A Perspective on Volatility and Valuations

Global stock market volatility has increased significantly in recent weeks. Volatility is especially apparent in certain parts of the market such as the Technology sector. The Tech-heavy Nasdaq Index has experienced daily swings of 3-4% in recent days. This has caused jitters among investors. Looking back over the last year, global stock markets are up a lot and they are expensive. But should we be selling? This is a question which many of our clients have recently been asking of us.

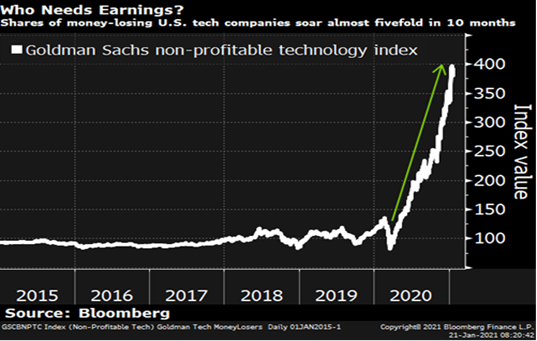

We agree that the stock market is expensive but it’s not across the board. Some areas of the market offer very attractive valuations such as Financial Services. However, some areas are highly speculative and are reminiscent of the Tech Boom in the late 1990’s. Back then, many stocks got so expensive they were being valued on eyeballs. Earnings didn’t matter back then and we are hearing the same narrative today. But earnings do matter, and perhaps that explains why some of the speculative froth has been taken out of the market. The huge advance in non-profitable Tech companies during 2020 (as seen in the chart below) was bound to have a setback at some point.

While stock market volatility creates anxiety, investors should ask themselves if the price action is surprising or out of the ordinary before hitting the panic button. At this point, the moves in the stock market seem quite rational and do not look out of the ordinary. Looking back in history, it is not unusual for stocks to start pulling back when bond yields begin to rise. It’s also not surprising to see high-flying growth stocks bearing the brunt of the selling pressure. Underneath the surface, it appears as though investors are taking profits on speculative growth stocks and using the proceeds to buy stocks within more cyclical sectors that will benefit from the ongoing global economic recovery. This seems rational.

Over the last several months, there have been some huge downward swings within the speculative corners of the market. Several companies have experienced peak-to-trough declines of 30-50%. Examples include Zoom Video Communications which was down nearly 50%, Peloton -40%, Tesla -35%, Spotify -30%, and Shopify which was down nearly 30%. These declines compare with a pullback of about 5% for the S&P 500 and 3% for the Dow Jones Industrial Average Index.

So, should we be selling?

While the market is expensive and there is ongoing speculation in certain areas of the market – we don’t own the market. We own a concentrated portfolio of highly profitable companies that trade at reasonable valuations. One of the lessons from the bursting of the Dot Com bubble is not to get out of the market when speculative activity surges. Rather, the lesson is to avoid the concept stocks with frothy valuations and to be skeptical of unproven companies that claim they are guaranteed to capitalize on exciting new trends.

So, as we navigate today’s markets, in which speculative activity is surging, we will continue to invest in fundamentally sound companies with a proven track record of profitability and only buy them if we can do so at reasonable valuations.

Have a great weekend,

Phil

*Cumberland and Cumberland Private Wealth refer to Cumberland Private Wealth Management Inc. (CPWM) and Cumberland Investment Counsel Inc. (CIC). NCM Asset Management Ltd. (NCM) is the Investment Fund Manager and CIC is the sub-advisor to the Kipling and NCM Funds. CIC is also the sub-advisor to certain CPWM investment mandates. This communication is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. Reasonable efforts have been made to ensure that the information contained herein is accurate, complete and up to date, however, the information is subject to change without notice. Information obtained from third parties is believed to be reliable but no representation or warranty, express or implied, is made by the author, CPWM or CIC as to its accuracy or completeness. The communication may contain forward-looking statements which are not guarantees of future performance. Forward-looking statements involved inherent risk and uncertainties, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. All opinions in forward-looking statements are subject to change without notice and are provided in good faith but without legal responsibility. Past performance does not guarantee future results. CPWM and CIC may engage in trading strategies or hold long or short positions in any of the securities discussed in this communication and may alter such trading strategies or unwind such positions at any time without notice or liability. CPWM, CIC and NCM are under the common ownership of Cumberland Partners Ltd