Indexing

When the market is rising steadily, passive investments such as ETFs that track the index can be effective. But when the market goes down—or even sideways—it’s a different story.

In a rising market, indexing can work well. The trouble is, without an experienced money manager to intervene, your investments will reflect the performance of the market index, for better or worse.

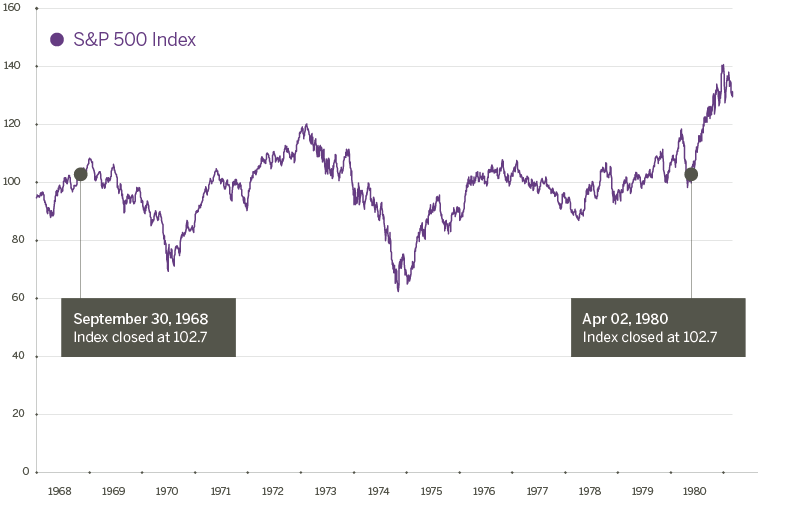

As this chart shows, someone who invested passively in the S&P500 Index in 1968 had to wait until 1980 to make any money. That’s over a decade of investing with nothing to show for it.

However, an active money manager would have had the opportunity to scan the market for stocks that were rising during that period in order to produce a positive return.

The Opportunity

At Cumberland, we’re active money managers, and that means we’re not just along for the ride. For example, after the dot com bubble of the late 1990s, we were able to deploy cash and capture gains for our clients. In 2008, on the eve of the financial crisis, as much as 40% of our clients’ assets were safely out of harm’s way.

It’s this ability to constantly monitor market cycles and take action that has helped our clients stay a step ahead of the market over the last 15 years.