduction of its injection of liquidity through the purchase of $120bn of bonds and mortgages each month, which they refer to as tapering. Current thinking believes this could start as early as November and be completed by mid-next year. This would then be followed by higher interest rates. The timetable has been moved forward by almost a year from what was earlier expected. It would appear that the Fed’s position is compromised in favor of higher interest rates. Either employment picks up and their goals are reached suggesting a more normalized monetary policy or employment doesn’t improve and wage escalation drives further inflation and market forces will take control of the Central Bank’s agenda. Complicating the Fed’s independence is the government’s dependence on additional deficit financing to fund their programs. There are currently two open positions at the Fed and Chairman Powell, who has been labeled a dangerous man by Senator Warren, sees his term up for renewal this coming February. It is hard to believe that he won’t be pressured to remain accommodative.

China

Somewhat extraneous to my message here is what is happening in China. But, it bears watching. The topic is worthy of a fulsome analysis, but let me just touch on what I think is the main principle, which is the current leadership under Xi Jinping undoing Deng’s market reforms and returning to Mao Zendong’s socialist vision. An exaggeration? Well, in July Xi appeared in a Mao suit at a Centenary Celebration and sang a song long symbolizing the declaration of war by the working class on capitalism. In general, the government is cracking down on the private sector and specifically the real estate and technology sectors where a lot of wealth has been made, and celebrities.

The most apparent symptoms of this reform are the recent problems with real estate company Evergrande and the saber rattling over Taiwan. Evergrande is listed in Hong Kong, employs about 200,000 people, and has 800 unfinished residential buildings across China with 1.2 million people having made deposits. However, it is only one of a further twelve real estate companies that have now defaulted on bond payments totaling $3.0bn. Real estate and related industries account for about 20% of the urban workforce and almost 30% of GDP. Although the Chinese leadership is not sympathetic of higher home prices and the wealth that has been created, it will not likely walk away from those who have purchased unfinished units, construction workers, suppliers and small investors.

In reality, Evergrande is too big to fail and will likely either get a Beijing bail out or be restructured. Nonetheless, it is symptomatic of a shift in attitude and likely slower expansion and what that will mean for Global economic growth.

Taiwan is a wild card. Beijing has been making threatening military gestures towards the island which raises tensions with the US. After Biden’s abrupt pull out from Afghanistan many allies question his resolve to live up to treaty obligations. Xi recently said “To achieve the reunification of the motherland by peaceful means is most in line with overall interest of the Chinese nation, including our compatriots in Taiwan. No one should underestimate the Chinese people’s determination and strong ability to defend national sovereignty and territorial integrity. The historical task of a complete reunification of the motherland must be fulfilled and it will definitely be fulfilled”. The 20th National Party Congress meets in November of next year to decide on whether Xi remains in his role. Who knows whether Taiwan will factor into this decision.

Conclusion

As I said, the economy will probably improve as bottlenecks get resolved, inventories are replenished and the Delta variant runs its course. Furthermore, Fed policy is about to shift, but will remain accommodative until tapering is completed, probably next summer. This should cause some further steepening of the yield curve, which combined with further economic strength should favor a value bent to stock selection.

However, as the year progresses I become a little less enthusiastic about the market. Macros shift from supportive to headwinds. Accelerating economic growth and earnings downshift dramatically by the end of next year. We’re also likely to have a less accommodative monetary policy and less government stimulus aggravated by increased government regulation and anti-trust legislation specifically directed at technology and media companies.

Furthermore, a strong economy soaks up liquidity which is principle number one.

Just look at this chart.

It shows how inflation and economic growth require funding and has already turned negative. Simplistically, Main Street draws money down from Wall Street. Furthermore, we’re likely to have tax increases to factor into our earnings projections and all of this in the context of a stock market that is overvalued by most historical measures. But don’t let this sound too bearish. These are contrasted with unusual strengths. In absolute terms things will still be pretty good.

Nevertheless, traditional, market tops are created by a strong economy that elevates inflation, which the Fed resists by raising interest rates and draining liquidity. A lot of these conditions seem to be falling into place, but time will tell.

Gerald R. Connor

Chairman

Credits:

Yardeni Research

Ned Davis Research

Reuters

John Aitkins

Woody Brock

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Reasonable efforts have been made to ensure that the information contained herein is accurate, complete and up to date, however, the information is subject to change without notice. Information obtained from third parties is believed to be reliable but no representation or warranty, express or implied, is made by the author, CPWM or CIC as to its accuracy or completeness. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involved inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd