Inflation: What it means and what could happen next

Twenty years ago, the price of a movie ticket was about $10. Today, you can expect to pay closer to $13. From an economist’s point of view, it’s not so much that movie tickets became more valuable, but that the dollar lost some of its purchasing power.

Inflation is a measure of how much purchasing power has been lost. We are currently experiencing a potent economic rebound and purchasing power is declining faster than usual at gas pumps, grocery stores, lumber yards and more. While the Bank of Canada and US Federal Reserve aim to keep annual inflation capped at around 2%, it has risen much more sharply this year.

Here’s what Cumberland Private Wealth Management Inc. (“Cumberland”) ’s Chief Investment Officer, Peter Jackson, communicated in his Strategy Review for the 2nd quarter of this year:

“Personal Consumption Expenditures (PCE) inflation is now expected to rise 3.4% in 2021 before trending back to just above 2% in 2023, the Federal Reserve’s long term targeted level. While the Fed Chairman, Jerome Powell, downplayed the inflation as transitory, as many components of recent Consumer Price Index (CPI) data, such as used vehicles, auto rentals, airfares and lodging probably were transitory, it is possible that a reacceleration in employment and future wage gains may not be so transitory.”

When central banks wish to curb inflation, one method they deploy is to increase interest rates. This tends to discourage borrowing and spending and prevent runaway prices. Jackson thinks hikes in the current record-low rates are likely to happen sooner than originally planned, while pointing out that stock markets have historically been able to persevere through similar periods:

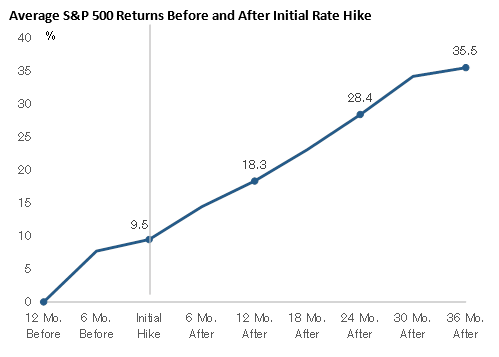

“This higher inflation outlook is likely to pull forward the timing of a policy shift towards two rate increases in 2023. Also, several Fed members indicated a willingness to begin the discussion about the tapering of asset purchases. What this might mean for the markets is shown in the chart below, which reviews the historical performance of the S&P500 over four previous interest rate cycles. As indicated in the chart, the average returns both 12 months prior to the initial rate hike and 36 months after that have remained quite positive. It is not until the yield curve flattens or inverts that market returns typically turn negative.”

In his most recent commentary, Cumberland Chairman Gerry Connor agrees that inflation may be more than transitory as highlighted in the following excerpt:

“Obviously, everyone favors a strong economy, but they don’t want the inflation baggage that usually accompanies it. Here again, we have the transient argument. Most of it is supported by the short-term economic strength factors that most see waning. But the Fed adds other items to watch to this list, such as the base effect. This is the difference in prices today compared to the depressed prices during the Covid lockdown, which is accentuated by supply shortages and one-time stimulus cheques being spent. The Fed’s belief is that the secular forces that have held inflation down such as globalization and technology-driven productivity will reassert themselves, and that’s probably true, but there are some big hurdles to overcome before this.”

Among these hurdles are political pressures, the overhang of corporate and sovereign debt, and potential backlash from financial markets:

“The economy, inflation and earnings growth are as good as they are going to get and will diminish… but I don’t think we’re going to regress back to pre-Covid levels, and the residual economic strength will result in an inflation level above the Fed’s expectations.

Will the Central Bankers react to this or will they be compromised by political influence? I don’t know, writes Connor. Furthermore, given the enormous amount of corporate and sovereign debt outstanding, can the Fed even use traditional interest rate increases as an antidote for inflation? If not, it will fuel a secular shift in investments to an inflation hedge type of strategy.

For sure, any attempt to stem inflation with monetary policy will be met with a negative reaction by the financial markets, which has normally caused the policy makers to back off…”

Connor sees a departure from traditional economics, where politicians and policymakers were once more willing to do what was necessary to curb excesses. Nonetheless, he believes that, in an inflationary world, equities will remain the most desirable asset class:

“Structural forces are seen to replace traditional paradigms and this has allowed monetary policy to go beyond stabilizing the business cycle to underwriting political and social agendas under the guise of a pandemic.

Although I do expect the market to work its way higher, I think investors are going to have to be a little more astute as to what they invest in. I don’t think the general market averages will provide a rising tide to make index investing attractive. But, I do believe equities, even with a market correction, which is overdue, will be the best asset class to protect your wealth.”

This leaves the question of how exactly to position an equity portfolio for an inflationary environment – whether transitory or longer-lasting – as well as the higher interest rates that might accompany it. In his latest Strategy Review, Portfolio Manager Phil D’Iorio at CIC* explained the importance of choosing quality names:

“We believe that investing in high quality companies is the best way to protect our portfolios given the potential for higher inflation and increased volatility. High quality companies are characterized by strong pricing power and very stable cash flow generation. These types of companies can among other things,…pass along rising input costs and will also be insulated from the impact of higher interest payments associated with rising interest rates.”

At Cumberland Private Wealth**, a focus on quality is intrinsic to our investment process. While we will continue to monitor signs of inflation and signals from central banks, our experience and research tells us that owning high quality companies at appropriate valuations is an approach that should work regardless of the market cycle. Inflation or not, we believe that our clients’ portfolios are well-positioned for the current and potentially changing economic and market environments.

*CIC is Cumberland Investment Counsel Inc.

** Refers to Cumberland Private Wealth Management Inc. (Cumberland) and Cumberland Investment Counsel Inc. (CIC).