A Perspective on Earnings Revisions and Pent-Up Demand

Global equity markets have continued their upward trajectory over the last several weeks. During the month of April stocks were particularly strong with the S&P 500 up 5.3% and the MSCI World Index increasing by 4.7%. The strong gains are being driven by optimism around prospects for a strong post-Covid economic rebound fueled by pent-up demand and unprecedented levels of monetary stimulus. The global vaccine roll-out is also providing a boost to the recovery and helping consumer confidence. On the back of the large gains in the stock market, concerns around valuation have begun to surface more frequently. Although these concerns are valid, there are some factors to consider.

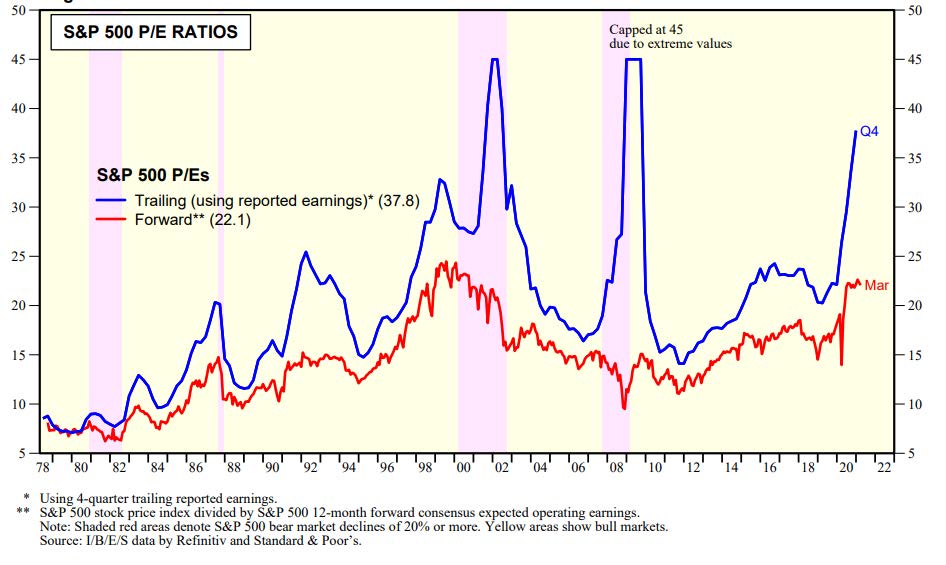

During the early stages of an economic recovery, stocks typically appear expensive on valuation metrics such as the PE ratio (Price-to-Earnings ratio). During economic recessions corporate earnings become depressed and this causes valuations to look expensive. This has occurred during previous recessions and was particularly noticeable during the downturns of 2001-2002 and 2008-2009. This phenomenon is especially pronounced for the Trailing 12-month PE ratio as seen in the chart below. The various spikes in the blue line (the Trailing 12-month PE ratio) illustrate this point.

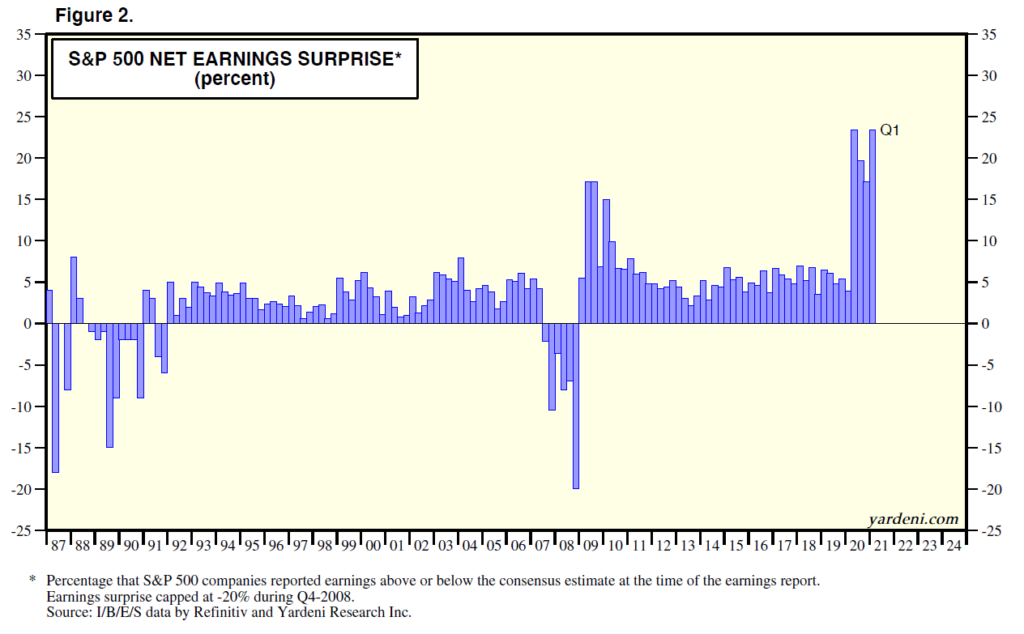

Although the trailing 12-month PE ratio is helpful, it is a backward-looking indicator. In our view the 12-month forward PE ratio is more meaningful as it provides information about the future. This metric is represented by the red line in the chart above. The 12-month forward PE ratio is currently elevated and is above the long-term average. We would be concerned by this metric if we looked at it in isolation and assumed all else equal. However, one must consider the level of earnings revisions. One of the reasons we remain cautiously optimistic about global equities for 2021 is related to the magnitude of positive earnings revisions. As seen in the chart below, positive earnings surprises for the S&P 500 are at their highest level in the last 35 years.

What this means is that consensus earnings estimates have been underestimated and are now being revised significantly higher. One of the reasons this has occurred is that analysts cut their earnings estimates by huge amounts after the pandemic struck the global economy in March of 2020. At that time, stock analysts slashed and burned their earnings estimates given that the world had just entered the deepest recession since the Great Depression. As we all know this recession was very short lived thanks to the vaccine approvals and unprecedented levels of fiscal and monetary stimulus. The speed and the magnitude of the global economy recovery has forced analysts to revise their estimates higher and there could be more to come. What this means is that the stock market may not be as expensive as it looks on the surface.

Positive earnings revisions are always a welcome sign. But it’s especially impressive at this point in time given that the world is still in the very early stages of re-opening the economy. Once that happens, there is a substantial amount of pent-up demand that should provide a key driver for sustained growth in the global economy.

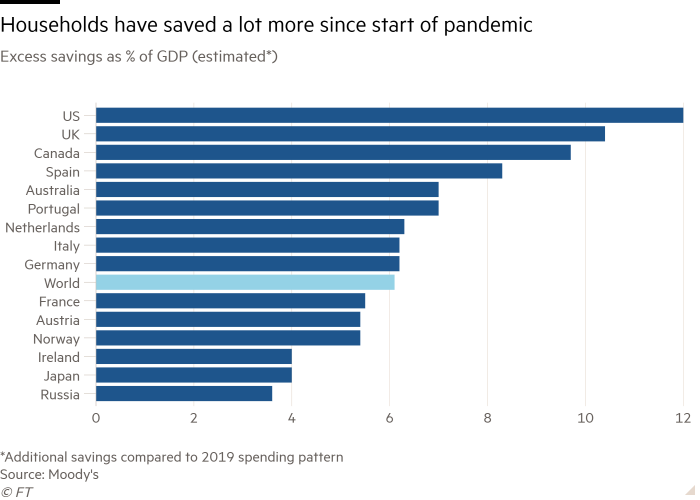

How much pent-up demand are we talking about? We believe there is a huge amount of pent-up demand given that most people were trapped inside their home for the better part of the last year. As most people get vaccinated, they will want to travel, eat at restaurants, go shopping, and go see concerts and live sporting events. One way to think about the level of pent-up demand is to look at excess savings. Moody’s defines excess savings as the additional savings compared with the 2019 spending pattern and equating to more than 6% of global gross domestic product. Based on this definition, households have saved massive amounts of money since the start of the pandemic. This point is illustrated in the chart below.

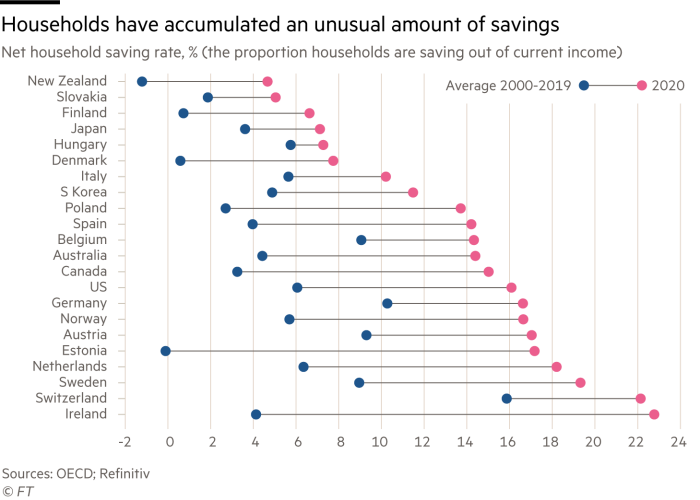

Based on this definition, it has been estimated by Moody’s that consumers around the world have stockpiled an extra $5.4 trillion of savings since the pandemic began. As seen in the chart below, consumers have accumulated a level of savings that is well above the average of the last 20 years.

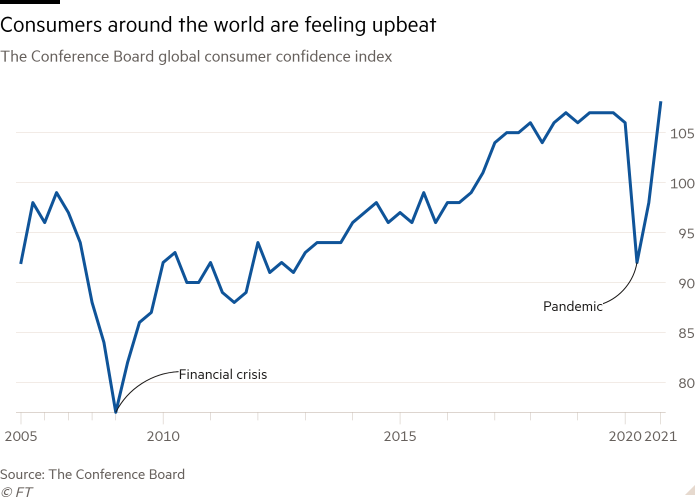

Furthermore, consumers are becoming increasingly confident about the economic outlook, paving the way for a strong rebound in spending as economies re-open around the world. As seen in the chart below, the Conference Board’s Global Consumer Confidence Index recently reached its highest level in the last 15 years.

Bringing it all together, it appears that there is both the ability (excess savings) and willingness (consumer confidence) for consumers to unleash this pent-up demand. This is a powerful combination and we believe it will provide a very important driver for the global economy, corporate earnings, and global equity markets.

Have a good weekend,

Phil

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Reasonable efforts have been made to ensure that the information contained herein is accurate, complete and up to date, however, the information is subject to change without notice. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involved inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd. Please contact your Portfolio Manager and refer to the offering documents for additional information. If you would like to unsubscribe from our email distribution list, kindly email [email protected].